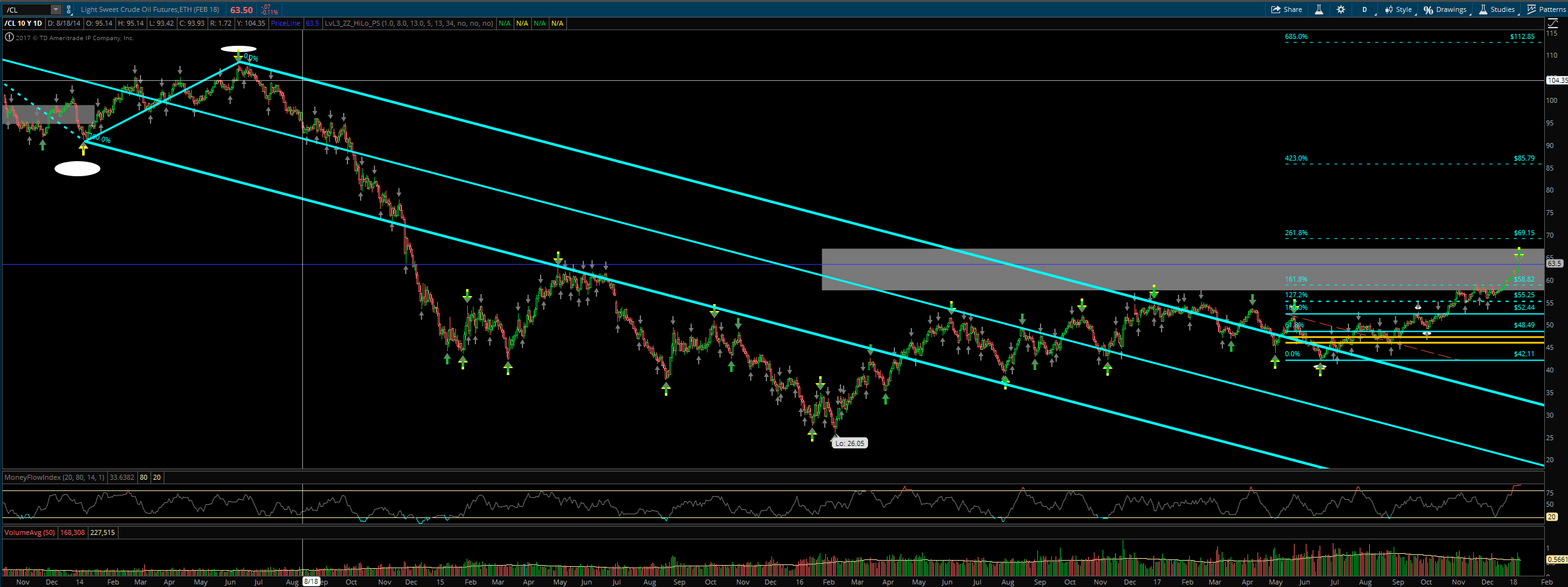

On November 17th I posted that Oil (CL) was on its way to $66 and would be topping $60 soon: https://evancarthey.com/oil-may-topping-60-mark-soon-pushing-70-2018/. In this post on September 30, 2016 I said that the bottom had more than likely been in and any weakness in oil was a chance to buy: https://evancarthey.com/updated-long-term-cl-oil-analysis/.

Retracement About Over?

Now oil is in a serious run up and from this chart it looks like the $66 level will be hit sooner than later. The top of the gray box is the 50% fib retracement level which is where I consider the retracement to be over. Price can definitely go higher than that but if I am long a stock using my Bread and Butter Fibonacci Extension trade then I am out around the 50% fib retracement level: https://evancarthey.com/my-bread-and-butter-trade-part1/

I could see price even pushing up to the $69 level where the 261% fib extension level is from the pivot points I have it drawn from.

Finally when price hits around $66 then that is when the retracement from the historic run down will be officially over in my book. Hopefully for the oil and gas industry price plants its flag north of $60 and can even push $70 for most of the year. I wouldn’t mind a couple of years of oil between $70-$90.

Easy Money Is Over

From oil in the $30 and $40 the easy money from the run up is over. I have bought stock in ConocoPhillips anytime there was a dip during these last two years. Once the $66 level is reached then I will do shorter term analysis’s because the long term play of buying any dip once prices went into the $30s and 40s during the historic downturn is about over. The good news is there will be another market right around the corner with an amazing opportunity to make some serious money in a downturn.