Finally the Move is Complete

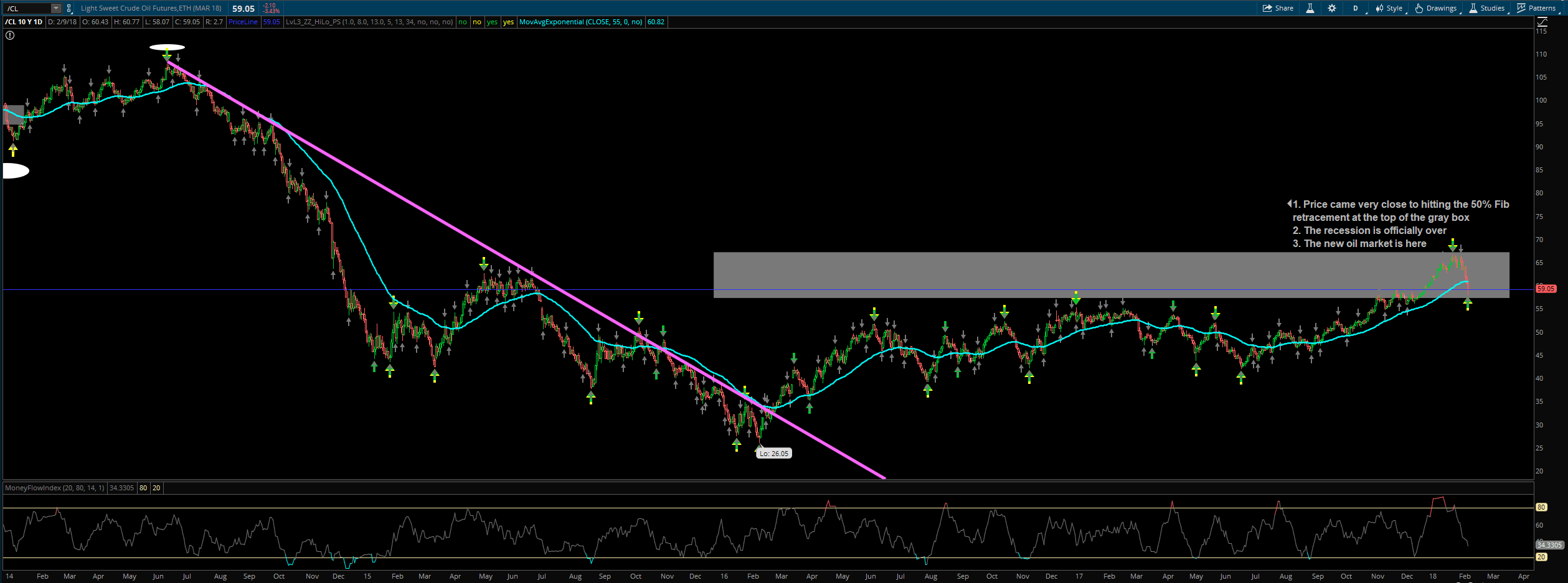

From June 16, 2014 until February 11, 2016 the price of oil was pretty much straight down. It started at a high of $107.54 and went to a low of $26.05. There has never been a move like that in the history of oil’s price. On 1/25 the price of oil hit $66.66 and that is the day that according to my analysis the recession is officially over. Price didn’t hit $67.11 which was the 50% Fib retracement level but it is close enough.

You can read about some of my other posts regarding what would happen to oil here:

- What’s next for oil on 9/30/16?

- Will OPEC agree to production cuts? 11/30/16

- Oil may be topping the $60 mark soon and pushing $70 in 2018 (11/17/2017)

- Oil outlook for 2018, on its way to $66 (1/11/2018)

I had been extremely bullish on oil since the lows of 2/11/16 and saw any weakness as an opportunity to buy. I have been long ConocoPhillips (COP) all through this through a direct reinvestment plan. If you are interested in it I purchase it through here: https://www.computershare.com/us. They offer a bunch of other stocks and some don’t really have a cost. I think every time I purchase COP it is around $2.50. In the past I had Exxon (XOM) through them and withdrew the full amount with no problem.

What is next?

In another post I’ll explain what I see happening since now we can focus on other moves because the major retracement from the lows is now complete. I am still very bullish on oil and would use any dips as buying opportunities. Conclusion, the recession officially ended on 1/26/2018 and the new oil market is here. The current dip is a great buying opportunity since price is hitting hard off of the 50% Fib retracement level.