Should you buy the 3 stocks Warren Buffet has invested $58 billion in?

According to this article about Warren Buffet – https://finance.yahoo.com/m/b95afa30-2f9a-3186-94a7-de4ab4d0b801/buffett%27s-%2458-billion-bet-on.html he has invested $58 billion dollars into 3 stocks. The stocks are American Express (AXP), Goldman Sachs Group (GS), and Apple (AAPL). One very important point is he is ALREADY in these stocks. There is a reason why they are releasing this information now. They want the public to piggy-back and drive up the price of the stock. They know many people will buy whatever stock they hear Warren Buffet is in. So should you buy the 3 stocks Warren Buffet has invested $58 billion in?

Warren Buffet is a machine. Everything is calculated. The old grandpa persona he portrays is an act. He may be a super nice guy, I don’t know, I’ve never met him. But there is a reason why he wants the public to see him as a trustworthy grandpa type of person.

Let’s look over those 3 stocks.

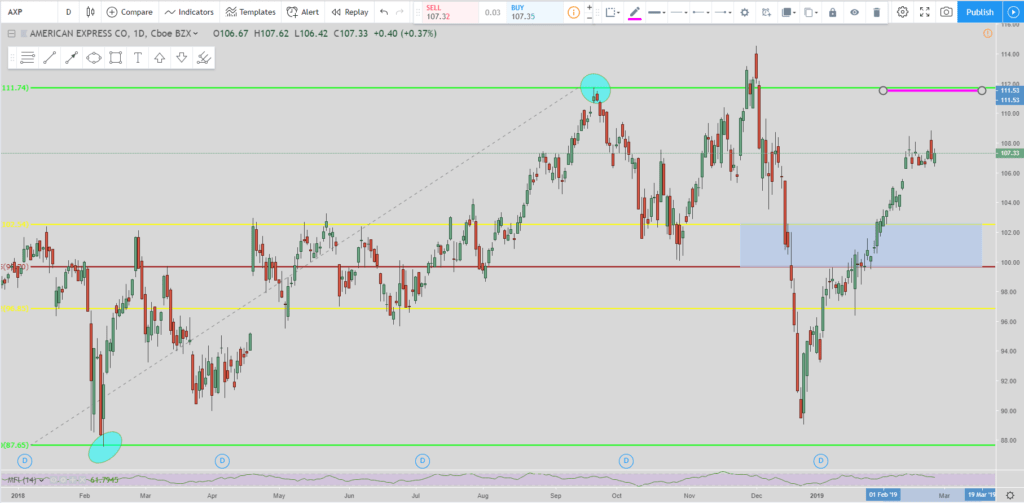

Should you buy American Express (AXP)?

In looking at American Express (AXP) I would not buy a buyer at it from where it is right now. Currently, on 2/26/2019 the price is around $107.33. Using the Lightning Trade setup to the long side you can see the exit at the pink line, $111.53. With the price being at $107.33 there isn’t much room left to run to complete the move. This doesn’t mean the price couldn’t continue up and blow past $111. But the way I trade and my setups that is the exit I have.

Now if the price doesn’t hit $111.53 and goes down to the bottom green line at around $88.00 then I would definitely look at going long in American Express. For the way, I trade I would not currently be a buyer of AXP. Warren Buffett probably started getting in around the low $90s and now wants the public to pile on to boost the price some more.

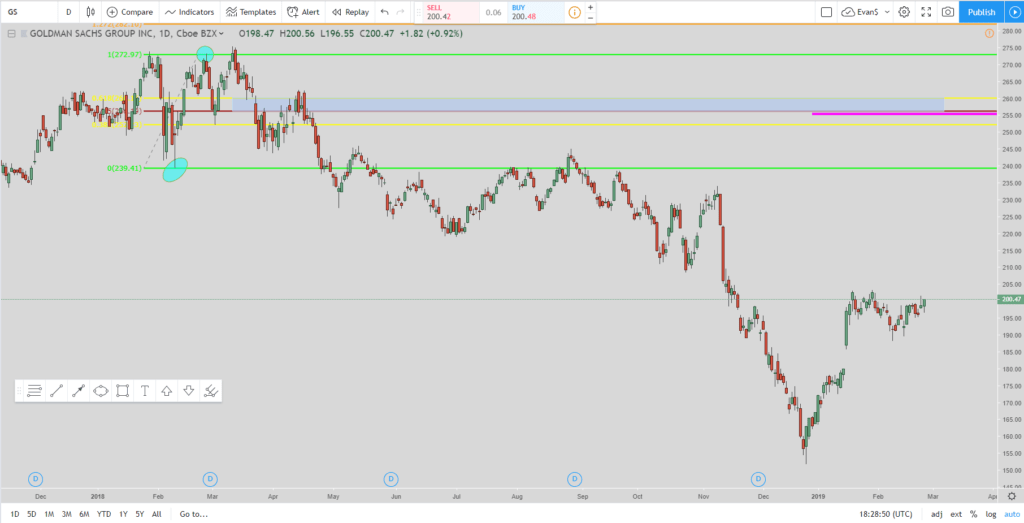

How does Goldman Sachs (GS) Look for a Buy?

Goldman Sachs is a different story. This stock has some very nice room left to the upside. The price is currently around $200. The exit I have based on the Lightning Trade Long setup is the pink line at around $255. I bet Warren Buffett started purchasing GS when it was below $200 and probably all the way down into the $150s. Now he has released he owns this stock because he wants the public to help push it up even further.

There is only one hesitation. Do you see the gap from $180-$185. There is a good chance that comes back and gets filled before the run-up. So if I was looking at getting in I would buy 1/3 of my position now and then wait and see if the price drops into the $180s. Then buy the other 1/3 there. Finally, I would save the last 1/3 and buy GS if it fell all the way to the lows of the $150s.

Full disclosure, at the time of writing this article I did make my first GS purchase at $200.30. The exit I have is $255. I could get out sooner if I want but that is the final exit. It won’t be adjusted even if the price moves to lower levels like it does if other certain levels are hit.

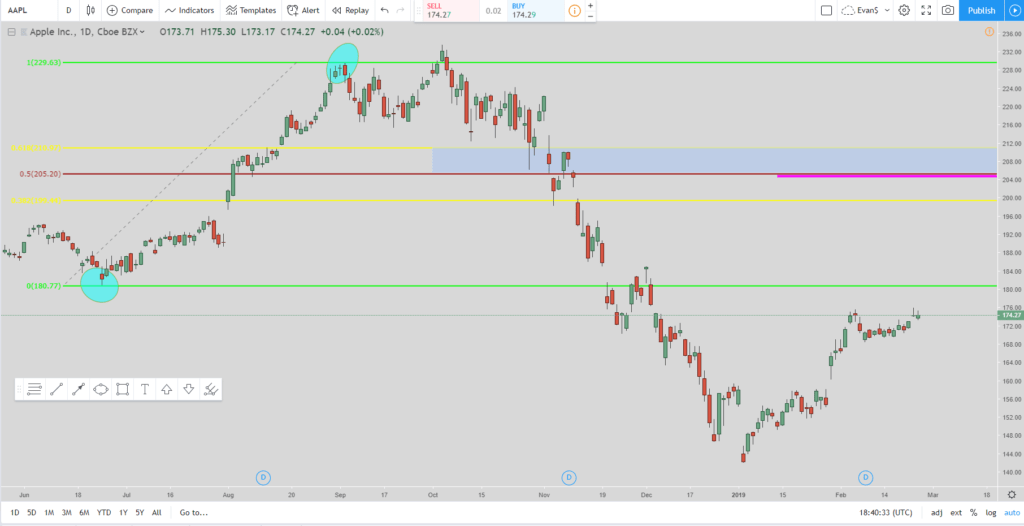

What about Apple (AAPL)?

Apple (AAPL) is another stock I agree with Warren Buffett. It is a great stock to own and has room to run until the exit I have for it is hit. The price is currently at $174.25 and the exit I have is the pink line at $205.00. I currently own Apple. I’m sure Warren Buffett got in around the $150s or lower. My entry point is $172.

I don’t have much else to say except that I own it and agree with Warren Buffett that it is undervalued and has some very good room to move to the upside.

Recap

I wouldn’t buy American Express (AXP) at its current levels. It doesn’t have much more to go in order to fulfill my setup.

With Goldman Sachs (GS) it is at such a great level right now that I went ahead and purchased it.

I currently own Apple (AAPL) and still feel it is a great buy at its current level of around $174.

Warren Buffet and I agree on 2 out of his 3 stocks. As Meatloaf sang, “Two out of three ain’t bad.”

If this post benefits you and if you haven’t used Robinhood for trading stocks but are thinking to then please consider using my referral link when you do sign up: http://share.robinhood.com/evanc203.

This way each of us will receive a free share of a random stock if you sign up through my referral link.

My Robinhood Review: https://evancarthey.com/review-robinhood-trading-service-with-no-fees-part-1/