I ran across an interesting article today on Zerohedge where the author gave scenarios about how two “nuclear options” could strike the global economy: http://www.zerohedge.com/news/2016-10-06/global-economic-nuclear-options-oil-pinned-below-30barrel-us-dollar-rising. It is an interesting article and I believe he would be accurate in that the world economy would go into a massive recession if his two scenarios with oil getting stuck below $30/bbl and the USD making another leg up happens. Fortunately that is not going to happen anytime soon to either of them.

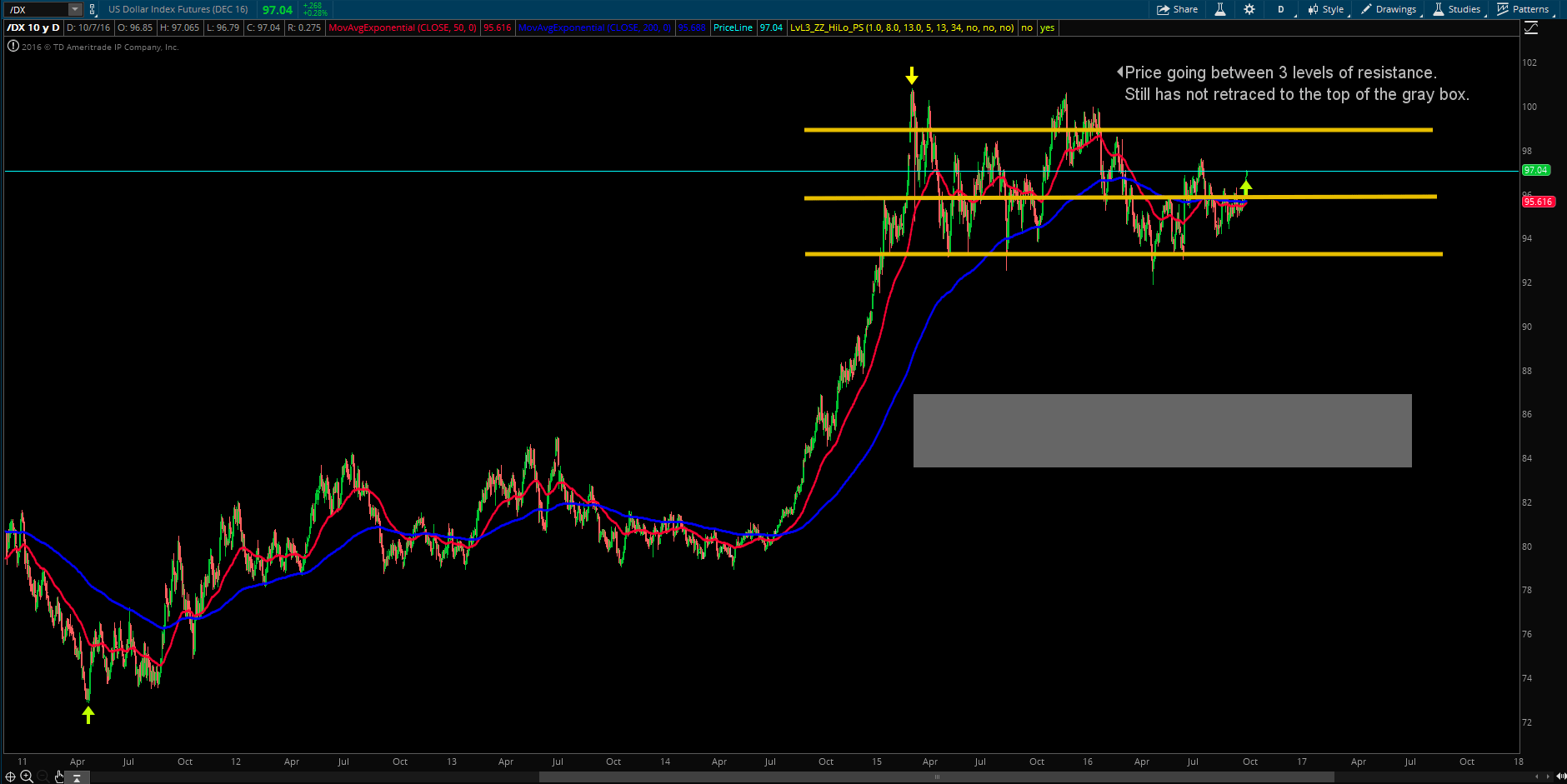

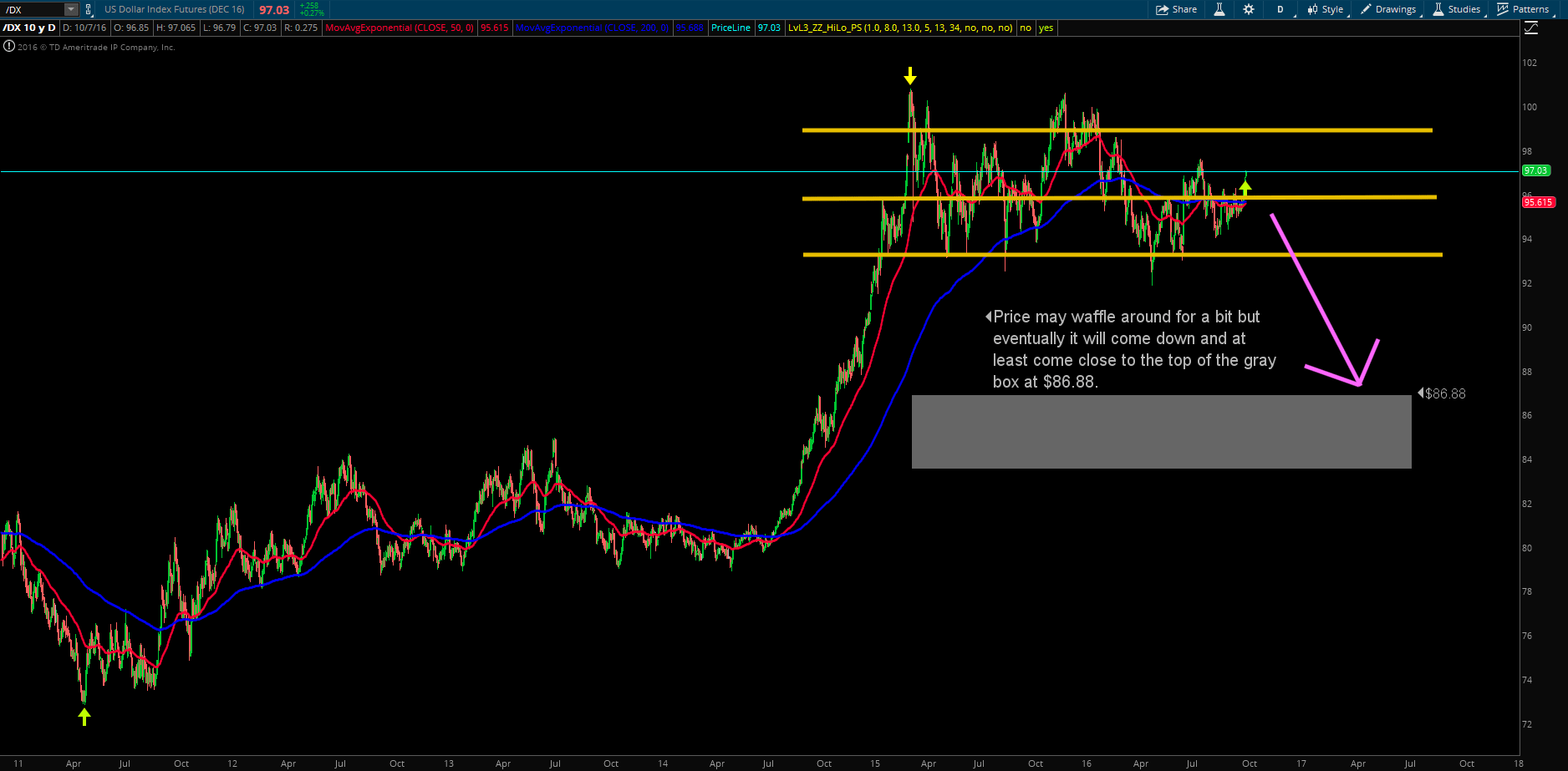

In this post I showed how the US stock market is on its last leg up and will start its retracement sooner than later: https://evancarthey.com/bull-run-us-stock-market-almost/. I think it will coincide with the Fed raising the interest rate. Let’s look at the USD and see what it is showing:

I think the decline in the USD will go right along with the retracement in the US stock market and I think both will happen when the Fed raises the interest rate.

The other item the author mentioned is oil. He is correct in that if oil goes under and stays under $30/bbl then it will destroy the oil and gas industry much worse than what has already been done. This would coincide with the another leg up in the USD but fortunately I think the next major move (as stated above) for the USD is to the downside. In this post I show how I believe oil is on its way up to at least $66.80: https://evancarthey.com/updated-long-term-cl-oil-analysis/. After oil reaches $66.80 then anything can happen but my projection is oil to reach that level so there is no fear of oil being stuck below $30 anytime soon.

I did enjoy the article the author wrote and it had me go back and check on the USD to see what it is doing but it lines up perfectly with my previous analysis for the US stock indexes and oil. Oil usually rises when the USD goes down and vice versa. To recap, I think oil is on its way up to at least $66.80 and that the US stock market and USD’s room to the upside is limited with a retracement coming sooner than later.