Robinhood Trading Platform Review: A Beginner’s Guide to Investing in Stocks

Robinhood is a commission-free trading platform that has gained popularity among investors. The platform offers trading for more than 5,000 stocks, ETFs, and options. Robinhood’s user-friendly interface and no minimum deposit requirement make it accessible to beginner investors.

However, Robinhood has faced criticism for its customer support and regulatory issues. In 2020, a college student took his own life after seeing an unexpected negative balance on his Robinhood app. The platform has also run afoul of regulators for issues such as failing to disclose its receipt of payment for order flow.

If you’re considering using Robinhood, it’s important to weigh the pros and cons. While the platform offers commission-free trading and a user-friendly interface, it may not be the best fit for every investor.

For the past couple of years I have been using Robinhood as my primary broker for trading stocks.

This post will be the Robinhood trading platform review of the stock trading platform.

Before this, I had been using Scottrade which is now TD Ameritrade. The main feature of Robinhood is they charge $0 in commissions for trades! But that has now become pretty standard in the industry.

Years ago it was not standard and Scottrade would charge you $7 per trade. Thank you competition for doing away with charging for stock trades!

This Robinhood trading platform review will explore the features of Robinhood and help you decide if it’s the right platform for you.

What is Robinhood?

Robinhood is a commission-free trading platform that allows you to buy and sell stocks, ETFs, and options without any fees. With Robinhood, you can trade stocks and other securities directly from your smartphone or computer.

The platform offers a simple and intuitive interface that makes it easy to navigate and place trades. You can also access real-time market data and news to help you make informed investment decisions.

Robinhood is popular among young investors who are just starting out in the stock market. Its commission-free model makes it an attractive option for those who want to invest in the stock market without paying high fees.

Robinhood Trading Platform Review – Features

Commission-free Trading

Robinhood’s commission-free trading appeals to investors looking to cut costs.

User-friendly Interface

Robinhood’s user-friendly interface provides a simple, intuitive trading experience.

Mobile Trading App

Robinhood’s mobile trading app allows users to access all platform features on the go.

Fractional Shares

Robinhood offers fractional shares, allowing investors to buy a portion of a share.

Cryptocurrency Trading

Robinhood allows users to trade cryptocurrencies, including Bitcoin and Ethereum. Overall, Robinhood’s features make it a popular choice for investors looking for a low-cost, user-friendly trading platform.

Robinhood Trading Platform Review – Pros and Cons

Pros

Robinhood offers commission-free trading, which decreases costs for frequent traders and long-term investors.

The platform allows trading for more than 5,000 stocks and ETFs.

Users can receive one free stock for referring a friend.

Robinhood Gold includes $1,000 in margin credit and reduces interest rates for margin accounts.

Cons

Customer support is lacking and the broker has run afoul of regulators.

There is no minimum deposit requirement, but users cannot buy fractional shares.

The platform has experienced outages during high-volume trading periods.

Robinhood does not offer mutual funds, bonds, or options trading.

The Gamestop Fiasco

Account Types

Robinhood offers two types of accounts: Instant and Gold. Instant accounts are free and allow you to trade with your deposited funds instantly. Gold accounts cost $5 per month and give you access to margin trading, larger instant deposits, and after-hours trading.

With a Gold account, you can also borrow money from Robinhood to trade with, but be aware that this comes with interest rates that can add up quickly. Robinhood also offers a Cash Management account that allows you to earn interest on your uninvested funds and spend money with a debit card.

It’s important to note that Robinhood does not offer retirement accounts, such as IRAs or 401(k)s. If you’re looking to invest for retirement, you’ll need to look elsewhere.

Account Opening Process

Opening an account with Robinhood is a simple process that can be completed in minutes.

- Enter your personal information, including name, address, and social security number.

- Answer a few questions about your investment experience and risk tolerance.

- Link your bank account to fund your account.

- Verify your identity by uploading a photo of your ID.

Robinhood does not require a minimum deposit to open an account, making it accessible to investors of all levels.

Once your account is approved, you can start trading stocks, ETFs, options, and cryptocurrencies.

| Pros | Cons |

|---|---|

| Simple and fast account opening process | No retirement accounts offered |

| No minimum deposit requirement | Limited customer support options |

| Ability to trade stocks, ETFs, options, and cryptocurrencies | Has faced regulatory scrutiny in the past |

Fees and Charges

Robinhood charges no commission fees on trades, making it an attractive option for investors looking to cut costs. However, there are some fees and charges to be aware of.

- FINRA charges a trading activity fee (TAF) to brokerage firms like Robinhood to recover the costs of supervising and regulating these firms.

- Robinhood passes this fee to its customers, except for sales of 50 shares or less.

- As of January 1, 2023, the TAF is $0.000145 per share (equity sells) and $0.00244 per contract (options sells).

- Robinhood also charges fees for certain services, such as wire transfers ($25) and returned checks ($9).

It’s important to note that Robinhood may also charge fees for other services, such as margin trading and cryptocurrency trading. These fees can vary depending on the specific service and account type.

Overall, while Robinhood’s commission-free trading is a major draw for investors, it’s important to be aware of the various fees and charges that may apply to your account.

Customer Support and Service

Robinhood’s customer support has been criticized for being lacking and slow to respond.

Users have reported long wait times on the phone and difficulty getting in touch with support agents.

However, Robinhood has recently made efforts to improve its customer service, including hiring more support staff and implementing a live chat feature.

Robinhood also provides a comprehensive FAQ section on its website, which includes answers to common questions and troubleshooting tips.

Additionally, Robinhood offers a variety of educational resources, including articles and videos, to help users learn more about investing and using the platform.

Overall, while Robinhood’s customer support has room for improvement, the platform provides ample resources for users to troubleshoot issues and learn more about investing.

If you are looking to speak with a real person to solve an issue with your Robinhood account well then good luck with that.

Security and Safety

Robinhood takes security seriously and has implemented various measures to ensure the safety of its users’ accounts.

Users can enable Two-Factor Authentication (2FA) to add an additional layer of security to their accounts. Robinhood also uses encryption to protect user data and has a bug bounty program to incentivize security researchers to report vulnerabilities.

However, in the past, Robinhood has run afoul of regulators, and there have been instances of hacking and fraud on the platform.

It is important to note that while Robinhood is a member of the Securities Investor Protection Corporation (SIPC), it does not provide the same level of protection as FDIC insurance for bank accounts.

Overall, while Robinhood has taken steps to improve security and safety, users should still exercise caution and be mindful of the risks involved in trading on the platform.

The Robinhood Trading Platform Review Conclusion

Overall, Robinhood is a low-cost trading platform that offers access to a wide range of investment options, including stocks, ETFs, options, and cryptocurrencies. It is an ideal choice for beginners or those who want to invest small amounts of money.

However, the platform’s customer support is lacking, and it has had issues with regulators in the past. Additionally, some users have reported technical issues, such as delayed orders and slow processing times.

Despite these drawbacks, Robinhood remains a popular choice for those looking to invest in the stock market. Its commission-free trades and easy-to-use interface make it an attractive option for many investors.

Overall, if you are looking for a simple, low-cost trading platform, Robinhood may be the right choice for you. However, if you require more advanced features or need more robust customer support, you may want to consider other options.

Invite A Friend to Robinhood

One feature they offer is if someone signs up under your link then you both will get one share of a random stock. If you find this article informative and you do sign up to use Robinhood’s service then please consider using my referral link so we both receive a free share of a random stock. Here is my link: http://share.robinhood.com/evanc203.

It isn’t necessary you do this but I think it is pretty cool that if you do use my link and then fund your account that we will both receive a share of some random stock. They say they give out some good shares of stocks when they do this but I think it is pretty rare. More than likely we’ll both receive some crap stock but it is better than nothing for being free. So if this Robinhood review benefits you then consider using my referral code.

$0 Commissions on Trades

Yes, you read that right. Robinhood charges $0 for stock trades and options. They do not offer mutual funds, bonds, or Forex. For stocks you can only go long, they do not offer shorting. They have recently offered the service of trading Bitcoin but I am still on the wait list to access it so I cannot give an accurate feedback for that service. In all of my trades over the past year I have paid $0 in commissions! If you are only concerned with purchasing stocks and are not a day trader then this service will fit your needs just fine. They used to only offer their trading platform through a mobile app but they now have their services available through the web.

To Recap on What They Offer:

- Stock Trading (Buy side only)

- Options

- Bitcoin (I am still on the wait list)

- Mobile app and web trading platform

What They Do Not Offer:

- Shorting stocks

- Futures

- Forex

- Mutual Funds

- Bonds

Trading with Robinhood Review

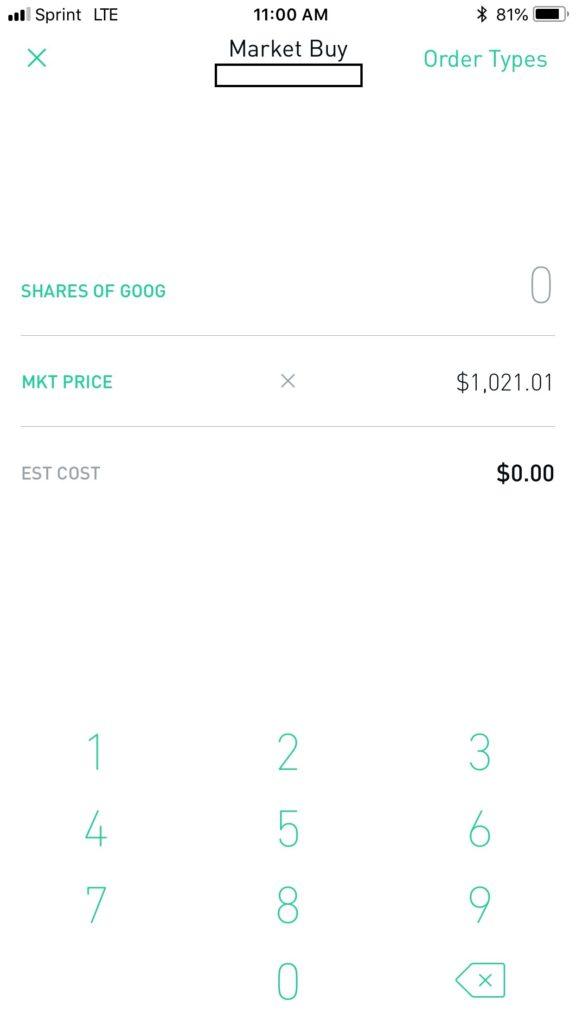

For executing stock trades I found it to be very simple to use from my phone or through their website. You click on the stock, then click buy, and then you can select in the upper right hand corner if you want to use a limit order and all of that good stuff. Once executed you will get an alert on your phone and also through your email. The default order is a market order. Here is a screen shot showing this:

The Robinhood Review of the Trading Platform

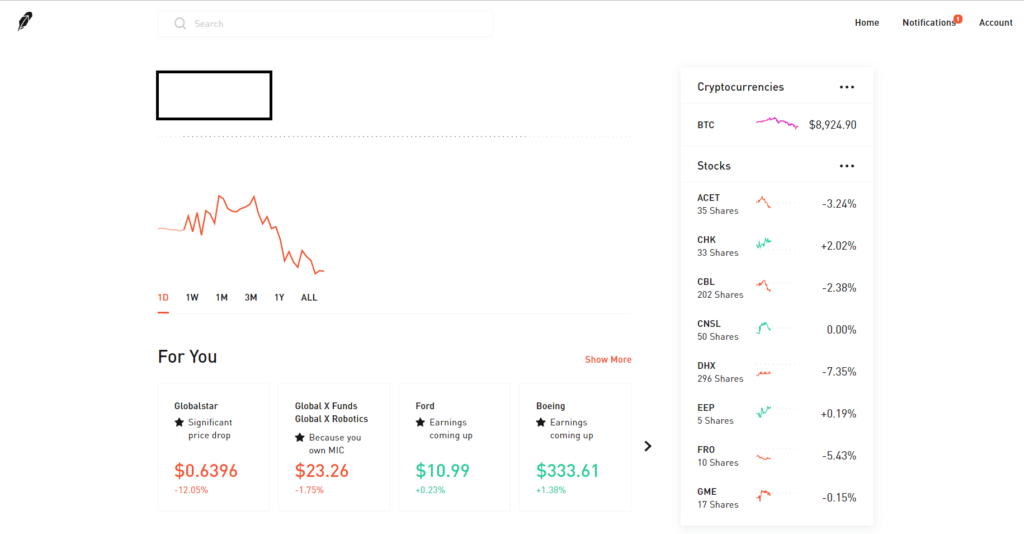

When I first started using Robinhood you could only trade from their app on your phone. Recently they opened up their website that I now have access to. There is nothing fancy about it but it is very easy to navigate. I had called Scottrade (before TD Ameritrade bought them) because I was going to transfer my stock over to Robinhood and the only rebuttal they had was that Robinhood doesn’t offer the same in-depth features to research that they offer. I can get all of that from other websites so that reasoning was worthless. But if you are looking for a broker who provides in-depth research then Robinhood is not for you. The only research they offer are articles linked from SeekingAlpha and Yahoo Finance besides the general information about each stock you are viewing.

One feature I like is it is very easy to see what your P/L is for each stock. Then when you are selling your stock you know how many shares you have and what is your average cost per share. When I was using Scottrade that would drive me nuts because they never had that information on the trade screen.

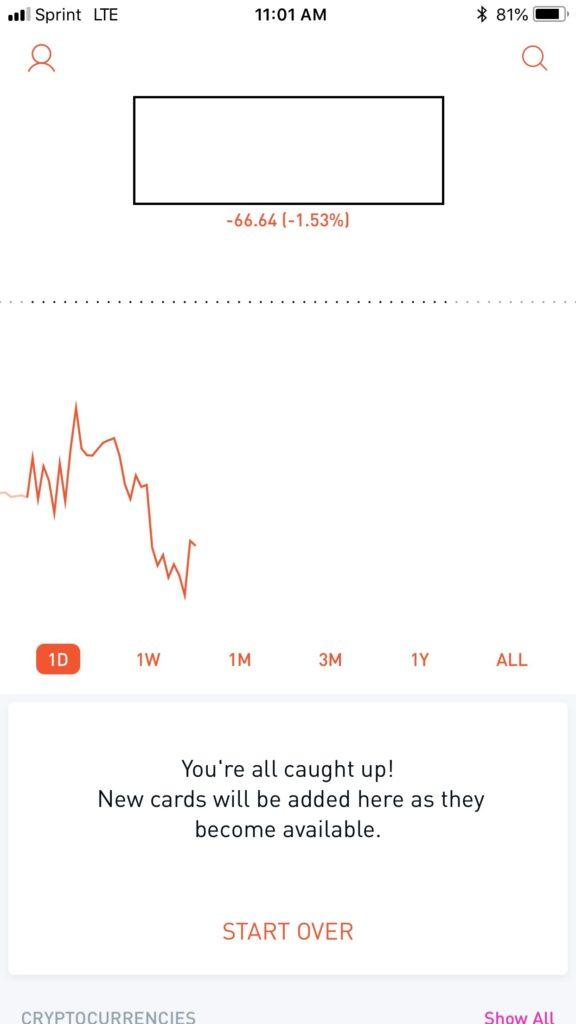

The home page shows your total account value and your profit/loss for the day. Below it has alerts such as any trades that were executed, dividends or high impact company news. Then you have your active stocks you are trading through Robinhood. Finally you have your watch list at the very bottom. Nothing fancy but fits just fine with what I need. I just need the cheapest service for trading stocks and Robinhood provides that perfectly. At all times you know how much buying power you have and what your average cost of the stock is if you are looking to buy more or sell.

Here is a screen-shot from their app and also the website:

Mobile App:

Website:

In part 2 I will go over:

-

Robinhood Gold

-

Customer service

-

Transfers/Banking