There are many different ways people use to draw Andrews Pitchfork with many different rules. I like to keep things as simple and as easy as possible. This post will be about Andrews Pitchfork: A Beginner’s Guide on how to use it.

In my trading, I try to take out as much subjectivity as I can with my trading. My preferred methods to do this is Fibonacci retracements and extensions but there are other tools I sometimes use as well.

One of them is pitchforks. The one I currently prefer to use is the Schiff Pitchfork but I got there by extensively testing Andrews Pitchfork so that is why I am writing this post. There are numerous books and YouTube videos where people go over how to trade using pitchforks. But what I hope to provide that is different are the exact ways I use it in my trading. Because I am not talking about “theory and practice.” I personally use pitchforks in my trading with real money on the line and I will show you how I use it.

If it helps you then awesome if not then no big deal. You have to use what works for you and your trading. That is all that matters.

As I mentioned earlier I try to keep things as simple as possible in my trading. So in this post, I will show you how I use them and also give a couple of examples of how you could start to incorporate them in how you view the markets.

For a trade setup I use (the Springboard Reverse) I use the Schiff Pitchfork as one of the indicators for the trade to be valid. When I do a post about that I will show why I use the Schiff Pitchfork over Andrews Pitchfork. The main difference is where the median line is drawn. Either one is perfectly fine, it is just in that setup the Schiff Pitchfork fits perfectly with criteria I need for an entry with it.

Pitchfork Trading

In my post The Ultimate Guide for the Best Day Trading Books in 2019, I wrote about the book Trading With Median Lines by Timothy Morge. It is an excellent book about incorporating pitchforks into your trading arsenal. The book helped guide me on what to look for and how to properly draw pitchforks, specifically Andrews Pitchfork.

In the future I will do another post about the Schiff Pitchfork because to be honest I prefer it over Andrews Pitchfork. But Andrews Pitchfork is the one most people use so I will go over it first.

In the old days, you had to draw pitchforks by hand. Now with just about every trading platform and charting program out there they provide the framework to draw it. So if you are not using a charting program that has one then you need to switch to one that does. MetaTrader 4 & 5 both offer Andrews Pitchfork as well as the Think or Swim trading platform.

The main platform I use is Tradingview. They have an easy to use charting platform where they have several types of pitchforks. In the charts I provide below, with the steps provided, they will be through Tradingview.

It is as easy as connecting 3 dots. How you use it with your trading is where the fun begins. This post will be about how I use it and I think I use it in a very simple manner so that is why this is very applicable for beginners or anyone who isn’t familiar with Andrews Pitchfork and how it works.

Later I will do a video that you will be able to find here but I am not currently in an area where I can make a video. This will show much more in depth examples of how I use pitchforks in my training that will complement the pictures.

Andrews Pitchfork Rules

Just about any book, you read that goes in depth about pitchforks have rules about certain setups and price reactions from Andrews Pitchfork. I’ve looked at them in-depth but they didn’t help in my trading to increase my profitability so I don’t use them. But I will put them below so you can see what is usually recommended.

Here is a summary of the rules most books recommend that I took from the website ProfitF:

- 80% of the time, the price reaches the Median line

- When price reaches the median line, it can either reverse to the upper or lower median line or cut through the median line

- Failure to break reaches the upper or lower median lines after the median line is cut through indicates a reversal back to the median line

- When price reverses before reaching the median line, there is a high probability of price will continue to move in the direction, reaching the upper or lower median line, opposite to the median line

- When price breaks the upper or lower median line, they are most likely to reach the upper or lower warning lines

- When price cuts through the upper or lower warning lines, they indicate consolidation or the start of a new trend.

If you want to go old school and waste your time then here are the rules to drawing Andrews Pitchfork if for some reason you don’t have a charting platform that will do it for you. I took these steps from Forex Training Group.

To build an Andrews Pitchfork on the price chart, you should implement the following steps (for bullish trend):

- Identify a trend, or an emerging trend.

- Take the lowest point of the trend (the beginning) and mark it with (1).

- Take the subsequent swing high point of the trend and mark with (2).

- Then take the next swing low point on the trend and mark it with (3).

- Build a straight line between (2) and (3).

- Mark the midpoint of this line.

- Build the Pitchfork Median Line by adding a ray from (1) through the midpoint between (2) and (3).

- Add a ray starting from (2), which is parallel to the Median Line.

- Add another ray starting from (3), which is parallel to the Median Line.

- Then you should have three parallel lines on the price’s trend, which are equally distanced from each other.

- This is a completed Andrews Pitchfork Indicator.

- Confirm the validity of the Pitchfork by finding places where the price action conforms to the levels of the indicator.

- If you are unable to confirm the validity of the Pitchfork, find a replacement for (2) or (3) or both.

- All the rules are fully applicable for bearish trends, but in the opposite direction (High – Low – High).

As you can see that is a ton of work for drawing a couple of lines. So just use the indicator the charting platform provides you with. Some platforms are better than others but drawing pitchforks by hand will take up too much of your time.

What I Look For When Using Pitchforks

If the video below doesn’t load then click this sentence to watch it since it goes over this post.

I look for the price to retrace down to the 76.4% Fibonacci retracement level to get the anchor points 1 and 3. You can use any Fibonacci retracement level you like (I used to use the 38.2% level). Or you can use none at all.

But when you wait for a Fibonacci retracement level to be hit you then confirm the level as a solid level to draw your pitchfork from. I don’t use anything less than 38.2%. I had tried 23.6% but after testing it out I didn’t like the way it caused some “false” moves.

When Looking For a Trend

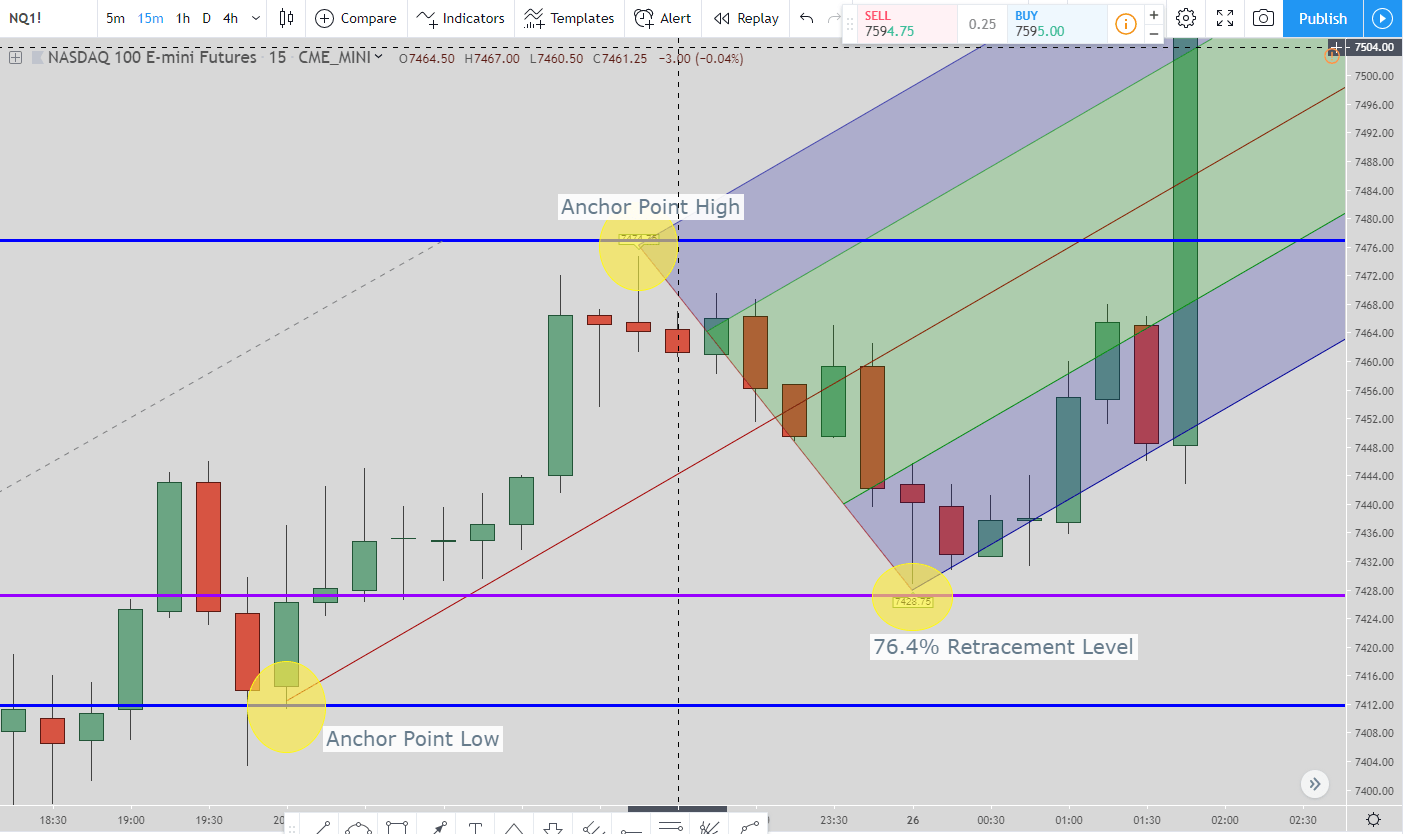

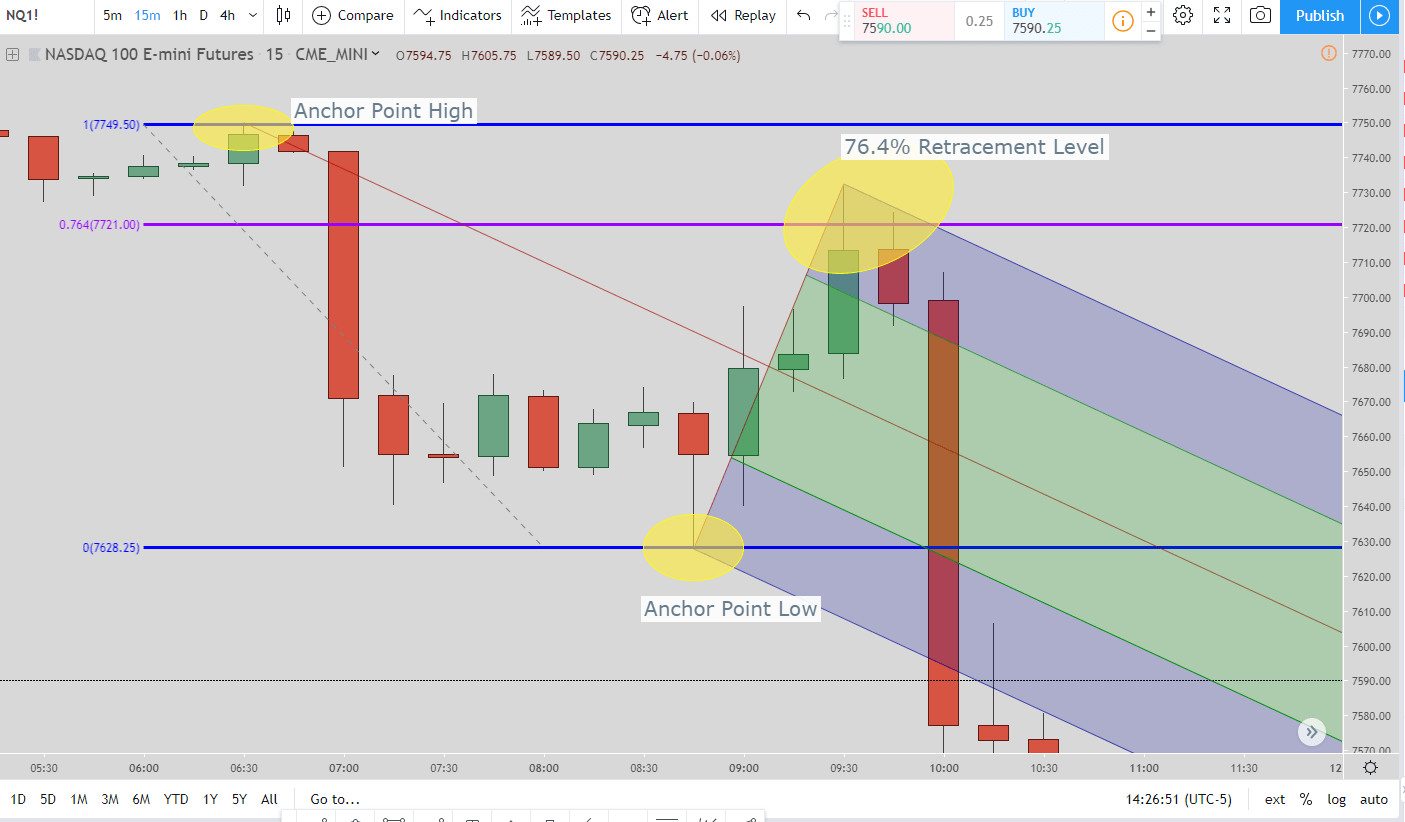

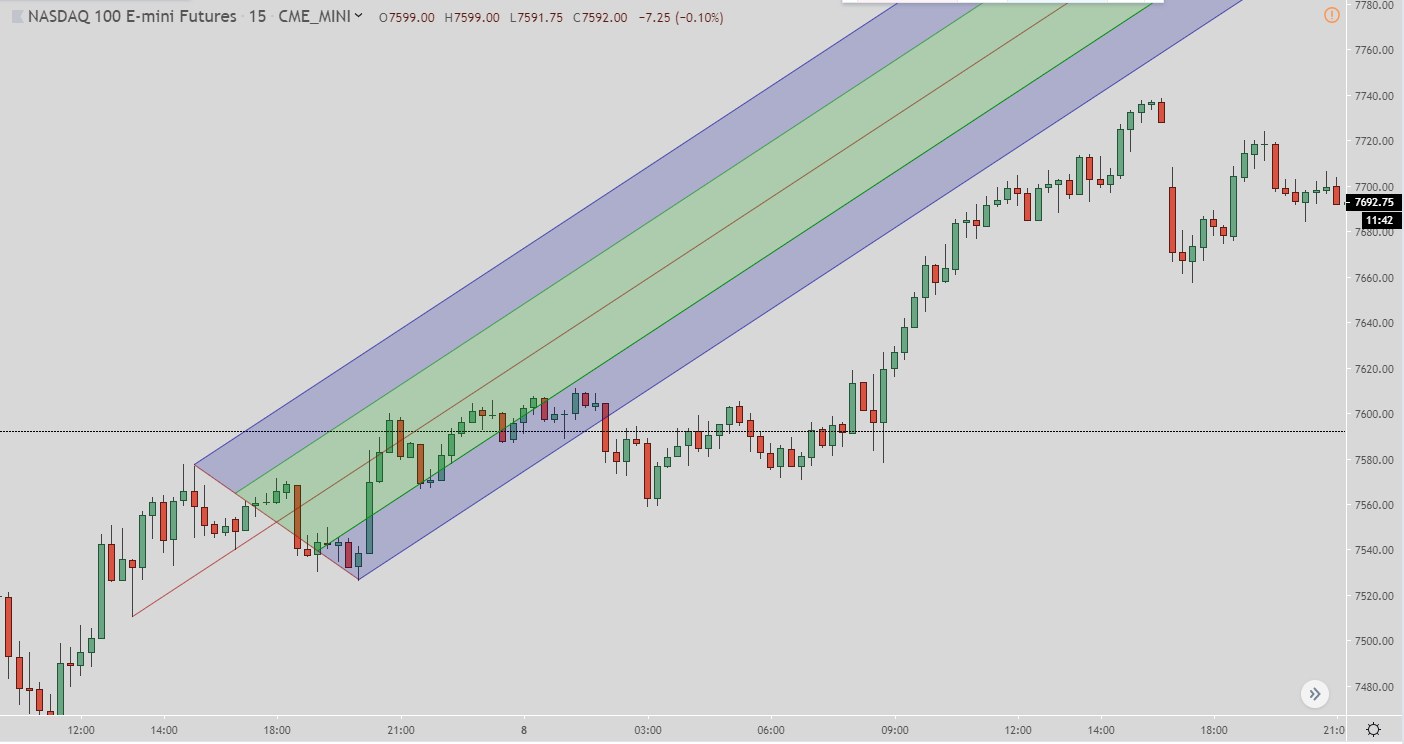

In the picture above you can see the 3 anchor points used. The lower, the upper, and the 76.4% retracement level. So what the Fibonacci retracement level does for me solidifies the move. It helps takes the subjectivity out of how and what I look for when drawing pitchforks, especially when looking for a trend.

Here is a short setup of how I draw Andrews Pitchfork. You can see the circles are the anchor point high, anchor point low, and the 76.4% retracement level.

So when I am looking for a trend that is the setup I use. I prefer to use the 76.4% retracement level to set the final anchor point but you can use the level you prefer……or none at all. Just do what works for you.

For spotting trends, it is that easy. Don’t complicate it. Use the way that works for you to spot the pivot points (pivot point indicator, Fibonacci retracements, etc.) and start drawing to see how price reacts to them.

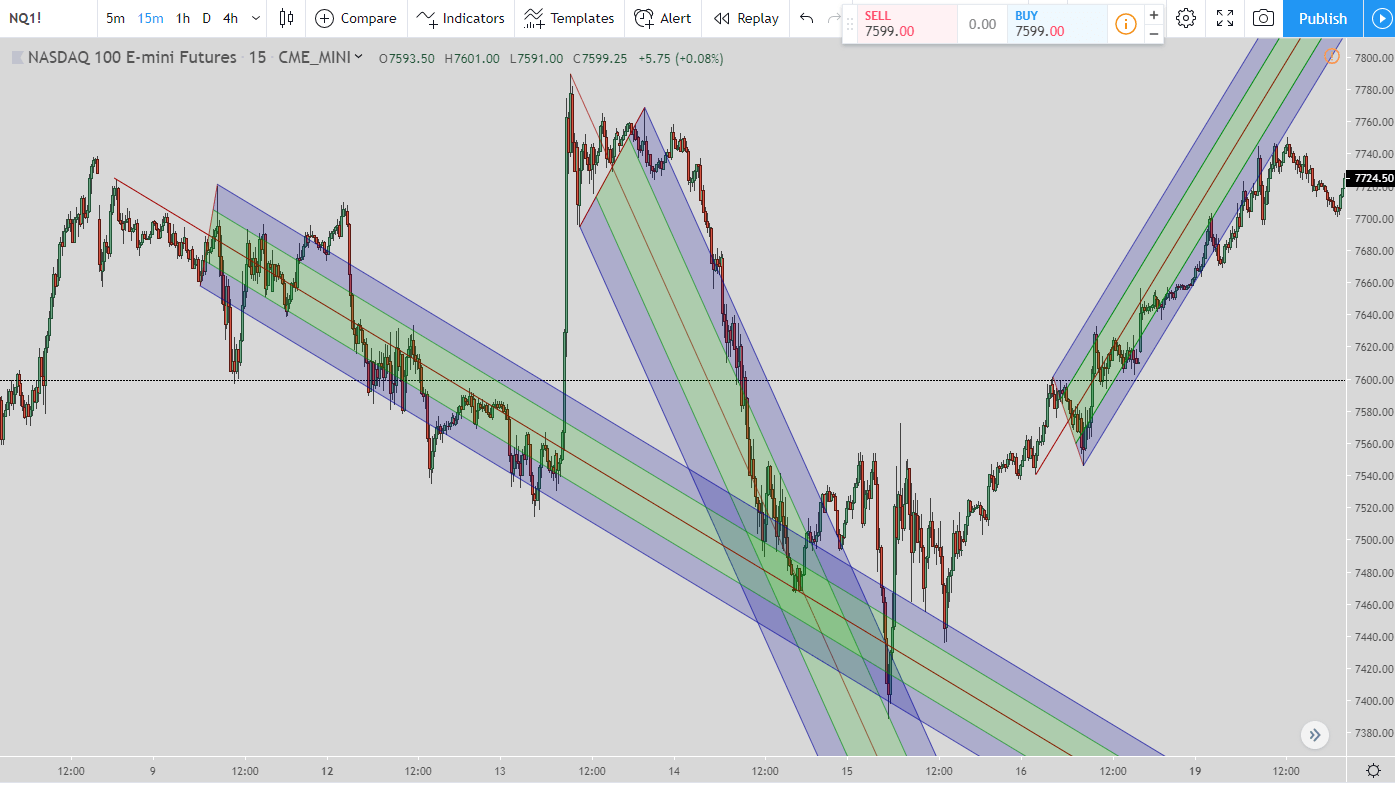

Here is a long-range chart to show what the pitchfork drawings look like when I use the 76.4% retracement level for the pivot point:

A Trade Setup To Consider

Here is a trade setup I have looked at but haven’t found a way to make it work for me…..yet. So I am sharing it with you in case it can help you.

This setup is a momentum set up so when the price is heading one direction then you are looking to piggyback off of the momentum.

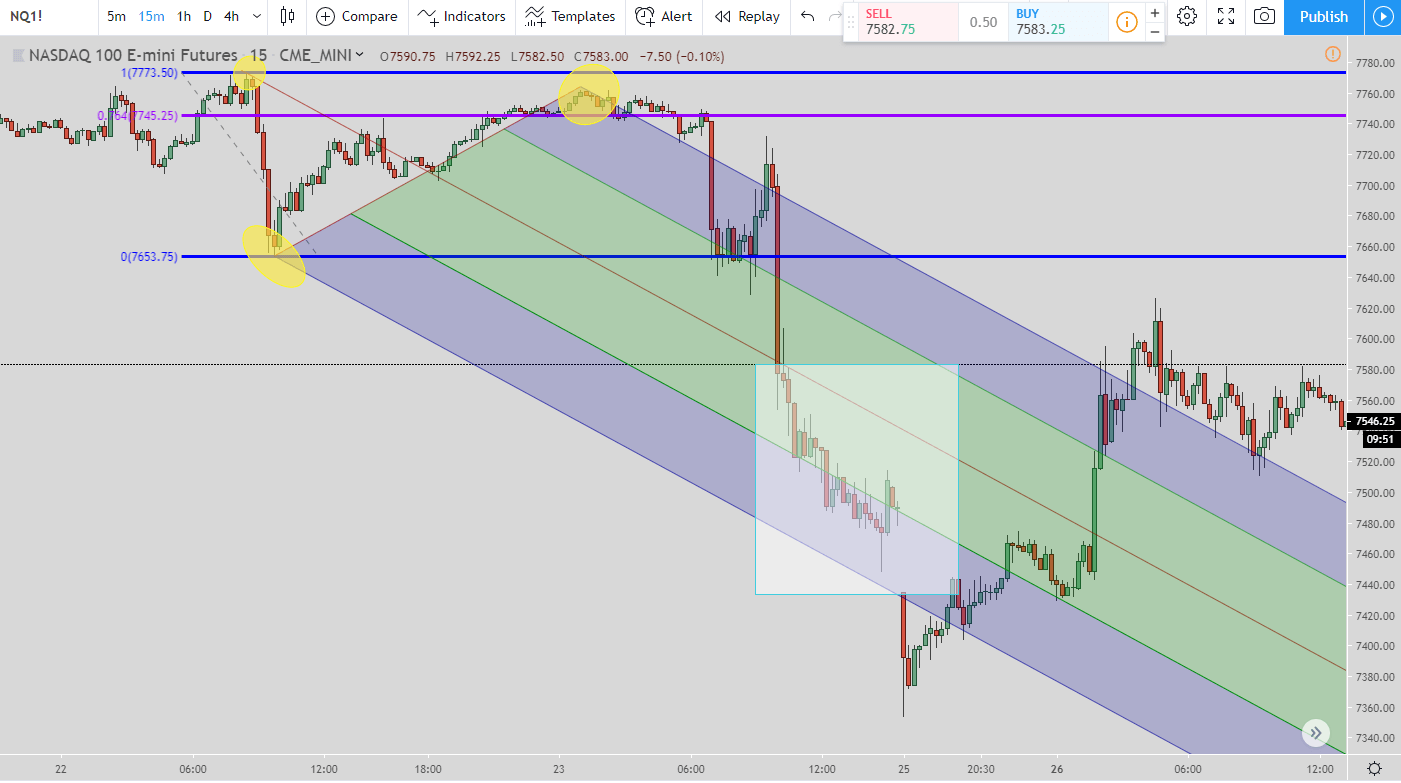

For this setup I draw the Fibonacci retracements just like I would when looking for the trend as you can see from the 3 yellow circles.

Your entry is when the price breaks the median line of the Andrews Pitchfork. Once it breaks it then you enter the trade. I highlighted it with the white box.

Your exit is the top of Andrews Pitchfork.

So to recap, you enter when price breaks the median line and exit when price hits the upper channel of the Andrews Pitchfork.

For the exit level that is one thing, I haven’t figured out which is why I don’t use this trade for my live trades yet. I’ve looked into putting the exit below the entry bar (if long) or at some other levels but nothing so far has worked for me.

Here it is below as a short example:

As you can see it is the same setup as the long except that it is a short setup. The top of the white box is the entry where the price hit the median line. The bottom of the white box is where the price hits the lower end of the pitchfork channel.

Obviously this doesn’t work 100% of the time. I’ll put some screen-shots below where it doesn’t. But the issue isn’t whether it works 100% of the time or not. The main issue is how and where to have the stop loss (if you use one). I don’t use a stop loss when I trade but for this setup, I am looking for one. Maybe I should look and see about not using one and basing it off of Fibonacci retracement levels like my other trades?

Drawbacks of Pitchforks

Although I use pitchforks in some areas of my trading I do not think they are the “be-all-end-all” indicator. I do think they are very useful but they do have some limitations.

The first is picking where you want your exit point to be. With the price levels constantly adjusting due to the price always moving it is hard to simply set your exit level and be done with it. You have to constantly monitor the move.

There are plenty of false breakouts. If you simply look for the move to be over when the price breaks out of a pitchfork then you will soon discover that simply isn’t the case. There are numerous times the price will break out of the pitchfork before continuing to move in the direction it was headed. Here is a picture showing this:

Lastly, when the median line works, it works amazingly well. But when it doesn’t work you are screwed. In pitchfork trading the median line (which is the red line) in the charts is the main aspect to the trade. Just about everything revolves around it.

You’ll see some charts where price reacted perfectly off of the median line and it would have been a perfect trade if you were trading off of it. Then there are other times price blows right through the median trade and it is a losing trade.

So how do you decipher when the median line works and when it doesn’t work? To be honest I haven’t found that out. But what I have found is you have to have some other parameters in place and make the median line be one of the criteria to see if you are going to take the trade or not.

As I mentioned at the beginning I do use the median line to filter a trade setup I use, the Springboard reversal. When I do a post about it you will see how I use the median line to filter out if it is a valid trade or not.

Conclusion

Andrews Pitchfork is a tool to use just like every other indicator. If you find it useful then use it, if not then do not use it. There is no right or wrong way to trade.

If it makes you money then that is the right way to trade for you. If you lose money by trading a certain way then that is the wrong way to trade.

The two biggest features I enjoy about pitchfork trading is that it helps take the subjectivity out of trading and it can help show the target area or support/resistance area where price may be headed.

Subjectivity is a great enemy of mine. As I mentioned earlier, my trading style seeks to take as much subjectivity out of my trading as possible. What that means is my entries, exits, and setups are not based upon chance. They are based upon a set of parameters that must be fulfilled before I enter a trade. Then when I enter I know exactly when my exit is going to be. There is not guesswork so I don’t trick myself and get in bad trades.

That is an issue I had in the past but once I started meditating and creating my own setups and trading style then I soon realized this is an issue that must be corrected. Soon after I started having my first consistent profits through trading where the previous 10 years I had never experienced.

You can have the same if you are not currently profitable. Trust yourself and create your own trading setups and system which you can do by tapping into your subconscious through meditation.