With the Ford stock forecast in 2019, we are going to look at what setups have presented themselves and which ones we are waiting to get started with.

Since the highs of around $19 the stock have taken a rocky path and are in a clear downtrend at the moment. During the financial crisis, they went as low as $1.01 and in the charts, I’ll go over what to look for if the move lower continues.

Recently Moody’s Investors Service cut Ford’s credit rating to junk level status.

Moody’s downgraded Ford to Ba1, just below investment-grade status, on concerns that the company’s cash flow and profit margins are lagging those of rivals at a moment when Ford is gearing up to spend a lot of money overhauling its global operations.

Moody’s acknowledges that Ford is in the early stages of a product-line overhaul that should help its margins, particularly in North America. And it’s clear that Ford’s balance sheet is in good shape, and the company has plenty of cash to see it through. But — again, as Moody’s sees it — the restructuring efforts, particularly in Europe and South America, will take several years to complete, and the economic waters are likely to get choppier before Ford’s work is done.

If you have seen the movie The Big Short you have seen the scene where the character played by Steve Carrell goes to rating services companies who refuse to downgrade the subprime bonds since the underlying loans were deteriorating. I’ll post the clip below. If you haven’t seen the movie then I HIGHLY recommend you check it out.

The movie does an excellent job explaining what happened in the sub-prime mortgage crisis in very easy to understand the lingo. It also points out how the system is rigged.

So needless to say I am not a fan of S&P, Moody’s, etc. and don’t really pay attention to what they do since their job is to make as much money as possible and not to tell the truth. So I don’t really care that they gave Ford (F) a junk level status rating.

But if you are looking for a shred of positive news then Morgan Stanley in August 2019 upgraded Ford’s stock from a price target from $10 to $12 which does align closer to one of the charts I will talk about below.

The Charts for the Ford Stock Forecast

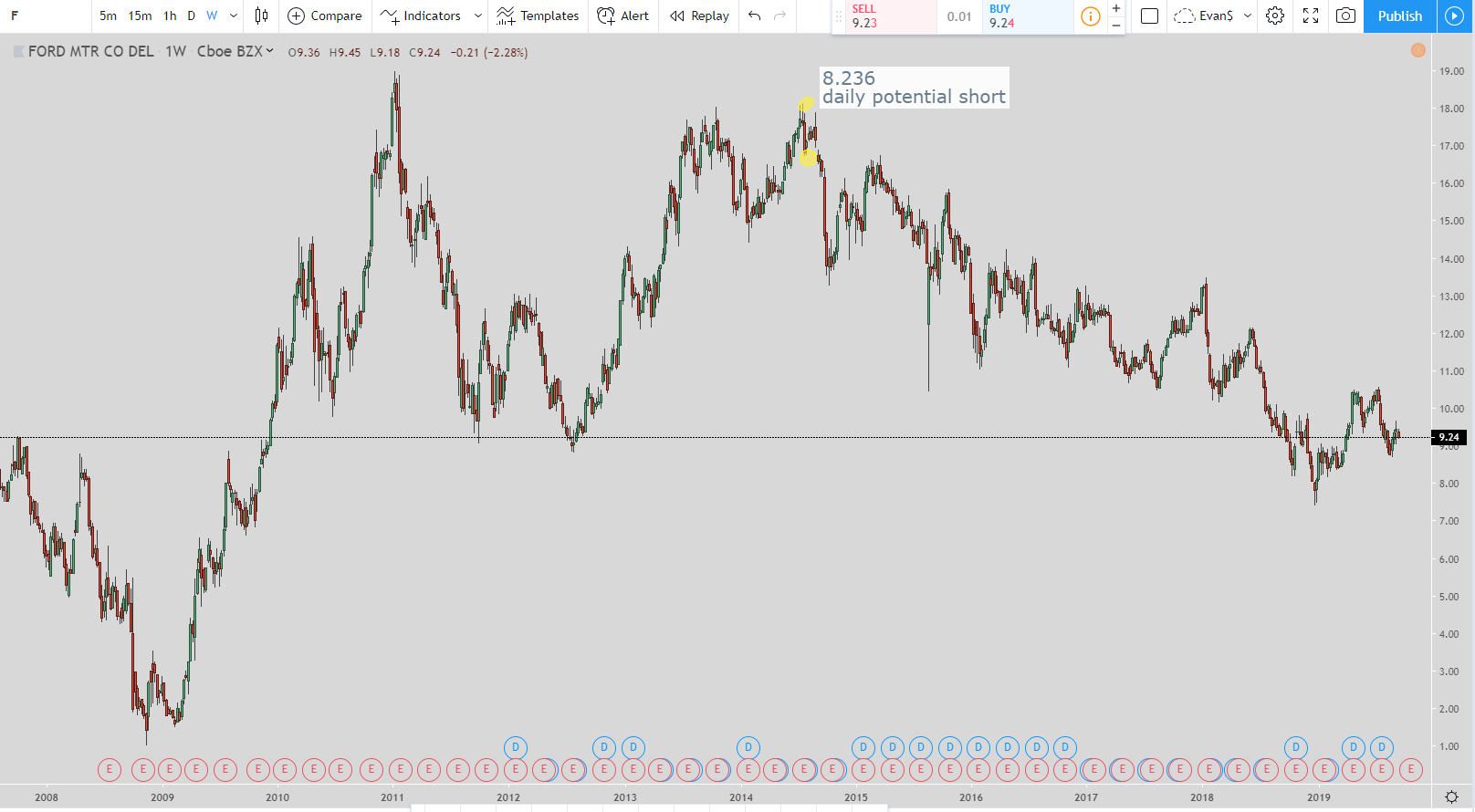

Here is Ford’s stock chart for the past 10 years. You can see during the financial crisis how Ford went down to a low of almost $1.00. Since then it went all the way up to around $19 but now it is clearly in a downtrend. Will it go all the way down to $1.00 again?

I doubt it but you never know. But I’ll explain below how I do hope it does go closer to $6 because then I would get very interested in purchasing Ford’s stock.

Ford Stock Forecast

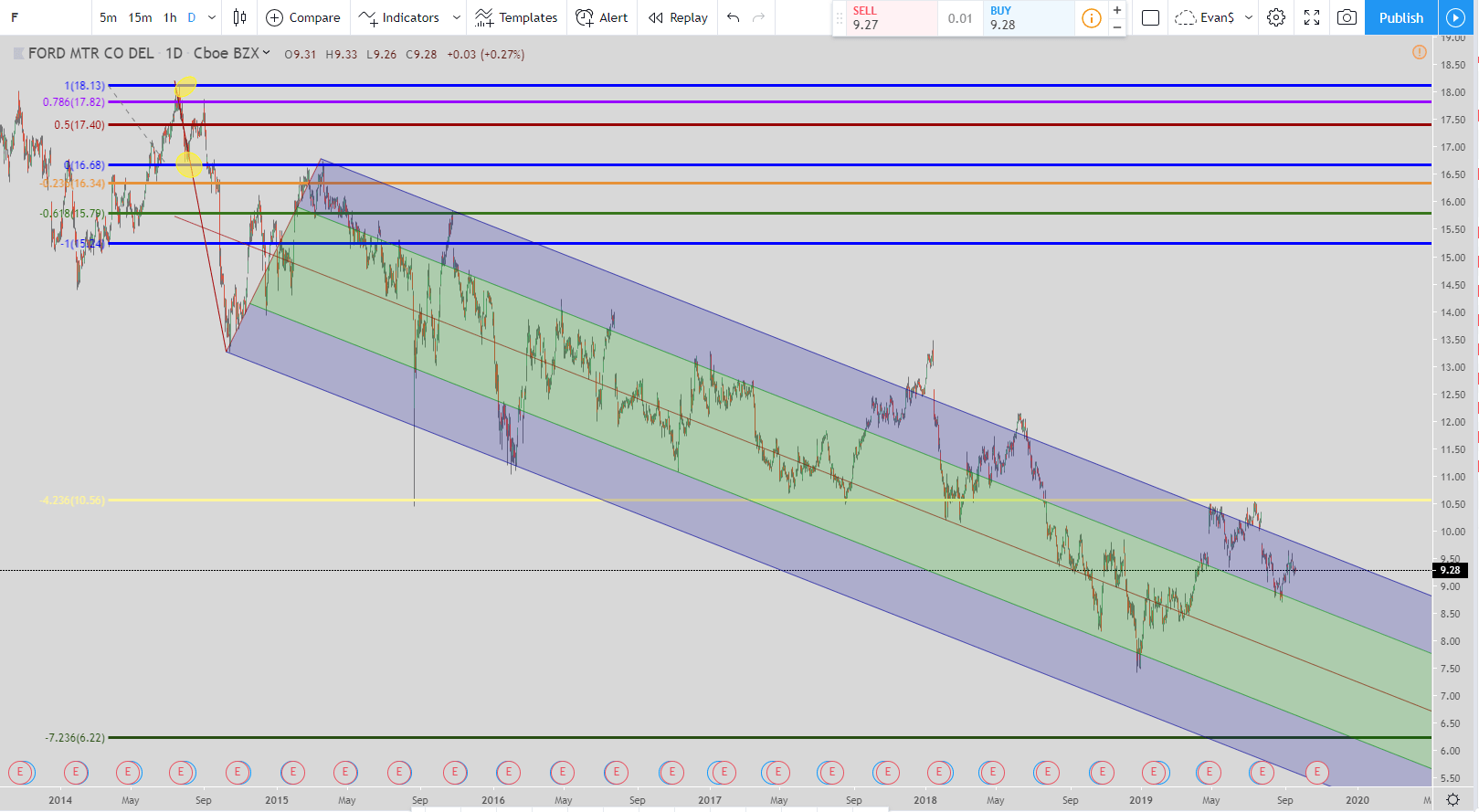

This is the 8.236% setup we are waiting to get started. If the price ever goes back down to $6.22 (the green line) then that will initiate the trade. The exit will be the yellow line at $10.56. This is a setup I am waiting on and if I catch it in time then I will try to get in on it. The time frame used here is the daily time frame.

You can see that price is currently in a solid downtrend that I highlighted using the Schiff Pitchfork. I wanted to show that because if you are looking in to the stock then this is a downtrend to be aware of.

Right now you could even start getting into the stock if you feel Ford has great long term prospects. The reason why is because the exit won’t move from $10.56. So even if the price hits $6.22 and continues to go lower the exit won’t move from $10.56. since the -21.236% Fibonacci extension level can never be reached since it is below $0 then that is the only exit we have.

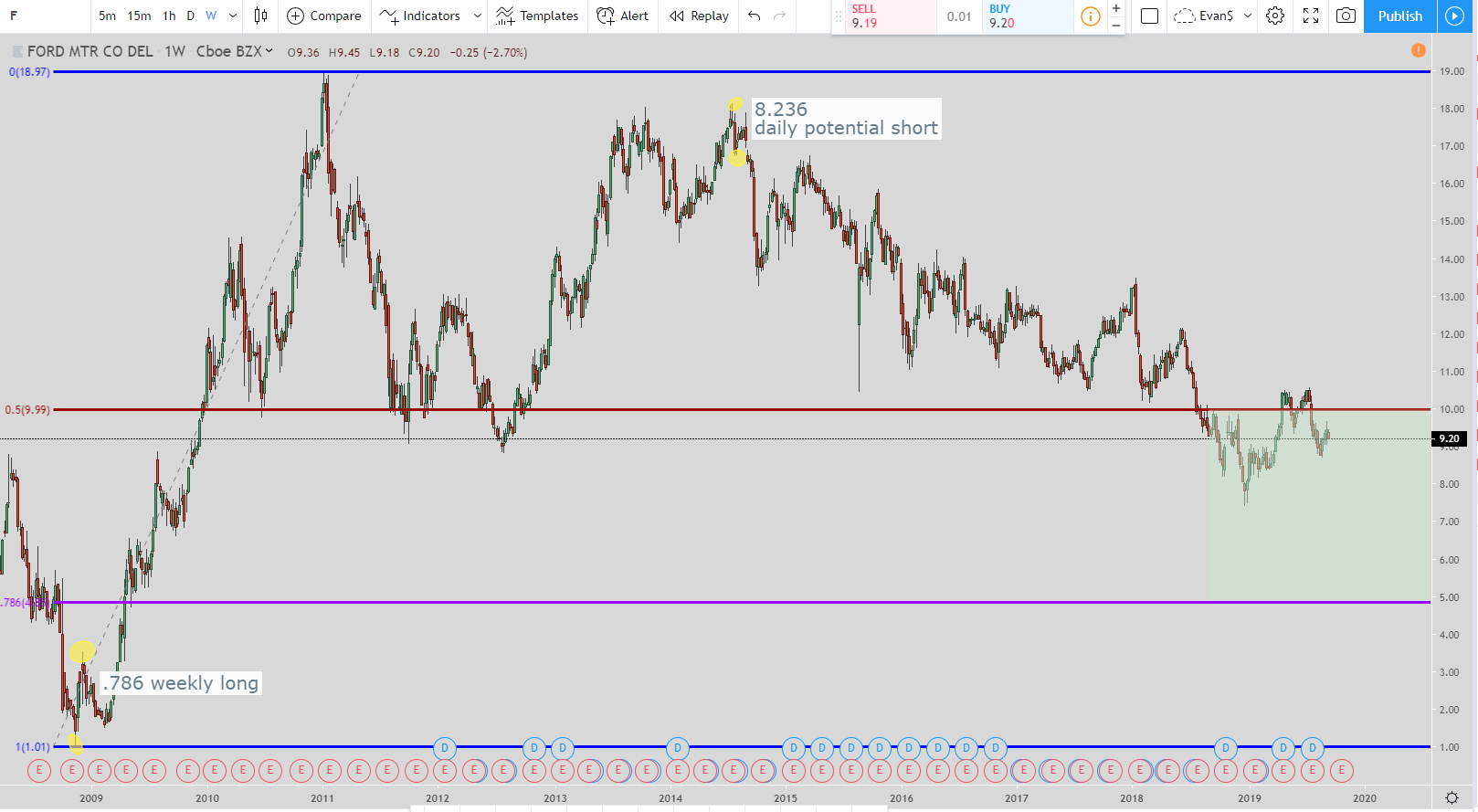

This is another setup we are waiting for it to initiate as well. The setup used here is the 78.6% long setup on the weekly chart. You can see in the bottom left-hand corner where it initiated from.

What I am waiting for is the price to retrace down to the purple line which is the 78.6% Fibonacci retracement level. The price is $4.90 for the purple line. Once the price hits that then the exit is the 50% Fibonacci retracement level which is the red line at $9.99.

But if the price keeps on moving down and hits the 100% level at $1.01 then the exit will move to just below the purple line at around $4.70. That will be the last time the exit would move. It may not even get to that point if the price goes up and hits the 50% retracement after the trade is initialized. But I always try to give all of the entry and exit possibilities for each trade I post.

Video

If the video does not load then click on this sentence. The video will go over all the charts listed above and maybe some extras for better clarification.

Conclusion for the Ford Stock Forecast in 2019

If Ford moves lower, especially closer to the $6 mark then this is a stock I am looking to get into. The government has shown they won’t let Ford or the other major US automakers go bankrupt so they are safe on that front. Usually, when a stock is under $10 and in a downward spiral are ones I now try to avoid.

I’ve been burned in the past with these stocks going bankrupt but they were a whole lot smaller than Ford.

But based upon some of the stock charts I have shown I do like Ford when it gets closer to $6. If you are bullish long term on Ford then you can start scaling in now. But all of the information here is my own opinion based upon my own technical analysis and should not be treated as financial advice.

Generally speaking, when a company’s credit rating is lowered, it has to pay more to finance its debt. That wouldn’t be a disaster for Ford, but it wouldn’t be helpful, either. That said, note that there are three credit-rating agencies, and so far only Moody’s has downgraded Ford. Until and unless one (or both) of the others also cuts the Blue Oval’s ratings, the practical effects of this downgrade will likely be minor.

For Ford shareholders (I’m one), my advice is to sit tight. This downgrade doesn’t change my view that while things could get worse before they get better (and that’s true of any auto stock right now), Ford is healthy and on the right track to improve its bottom line over time. I plan to stay patient, reinvest the dividend, watch Ford’s new-product launches, and see where things stand a few years from now.