August is here and it is time for another monthly installment for ES trading or futures trading for the S&P 500. As always I will provide precise entries and exits for the trades provided.

All of the analysis will be trading setups I personally use. This doesn’t mean I will be taking all of these trades. What it means is these are valid setups that I could potentially take based upon my technical analysis.

In July we were in a range from about 2,963 to 3,029.50. At the time it didn’t really look like it. The S&P 500 looked like it was continuing its uptrend. But now that the market has dropped out over the past couple of days it was clear to see we were range-bound.

The news is blaming the drop in stock markets on the US vs China trade war. Sure that could be a factor, but the main issue is a bunch of technical setups on the short side had not been filled which are now starting to get filled.

Or they are at least coming close to getting filled. I’ll list a big one that just was completed. In my opinion, the news stories that get blamed for the move in the S&P 500 futures is to hide the big move the banks and institutions are doing.

I believe that is what is going on today.

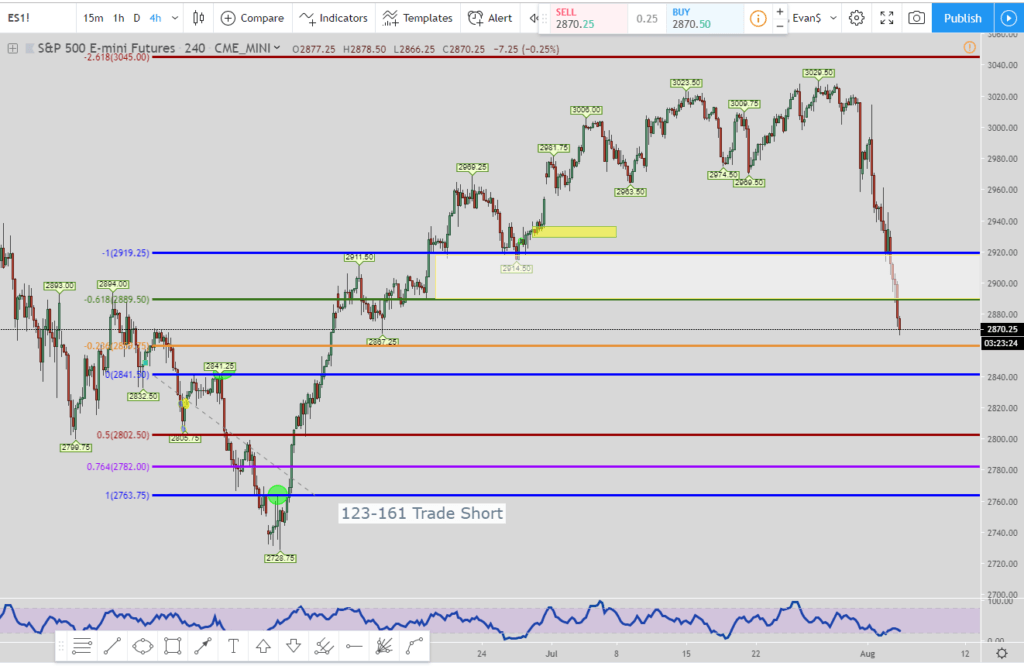

An ES Trading Setup That Was Just Completed

As you can see from the setup above, it is the 123-161 short setup. Price initiated it back on June 19th. The exit we were looking for was the bottom of the white box around 2,890.

Today the price came back and filled that short setup. That was a big move we were looking to complete. With this move to the downside, it doesn’t look like it is over yet.

The good news is that the more downside we have then the more long setups its will create. So hang tight for now because even though CNBC and every other financial news network will display flashing red big block letters about the impending doom to the market, we are creating long setups in the process.

Video Review/Preview

August Technical Setups for ES Trading

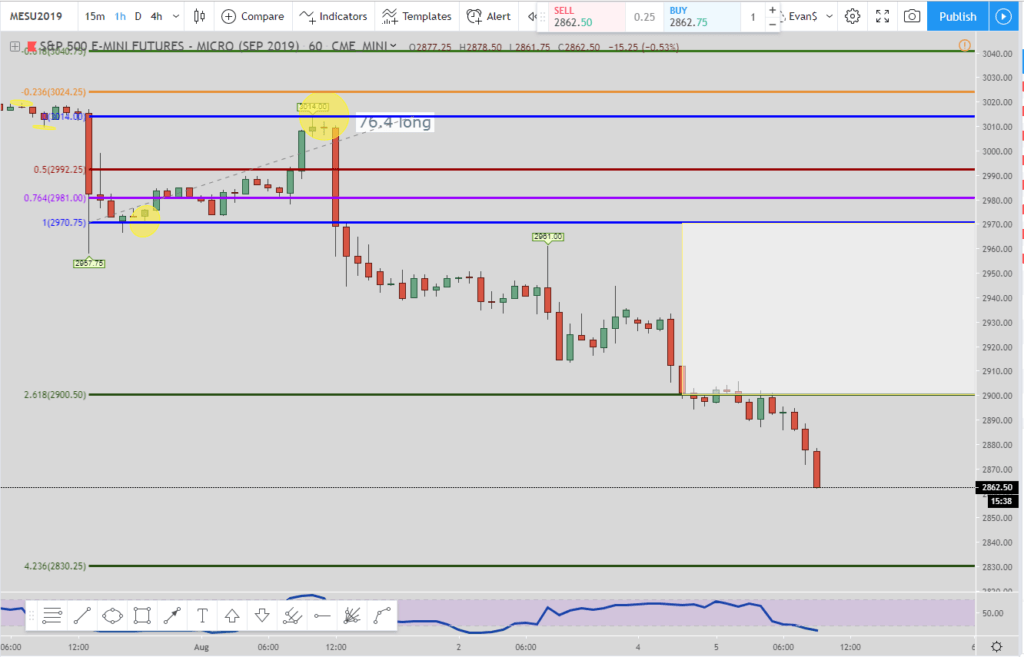

Monday, August 5th

This setup is a 76.4% long setup. The price blew through the 76.4% level and the 100% Fibonacci retracement level so those exits were never hit.

Then when the price hit the 2.618% Fibonacci extension level this brought the exit to the 100% retracement level which is around 2,970.

So 2,970 is where the exit is located. It won’t move to another level even if the price continues to plummet. When I do this trade and when it hits the 261.8% level I move my exit a little south of the 100% level.

This ensures I’ll get filled and get out of the trade when the price returns. You’ll have such a huge gain when the move up happens that in my opinion, it is better to get out a little early than to try and milk it for the very last tick.

I have seen the price come and barely tick the 100% level or get extremely close to it. So if I had my exit right on the level I would have not have gotten filled.

That is why I always get out a little early from the hard exit.

The other level I would look to enter would be the 4.236% Fibonacci extension level. This is around 2,830. If you got in here it wouldn’t move the exit but it is a level that would provide even better returns if the ES does go that low.

Conclusion

ES trading is the most popular form of day trading, especially if you live in the US. There are plenty of other markets to trade but this is considered the biggest and best.

With the new micro contracts that became available, it has opened it up a new world of money from smaller traders like me who have come into the market.

My trading was created through meditation. Before I began meditating I was a consistently losing trader. All I did was spend my money learning from gurus who almost all were a ripoff.

Fortunately, I met a friend through a trading forum who showed me how important it is to meditate, not only for your trading career but for your overall life. This is a practice a take very seriously and I hope you try it out for yourself.

Even if you only can do it for 5 minutes a day then that is just fine. My system is to create a habit out of it so that eventually I will be doing an hour per day without even thinking about it. Right now I range from 30 minutes to 1 hour.

But before I would randomly do it with no consistency. I believe that consistency is the key to success in just about everything in life, and I believe if you consistently meditate day after day you will see improvements in your life as well.

We are all in this journey together so if there is anything I can do to assist you please let me know.

Take care,

Evan Carthey