The S&P 500 finally reached the long target but it has now set itself up for a couple of short trades I will go over. This post will be about the S&P Futures Live Technical Analysis for the week of 9/8/2019. The theme for the upcoming week will be to play it safe. Based upon some of the setups the market is setting itself up for a pullback.

There is a long term short setup we are still looking to get filled. Now that the long setup has been completed we will see what the market has in store for us.

All analysis is based upon my personal setups I use to trade. The trades I talk about here are ones I do not necessarily take but they are valid trades based upon how I trade.

If I am in a trade I will let you know and if I am looking at taking the trade then I will let you know as well.

How I discovered my trades was through meditation. I truly believe it is the key for you to tap into your subconscious and discover the trading style and setups that work for you.

At the end of the day, the only thing that matters is that your trading style makes you money. If it doesn’t then it isn’t the right trading style for you.

So quit wasting your money by giving it to “gurus” who won’t show you they are profitable traders. Trust yourself and begin meditating to discover how you can create your own path to trading profitability.

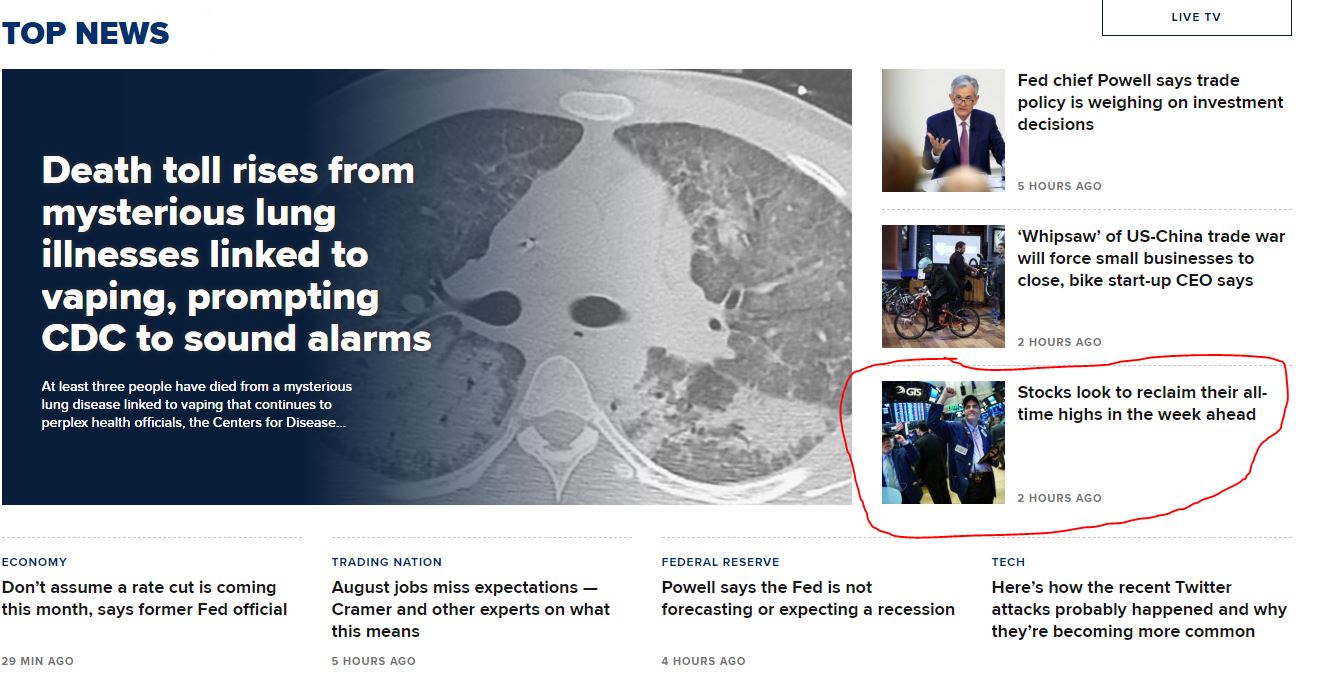

What Does CNBC Think About Next Week?

Based upon CNBC there is one story I want to talk about real quick. It is the “Stocks look to reclaim their all-time highs in the week ahead.” I disagree with their assessment. As I mentioned in last week’s post, the news is reported to help move the market the way the big banks and institutions want it to go. There isn’t much drama going into the weekend like there was a couple of weeks ago when Trump and China were squaring off in a trade war.

But that one article I circled stuck out to me because they are obviously looking for people to hold their positions through the weekend and to purchase again on Monday. I’ll explain why in this post and the video below why I disagree that the markets will continue to move higher.

Here are the key points from the article:

- The S&P 500 is about 2% from an intraday record reached on July 26 after notching back-to-back weekly gains.

- Wall Street’s move toward all-time highs comes as recent U.S. economic data suggests a recession may not be in the cards while the Federal Reserve is expected to cut interest rates later this month.

- Easing fears around the U.S.-China trade war are also lifting investor sentiment.

- “For now, it’s a bull run,” says trader Steve Grasso.

S&P Futures Live Technical Analysis for the Week of 9/8/2019

Here are the pictures below for the charts that will be included with my video in the next section. That way if you need to enlarge the pictures you can do so.

For the chart above it is a 76.4% short setup we are looking to come back and get completed. You can see how the price is using the 423.6% Fibonacci extension area as resistance. The final exit that doesn’t move anymore is the bottom of the blue box around 2,935.25.

This chart is a daily chart. You can see we have the exit at 2,703.50. The price also broke the trend line and is now looking at using it as resistance where it ended on Friday. This is one of the main reasons why I am bearish on the market.

This is a short setup we are waiting on. When the price hits the top of the blue box at 2,998.75 then the exit will be at the bottom of the blue box at 2,934.25. But this setup only happens when 2,998.75 is hit.

Video for the S&P Futures Live Technical Analysis for the Week of 9/8/2019

If the video does not load then click this sentence to view it.

Conclusion

I am looking for the market to pull back. With the long setup being completed this past week then that leaves only a sell setup for a longer-term time frame.

The market could definitely go up another 2% and make an all-time high but I would be very careful because I think the market is due for a pullback based upon the exit levels and setups.

So be careful out there. Once the short setups are completed from the pullback then that will create long setups and my view of the market will probably move back to bullish.

But since right now we only have short setups that need to be completed then I am definitely bearish in the short term.

Also, if you are looking for a broker to trade stocks that don’t charge trading fees then check out Robinhood: http://invite.robinhood.com/evanc203.

If you register using the link then both of us will receive a free stock.