This post is a collection of old blog posts I am consolidating into one post. I’ve been posting to this website (www.evancarthey.com) since 2019. The other day I took a look at some of my old posts and they are hilarious. None of them have any optimization for SEO. They are just plain awful. If you need a good laugh about some old posts when I first started then this is a great collection to begin with.

I’m redirecting all of the old blog posts to this page and will post them all because most of them are short. Some blog posts are nothing more than a chart picture and a small paragraph talking about it. The blog posts would have been better off being posted to Twitter.

Some of the old posts are just plain wrong in my predictions which happens. I’ve never claimed to be perfect. Some hit the nail on the head. But overall it is interesting to see how my writing style has changed over the years.

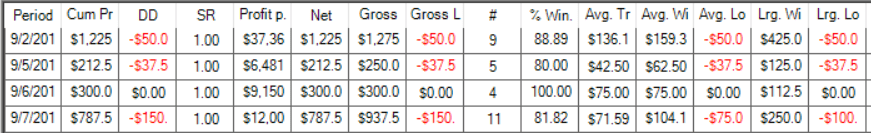

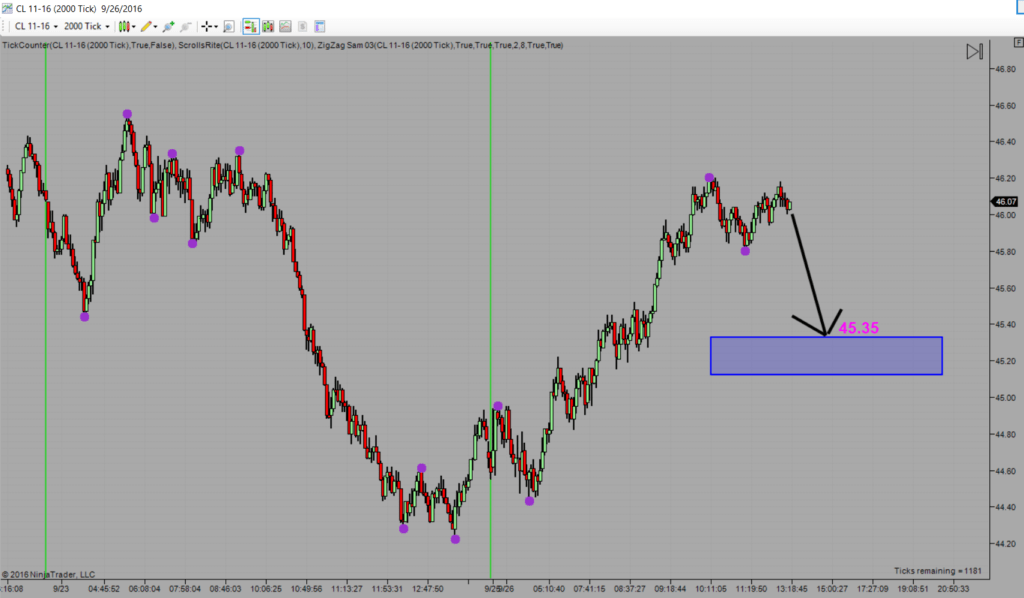

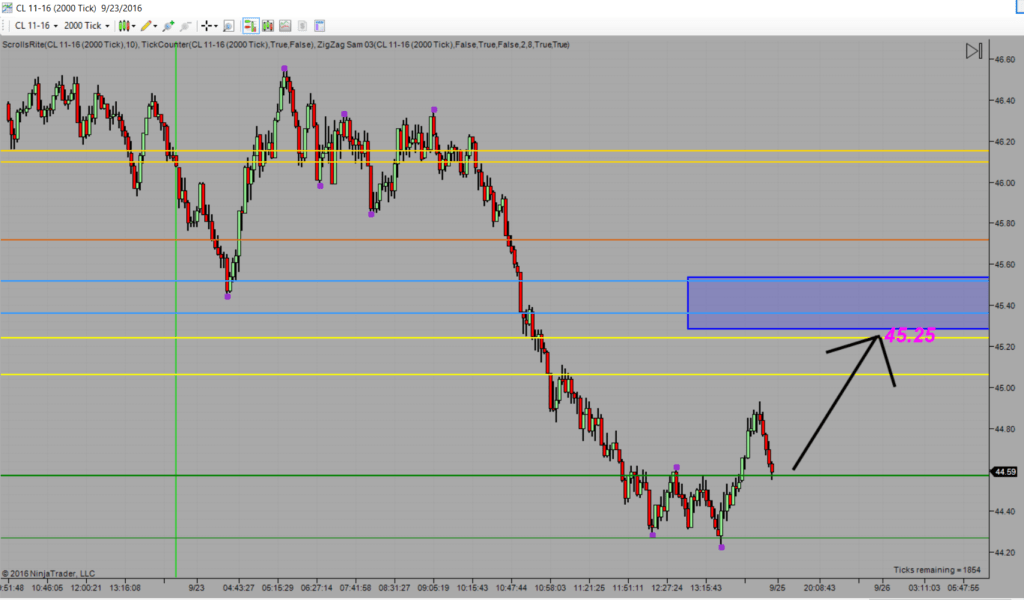

CL (Oil) Hit the Target of 45.25

Originally posted on 9/27/2016

As I posted here: https://evancarthey.com/cl-oil-gameplan-monday-9262016/ the game plan for Monday was to look for the CL to come back to at least 45.25. At the time I wrote it the price was 44.59. Price went and hit it easily. I already made a post about what I think the CL will retrace to from where it was earlier today here: https://evancarthey.com/bet-no-opec-deal-gasp-surprise/

The US Stock market is on Its Last Legs Up (Old blog post)

Originally posted on 9/27/2016

In the next day or two I’m going to post some charts (SPX and DJX) showing how the US stock market is in the final stages of its massive uptrend that began all the way back in March of 2009. It has one more level which would be the absolute maximum it could go to but I seriously doubt it makes it up there. If it does then I would use every spare dollar I had to short the market at that point but it still has a ways to go to get there.

If I had all long positions and had not taken a decent amount of profit over the past couple of years then I would start scaling out now because even where the markets are now it could start the retracement today, that is how long and how far the uptrend has gone. If I was near retirement and had a lot of exposure to stocks then I would definitely start scaling out and taking my profit to the bank.

I’m not sure when it is going to happen but it is coming and will happen sooner rather than later. It needs to happen to complete the cycle. It won’t be nearly as bad as the 2008 crash, not even close, but you will have CNBC and the rest of them hype it up as the next great depression.

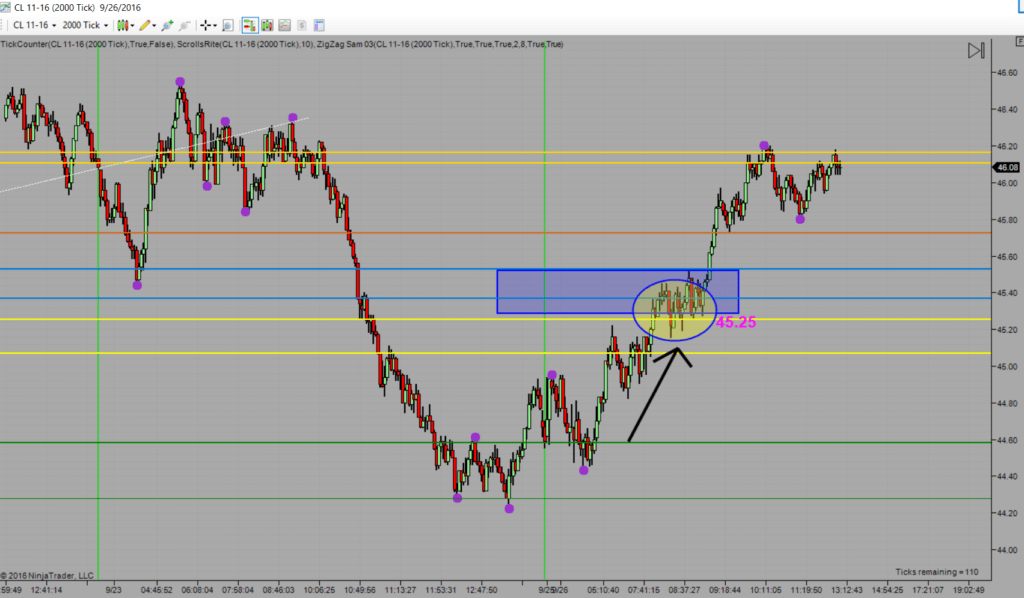

CL (Oil) hit the target of 45.35 from the non opec deal yesterday

Originally posted on 9/27/2016

In what was a surprise to no one, OPEC came out of their meetings without an agreed upon plan to cap oil production. As I said yesterday: https://evancarthey.com/bet-no-opec-deal-gasp-surprise/ there won’t be a deal so short oil down to $45.35. Early today that target was reached easily and continued to go down. The charts predict the news, it happens almost every time.

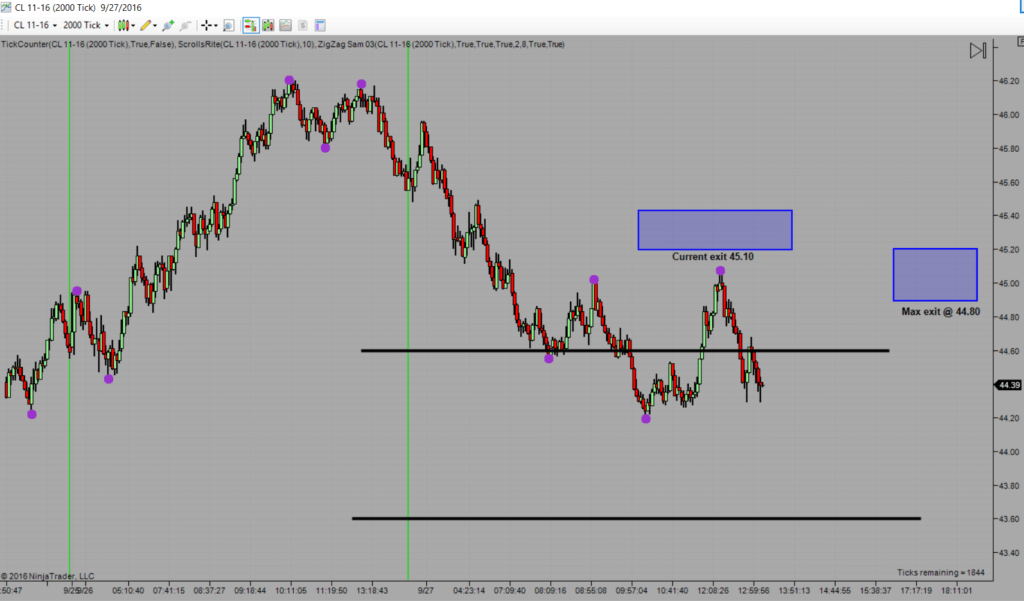

CL (oil) 9-27 into 9-28 Game-plan (Old blog post)

Originally posted on 9/27/2018

At the time I took this screen shot the price was $44.39 for CL (Oil). Today price has gone down a good bit and hasn’t retraced enough so you currently could go long here at $44.39 with an exit at $45.10. There is still room to the downside so price could go all the way down to around $43.60 before it retraces. If I was trading the CL what I would do is go long here around $44.39 and have a buy limit order at $44.20, $44.00 and $43.70.

If price doesn’t go below $44.20 then the current exit of $45.10 is still in place. If price goes down to around $43.60 then the new exit would be $44.80.

Either way you’ll be a winner. If price goes up from this point then you are good. If price goes down and gets you in at those points then you’ll make even more when price finally retraces. Look for price to eventually go back up but it could go down to $43,60 before it does.

I wouldn’t be surprised if the API report today shows a less than expected draw so price goes down further and then when the EIA reports tomorrow it shows a bigger than expected draw so prices shoot back up. It’s how they play the game.

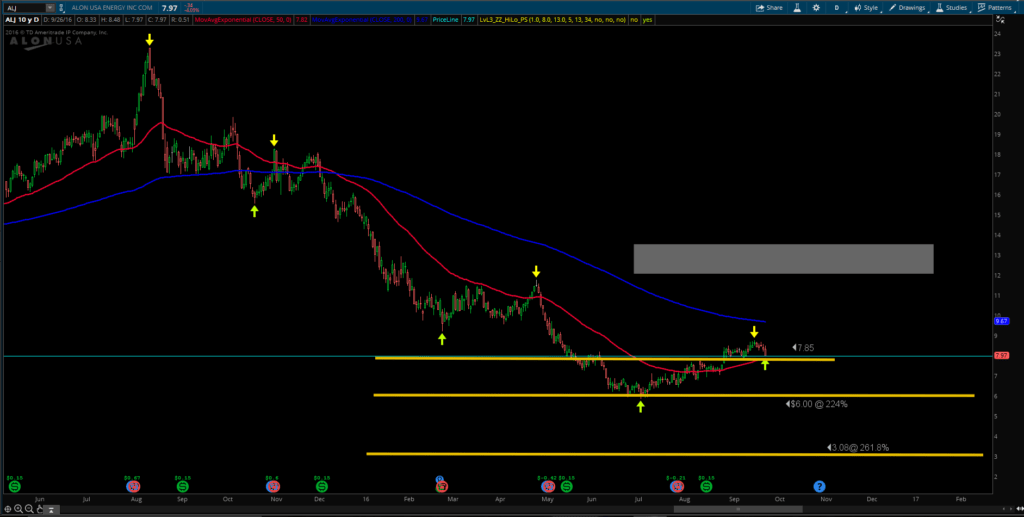

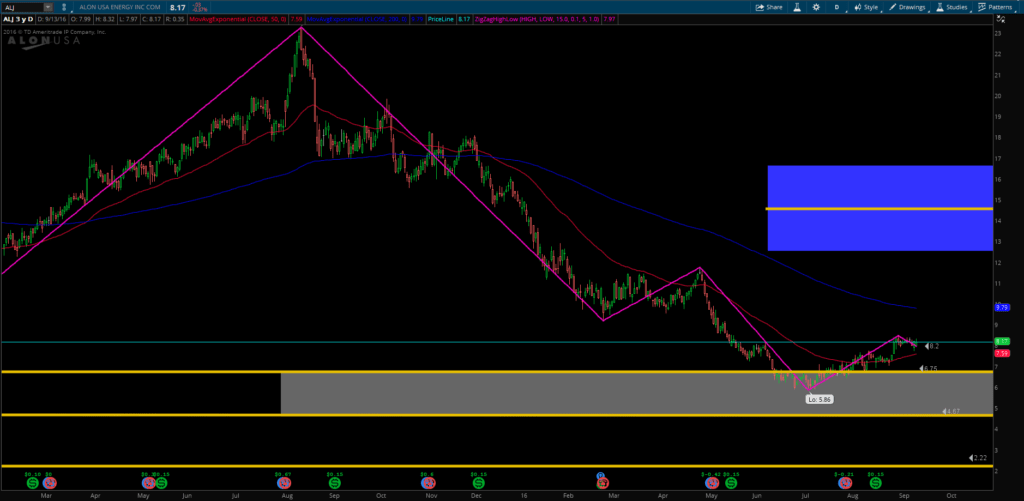

Updated Targets for Alon (ALJ) (old blog posts)

Originally published on 9/27/2016

I am currently long Alon (ALJ) but I need to update the targets from this post: https://evancarthey.com/alon-alj-using-forex-trading-style-stocks/ because I now have my Think or Swim charts correctly setup (or at least they are getting very close).

Here are the updated entries:

- $7.85

- $6.00

- $3.08

The last entry would be around $1.50 but there isn’t a level since the next level would be a negative number so that’s where I would have my last entry which is just a guesstimate.

The new exit is now $11.80.

There ya have it, I’m currently long around $8.00 and I hope it goes down lower so I can add more to my position.

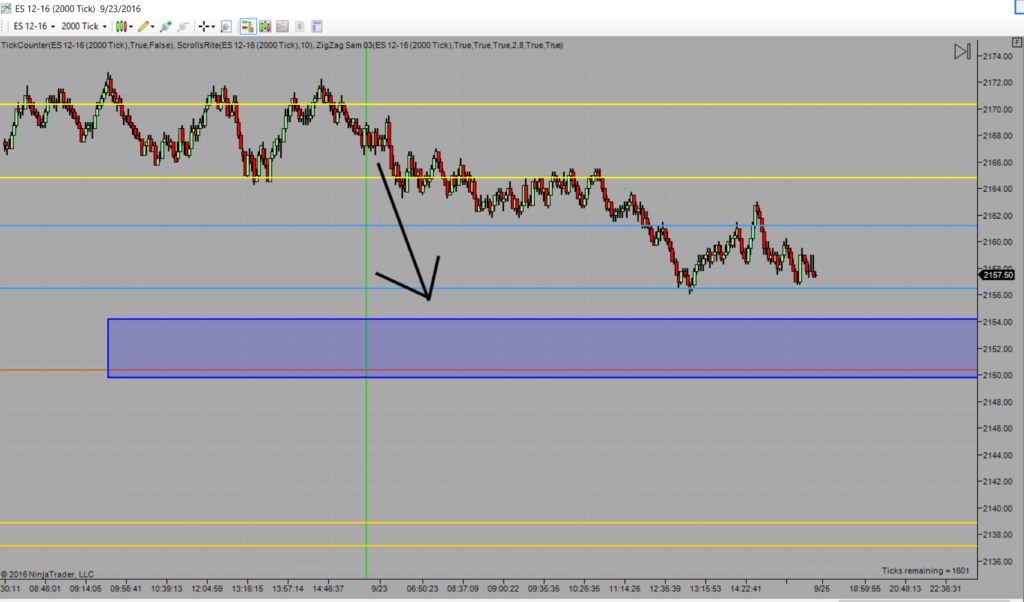

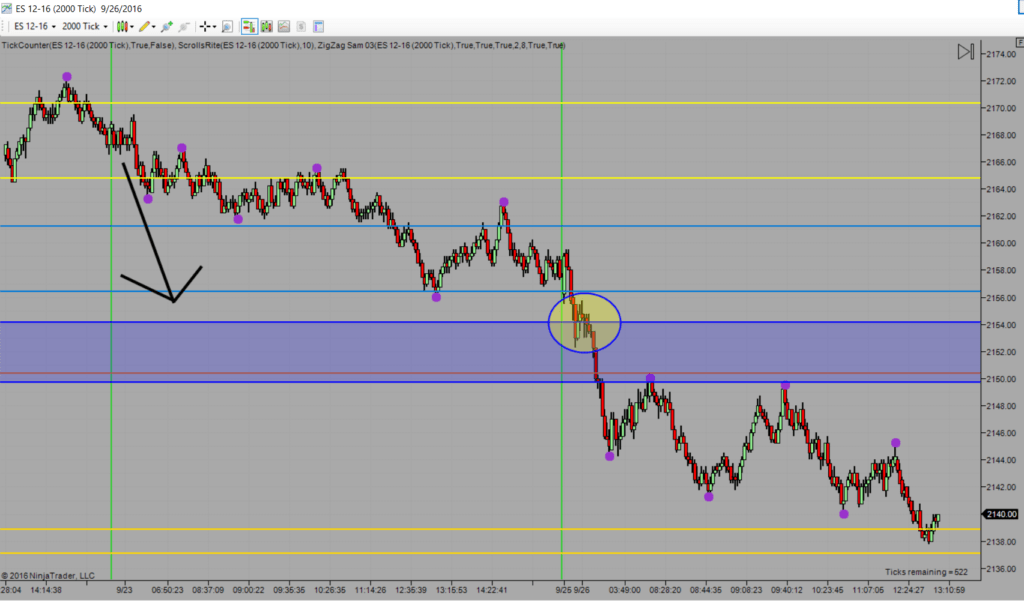

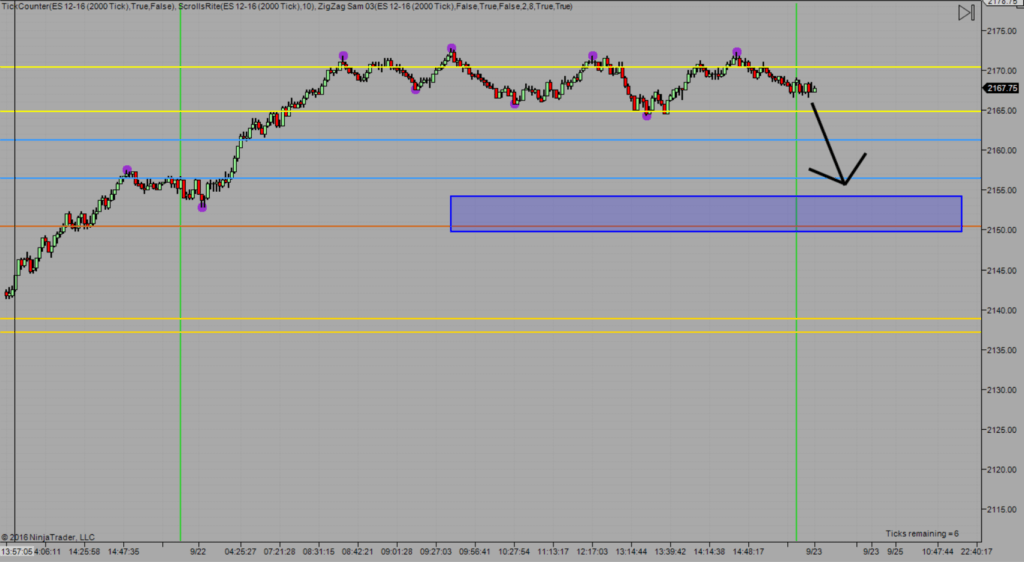

(e-mini) ES Hit the Target of 2154.25 as soon as the market opened (old blog posts)

Originally published on 9/27/2016

It didn’t take long b/c as soon as the market opened the Friday target I had of 2154.25 was run through with ease and then the bottom fell out. Here is my post from Friday evening: https://evancarthey.com/e-mini-es-9-23-2016-end-day/

Bet there is no OPEC deal (gasp what a surprise!)

Originally published on 9/26/2016

Go short looking for a target of 45.35. The charts are saying that OPEC won’t come to an agreement on a freeze output.

CL (Oil) gameplan for Monday 9/26/2016

Originally published on 9/24/2016

I love when I check CNBC.com to see what the price of oil is doing and there is some stupid headline every day explaining the day’s fluctuation in price. You can tell they literally make stuff up and pass it off as why the price of oil is moving one way or another. I need to find a better website to check the indexes, oil, and futures. I try to support NBC as little as possible anyway.

What was I talking about, oh yeah, what CL is going to do on Monday! So I was doing some back-test trading the CL tonight and saw where the price will go to. So if you trade the CL then here is some free money:

Price never retraced enough on Friday so it still has some ground to make up. Look for price to go to around 45.25 at some point on Monday. If I was trading the CL now I would already be long several positions holding them over the weekend and looking for price to touch 45.25 as my exit on Monday.

E- Mini (ES) 9-23-2016 End of Day (old blog posts)

Originally published on 9/23/2016

Pretty close to my projection from last night with the ES hitting a low of 2156.25 today. I still think it will touch 2154.25 on Monday even though it didn’t quite make it to that point today. Still was a good 10+ point move from when I called it moving lower from 2167.25. https://evancarthey.com/9-23-2016-look-e-minis-es-come/

9.23.2016 Look for the e-minis (ES) to come down to…..

Originally published on 9/23/2016

Look for the ES to come down to 2154.25 today at some point. It is currently at 2167.75. Where it ends up by the end of the day I do not know but if I was trading the ES right now I would be shorting it and then exiting around 2154.25.

Alon (ALJ) – Using my forex trading style in stocks (old blog posts)

Originally published on 9/14/2016

I’m using what has worked in forex and now am starting in stocks. Today I made my first purchase of Alon (ALJ). Here is what I am looking at:

I made my first purchase at $8.20. My second order is at $6.75. My third order is at $4.67 and my 4th order is at $2.22. All orders are limit GTC.

If the current swing low holds then I’m looking at exiting around $13.50. For which stocks to select I am using a screener: http://finviz.com/screener.ashx?v=111&f=fa_div_o5,sh_avgvol_o300,sh_price_u10. The stock has to have a dividend yield of 5%+ and I am only looking at taking longs. The reason why is I am using the daily chart and while I am waiting for the stock to make its move I might as well get some free money from the dividend payouts since these moves can take over 3 months. I’m also looking for stocks with an average volume of 300k+ so there is plenty of liquidity. Right now I’m looking at stocks under $10. As my account increases, I’ll raise the limit on the stock price.

An interesting dynamic that stocks have which doesn’t come into play in forex is that since this stock is so close to zero I only have a couple of entries based upon my fib extensions to get in. Normally I would have 10 different limit orders waiting to get filled.

The charting platform I am using for stocks is Think or Swim. It’s easy to find the different stocks but one feature I wish it had that Ninja Trader has is hotkeys. That way I can press CTRL + Space Bar to have the fib retracement tool pop up and not have to go manually select it each time. MT4 has this same issue as well.

DO IT! DON’T GIVE UP!

Originally published on 9/13/2016

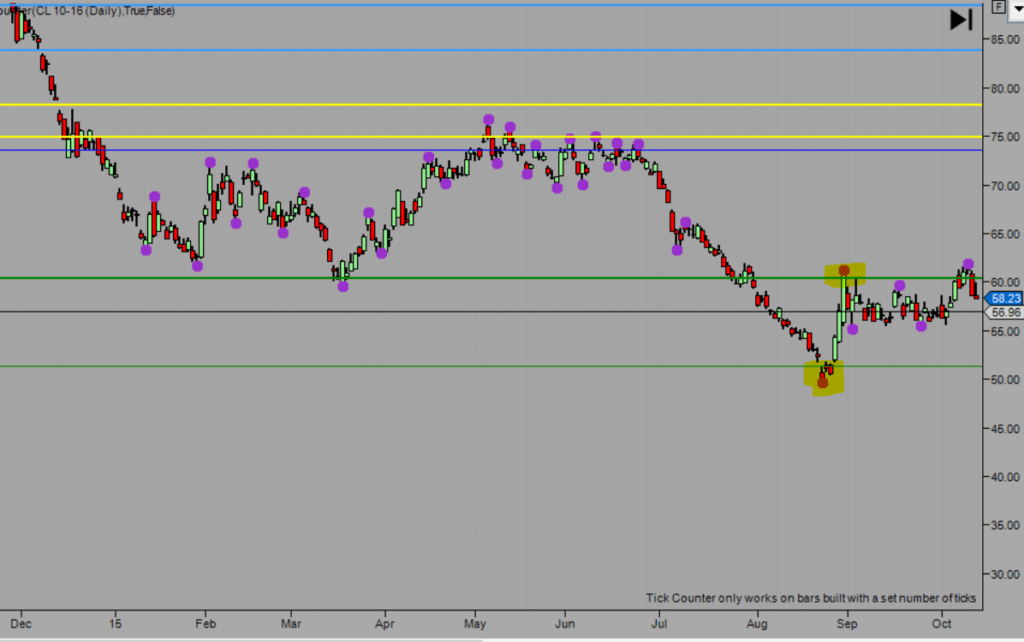

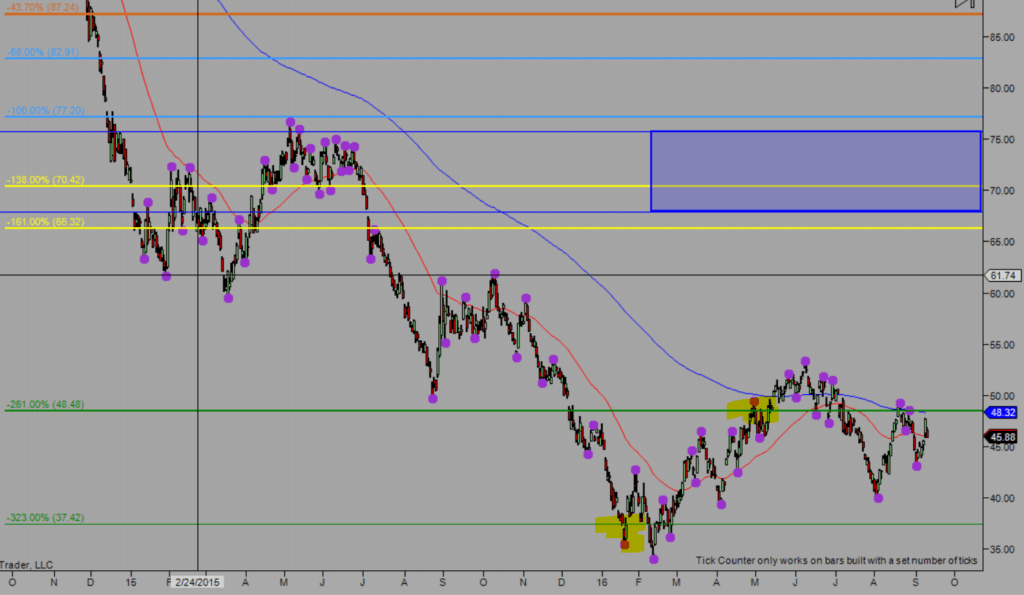

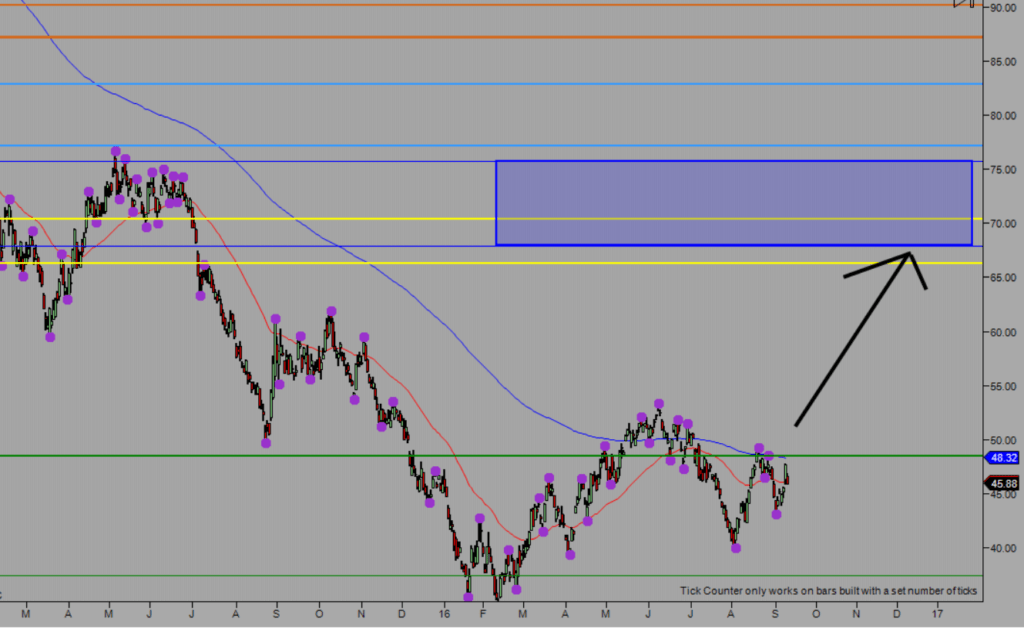

What’s next for oil (CL) long term? (Old blog posts)

Originally published on 9/20/2016

Since 6/13/14 when the price of oil was around $120 it has gone lower and lower until 2/11/16 when it looks like the bottom was put in. It is 9/10/16 today and here is how I see it playing out. If price doesn’t break much below $37.42 then my projections remain valid. If price drops below and moves much lower than that then recalculations will be made.

The original projection for the low was $51.23. When price hit that level it popped up nicely and the next level of resistance was $60.37. I would have thought that price would not have broken below the $51 level and that the bottom was in but I was wrong.

Price did and I had to recalculate. My new low was projected to be at $37.42 where price bounced off of it a couple of times and my 1st level of resistance was $48.48 where price came and hit that as well. If price breaks much lower than the $37.42 level then the new target low would be $28.01 and if price hits that then I would go long looking for a target of $40.64. For now it looks like the bottom is in

So far price is bouncing around nicely and when it does decide to make a break higher then the next major levels of resistance will be $66.30 -70.39 (lots of resistance in this area), 76-77, 82.91, 87.24 and 90.19. When the price of CL hits $67.88 then the recession in my book will be considered officially over since the 50% retracement will finally be completed.

I have no idea how long this will take and price could even go down and test the $37.00 level again (doubtful) before it moves back up but eventually as long as the $37 level holds then the price of oil will go back up to at least the $67 level and then the recession will be officially over. After that then it is a brave new world for the oil and gas industry and the new market will be well underway.

My long term bias is up so if you have an oil and gas stock or whatever you trade and are in it for the long term then I would feel very safe in going long here and buying any moves lower. If price moves down to the $28 level then I would load up on long positions there.

The e-minis are back in my sights

Originally published on 9/9/2016

So when I first started day trading I tried the ES (e-minis). It was through a trading room that I won’t mention because they were terrible. Even though I didn’t last long day trading that first time (busted account) I loved every second of it. I would stay up on the weekends trying to figure out where I messed up and how I could get better trading the style the way the trading room taught. The three big reasons I failed in that initial attempt was because 1) the system wasn’t my own so I didn’t fully understand or trust it 2) I was also relying on the moderator to call out the entries and exits 3) my psychology was at rookie level and I found out real fast that is the most important aspect of trading. The range of emotions I went through when I was in a trade were nothing short of amazing. Both good and bad. I learned from that experience that if I was ever to attempt to day trade again then I had a ton of work to do on my emotions.

Here we are on 9/8/2016, about 7-8 years after that initial attempt and these were my results from sim trading 3.5 days to test the waters:

Now I have practiced a ton between now and then sim trading the ES. One attempt was through another “trading guru” where it turned out he lied about his results and would change up the trading style he taught to the hot indicator of the month. He was good about reviewing charts you sent him and trying to help you out but it was obvious very quickly that the only money he made was from selling his course. Fortunately I never went live b/c I could never get profitable trying to trade his system. The next attempt was using a guy named Mack and his Price Action Trading System. I will link his website here: http://priceactiontradingsystem.com/ because at the time his e-book was only $100.00 and he provided daily reviews of the ES trades based upon his setups. I’m pretty sure he makes money trading since he only charges $100 for his book and he did provide some live trades. He started a paid member section to his website as well which I think was another $100/year or something like that. I’ll create another post about his style of trading b/c it was very influential on my trading journey in a positive way. I currently do not trade using his method since I created my own but at the time it was what I needed. I had a journal of Futures.io where I met some really cool people and one guy in particular where we still chat occasionally to this day. He has been the biggest positive influence in my trading journey. Everything happens for a reason. If you are an elite member of Futures.io go to the elite trading journals and search for the user “evanbro.” There you will see over the course of a year and a half my journey with teaching myself Mack’s style of price action trading.

Going back to the 3.5 days of sim trading the ES you can see the results. Never once did I EVER come close to having these results before and there is still a lot of room for improvement since a couple of things need to be tweaked for the ES that is different than forex! Why am I having these results now? It’s because I’m trading the system I created that works for me. I have no doubt when I enter trades and I know exactly where my entries and exits are before I even enter the trade. I know what exactly I am looking for. This is the same trading style I am using on the forex market and I wanted to see if I could adapt it to the ES. Well it looks like I can although some slight modifications for the entries need to be made to make it more profitable. Once my bankroll is rolling on forex I’ll transition to day trading the ES to give me something to do during the day because my forex trades are longer term trades (4 hour chart) and I’ll need around $50,000 to start with for day trading the ES due to some of the trades having to be held overnight on occasion.

Keep learning and don’t give up. You will eventually find the trading style that works for you. Try many styles out and use what works for you! It took me over a decade to get to this point but I love trading and I refused to give up no matter how long it took.

November 2, 2015 is when I set out on my own (The power of YOU) (Old blog posts)

Originally published on 9/2/2016

Looking back it was the date above when I started to come up with my own system of trading. I quit trying to follow someone else’s system. Psychology is the biggest element of trading in my opinion and a big reason whey copying someone else’s trading system doesn’t work (besides the person who sold it not making money trading it) is because deep down you don’t understand it and therefore you doubt yourself so no matter what you do you never fully trust yourself. A friend of mine had created his own system and is killing trading the e-minis. He showed me how he trades but no matter how hard I tried to adopt it I could not fully integrate it into my trading. I told him as much so he gave me help in how to trust yourself in creating your own trading style that works for me. The style I have created that works for me has some similarities but the entries, exits, time-frames and trades are totally different.

That is the key in being a profitable trader. YOU have to find out what works for you. You cannot copy someone else’s system and expect to have the same results because it is not something you created. The creator has the ultimate confidence and understanding of their trading style and methodology. You can see from the myfxbook account I have linked in another post that I was still a losing trader for almost 5 months after I had set out to create my own trading system. Now I did have some framework because I knew what I wanted to trade and to a certain extent how I wanted to trade, I was just missing some final pieces in making it profitable. For 5 months I tried 30+ different trading styles on my own. There were a couple of times I thought I had found what works for me but after 3-4 days of testing it was obvious it didn’t work.

Thomas Edison’s quote applied perfectly: “I have not failed. I’ve just found 10,000 ways that won’t work.” Every time I found that my new trading style didn’t work I knew I was one step closer to finding what did work for me and I was determined to figure it out because I knew I was close. Then on March 11th and over that weekend I had one of those “Ah-ha” moments. I could hear the thought clearly in my head which said “Instead of doing and following the rules of what everyone teaches, let’s do the opposite.” That was when everything changed. I knew I had found what worked for me. I don’t use stop losses and I buy more lots when price goes against me and sell more lots the more price goes up. Of course I have my defined entries and exits but the base of my trading style goes against every “guru” teaches. They say you have to use a stop loss and you should never catch a falling knife. Well my trading style breaks those two rules with every trade I make and the past 6 months have been amazing. I’m up over 300% in profitability so far this year and that is still after having losing months in January, February and half way in March.

There are a couple of guys who are friends of mine and I showed them verbatim how I trade but none of them use it. Why? Because what I created works for me and I told them as much. I told them to use what I teach them to help them find what works for them but if they try to emulate it then it won’t work for them. That is the key to creating your own trading style:

- Learn as much as you can

- Trade the different markets, time-frames and trading platforms

- Use live accounts with the smallest trades possible (I am a firm believer that if you are trying to trade then you have to trade live)

- Monitor your progress

- Find out what and how you like to trade

- Keep refining your trading style when you find out what doesn’t work

- Don’t give up

Eventually you will figure it out and then you’ll have it made. That is the key, you have to find out what works for you. Most people will never make it here which is why the con-artists are so prevalent in trading. They feast off of most people’s laziness. The majority of people want a ready made system and don’t want to put in the time and effort in creating their own. For those that do then your life will be changed forever.

Review: Trading Schools Website – www.tradingschools.org

Originally published on 9/5/2016

Occasionally I will recommend websites that have helped me out in my trading career. One of them is Trading Schools www.tradingschools.org. It is run by a guy named Emmett Moore where he and his team review trading websites to see if they are legit or not. A friend of mine told me about the website and it looks to be an honest review website. I’ve read many of the reviews and at first it was astounding to see how many con artists there are out there. A good rule of thumb is if someone is asking you for money to learn from them then they are a con artist. Now not everyone is but in my opinion 98% of them are.

You can contact them if you would like for them to review a trading site that they do not have a current review on.

1 Question to Ask Someone Selling You a Trading Product or Service

Originally published on 9/5/2016

Almost anyone who is requiring payment to learn their trading system, be instructed by them, learn from them, watch their videos, read their books or any other “trading service” they offer is someone who does not make money trading. What they are good at though is marketing. They convince you that they do make money while never providing any proof that their career is based upon trading. The biggest lie I’ve heard is: “Well I just like to teach and give back to others so that is why I am charging $4,999+ for my system.” If anyone tells you that lie then there is a 99% chance they are a loser at trading and are trying to con you out of your money. If someone who is asking you to purchase a product of service from them won’t provide verified results (like a live linked account from myfxbook) that they consistently make money then you know for a fact they do not make money trading. In my next post I will link a site that reviews other trading sites and for some of you it will be astounding to see how many trading sites are scams.

Before you pay even $1.00 to anyone ask them them 1 question:

- Will you show me your live up to date trading results that is verified by a 3rd party?

If they won’t show you this no matter what their excuse is then you know they do not make money trading and are a con artist. If you ignore this and give them your money then I can pretty much guarantee you that you will waste your money. I would highly recommend you take that money and go to a casino because your odds will be much higher that you will make money gambling than you would trading their loser system.

My account on www.myfxbook.com

Originally published on 9/5/2016

Here is the url to Myfxbook that keeps an up to date log of my trading progress: https://www.myfxbook.com/members/Curt_Hennig/mr-perfect/1616323

This is directly linked to my live trading account so you can always see how I am doing. So many people talk about how well they are trading but they never post their long term results. I try to have full transparency since I am not trying to sell you a system that doesn’t work. The reason why almost no one posts the long term results of their trading system is that they don’t make money trading so they have to con you into purchasing their system. I’ll talk more about this in much more detail later.

March 11, 2016 is when everything changed (Old blog posts)

Originally published on 9/5/2016

For over a decade (as of 9/5/2016) I have been trying to find a way to consistently make money trading. I’ve literally spent thousands of hours reading trading books, watching trading videos, watching trading shows, learning trading systems and so on and so on. All during this time I was really good at consistently losing money. But sometime during Friday, March 11, 2016, and over that weekend something changed. I remember distinctively thinking that I should do the opposite of almost everything I have learned up to this point. That is when everything changed. In my next post I will link my forex account that www.myfxbook.com keeps track of my progress so you can all see.

Conclusion for My Old Blog Posts

I hope this walk down memory lane of my old blog posts was as funny for you as it was for me. My writing style sure has changed as well of the way I look at the charts from then until now in my blog posts. Also, my blog posts have improved for the better in my opinion. Hopefully three more years from now I will look back at my current posts and realize I have improved even more.

Now I rarely use the Think or Swim charting platform as well as Ninja Trader. Back then they were the two main charting platforms I used in my old blog posts.

My progress has been mainly due to meditation. It truly can help make you a profitable trader.

If you would like to see the exact steps I take in creating my own trading setups through meditation then check out this article I wrote: https://evancarthey.com/how-to-become-a-profitable-trader-using-meditation/

If you would like further reading to the meditation and psychological books that have had the most influence on my life then read this post: https://evancarthey.com/best-meditation-books-for-traders/

Finally, if you are just starting out in the world of trading then read my beginner’s guide. It has information I wish people had told me before I started putting my money on the line in the world of trading: https://evancarthey.com/a-beginners-guide-to-day-trading/

My goal is to assist you in becoming the most profitable trader you can become. I seek to destroy poverty and if I can help you in your trading career in anyway please let me know.

Take care,

Evan