General Electric (GE) has been in a nose dive until recently when it is rumored that Warren Buffet has been purchasing the stock. https://www.cnbc.com/2018/03/28/general-electric-would-be-an-ideal-warren-buffett-investment-rbc-says.html With the way I trade the one positive piece of news is now General Electric is in free trade territory.

What this means is that if you buy at the current level of $13.68 then the current price is less than the 50% Fibonacci retracement exit level even if price goes down to $0.01. Would I be buying now? Let’s look at the charts:

But first you can read what I wrote on 12/29/17: https://evancarthey.com/time-buy-general-electric-ge-short-zero/. At the time I was looking to go long. Fortunately my trading has evolved slightly since then. I held off on going long at that time. The 3 filters are the reason why which I will talk about below.

Is the downward spiral over for General Electric?

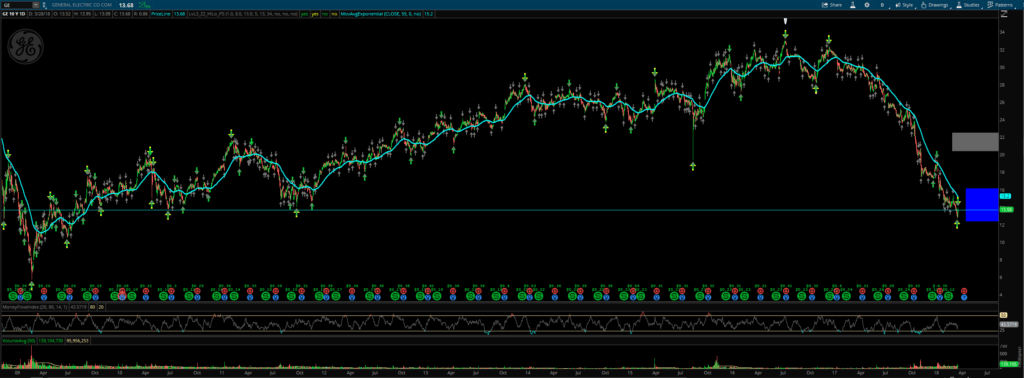

From this chart you can see that GE has been going pretty much straight down since 12/20/2016. Some people are starting to dip their toe in the water thinking that the floor might be in. It could be but I am not buying just yet and here are the reasons why. I have 3 criterias I have created in order to ensure I don’t get in too early and 2 of them have to be met. Sometimes I will go with only 1 being met but that is only if price is in “Free Trade Territory.” Which GE is at the moment but I am still waiting a little bit more.

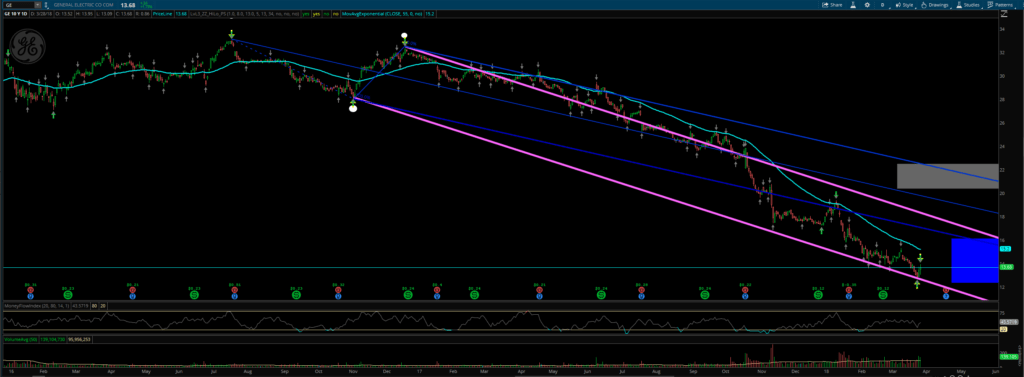

- From the chart above the moving average is the 55. One criteria I have for getting in a stock is price must have closed above (if looking for a long) the 55 moving average. Ever since price began going into the Fibonacci extension territory price has not closed above the 55 day moving average.

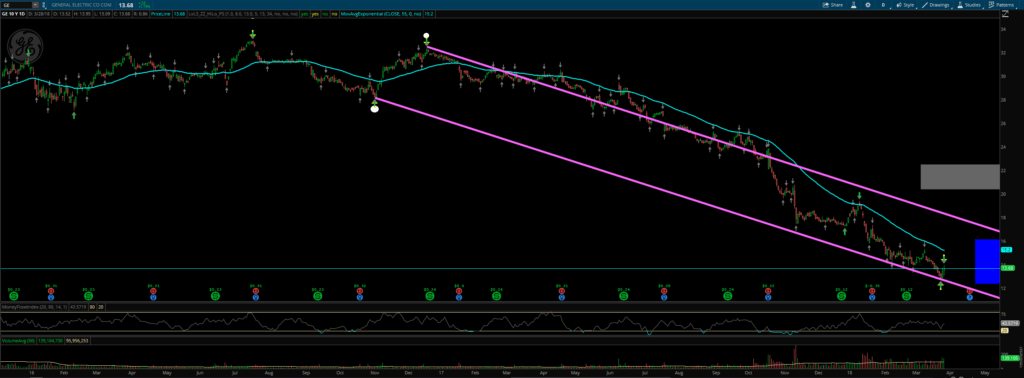

2. The way I draw trend lines is I draw the opposite side first from the pivot points and then move it to the other side. So from this example I drew the bottom trend line first and then moved it over to the top. Once price closes above the top trend line then that is the 2nd of 3 signals I look for to enter a stock when going long. But one thing I have noticed is that even when price breaks above and closes north of the trend line that a lot of the time price will come back down and created a double bottom or at least come back down and touch the top of the trend line before making its move up.

3. The 3rd filter I use is Andrew’s Pitchfork. As you can see price is well below the AP channel. What I look for when going long is for price to close above the north side of the channel. The AP filter is the one that usually gets left out because when you have a flat angle like that then you can miss a good chunk of the move. That is why I look for 2 out of the 3 filters to be met (MA, trend line, AP).

Here is What My Chart Currently Looks Like

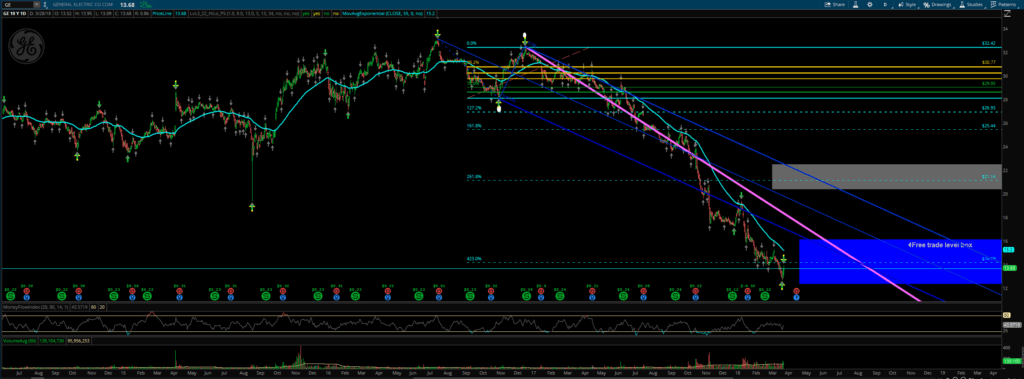

As you can see I am still waiting for price to close above the 55 moving average and to close above the magenta line. Now if you want to get in you can and here is why.

Price is now in free trade territory as mentioned earlier. The top of the blue box is the 50% fib retracement level. It is from the top of my pivot point down to $0.01. So even if price goes down there you are still good for the retracement exit at around $16.00. So you could get in now if you wanted to and continue to buy as price moves lower.

The gray box is the current fib retracement level with the top of the box being 50%. My current exit if I was long would be around $22.00. You can also see price is just past the 423% fib extension level so it is extremely over sold. If I was going to get in now here is what I would do. With $10,000 set aside for GE then I would buy $1,000 now. Then $1,100 more every dollar it goes down.