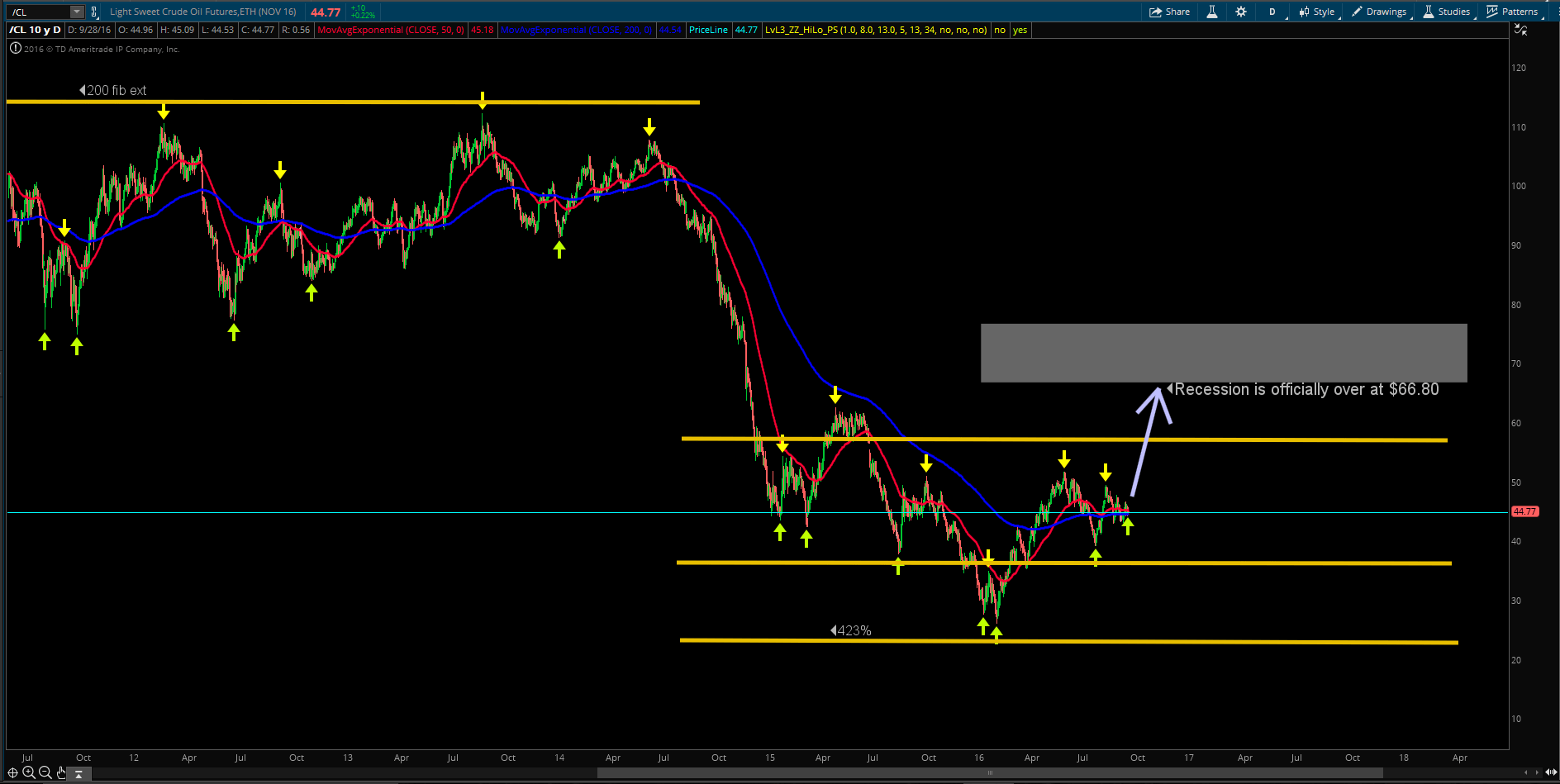

In this post I gave my analysis of what is in store for oil long term: https://evancarthey.com/whats-next-oil-cl-long-term/. Now that I have my Think or Swim charts adjusted I am using them for my longer term analysis and Ninja Trader for short term. In this update the overall sentiment did not change at all but now I have a much cleaner presentation.

I still expect price to move up to at least $66.80. When it does then the recession is officially over. Yesterday OPEC agreed (allegedly) to cap production in November and this is the first legitimate production cap agreement that a lot of people agree will happen. Will that be enough to move price up to $66.80? I don’t know, but it will help demand overtake the supply glut. The absolute low is around $23.00 and I seriously doubt price goes back to test the early 2016 lows. My analysis for CL (oil) is bullish and if you have any oil stocks that you feel are a good value then I would start buying them. Any dip in the price of oil into the low 40s and 30s before price hits $66.80 would be an even better buying opportunity because it is only a matter of time before oil goes back up to $66.80. It could go much higher but that is the level for me to declare the oil recession officially over. Once that target is hit then the new market is underway and I will have a new analysis. I believe the oil and gas market presents some very attractive buying opportunities at this time.