So far the EUR/NZD has started a little break down. The EUR/USD and the EUR/JPY have had big moves to the downside. The EUR/GBP is still holding steady but the EUR/CHF is getting ready for the next big break down. I am currently short the EUR/CHF. I think there is lots of room for it to move down.

Why is the EUR/CHF getting ready to move down?

From what I have seen when the dominant portion of the pair (the 1st one listed) makes a major move down across most of their pairs it doesn’t all happen at the same time. One or two pairs will move down and then 2 or so more and then finally the last pair or two. Unless it is some major event this seems to be how the pairs move. They move in a staggered moves. This is exactly what has started to happen with the EUR pairs. Let’s look at some of the other pairs I mentioned earlier.

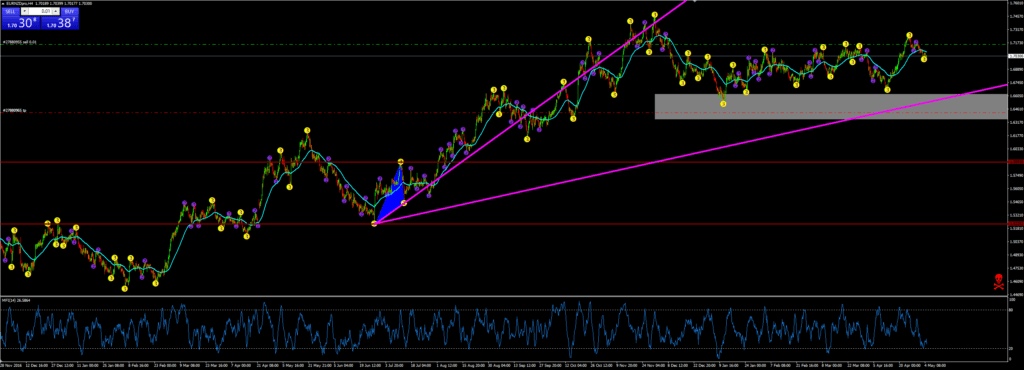

EUR/NZD

This is a trade I am currently shorting. As you can see price broke the magenta line a long time ago. The exit is at 1.64202. With the daily rollover rate being 0.88 on the short side then this trade is good to be in since they pay you a little each day. https://www.forex.com/en-us/trading/pricing-fees/rollover-rates/#. Rollover rates are important to watch if you are going to be in several trades for days at a time. Otherwise they will start to eat very slowly into your profits. There is a longer term magenta line that is yet to be broken but the main one from the move earlier has been broken.

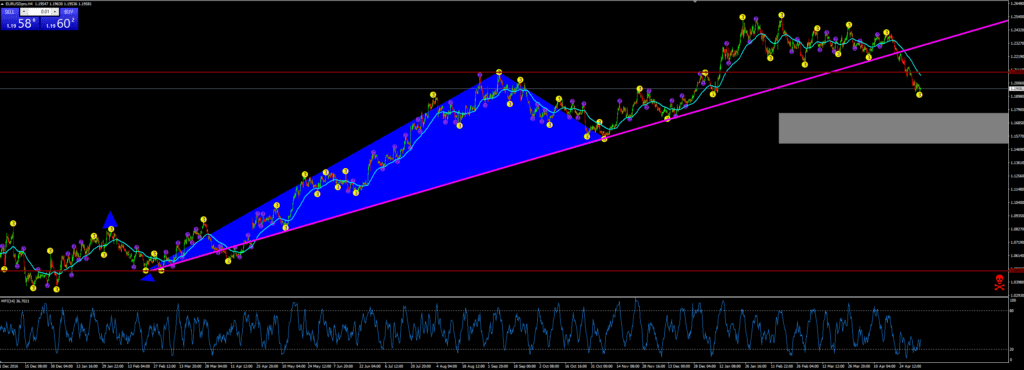

EUR/USD

The EUR/USD has had a major move to the downside. I was kicking myself for not getting in a week and a half ago when price broke the magenta line. It was also at the 423% Fibonacci extension level on the daily chart. That means it was wayyyyyyyyy overdue for a retracement. I normally trade off of the 4 hour chart so when I see anything above the 261% Fib extension without a retracement on the daily then I have to get in next time. You can see there is still a very big move left to the down side. I am looking for price to go back up a bit before I get in. Probably around to 1.21525 if the current low holds. You could definitely get in now and your exit would be 1.15556.

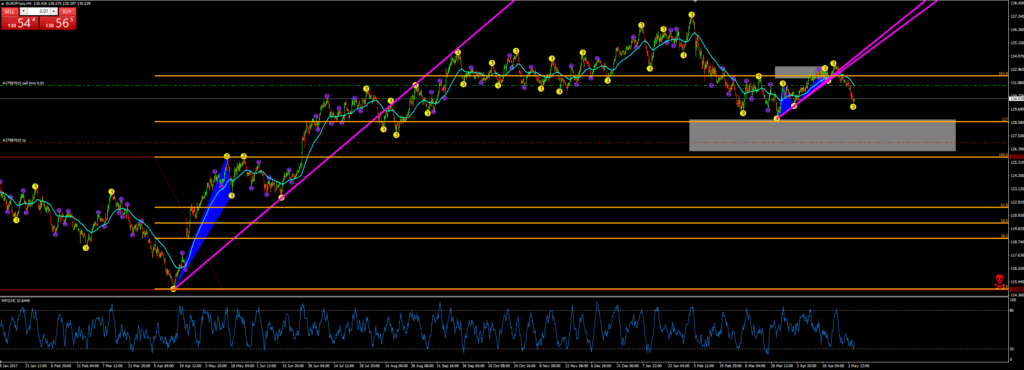

EUR/JPY

Here you can see I have a limit order waiting for the retracement. I could get in short now which I was last week. Last Friday I exited this trade. If price continues to take off without me to the downside then so be it. But if the 50% fibonacci retracement happens then I am ready for it. The profit target is at 126.948.

EUR/GBP

There is not too much going on with the EUR/GBP. I am still waiting on price to break the magenta line to the downside. Until that happens there is not a trade for me.

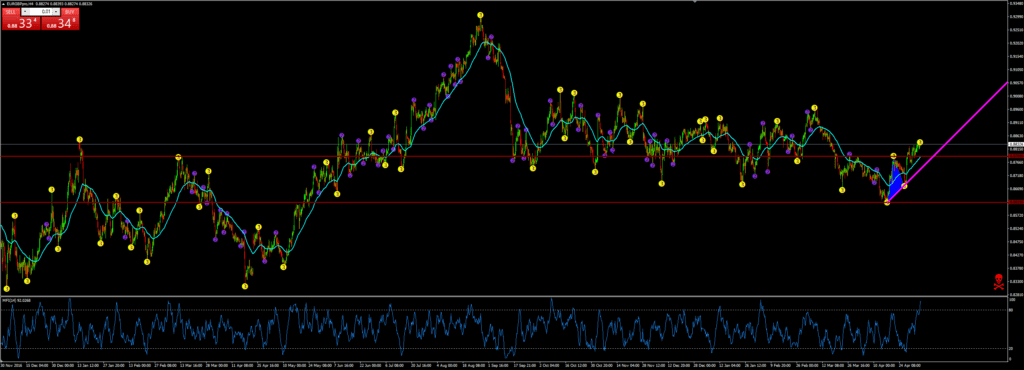

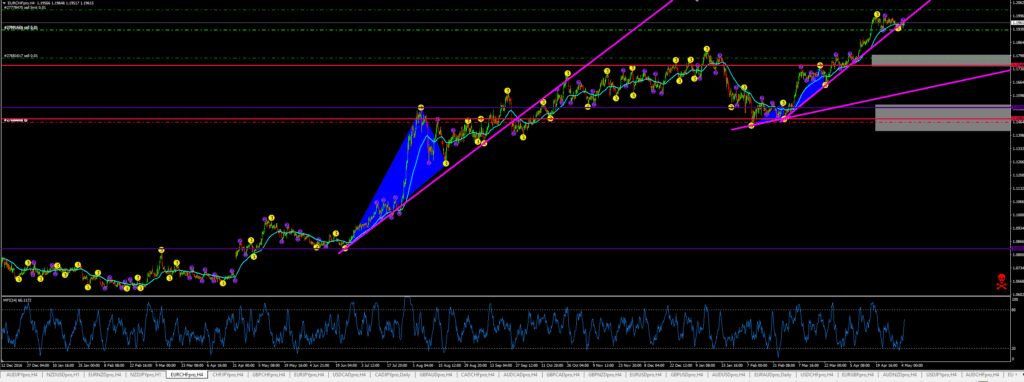

Now Let’s Look at the EUR/CHF

This is actually the result of three moves. You can see the larger blue triangle is the first move and the smaller blue triangles are the 2nd and even 3rd move. Price broke the big move a long time ago and it just broke the 2nd move last week. Price is currently bouncing off of the trend line. I view this as a very good sign because eventually that turns into resistance and the move to the downside will be underway. You could have your exit 1.17579 from the 2nd move if the current high holds but I am using the larger move as my exit at 1.14619. This is just above the 50% Fib retracement level which is the gray box.

Conclusion:

I am short the EUR/CHF and if the current high holds then my exit will remain at 1.14619. With the EUR/USD and the EUR/JPY already having big moves to the downside I think the EUR/CHF is next in line.