There are so many books about day trading and almost all of them are worthless. This post will be a collection and the ultimate guide for the best day trading books in 2019. But within the swamp of worthless trading books, there are a couple I have found that are decent and actually helpful.

Most trading books are written by people who either don’t trade or lose money trading so they write books to supplement their income. Then they have people “review” their book saying it is the best book ever and that makes them a trading celebrity. The one thing just about all of them have in common is they do not provide proof of their profitability.

It is so easy to provide proof you are a profitable trader but almost no one ever does. Especially the authors of trading books. If the author clarifies up front this is what they have learned and worked for them so it should be used as an educational purpose then that is fine. But most of these trading books are lead magnets to get you to buy a higher ticket item they are selling. Such as a spot in their seminar, a trading course, a trading room, or any of the other shenanigans the charlatans are selling that month.

Over the years I have read plenty of day trading books. From trading futures, Forex, stocks, cryptos, and options there are day trading books for all of them. Most of the books I read were garbage but there are a couple that made it through that I want to share with you.

Some of them may be from people you have never heard before. Most won’t be on Amazon’s best sellers list. A good rule of thumb to follow is if the book is on the best seller’s list then it isn’t any good. The reason why is most of the time the reviews are bought and they are nothing but hype. That isn’t true for every book but always use caution when everyone is universally declaring it to be the best day trading book ever.

So here are the books. I divided them up into different sections. Some of the books might fit into all of the sections below but I chose the one I felt it fit in best with.

If the link is an affiliate link then I will note it next to the link. If there is not an affiliate link note then it is not an affiliate link.

I will add to this post as the year progresses if I come across any other books I feel helped me out.

Best Day Trading Books

Mack’s Price Action Trading Manual

Mack is a trader who trades the e-minis. Also known as the ES. They are the S&P 500 futures contract for those of you who may not be familiar with the lingo. The ES futures are one of if not the most popular futures trading contract. I first found out about him through his Youtube channel.

Here is Mack’s Youtube channel: https://www.youtube.com/user/PATsTrading

Almost every day he does a review of the ES futures market based upon his trading style. His trading style is purely price action where they use “2nd entries” to get into the trades. He does both short and long trade setups. The time frame of the chart used is 2000 ticks and he uses Ninja Trader for his platform.

The price of his manual is $99.00. Years ago when I read it I fell in love with it. Mack was the first person to actually explain a trading style for trading the ES that made sense. Mack has stated this style can be used on any time frame and for any trading instrument. There might need to be some adjustments made as far as the profit target and stop loss target. But he says overall you can use it for just about anything.

I read his manual and then started watching his Youtube videos. His trading style influenced the way I trade today. The only indicator he uses is a moving average indicator. That is another aspect I really enjoyed. I didn’t want to be tied to an indicator for my profitability.

HIs system doesn’t have you hold any trades overnight. It uses a profit target and a stop loss. As mentioned above you normally get in when there is a “2nd entry.” A 2nd entry is when price makes two moves one direction to signal when you should get in. If you watch a video or two from his Youtube channel then you will understand much better than my poor description for 2nd entries.

Overall I think this manual is a gem in a sea of crap because it provides a structured system. Someone who is new to trading or who is looking to get into trading the e-minis would do well to take a good hard look at Mack’s Price Action Trading Manual. This is a book I definitely consider one of the best day trading books in 2019.

Here is what a Mack type of chart typically looks like. I don’t have the 21 ema he uses. I highlighted a 1st entry and the 2nd entry. With the 2nd entry, you would have gone short as soon as that red bar ticked one lower than the previous green bar. You would also draw trend lines because he is big with trend channels. The 2nd entry is the entry to his trading system.

Trading the Measured Move (Affiliate Link)

Trading the Measured Move is by David Halsey. He is a trader who operates his own trading room from his website https://eminiaddict.com. The main emphasis of this book is about Fibonacci extensions and retracements. It is a very intriguing book looking at how algos use Fibonacci extensions and retracements. He shows you the levels to look for when trading both long and short positions.

The book is described as a path to trading success in the world of algos and high-frequency trading. That is a statement I definitely agree with.

He is very clear up front that this book or his trading room isn’t for you to just try and follow along and expect to be spoon fed. If you are looking for a place to tell you when to buy or sell then this isn’t the product for you.

But if you are looking to learn how to interpret the markets you are trading then he can definitely help you out. The one negative about the book (if you purchase the Kindle version) is the charts can be very hard to read. He does provide all of the charts that you can download from his website which does make it a lot easier to follow along.

I loved this book because I trade using Fibonacci retracements and extensions. It opened my eyes to the importance of the 123.6% Fibonacci extension level. Plus he shows different ways to measure the moves. Sometimes from the top of the pivots and other times from the bottom. It set up my Springboard Reversal setup based upon the 123.6% Fib extension level when price misses it and retraces back.

He does offer a trading room but I have never done it. It is only $30/month or something like that which is actually less expensive than the book. From what I understand he has a chat room and talks about different markets based upon his trading style but there aren’t any “buy here and sell here” calls. You can check out his website from the link above to learn more. I get nothing from it if you join.

If you are looking for a book that is very structured and provides an excellent basis for how the market moves then you must read this book. Especially if you are looking at day trading. It will open your eyes to how the markets move and what to look for.

Here is a quick excerpt from the inside flap of the book that covers what I am talking about:

If you are an individual retail trader, you are competing with traders who have access to massive amounts of capital allocated by algorithms designed by brilliant mathematical minds and running on the ultrafast computers of the world’s largest financial institutions. These traders have changed the rules for the foreseeable future and have placed you at an unprecedented disadvantage. Trading the Measured Move offers individual retail traders a big-picture understanding of today’s market, plus the necessary details of how to trade fearlessly and profit in such a competitive marketplace.

With Trading the Measured Move, investing expert David Halsey—founder of the popular website EminiAddict.com—outlines a new and unique approach to investing success that draws on Fibonacci retracements (Fibs) within a series of measured moves across multiple time frames.

Trading With Median Lines – Mapping the Markets (affiliate link)

This book is written by Timothy Morge and makes the list of my best day trading books. If you are looking to learn about pitchforks then this is for you. It is an older book and is pretty expensive as far as books go, but if you want what is, in my opinion, a great way to look at the markets using pitchforks then this is the best book on the topic.

Mr. Morge goes over the median lines, Schiff median lines, inside median lines, and gap median lines. He provides examples for all of them. They are all drawn differently so the median lines will appear different each time you draw them. Nowadays a lot of charting services have tools that can draw them for you.

There are tons of charts where he clearly explains the drawings and what he is looking to do. You can describe pitchforks as simply being channels. That is basically what they draw for you on the charts. But there is a lot of detail that goes in these drawings and how the price moves in the different channels.

What this book does is give you the foundation and shows with very clear examples of how pitchforks should be used in your trading. You can use them in any market and in any time frame. The main key is the median line. When price reaches the median line then that is an area where a turn is likely and a pivot may form. Of course, that doesn’t always happen but the median line is the main crux of the pitchforks. He says the price is likely to test the median line roughly 80 percent of the time which is why they are so important for pitchforks. The median line is both an attractor and a barrier.

I prefer using the Schiff Median Line which he goes over in this book. It seems to fit in best with what I am looking for when searching for a reversal. This book introduced me to other pitchforks than just Andrew’s.

You can open up just about any trading software and try it out for yourself. www.tradingview.com has all of the pitchforks mentioned in this book and you can play around with them for free. I recommend you try them for yourself if you haven’t used them before. They are pretty interesting.

In my trading, I don’t use them specifically to take trades off of by themselves. How they have helped me is provide a filter for when I am looking for a reversal. I’ve found with the Schiff pitchfork that when the price comes back and breaks the median line then there is a high probability either a reversal has taken place or the 50% Fibonacci retracement level will be hit. Sometimes the moves go much further.

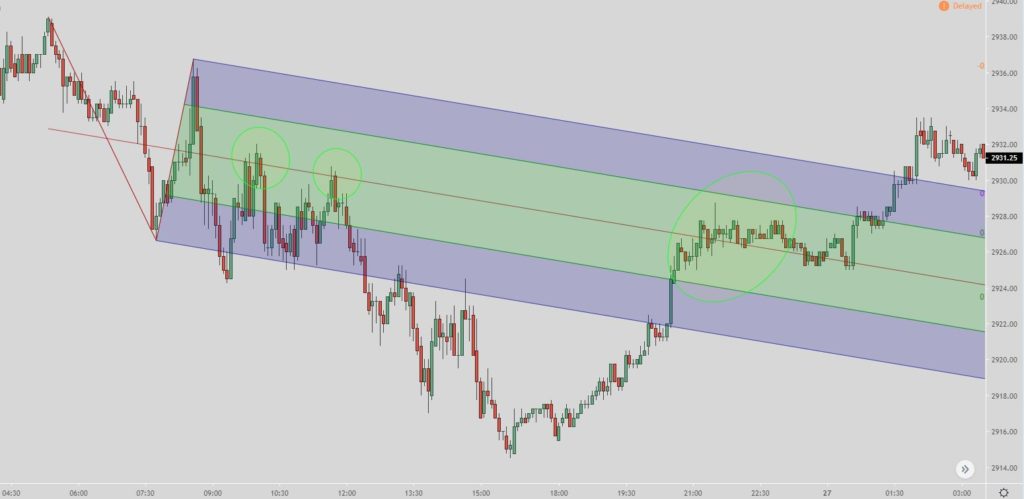

In the picture above you can see how the Schiff pitchfork works. Look at how price used the median line as resistance until it finally broke through and closed above it several times. Even then it took a bit for price to use the median line as support before it took off the other direction.

Conclusion

As you can see there aren’t 20 books listed because there aren’t that many good trading books available out there. Obviously, I haven’t read all of them so if there is one you like please let me know and I will be glad to read it. There were several that were close but the ones listed above are the best of the bunch that has helped me the most with my trading.

I am always on the lookout for new trading ideas and most of the time the good trading books are hard to find. The best day trading books are the ones that benefit you the most. The ones I listed above have impacted my trading the most which are why I listed and highly recommend them.

In another post, I am going to go over the best books for meditation and trading. Most people don’t realize how important your mindset in trading is for your success. Some of the books are directed towards traders but others are not. It doesn’t really matter because it is all about your psychology which impacts every aspect of your life.

Popular Links

Here are a couple of links if you are looking at how I view the market and with my trade setups as well as products I like and use.

- How to become a profitable trader using meditation

- How to scan for winning stocks

- Bread and Butter Trade

- How to Improve Your Meditation with the Brain Evolution System

- Review: Stikky Stock Charts – An Excellent Trading Book That is Interactive

Robinhood Trading Broker Review

If this post benefits you and if you haven’t used Robinhood for trading stocks but are thinking to then please consider using my referral link when you do sign up: http://share.robinhood.com/evanc203.

This way each of us will receive a free share of a random stock if you sign up through my referral link.

My Robinhood Review: https://evancarthey.com/review-robinhood-trading-service-with-no-fees-part-1/