Ever since Brexit the GBP has been going down. It has had a few small rallies but if you shorted any pair the night of Brexit then you have made a ton of money. I am here to tell you today that the downward move is close to being over. It still may go down a little bit more but I am long GBP/AUD, GBP/USD and short the EUR/GBP. All of the charts are getting very close to confirming the move to the downside is almost complete and when the retracement happens price is going to move quite a bit.

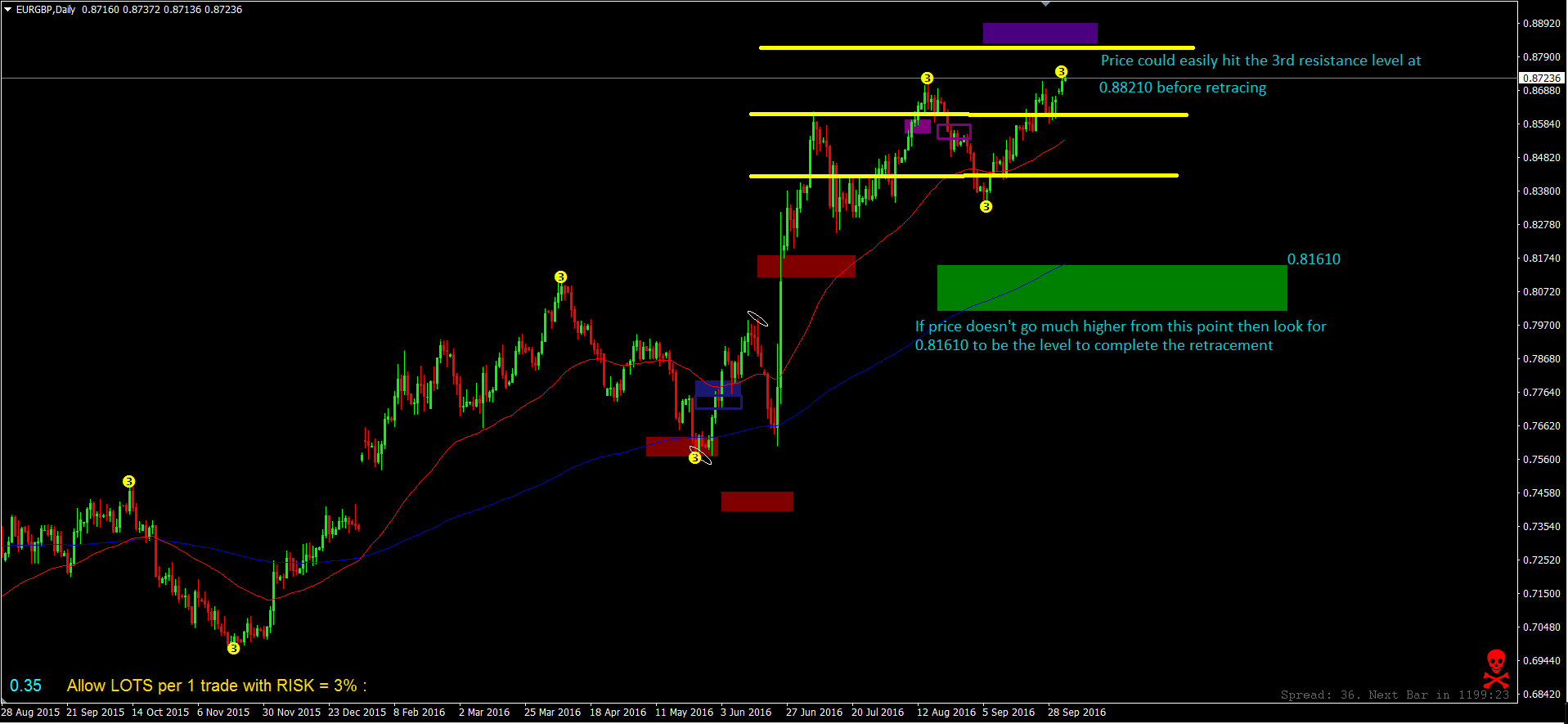

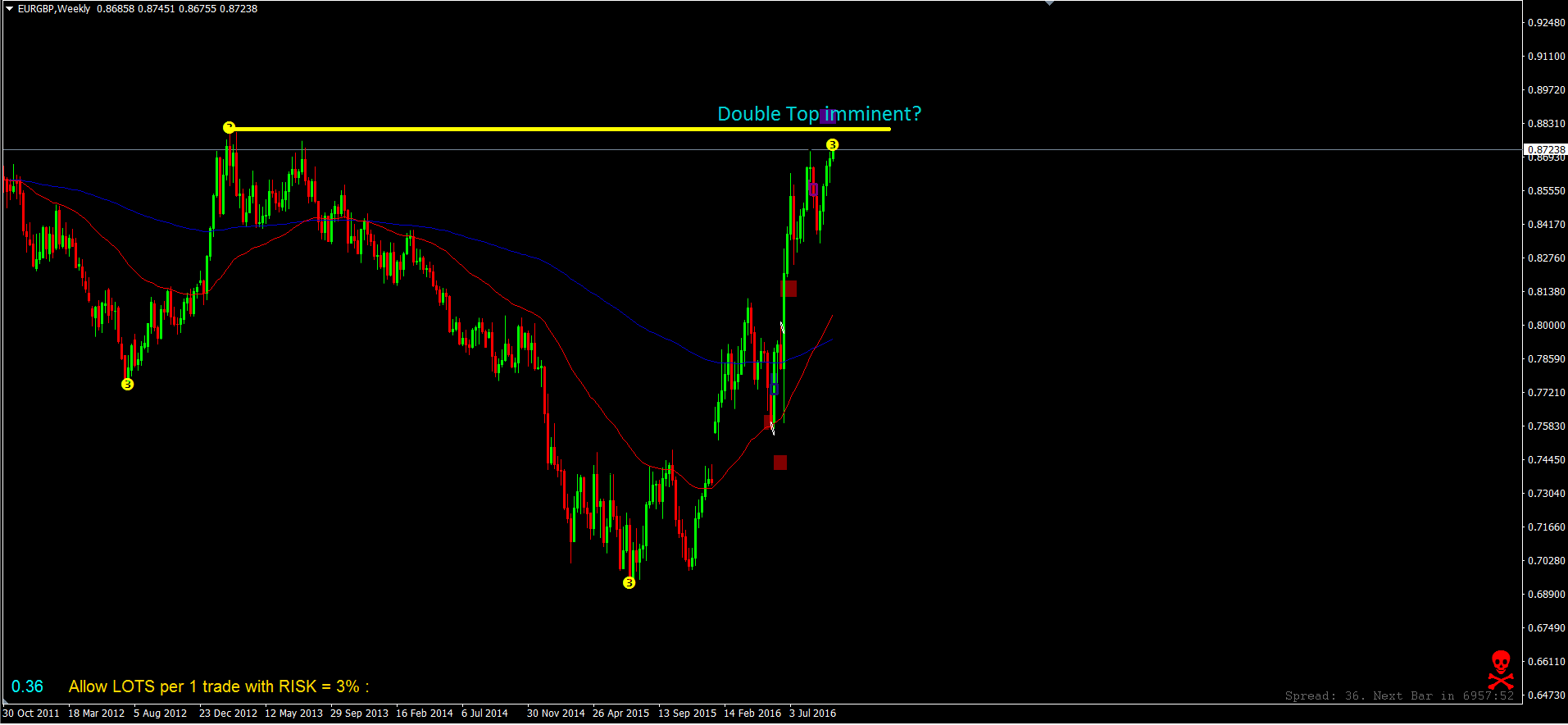

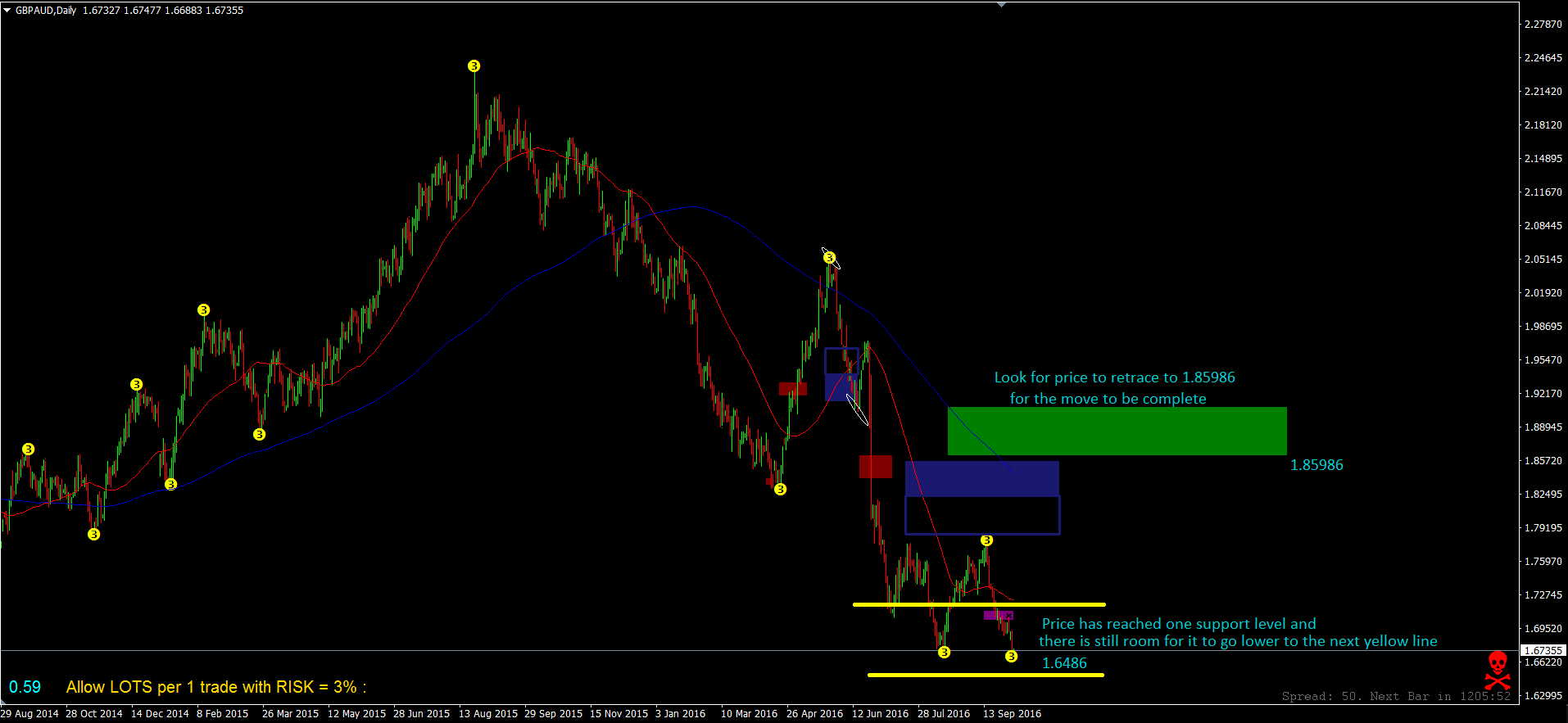

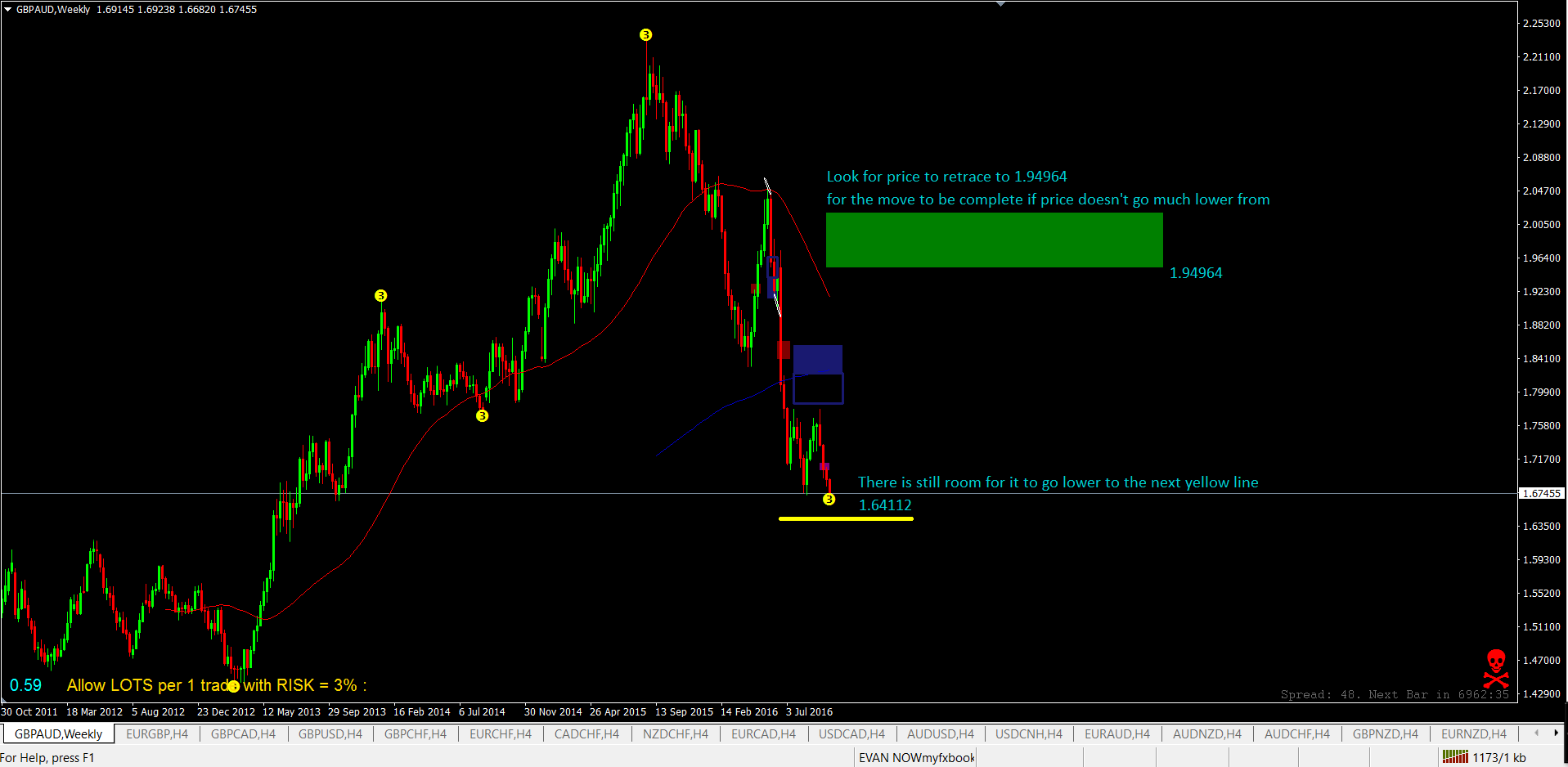

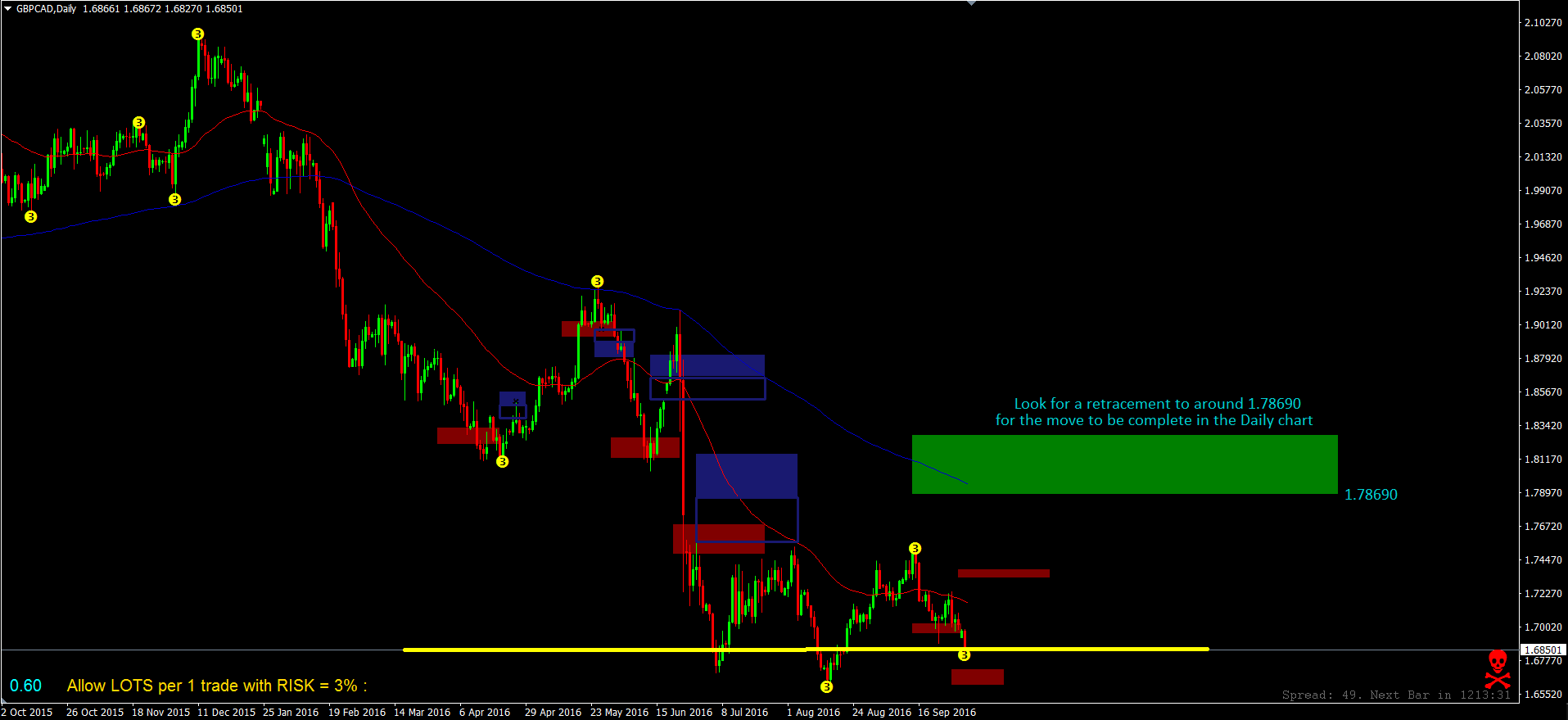

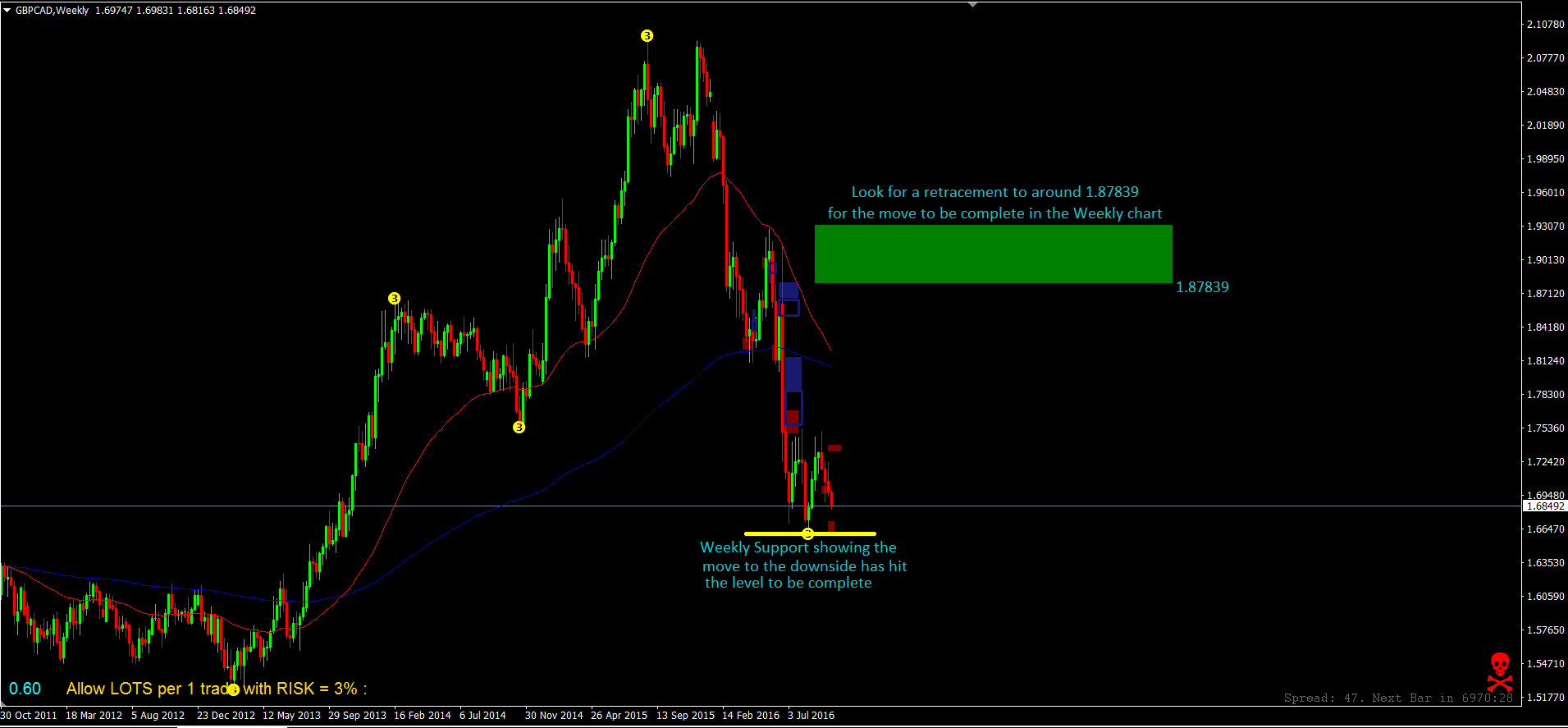

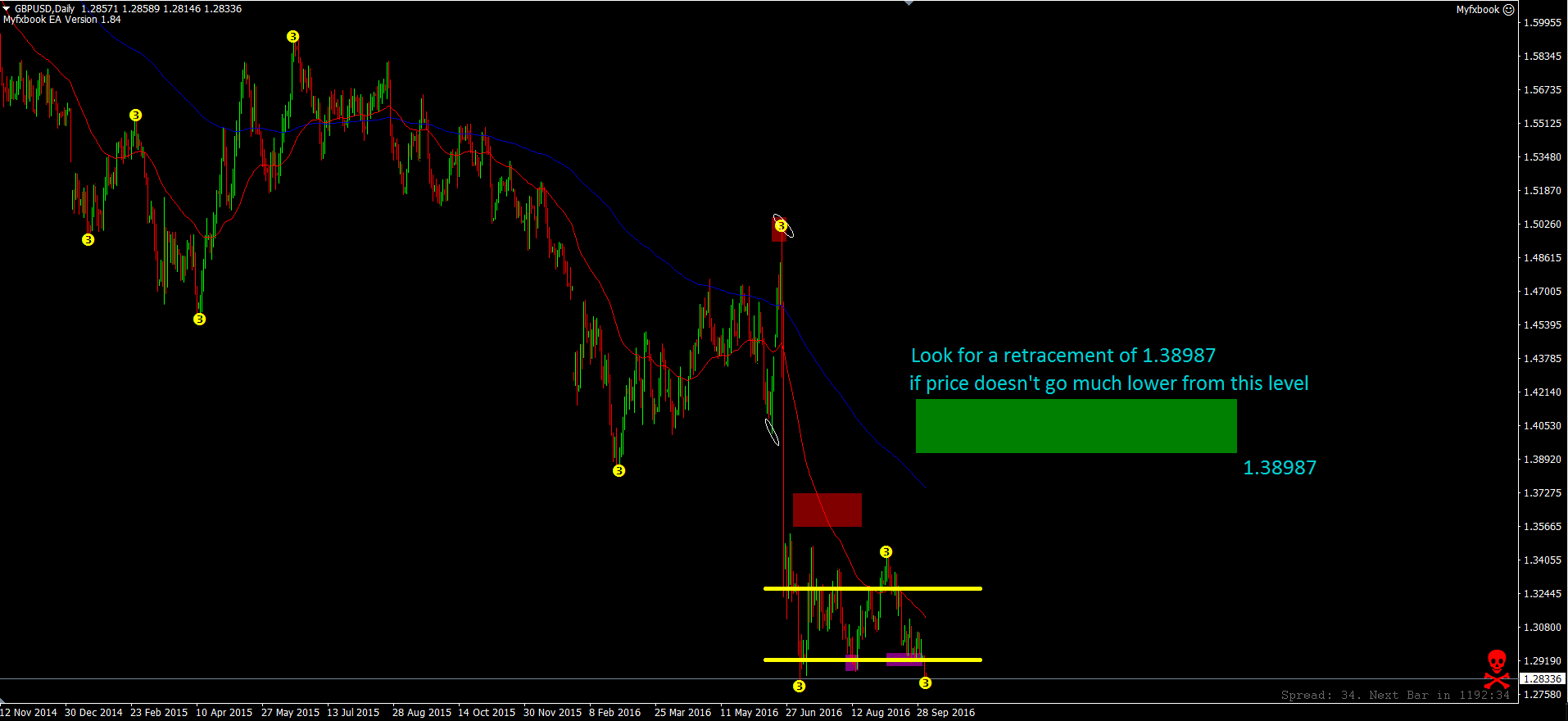

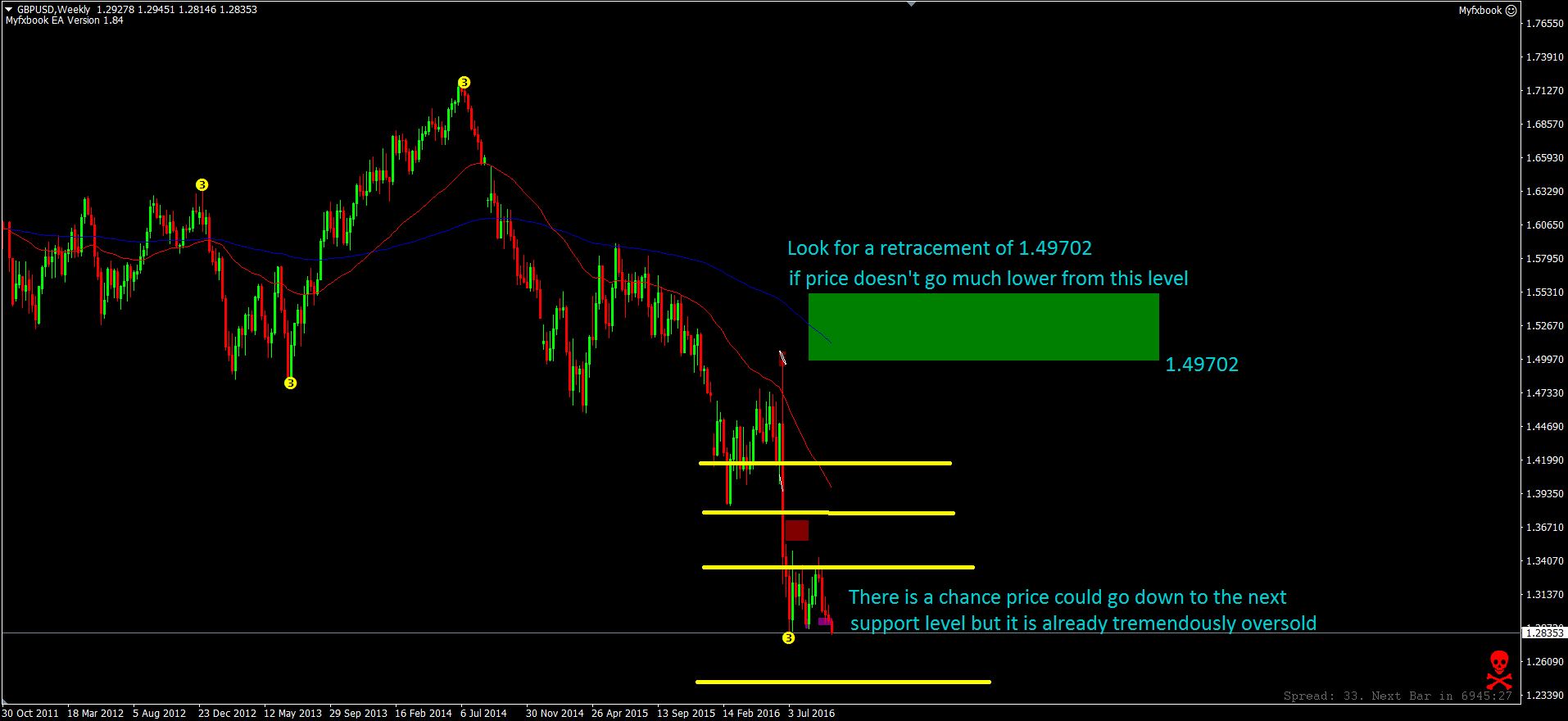

In the following charts I am going to show the Daily and Weekly time frames. Each will have slightly different targets with the Weekly being the biggest target. You have to go through the Daily to get to the Weekly. If price doesn’t go much further past the levels on the charts then the retracement prices remain on point. If price does move further than the current levels then I’ll need to recalculate the retracment targets.

The EUR/GBP weekly chart is the only one that is different out of the bunch. It is hitting a potential double top instead of fib extension levels.

There is still a little room to the downside for the GBP/AUD.

GBP/CAD looks to be at a good level for the retracement to happen.

Potential move to the downside in GBP/USD left in the Weekly chart but the Daily chart says it could be over.

If you missed out on the amazing 2 days that Brexit provided in June then you still have a chance to make some good money in the near future going long on GBP dominant pairs which I consider to still be a Brexit trade. The night of Brexit felt like I was day-trading. I use the 4 hour charts as my main time frame to trade forex and price was moving so much it looked like a 2000 tick chart on FOMC day after the announcement. Brexit is the gift that keeps on giving.