Earlier this month after Iran attacked Saudi Aramco’s oil production the crude oil price futures sky-rocketed from around $54.88 to a high of $62.68 in a matter of minutes. You can read about it in this post: https://evancarthey.com/stock-market-today-for-9-16-2019-oil-rises-in-aftermath-of-attacks/

At the time I felt that the price of crude oil would start to work its way down over the next couple of weeks. The main reason is that there isn’t any long term disruption to the global supply of oil. It was only temporary.

So I was advocating selling the highs. This post for “Crude Oil Price Futures: How to Trade the Oil Market for Late Sept 2019” will go over the setups that have now been presented and ones we are waiting on based upon the setups I use to trade.

For full disclaimer, I do not have any live crude oil futures contracts on with my trades at this time.

Crude Oil Prices Futures in the News

In this report from FX Empire the author gives both a bullish and bearish scenario for the rest of this week in looking forward to the API report.

Bearish Scenario

A sustained move under $57.19 will indicate the presence of sellers. If this move creates enough downside momentum then look for the selling to possibly extend into the uptrending Gann angle at $55.93, followed by the main Fibonacci level at $55.60.

Bullish Scenario

A sustained move over $57.19 will signal the presence of buyers. This could lead to a labored rally with potential resistance targets coming in at $57.73, $57.84 and $57.93. This is followed by $58.73, $58.91 and $59.29. The latter is a potential trigger point for an acceleration to the upside.

My stance is that if there is any strength in oil then look to fade it. Until the gap is filled then any strength shown in crude oil should be used to sell into.

From this article, the author recommends to buy any dips in crude oil from the current prices.

Iran has said that any retaliation for the attacks on the Saudi oil fields will result in a swift and devastating response. Russia stands behind Iran and the US behind the Saudis. The attack is the latest move in a geopolitical game that is not going away any time soon. The bottom line is that the price of oil is likely to be highly sensitive to events in the Middle East. Any hostilities that impact production, refining, or logistical routes in the region are likely to cause price spikes to the upside as we witnessed on September 16.

I am a buyer of crude oil on price dips based on the current situation surrounding Iran. The most dramatic moves in the oil market on a percentage basis are likely to come in the Brent futures as it is the benchmark for pricing Middle Eastern crude oil.

I don’t disagree but I would wait until the price of oil retraces to fill the gap. I am a long term bull on oil but I am waiting for the gap to be filled before I look at any other energy stocks to add to my stock portfolio.

Also, if there are any spikes higher for oil then I would be a seller and look to get back in when the retracement happens to smooth out the move up in crude oil.

Charts for Crude Oil Prices Futures

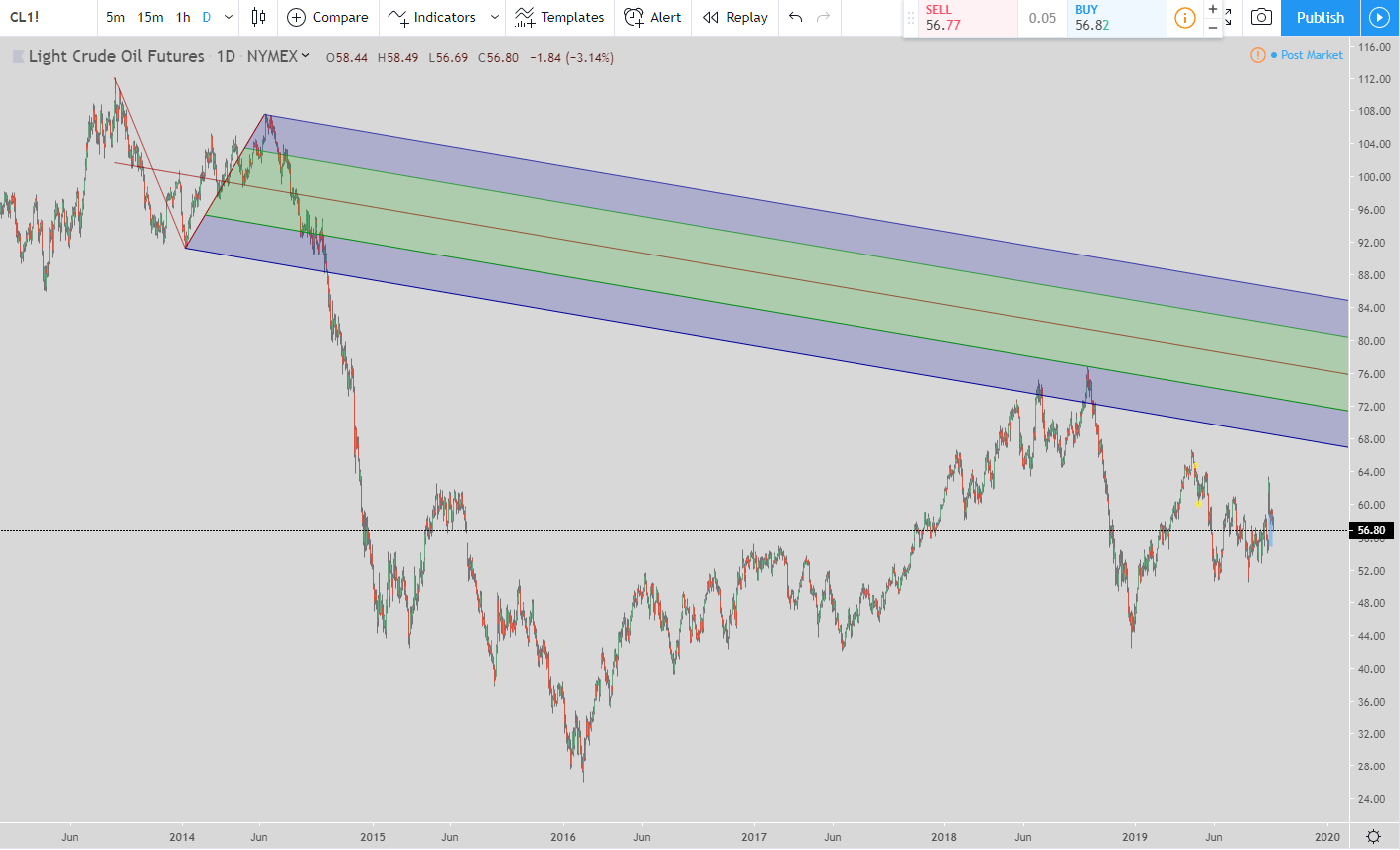

Here is a long term chart for crude oil going all the way back until 2013. You can see the Schiff Pitchfork I drew on the chart. The last time the price got up to the lower green line of the pitchfork it was rejected very quickly.

Look for the lines in this pitchfork to be resistance lines for crude oil in the future. Eventually, the price of oil will overcome the Schiff Pitchfork but it will take some time and you’ll see more swings as the price starts creeping back up into the Schiff Pitchfork.

Crude oil price futures

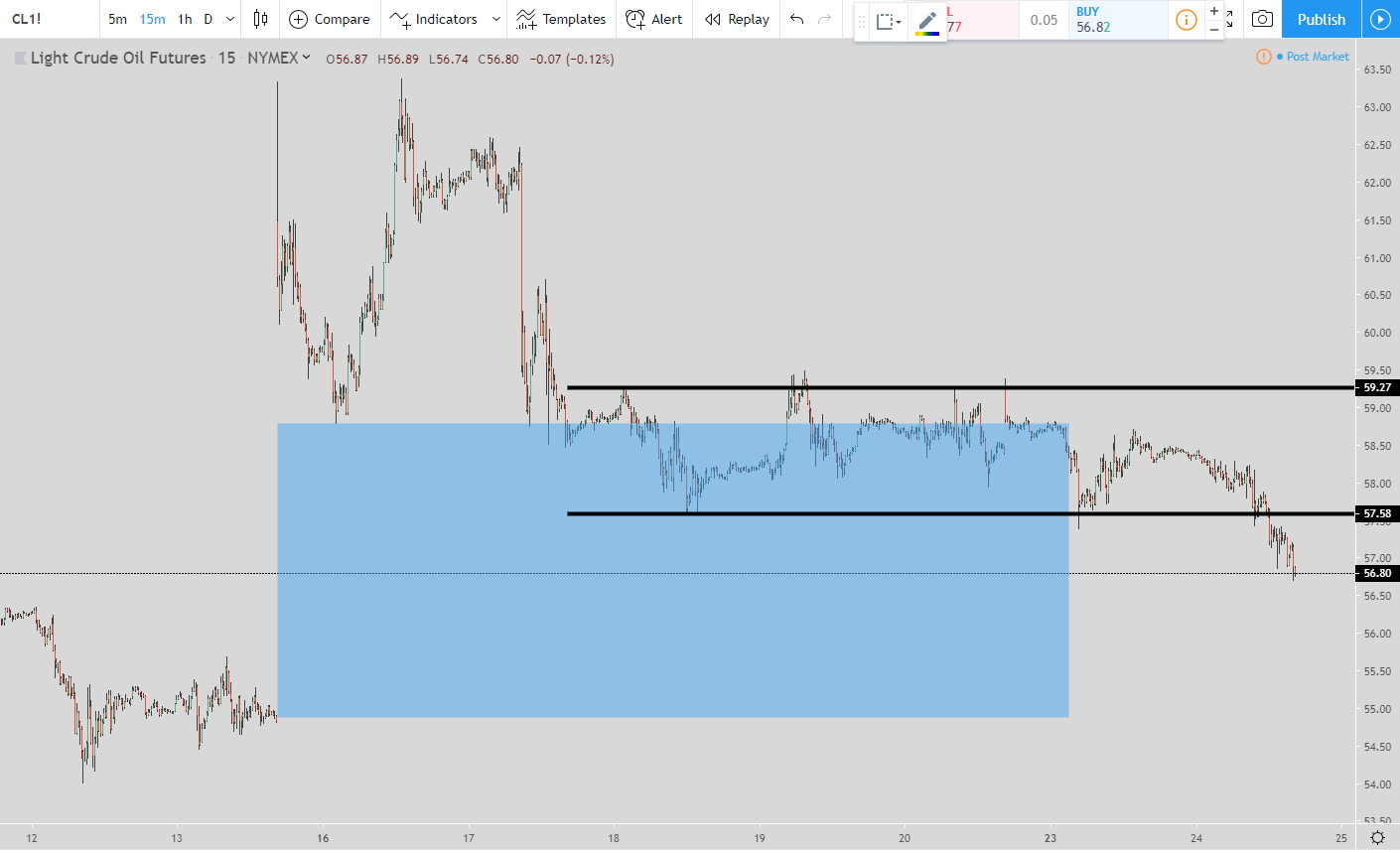

In this 15-minute chart, the blue box is where the gap is that needs to come down and be filled at around $54.88. The black lines are support and resistance lines I drew when that area was created.

You can see how the price of oil has firmly broken out of that area and has continued the move down.

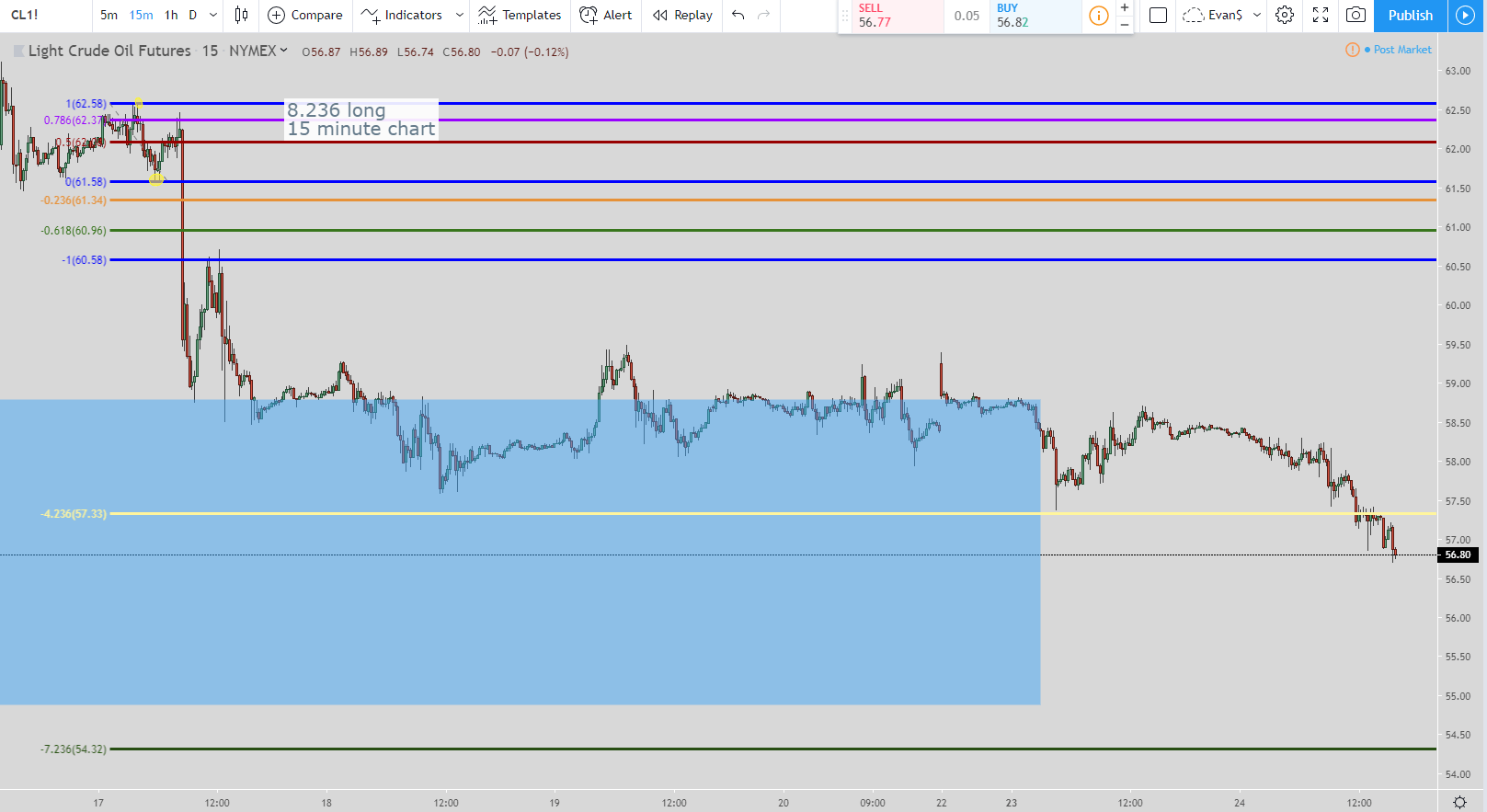

This is the 8.236% potential long setup to look out for. The entry is the green line at $54.32 which is just below the bottom of the blue box that is the gap I am looking to get filled. That is another reason why I am waiting to put any more money into the oil stocks I own until this downward move in oil comes to the mid $54 level.

So once the price hits $54.32 then that is the first entry. The exit is the yellow line at $57.33. But if the price keeps on moving lower and hits $40.27 then that would be the next entry. You would then move the exit to just below $54.23, so around $54.10 or so to be safe to make sure you would get filled to get out of the trade.

I always have my exits slightly above or below the exit to ensure I get filled and get out of the trade. I have seen the price go up and barely touch the line to complete the trade setup but there weren’t enough contracts traded in order to get filled and out of the trade. That is why I always get out a little early.

Video for Crude Oil’s Technical Analysis

If the video does not load below then click on the sentence to be taken to it.

The conclusion to Crude Oil Prices Futures: How to Trade the Oil Market for Late Sept 2019

From the post I did about oil last week I was bearish on crude oil and I still am. Until the gap gets filled at around $54.88. Then once that happens we can re-evaluate the market.

But with that big gap taking place it was simply much too large to ignore. Add in the fact the attacks would just be a temporary setback so I didn’t see the price of oil staying up in the $ ’60s from the spike up for very long. The price has already retraced back to $56.80 and I am looking for around $4 more of retracement so the gap gets filled.

Once that happens then I will start looking to add to some of the energy companies I own such as ConocoPhillips, Ring Energy, and Southwestern Energy.

For the long term, I am bullish on oil. After the historic collapse price is slowly working its way back up and most companies are profitable above $45 for a barrel of oil.

I do not think the $100 barrel of oil will happen anytime soon but eventually one day the price of oil will get up there again

Other Articles Related to Oil from https://evancarthey.com:

- Stock Market Today for 9-16-2019: OIL RISES IN AFTERMATH OF ATTACKS!

- Midweek Technical Analysis for the S&P 500, Oil Trading, and the Nasdaq

- Oil Trading Strategy for August 2019 Using Technical Analysis For Profits