For this post, the Dow futures live trades you will want to bookmark it because I will be providing live trades for the month of August. I do this for the S&P 500 (July) and the Nasdaq (July) as well. But I will do those for August as well, I just haven’t gotten around to it. Eventually I will do one for oil. The Dow Jones is one of the most heavily traded futures contract. It represents the DJIA or the DOW which is the value of 30 large publicly traded companies in the US.

For me, the Dow Jones futures are great to day trade and I do so along with the S&P 500 futures, Nasdaq, Russell 2000, and other Forex currencies. With the new micro contracts they have enabled a whole new batch of day traders to enter this market. This was very smart on their end because it brought new liquidity to the market who the big banks and institutions are looking to take their money. As always it is a battle and with the lower margin requirements it has opened the door for myself and others.

The trades listed will mostly be day trades. Some may go over into several days but the goal is to get in and out in the same day. So if you are thinking of taking any of these trades then please realize you must have enough money in your account to cover the overnight margin cost because they can go for several days.

The time frame I use to day trade is the 15-minute chart. If for some reason I use another time frame I will note it in the trade setup.

Dow Futures – What Do They Represent?

Here is the description from Wikipedia:

The Dow Jones Industrial Average (DJIA), or simply the Dow (/ˈdaʊ/), is a stock market index that indicates the value of 30 large, publicly owned companies based in the United States, and how they have traded in the stock market during various periods of time.[4] These 30 companies are also included in the S&P 500 Index. The value of the Dow is not a weighted arithmetic mean[5] and does not represent its component companies’ market capitalization, but rather the sum of the price of one share of stock for each component company. The sum is corrected by a factor which changes whenever one of the component stocks has a stock split or stock dividend, so as to generate a consistent value for the index.[6]

Many people who are looking to be exposed to the DJIA do so through ETFs which are exchange traded funds. I am only focusing on the futures contact for the Dow Jones Futures. If you follow the link from Wikipedia above it shows the 30 companies that makes up the Dow futures.

Dow Jones Live Futures for August 2019

Monday August 5th

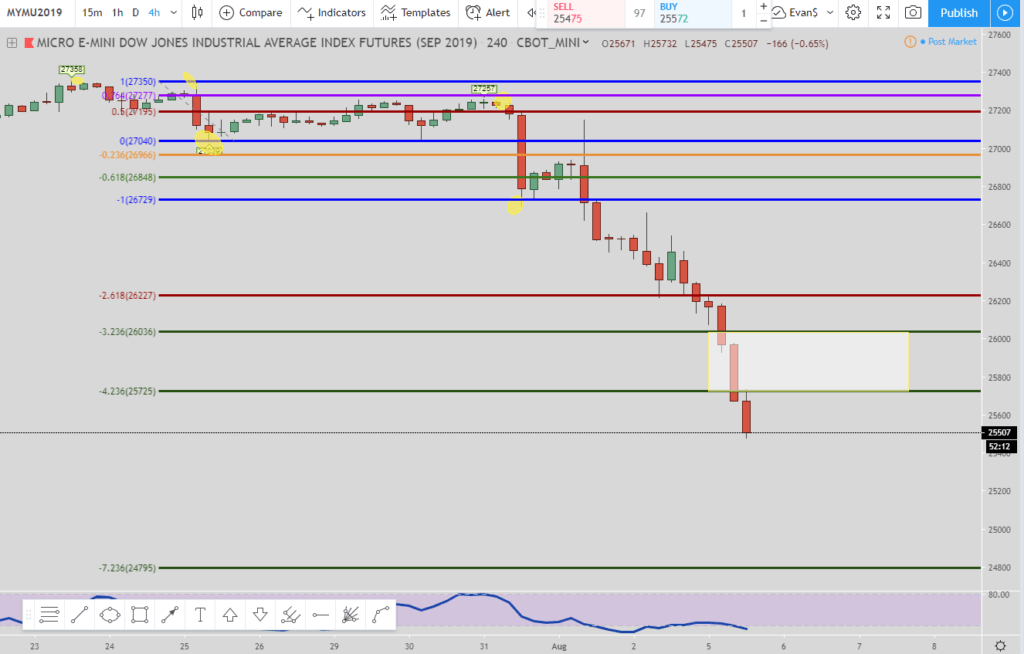

This setup is the 423.6% long setup. As you can see the price of the Dow Jones has sold off just like every other market the past couple of days.

The price blew through the 4.236% and the 5.236% level so this is not in the “free trade” territory. A free trade is when the instrument you are trading has reached a level that the entry is less than the final exit. So as long as your entry is less than the final exit then you have a profitable trade.

The final exit is the 5.236% (the -4.236% on the chart) which is also the bottom of the white box around 25,725. So if you get in at any point under 25,725 then you have a “free trade.”

The other entry levels (-3.236 and -4.236) were already hit without their exits being filled so this trade is still open. Eventually the market will stop the bleeding and it will retrace to fulfill the exit around 25,725.

I also put the 8.236% (-7.236%) level on the chart because a lot of the time the price will come even further and hit that level once the 5.236% level gets destroyed which is what looks like is happening here.

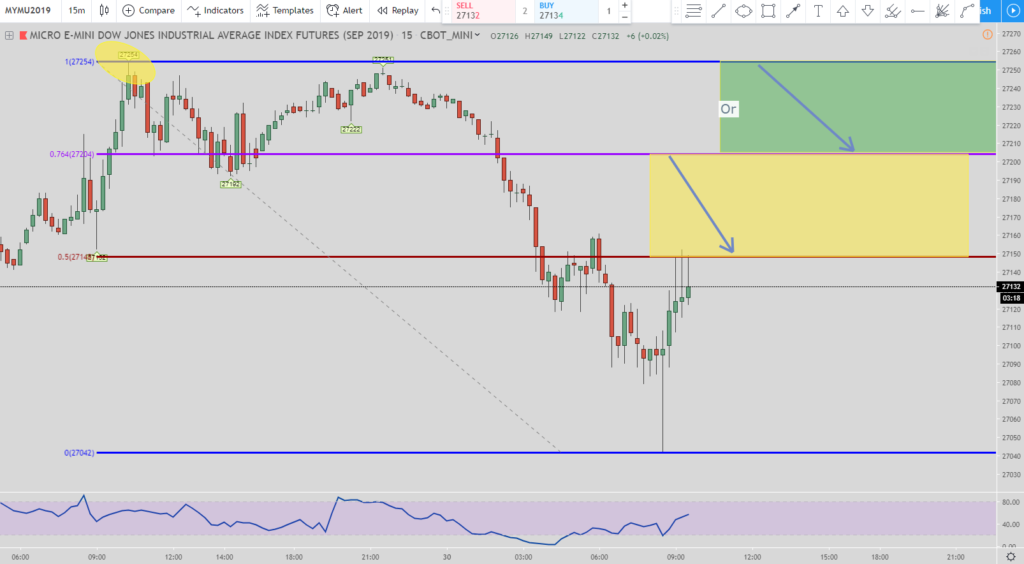

Here is another 76.4% trade. The one yesterday did not get initiated. The first entry is the top of the yellow box at 27204. Once that is hit then the exit is the bottom of the yellow box at 27150. But if the price does not hit that exit but continues to go up and hit the top of the green box at 27254 then you would get in short there as well. This would move the exits up to the bottom of the green box around 27210. If the price continues to move higher then all that means is you can short at higher levels but the exit does not move again. It stays at the bottom of the green box.

Once one of those exits are hit the move is over and time to look for another setup.

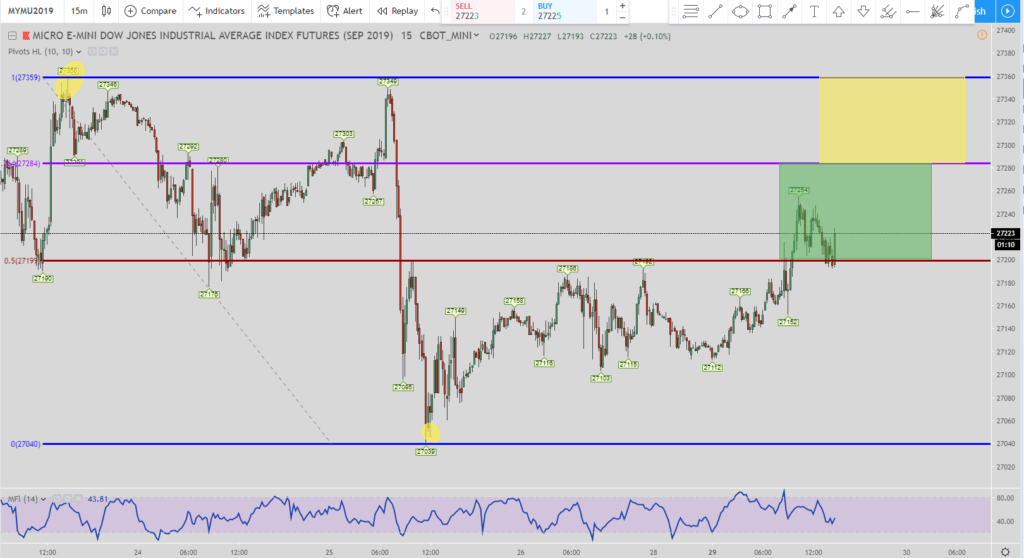

This trade is an upcoming trade that is the 76.4% short. It will remain valid as long as the pivot point low of 27,039 holds. If the price goes lower than that pivot point low before initiating the trade then it will need to be readjusted.

We are waiting for price to hit the top of the green box around 27,284. That is also the 76.5% Fibonacci retracement level. Once the price does that then the exit will be at the bottom of the green box which is also the 50% Fibonacci retracement level. That is at 27,199. But if the price doesn’t hit that ext but continues to go up and hit the top of the yellow box at 27,359 then that will be your next short entry.

The exits would then move to the bottom of the yellow box around 27,284. That is the last time you will move the exits. Even if the price continues to go up you would still not have to move your exit. So if the price continues to go up it just means you can go short at an even higher level and collect bigger profits when the price retraces back.

Conclusion

The Dow Jones live futures contract are a great contract to trade for day traders.

As you can see from my trades the setups are based upon Fibonacci retracements and extensions. I rarely use trend lines and when I do then are only to help see the direction of the trend. I’ve always been fascinated with the Fibonacci numbers and they fit how I am looking to trade. They help remove the subjectivity of trading.

I created my own trading style and setups. I’m not saying these are setups no one else in the world uses but they are the setups that work for me. How I got there was through meditation. Before I spent thousands of dollars “learning” how to be a losing trader from gurus and trading rooms that are a ripoff. A friend showed me how he created his own setups and it was through meditating.

I highly recommend you try it for yourself and see what it can do for you because I truly believe it can help improve just about every area of your life.

If I can assist in helping you with your trading please let me know and I will try to assist.

Take care,

Evan Carthey