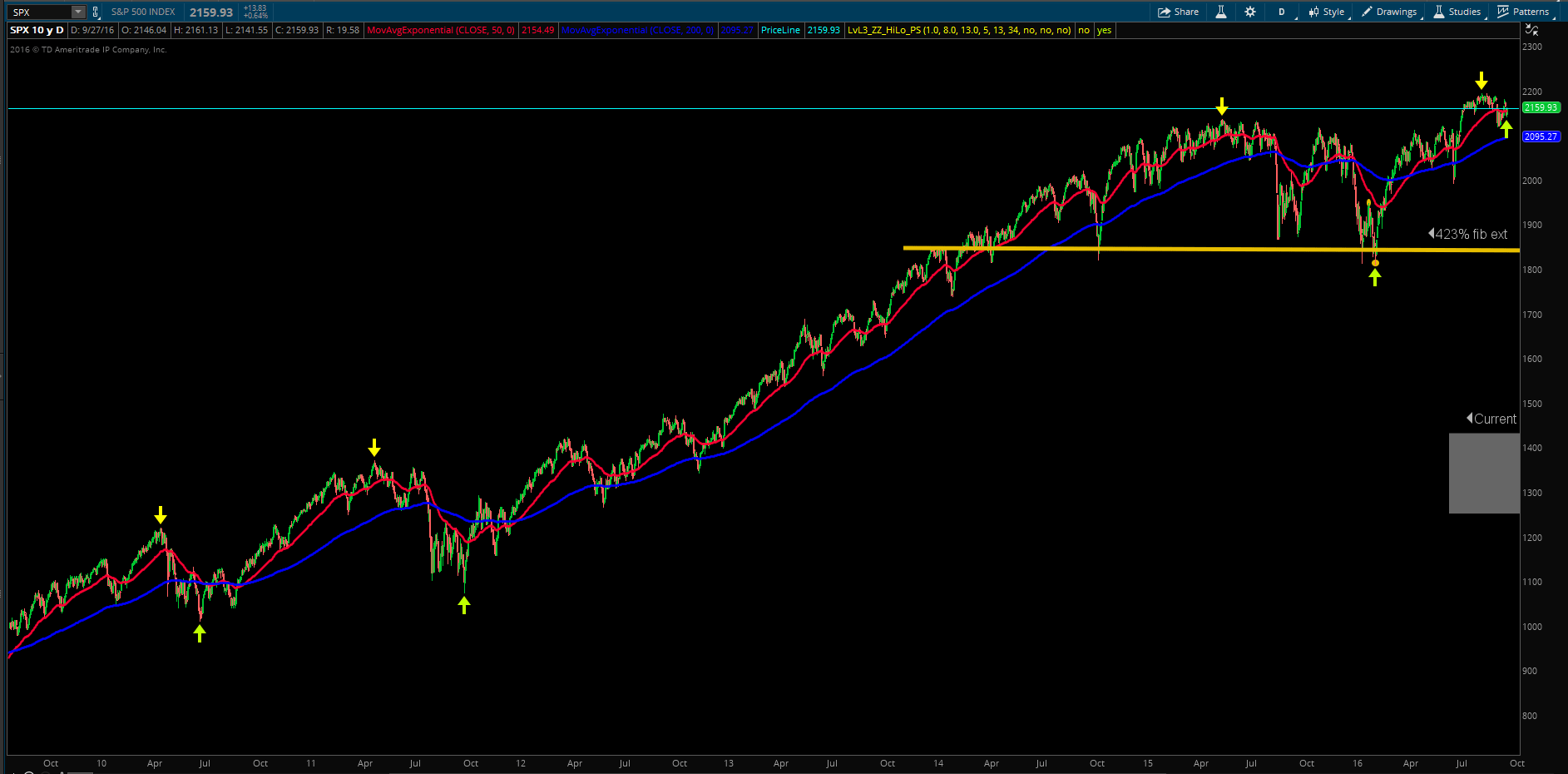

After the world’s economic “crisis” where banks were bailed out by the governments of the world the US stock market bottomed in March of 2009. Since then stocks have pretty much gone from the bottom left of the chart to the top right. Stocks have gone so far up that there is only one more level to go to and that one is the extremest of the extremes. I seriously doubt stocks will reach it but I will talk about it later just in case.

You can see from the picture above that the SPX (S&P 500 index) bottomed in March of 2009.

Since then US stocks have gone up to the levels we are at today with very little pullback.

Currently the SPX is already above the 423% fib extension level and is almost halfway to the 685% fib extension level. For it to reach the next level the S&P would have to go up another 400 or so points and it is already at an extreme extension with it being over the 423% extension. There is room to the upside and if it hits the next level at 2586 then get out of everything you are long in because the market is coming down. I would already be very hesitant with any long term long positions because I feel the market is in the final stages of the bull market and it is only a matter of time before the retracement starts. If the current high of 2193 holds then the S&P will retrace down to 1431 to complete the move at minimum. If the S&P does keep going up until 2586 then the retracement to complete the move would be around 1800 minimum. I don’t think the market will go up to the next level, in fact I think when the Fed finally raises interest rates is when the retracement will start.

Now lets look at the DJX (1/100 of the DJIA) because I cannot find the DJIA in ToS for some reason.

The chart looks just like the SPX.

Here you can see how price is currently above the 423% fib extension so this move has been amazing over the past 7 years.

The only difference is the DJX has not gone as far past the 423% fib extension as the S&P 500. Due to this discrepency I do not believe that either market will hit the next level of resistance which is why I think the retracement is going to happen sooner than later. If price stays at its current high then the retracement level to look for will be 126. If the DJX somehow makes it up to 243 then the retracment level will be 154.

I don’t think the retracement will happen until the Fed says for sure they are raising the interest rates but like I said earlier, the retracement will happen sooner rather than later so be careful with your long positions.