This post will be one you will want to bookmark for the month of August if oil trading is something you are looking at doing. I will post updated throughout the month for trades that I am anticipating in happening or ones that are currently live. There will be some “after the fact” trades that I will post because unfortunately, I won’t be able to get all of them in when they are live. This is something I like to do each month. I also have a running updated trade calls for each month for the Dow Futures, S&P 500, and Nasdaq.

The charts will all be 15-minute charts because I am looking for day trades. Please keep in mind that not all trades will complete in the same day. Sometimes trades will have to be held overnight so before you even think about trading please make sure you have more than enough in your account for the margin maintenance. That is how I trade. I try to get in and out in the same day but plenty of times I have to hold for a day or even a couple of days until the setup completes. If that isn’t for you then no problem at all, I just want to show you how I trade based upon the setups I personally use for futures, stocks, Forex, and crypto-currencies.

All of the setups I use are ones I created. That does not mean I am the only person in the world who uses them. I’m sure there are others. But these are the setups I discovered through meditation that works for me.

Why Trade Oil?

The oil futures contract is one of the most volatile and active contracts to trade. Many people shy away from it because the volatility is too much. Right now I really wish they had a micro contract for it because I would trade it. Eventually, when my account gets bigger I will move up and trade oil.

Here is how Investopedia describes the futures oil contracts:

A futures contract is a legal agreement to buy or sell a particular commodity or asset at a predetermined price at a specified time in the future. Futures contracts are standardized for quality and quantity to facilitate trading on a futures exchange. The buyer of a futures contract is taking on the obligation to buy the underlying asset when the futures contract expires. The seller of the futures contract is taking on the obligation to provide the underlying asset at the expiration date.

“Futures contract” and “futures” refer to the same thing. For example, you might hear somebody say they bought oil futures, which means the same thing as an oil futures contract. When someone says “futures contract,” they’re typically referring to a specific type of future, such as oil, gold, bonds or S&P 500 index futures. The term “futures” is more general, and is often used to refer to the whole market, such as “They’re a futures trader.”

In the simplest form, a futures oil contract for oil trading is used to capture profits in the movement of the price of oil. One oil futures contract represents 1,000 barrels of oil. Obviously, no trader who is doing some oil trading is buying 1,000 barrels of oil. Instead, we trade the price movements.

The big difference between the oil futures contracts and other futures contracts is the expiration date. For oil, it is typically the 3rd Friday of each month. That is something to keep in mind if you are looking at trading oil. The futures contracts for the S&P 500 and Nasdaq are quarterly so if you trade oil you must recognize when to roll over or close the current month’s position in order to start the next month’s futures contract.

Oil Trading Strategy Using the Charts

Here is the section where all the trades will be posted. Unless otherwise noted all charts will be using the 15-minute time frame.

Monday Night Tuesday, July 30th

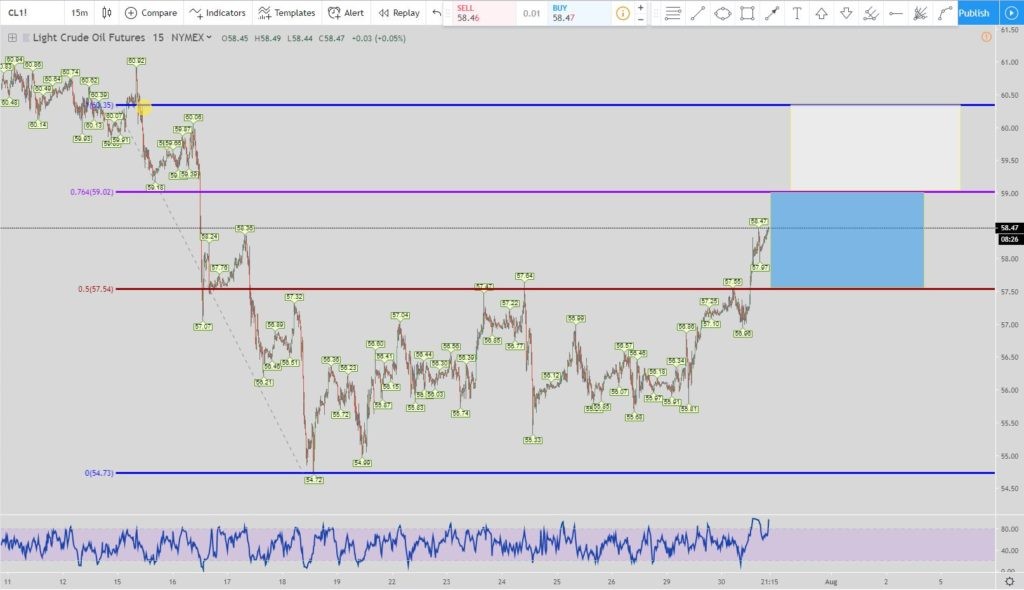

This setup is the 76.4% short trade. Basically, the setup is a retracement to the 76.4% where you can see the anchor point (pivot point high) is located with the yellow circle. Way back over there, there was a retracement to the 76.4% level.

That is what I mean as setting the anchor point (pivot point high). Next, we drag the Fibonacci retracement tool down to the very bottom that creates the big setup we are trading from. So we now have the pivot point low which is the bottom blue line. The pivot point high is from that initial 76.4% retracement.

The entry is the top of the blue box around $59.00 which is the 76.4% Fibonacci retracement. Once the price hits that then the exit is the bottom of the blue box which is also the 50% retracement level. That price is around $57.55.

But if the price continues to go up and hits the top of the white box at $60.35 then the exits move to the bottom of the white box around $59.10. If the price continues to go up without hitting the exit then you can get wherever but the exit does not move. That is the last exit move you have to do. So the way I do this trade is if you get in at the 76.4% level then you need to be prepared to get in at the 100% level which is the top of the white box (and also the top blue line).

If you only want to get in once then you can get in at the top of the white box if the price doesn’t hit the 50% retracement level when the 76.4% is activated.

Conclusion

Oil is a great market to trade if you love volatility. Over the course of the month, I can pretty much guarantee you there will be more setups than I can get to in order to post here but I’ll try my best. Oil trading can be crazy (which it is) but it is one of my most favorite markets.

The setups I use in the charts to show the trades are ones I created through meditation. For 10 years I did what most people do when they are learning about how to be profitable traders. I read dozens of books, watched countless trading videos, and wasted thousands of dollars in trading rooms and gurus who were nothing more than snake oil salesmen which were, of course, a huge ripoff. Even with all of that money and time spent I was still a losing trader.

It was not until a friend of mine showed me how meditating had made him a profitable trader. He was able to create his own setups that worked for him for trading. He showed me how and in some of the posts linked in this post I show you the exact steps I use almost every day in my meditation practice.

I highly recommend you give it a try. Meditation can help improve every area of your life. At worst it will quiet your thoughts and create a more relaxing and calm environment for yourself. Even if you don’t want to use it for trading then do it for your overall mental health. If you make it a habit I am very confident you will see positive results in your life.

If you have any questions or if there is anything I can do for you please let me know and I will be glad to help. We are all in this journey together in the trading world.

Take care,

Evan Carthey