The GE stock forecast for 2019 will also apply to go into 2020. The only way it wouldn’t is if the stock takes off to the upside or declares bankruptcy. The bankruptcy option is more likely than the stock shooting up.

There are two other posts I made about the GE stock over the years. Both of them are based upon the decline of GE.

- Is it time to buy General Electric’s (GE) stock or short it to zero?

- General Electric (GE) is now in free trade territory

The big news that just came out is that GE is selling millions of their shares of Baker Hughes and will no longer have majority control. Their attempt at being a major player in the oil and gas industry is now officially over.

This is something that needed to happen. They had no business entering into oil and gas. If they actually had a plan then they probably would have had a chance at succeeding. But all GE did was purchase a bunch of oil and gas companies and through them together and expect the money to start rolling in.

General Electric Co. GE, +0.44% plans to sell millions of shares in spinoff Baker Hughes BHGE, -0.29%, and will no longer control the majority of shares in the company. Baker Hughes said in an announcement Tuesday afternoon that GE and other affiliates plan to sell 105 million shares in an underwritten secondary offering, and sell $250 million in stock back to Baker Hughes.

This is one of the first big steps General Electric needs to do in order to get their stock trending up and not down. They’ve made a series of bad decisions over the years but it does look like they are finally making moves to correct their mistakes.

What Does the Technical Analysis Say for the GE Stock Forecast?

In this section, I will show the charts for the GE stock forecast. That way you can make them larger if you need to see them in an easier to view format.

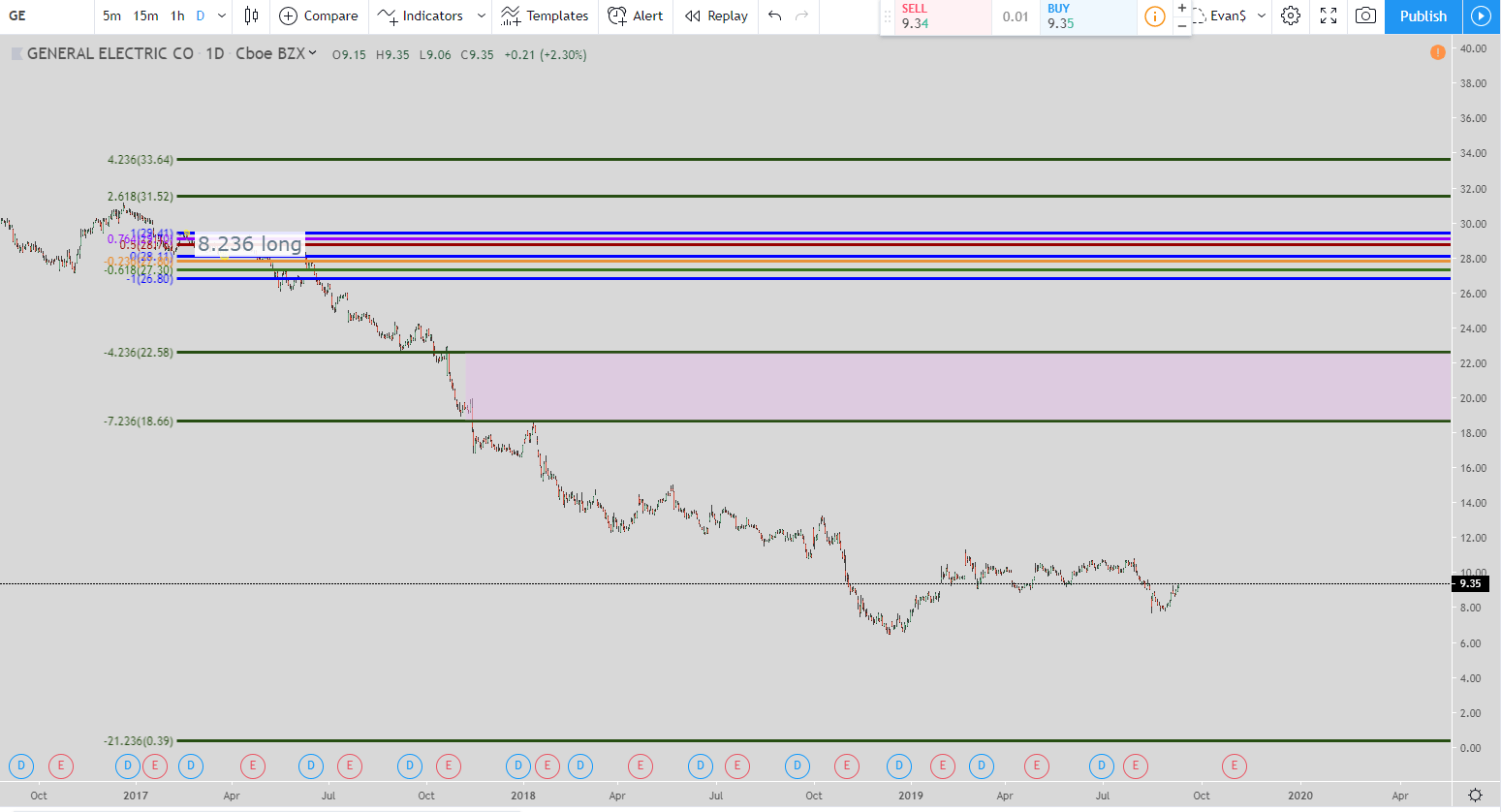

This trade is the 8.236% long setup. The current exit is the top of the pink box at around $22.50. But if the price continues to move down and hit the -21.236% Fibonacci extension line which is around $0.39 then you move the exit to the -7.236% Fibonacci extension level at around $18.50.

So if you believe the stock will eventually rebound then this could be an area to start purchasing stock and then continuing to purchase if the price continues to move lower.

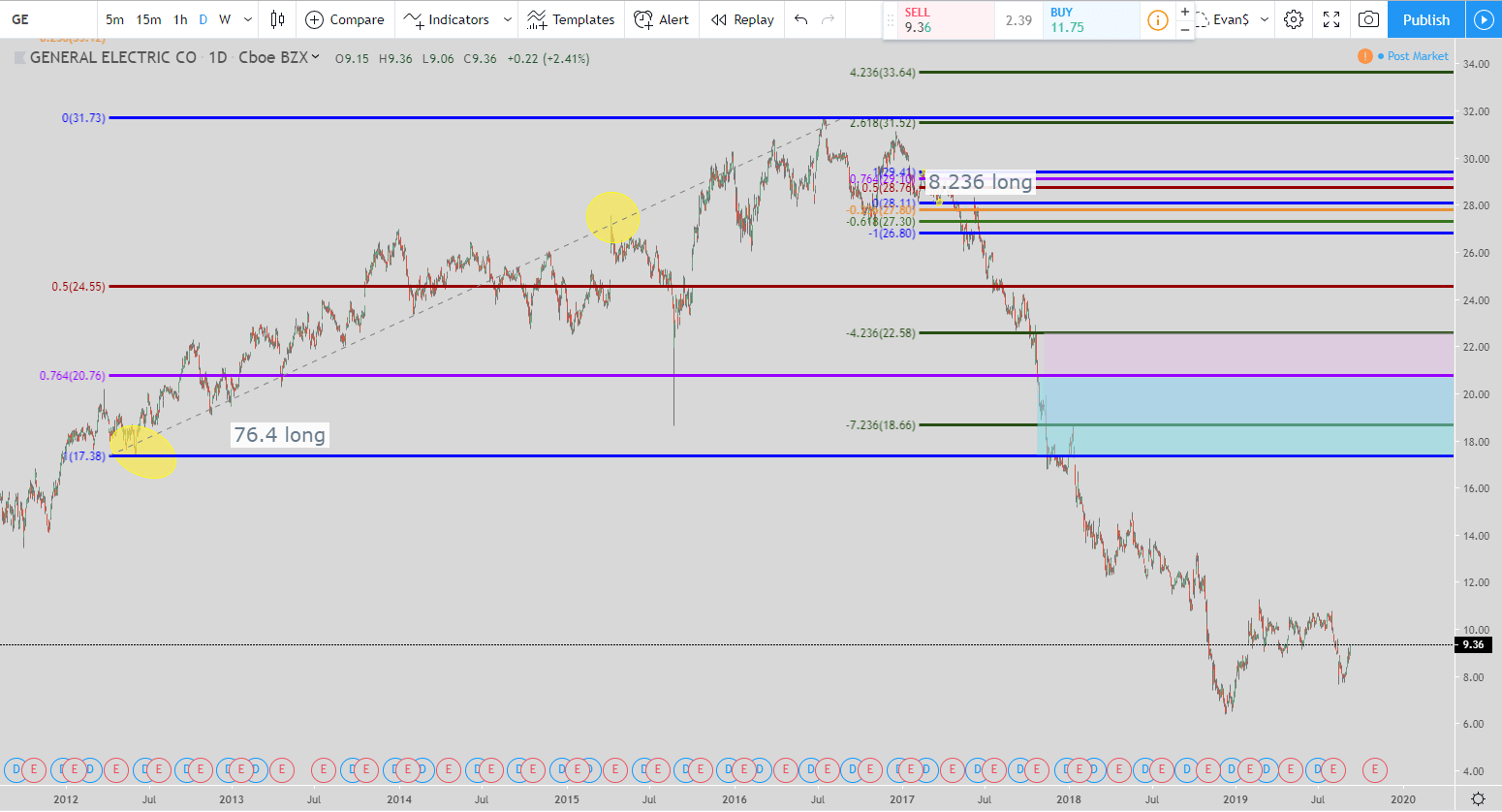

This setup is the 76.4% long setup. The exit is the top of the blue box which is around $20.70. The exit will not move again because the 2.618% Fibonacci extension level is in the negatives so obviously the price will never reach it.

This is another chart that shows if you believe GE will turn it around then where price is currently located at $9.36 can provide a great return.

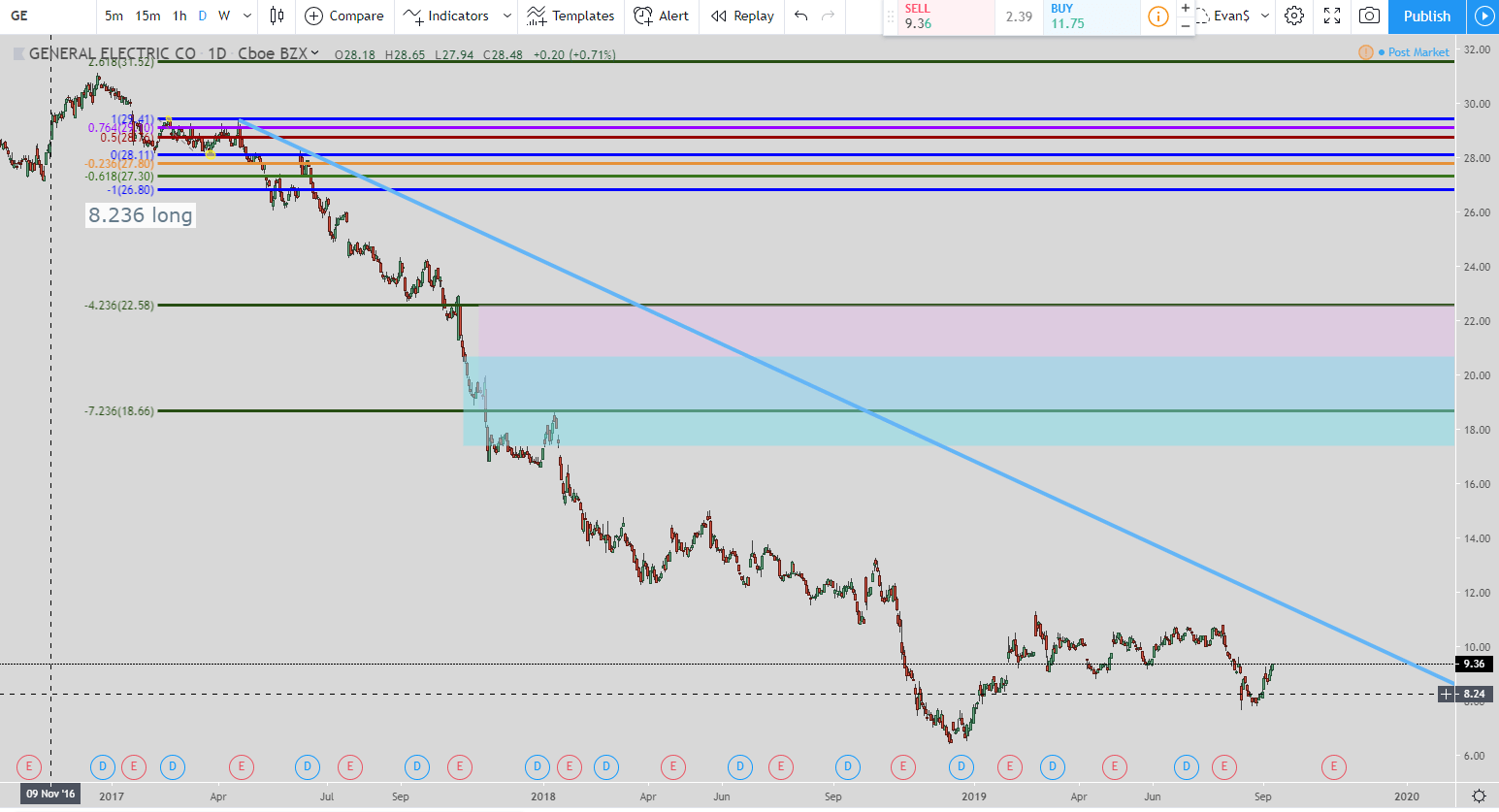

From the 8.236% buy setup, you can see the blue line as being the trend line I am waiting for the price to break. Once it does then you can except a higher percentage of something happening with the stock making a move.

So if the price remains between $7 and $11 then you can expect GE’s stock price to break the trend line sometime between October 2019 and June 2020. That is a little bit of time but it all depends on how much movement the stock has between now and that time frame.

One thing to note is that a lot of time when the trend line is broken to the upside then there is a high chance price will come back and touch it in order to use it as support before price makes its true move up. So be on the lookout for a fake breakout to the upside and then a pullback to the trend line and use it as support before the true move up.

I’m not saying it is guaranteed to happen but it does happen a lot of the time when a breakout like this occurs.

Video

If you cannot view the video then click on this sentence to be taken to the YouTube video.

Conclusion

If you do not think General Electric is going bankrupt then there is a great opportunity to make some great gains. This is the type of stock that can double or even triple.

Based on my technical analysis I do believe the stock has the potential to do so. But the fact remains that it is the fundamentals that will drive the stock. There is also anywhere between 1 month to 10 months before we start to see a big move. As explained above I am waiting for the trend line to break before I think the move happens.

If one happens to the upside then we should start seeing some type of movement within the next 10 months.

If GE can recoup and get everything under control then they can pull out of their horrible tailspin. But if they keep on doing what they have been doing then they will eventually be filing for bankruptcy. They are getting out of the oil and gas business by getting out of their Baker Hughes purchase so that is a wise first step in getting their stock heading north and not south.

I’ve been burned in stocks like this in the past so, to be honest, I am a little hesitant to pull the trigger. Although, none of them were anywhere close to the size and scope of General Electric.

But if you are thinking about trading General Electric and do not currently have a broker you use. Or you are looking for one without trading fees then checkout Robinhood through this link: http://invite.robinhood.com/evanc203

If you use the link above then each of us will receive a free stock if you sign up and fund an account. Currently, this is the only broker I use for trading stocks since they have $0 commissions for trades.

Take care and if there is any stock, future, Forex, or crypto you would like me to review then let me know and I will be glad to do so.