In February I wrote about an an article that spoke about gold going hyperbolic in the near future: https://evancarthey.com/is-gold-going-to-go-hyperbolic/. I agreed with the article that gold is poised to go up but there is resistance in the way. After reviewing the gold chart it hit me that this is a great long trade for gold and GLD! In this article that is a trading handbook (somewhat) for a long trade I will show how you can get in right now and be confident about making money. Even if price goes down while you are in then that is just fine. It will give a better ROI when it rebounds if you continue to get in if price decreases.

If this post benefits you and if you haven’t used Robinhood for trading stocks (they don’t offer forex) but are thinking to then please consider using my referral link when you do sign up: http://share.robinhood.com/evanc203.

This way each of us will receive a free share of a random stock if you sign up through my referral link.

My Robinhood Review: https://evancarthey.com/review-robinhood-trading-service-with-no-fees-part-1/

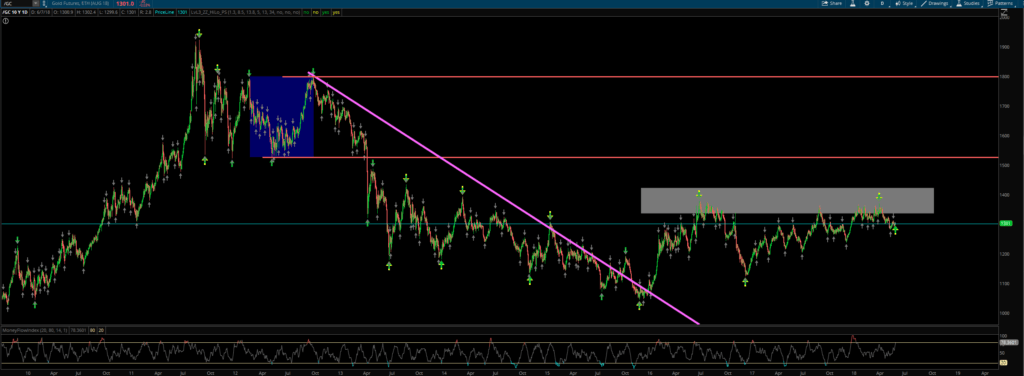

Where Gold Currently Stands

At the time of this post gold is at 1301. The 50% Fib retracement is at 1423 so if you get in I would get out around 1400.

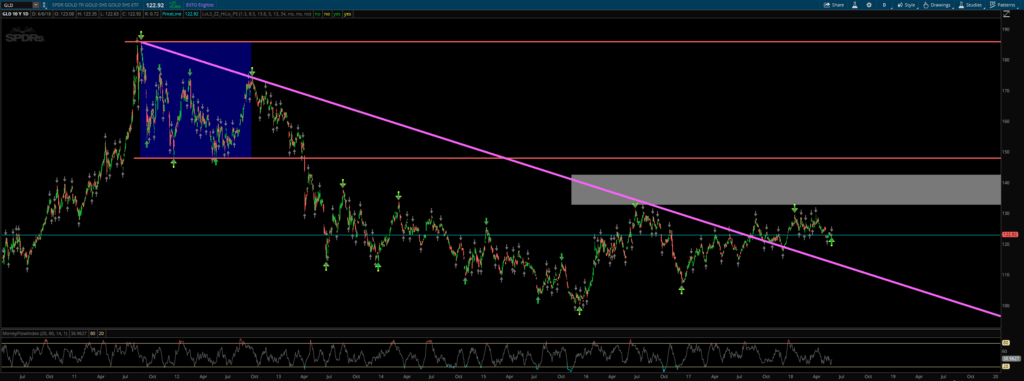

An ETF That Follows Gold – GLD

Now if you are looking for a trade that you don’t have to rollover then there is an ETF with the symbol GLD. One of the drawbacks the way I trade is they can last longer than the expiration dates. So I would have to roll them over which is not something I am looking to do. GLD follows the price of gold extremely well as you can see from the chart. You also don’t have to worry about a rollover.

As of right now price is at 122.76. The top of the gray box is the 50% Fib retracement level. It is at 142.64 so if I was in my exit would be around 140.