Intraday trading is another term for day trading so what is intraday trading? Basically what you are doing when you intraday trade is you are entering and exiting a trade within the same day’s trading session. Depending on the market traded there will be a “close” time when you will need to have any open orders closed or you will be subject to a higher margin requirement for a short time. I will speak a little bit more about this below.

When you think of intraday trading just think of day trading. You can day trade just about anything that is able to be traded – stocks, Forex, futures, options, etc.

Depending on the market you trade will require a different amount of margin. If you are unfamiliar with margin it is the amount of money you have to have in your account to cover any open positions you have.

Here is the brief synopsis Investopedia gives for Intraday Trading: https://www.investopedia.com/terms/i/intraday.asp

Intraday means “within the day.” In the financial world, the term is shorthand used to describe securities that trade on the markets during regular business hours. These securities include stocks and exchange-traded funds (ETFs). Intraday also signifies the highs and lows that the asset crossed throughout the day. Intraday price movements are particularly significant to short-term or day traders looking to make multiple trades over the course of a single trading session. These busy traders will settle all their positions when the market closes.

There are numerous brokers to choose from depending on what markets you are looking to trade. I’m going to focus on the markets I currently trade because that is what I am best versed to review.

From my personal experience, I have used Forex.com, AMP Futures, and Ninja Trader who uses Dorman for their accounting. I have never had any issues with any of them so if you are based in the US then I would recommend Forex.com for Forex trading.

Then either AMP Futures or Ninja Trader depending on the platform you wish to use. Obviously, if you want to use the Ninja Trader platform then you have to go through them.

My current setup is using Forex.com for the broker and TradingView for the charts for Forex.

I use Robinhood for stock and options trading and TradingView for the charts.

For futures trading, I use AMP Futures for the broker and TradingView for the charts.

In my opinion Ninja Trader is the best platform for intraday trading.

If TradingView had some standard features such as multiple profit target capabilities then I would recommend them, especially if you cannot use the same computer each day. But TradingView is not as robust as Ninja Trader.

The reason I use TradingView is that I can access the charts from any computer since it is HTML based and not a program you install on a computer.

But if you will be in front of your own computer each day then Ninja Trader is my recommendation for intraday trading.

I highly recommend using a reputable broker that is regulated. In the past, I have dabbled with offshore brokers for Forex since they provided better leverage than US brokers but the risk isn’t worth it. They can shut down at a moment’s notice (and have) where they take all of your money and you never hear from them again. It has happened to me.

What is Intraday Trading for Beginners

In my opinion, the best reason for intraday trading is the leverage you can use for trading. For example, if you trade the Emini futures which are the futures contract for the S&P 500 you can day trade with a margin as low as $400 (NOT RECOMMENDED).

For intraday trading stocks I believe you need $25,000 in your account but am not 100% sure because I do not day trade stocks.

There are countless courses and trading rooms that seek to charge you money so you can learn to trade and make money from them. If you have read my site for any amount of time you will know that I am generally against just about all of them.

If those people who are selling their courses or trading room subscriptions were actually profitable then they more than likely would be making so much money that having a course or trading room would be too much of a pain and too little money to make it worth it.

But almost all of the people charging outrageous amounts for their courses or trading rooms

Decisions Are Magnified

There are multiple time frames you can use for intraday trading. The one I currently use is the 2-minute chart for trading and the hourly chart to watch the major trend of the market.

What that means is every 2 minutes a new candlestick bar is created. You can use just about any variety of minutes to trade.

Another way I have used in the past is the 2000 tick chart. What that means is every time a trade is made then the candlestick gets a “tick.” When you get 2000 trades to take place then the candlestick is finalized and onto the next candlestick being created.

There is no right or wrong time frame or tick chart to use. You just need to find the one that works for you.

The faster the time frame then the more your decisions are magnified. The way I started trading years ago was buying and selling stocks.

I wasn’t day trading or intraday trading. I would simply buy a stock and hold it until I thought I had reached enough profit (or loss) and then would sell it.

Sometimes I held the stock for weeks or months and other times I held it for a day. But the decision time frame was very long. I could take days or even weeks to make a decision to buy or sell a stock.

When I dove into futures trading I quickly discovered that any shortcomings I had in my trading system or my psychology were magnified 1000X! You will find out very quickly if you have any shortcomings in your trading by the losses that could pile up very fast.

Due to your decisions being magnified this leads me to the next topic of simulation trading.

To Sim or Not to Sim

Sim trading is demo trading. You can test out a broker’s trading platform or software and use pretend money. It doesn’t cost you anything. This is how most people recommend getting started in intraday trading and I agree to a certain extent.

Whatever your trading platform or broker is you are using you will want to make sure you are 110% comfortable with it and if you have to make any decisions then you know how to do so instantly.

Depending on how short your time frame you trade this can mean this difference between a profitable or losing trade.

The goal of sim trading is to ensure you know what you are doing with your strategy and how to execute it on the fly.

This is the first goal of simulation trading. The second is to get out of simulation trading as soon as possible. The reason why is because sim trading will not prepare you for the psychological impact that having live money in the market will do to your decision-making process.

I have sim traded a ton in the past and it does me no good when I have money on the line. When I first started trading live something flipped a switch in my brain and I was flooded with emotions I didn’t know existed.

It was brutal.

It took me blowing two accounts to realize that sim trading does not prepare you to be successful when you go live. Yes, it can help and does have its place but you want to go live as soon as possible. I am convinced that the psychological part of trading is greater than the technical part. (I don’t trade using fundamentals so I can’t speak to that aspect)

It can make or break you extremely fast.

If you have ever revenge traded then you know what I am talking about. One loss used to set me off and before I knew it I was trading to “get even” with the market.

As soon as I went live my strategy went out the window and I made a stupid decision after a stupid decision.

It wasn’t until I was live in the market for a long time did I finally start to embrace my psychological makeup and work on it when I am in the market and out of the market.

How Much To Trade Live With?

This is where it all depends on your bankroll.

When I first started and was testing my systems I used 0.01 lots in the Forex market. I was using Meta Trader 4 as the platform. My bankroll was $2,000.

The losses were so small that they didn’t impact my emotions and I was able to gain valuable experience while I learned what worked and what didn’t work very fast. At most I would lose $100 per month trading this way.

If you are trading the Micro Emini contracts then your losses can be much more than that. If I was starting out this way then my bankroll would be at least $5,000.

Again, it all depends on what your risk tolerance is and how big your bankroll is for you.

But you want to have a big enough bankroll when starting out that the losses do not impact you emotionally. The moment your bankroll gets too small is when disaster is right around the corner.

You’ll make plenty of mistakes starting out when you go live no matter how successful you are in sim trading. So make sure the drawdown you have until you get your emotions under control does not negatively impact your bankroll to where any loss sends you into a tailspin.

How I Handle Losses

Even today when I am in a trade I will be honest and tell you that when a trade is going against me I get a knot in my stomach and negative thoughts start creeping into my head.

“You are worthless.”

“You will never figure this out.”

“Why do you even trade, you are hopeless.”

Even with the meditation and psychological work I have done this is something that I have embraced. When that emotion and thoughts come into my head I start focusing on my breathing and start telling myself that I am learning every day. I am successful. Even if I lose it will teach me to be a better trader in the next trade. I am an extremely profitable trader.

I’m not sure why my body defaults to the negative when a trade goes against me but it does. But the key is that I have recognized this and embrace it. Instead of fighting it, I recognize it because it is some twisted way my ego is trying to protect me.

So when I do have a losing trade those emotions are present and I do what I mentioned above such as focusing on my breathing and replacing the negative thoughts with positive ones.

Then before I take another trade I look at where I went wrong.

The market is never wrong, it is me who is wrong. I am just along for the ride when I trade so I seek to get on the right side of the market’s directions and learn from how my decision-making process was incorrect and got me on the wrong side of the market.

It took me a long time to get to this point. I wish I could say I never broke down and had to lock myself in the bathroom to get my head straight because of a day where I never thought my losses could be so much………. but that wouldn’t be true.

There have been days that have carried over and stung for 2-3 days at a time due to the bad decisions I have made.

Especially when you have a couple of weeks of trading success and you think you have finally figured out a trading strategy that is a gold mine but only to discover it has a terrible flaw.

So you have to pick yourself back up and start again. This is the reality.

Trading is a brutal business. I have been knocked down over and over and over again. But I keep getting back up and trying to learn from my mistakes.

It wasn’t until I realized that I am not in control of anything the market does. I am just along for the ride and am looking to make the best decision possible to be on the right side of the market direction.

When I have a losing trade the only person to blame is myself. Not God and not the market. Just myself.

You have to take 100% responsibility for every decision you make because there is no one else but yourself to dictate your success or failure through trading. It truly is up to you.

How much time and effort are you willing to put into trading until you become a profitable trader?

If you know deep down you do not want to invest the time and effort then no big deal at all. Trading isn’t for everyone. But do not be fooled by anyone selling a course or trading room that trading is easy to learn to pull money out of the market on a consistent basis.

Intraday Trading Strategies

There are virtually countless strategies for intraday trading, almost all of them are crap. But the key is to find out how you like to trade and build on it from there.

Intraday trading is extremely easy to get set up and running. The market wants your money.

I once heard the saying that the easier something is to get into the tougher it is to make money. The harder something is to get into the easier it is to make money.

Intraday trading falls in the first category. There is a reason why most people don’t make money trading. It is full of some of the best and brightest people on earth whose sole job is to maximize the rate of return they make by trading the markets.

This doesn’t mean it is impossible to make money but it will take a ton of work. Anyone who says trading is easy is trying to sell you a course for $4,999. It is not easy because the market is built to trick you in order to take your money from you.

You have to love trading and put your time, sweat, and tears into it. It is a business just like any other business. Probably more cut-throat and savage than most other businesses.

If you are reading this then I assume you are trading with your own money which is where most of my readers fall into this category.

So I am going to give you a strategy that is the basis of what I use to trade. It isn’t everything that covers 100% the way I trade but if you are looking for a trading style to emulate then try testing the one out I am going to mention.

But before I do that I want to give you two other intraday trading styles that I recommend. They are from two other traders.

The reason I recommend them is because they don’t charge outrageous amounts to learn how they trade and they are not selling a trading service where you rely on them for your trading success. They want you to learn for yourself.

You have to learn and teach yourself. Both of these guys have positively impacted my trading and I use some form of the style they teach but have adapted it to fit how I want to trade:

I believe that Mack charges $100 for his eBook but you can learn the way he trades by watching his YouTube videos that he uploads almost daily.

Emini Addict charges $30/month to have access to his site but he also gives a week free so you can see if his trading style would be beneficial to you.

If you sign up for either of these guys then awesome but please be aware that I get nothing. These are not affiliate links and these guys have no idea who I am. I recommend them because they have helped me out in my trading journey and if you are looking for a good place to start with your intraday trading strategy then those two are who I recommend.

The key is to find your own trading style.

Test and verify the way you want to trade. You have to poke holes in it from every angle to ensure you can make money trading whichever way you decide. Once you find a hole in it where it doesn’t work then it is time to look for a new setup.

There isn’t a right way to trade. You can use as many indicators as your heart’s desires or you can use none. The only way to trade is the way that makes you money so trade whichever way you want, as long as it makes you money.

My Trading Strategy for What is Intraday Trading?

Intraday Trading Rules

Margin

The broker I currently use for intraday trading is AMP Futures. Here is the link to their margin requirements for everything they allow you to trade: https://www.ampfutures.com/trading-info/margins/

The margin is one of the biggest parameters you must follow based upon the market you trade. Most brokers use around the same margin because it is set by the exchange that is traded.

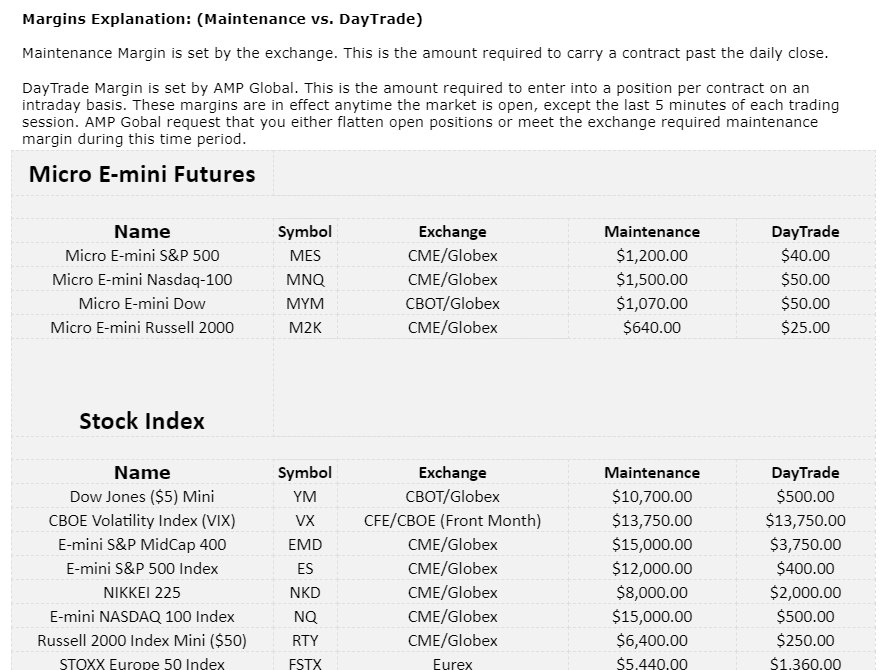

Here is AMP’s description of Maintenance vs DayTrade margins:

Maintenance Margin is set by the exchange. This is the amount required to carry a contract past the daily close.

DayTrade Margin is set by AMP Global. This is the amount required to enter into a position per contract on an intraday basis. These margins are in effect anytime the market is open, except the last 5 minutes of each trading session. AMP Gobal request that you either flatten open positions or meet the exchange required maintenance margin during this time period.

Above is a picture from AMP Futures that shows the Maintenance vs Day Trade margin requirements. You only need to have the Maintenance margin if you plan on holding after the daily session closes.

If your account ever falls under the required margin requirement then expect your broker to do a “margin call” where they warn you to put capital in your account to cover the amount needed for margin or they will pull the trigger and close your positions.

During the Corona crap the margin rates were increased and in the energy market AMP Futures were not allowing trades to be made there due to the volatility. They didn’t want people to get caught on the wrong side of a huge instantaneous move and have trading get halted and not able to get out of the trade.

In most other times the maintenance and day trade margins will remain the same but in times of great volatility then please be aware that margin requirements can change on a moment’s notice.

Trading Hours

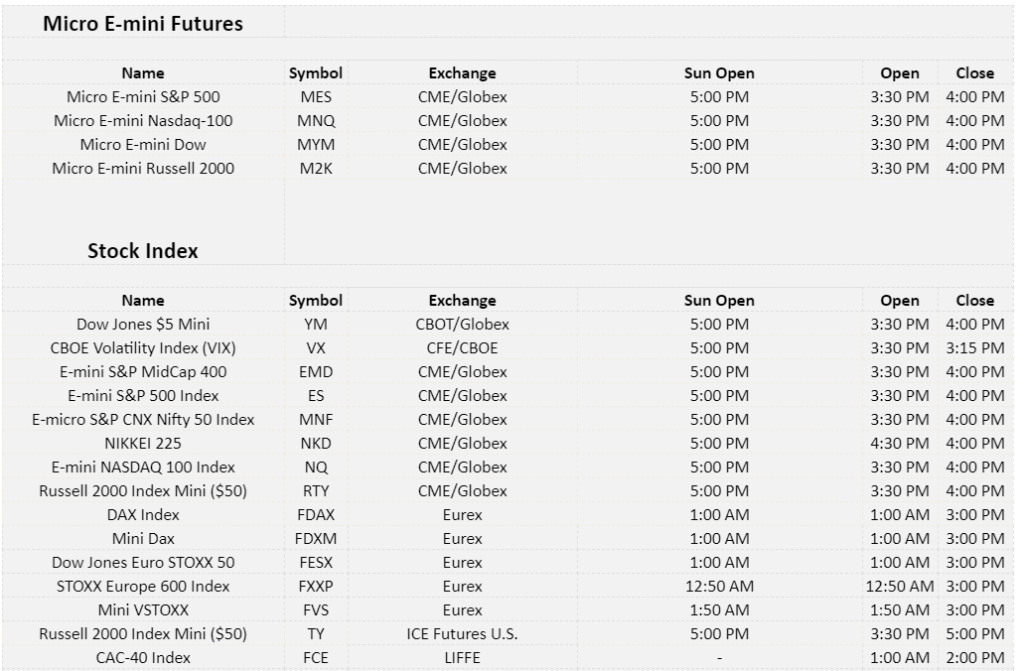

Here is the link from AMP Futures for all of the markets they allow you to trade with the open and closing time: https://www.ampfutures.com/trading-info/trading-hours/

For most markets, you have to have any open positions closed five minutes before the close time or the maintenance margins will come into play.

As you can see from the picture above there are different open and closing hours depending on the market you trade.

The conclusion to What is Intraday Trading – A Beginner’s Roadmap to Success

Depending on what markets you trade the two main areas to keep in mind are the hours the markets are open and the amount of margin required – DayTrade vs Maintenance.

Overall there is a lot that goes into it but I would break it down into a couple of easy steps:

- Find out the margin and bankroll you need to trade

- Get your broker and trading platform setup

- Demo trade until you are comfortable with your trading platform and broker

- Go live but trade the smallest amount possible

- Test, test, and test again until you find the first trading setup that works for you

- Keep learning and testing to discover new trading setups

The reality is you will probably lose money when you first go live trading. That is just the cold hard truth. But the goal is to minimize it until you figure out what works for you and the trading style you need to adopt to become a profitable trader.

Hopefully, the info here in this post – What is Intraday Trading – A Beginner’s Roadmap to Success – will help clarify the intraday trading picture a little bit better. Especially the psychology part.

I feel that most people gloss over it when it really is one of the most important factors in your success in trading.

Best wishes out there because it is an amazing journey.