As my trading continues to evolve through experience and meditation one aspect I discovered this week is I am not a break-out trader. From that I discovered the The 61B Trade Setup – A Setup That is Extremely Profitable. There are 3-4 setups I am using. A setup I loved but had to scrap because I found a couple of instances in stocks where it didn’t work was my reverse lightning trade. It was based on a break-out setup and worked most of the time.

I would love to have a setup that catches a breakout for huge profits but I do not. All of my setups are based upon retracements and buying or selling at extreme overbought or oversold levels.

With that said lets talk about the 61B Trade Setup. There is one caveat, with stocks I have seen it not work before. It was with Amazon. It has worked 90% of the time in other stocks but I wanted to point that out for stocks. For futures and Forex I have not seen it not work like it should.

The 61B Trade Setup – My Process

The 61B Trade Setup is a retracement trade. The one indicator I like to use is a pivot point indicator. You don’t have to use one but for me it helps show where the pivot points are located since that is where I draw the retracement levels from. The MFI indicator at the bottom simply shows me if the stock is overbought or oversold. I use it as a guide, not to take trades from.

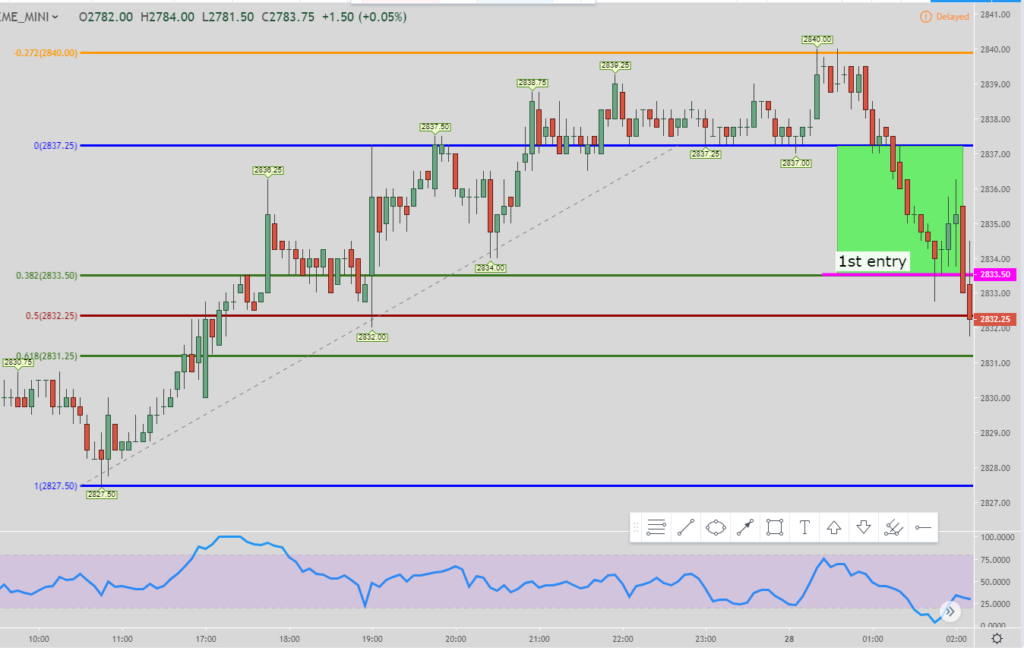

In the chart above we are looking at a 61B long setup. First you choose the bottom pivot you want to use. Next you use the bottom pivot, not the top pivot for the upper pivot point. Hopefully the picture better explains what I am trying to describe.

Above is a chart showing how to use the pivot points for a short setup. You use the pivot points on the topside where on the long setup you use the pivot points on the bottom side. I wanted to show.

The Entries and Exits

The main rule to keep in mind with the 61B setup is once an exit is hit then the move is over and DO NOT get in at any entry levels that have not been initiated. If an entry is left then delete it and look for the next setup, the move is over.

You can use as many pivot points as you would like, they do not have to be connecting pivot points. You can see in this example I am using four.

First, price has to hit the 127.2% Fibonacci extension level that signals this trade setup. The orange line is that level.

Next you wait for the retracement to the 38% Fibonacci level. The pink line is that level. Once that hits then the trade is live. The exit is the top of the green box which is your upper pivot point level, or the 0% Fibonacci level. I usually have my exits just before the exact exit to ensure I get filled to get out of the trade. I have seen it numerous times where price goes up and barely touches the exit to complete it, but it wouldn’t have been enough volume to get you filled and out of the trade with a resting limit sell order. That is why I ALWAYS have my exits setup to get out slightly early.

If the 1st exit is not hit and price continues to move down then your next entry level will be the 61.8% Fibonacci retracement level. When that is hit (the pink line) then you move the exit to the top of the teal box which is really the 38% Fibonacci retracement level. You can see from this example after the 61.8% level was hit then price went up and hit the 38% level which would have ended this trade.

There is one more level to get in at that I will show below but if this was a live trade then the move would be OVER. You would not get in at this next level I will talk about.

For the sake of this example I will use the same move but in real life you would NOT take this 3rd entry since the 2nd exit level was already hit. But lets pretend the 2nd exit level wasn’t hit. With that said there is one last entry level we will look for if the first two exits are not hit.

It is the 100% Fibonacci level. If price has not hit the previous exit levels and continues to move down and hits the 100% Fibonacci level then that is your 3rd entry. The exit then becomes the top of the green box which is the 61.8% level. That is the final time your exit moves. If price continues to move lower then you can keep scaling into the trade but your exit does not move.

I also wanted to show what a short setup looks like. Highlighted are the pivot points used. The colored boxes are the trade zones. The top of the green box is the 38% which is the 1st entry level and the bottom of the green box is the exit level. The top of the teal box is the 2nd entry level (61.8%) and the bottom of the box is the exit. The top of the blue box is the 3rd entry and the bottom of the box is the exit.

You can see from that example that we would have entered at the 38% level. But then price went up and hit the 61.8% level so we would have shorted there as well while also moving the exits to the 38% level. Then we would have exited at the 38% level when price came down and hit that level 2 bars later.

Conclusion of The 61B Trade Setup – A Setup That is Extremely Profitable

Hopefully these explanations made sense. As my trading style continues to evolve I can’t guarantee I will always use this trade setup but right now it is working extremely well for me. I’ll continue to use it until I find where it doesn’t work if that ever happens.

This is a retracement type of trade. The way I trade I don’t use stop losses. It doesn’t mean I won’t take a loss overall, it just means I don’t have a level I am willing to get out. Now if I get in a trade using an incorrect setup then I will take a loss and get out. I have done it before and will probably have to do it again at some point. But just because price moves against me it does not make me exit the trade if I have followed my setup rules.

This trading style isn’t for everyone. It took many years of trading of trying to copy others and failing in my trading by doing so. It wasn’t until I began meditating that I then started figuring out what worked for me. In my opinion if you want to be a profitable trader you have to figure out what works for you and trade that way. Trading is a reflection of who you are as a person so there is no difference between your psychology and your trading psychology.

There is a link below in the “Popular Links” where I go over step by step on how I meditate, specifically for trading.

Popular Links

Here are a couple of links if you are looking at how I view the market and some trade setups. You can create your own trading style and setups. Quit paying losing traders to teach you. The only thing they teach is how to lose money.

Robinhood Trading Broker Review

If this post benefits you and if you haven’t used Robinhood for trading stocks but are thinking to then please consider using my referral link when you do sign up: http://share.robinhood.com/evanc203.

This way each of us will receive a free share of a random stock if you sign up through my referral link.

My Robinhood Review: https://evancarthey.com/review-robinhood-trading-service-with-no-fees-part-1/

3 comments

Matt

“A setup I loved but had to scrap because I found a couple of instances in stocks where it didn’t work was my reverse lightning trade”

I’m wondering what you mean here. If a setup doesn’t work a few times you scrap it? Or is there some win/loss threshold that this setup failed to achieve?

MillionDollarMan

I put them in the “further testing” category so I quit trading live with it. Although to be fair, the only time the setups have failed has been in stocks. With Forex and futures I haven’t found any issues.

Matt

That makes sense. Thanks for responding, and for quickly fixing the comment issue 🙂

Comments are closed.