Nasdaq (NQ) Technical Analysis on 2/16/2019 – 15 min and Daily Chart

Today I am looking at the Nasdaq (NQ) using the 15-minute and 1-hour chart. Eventually, there will be a huge move to the downside. I think we are in the consolidation phase at the top before it breaks and the big move down happens.

Above in the 15-minute chart, we are still looking for a retracement back to the pink line. Price could still go up but eventually, it will return to the pink line so be ready.

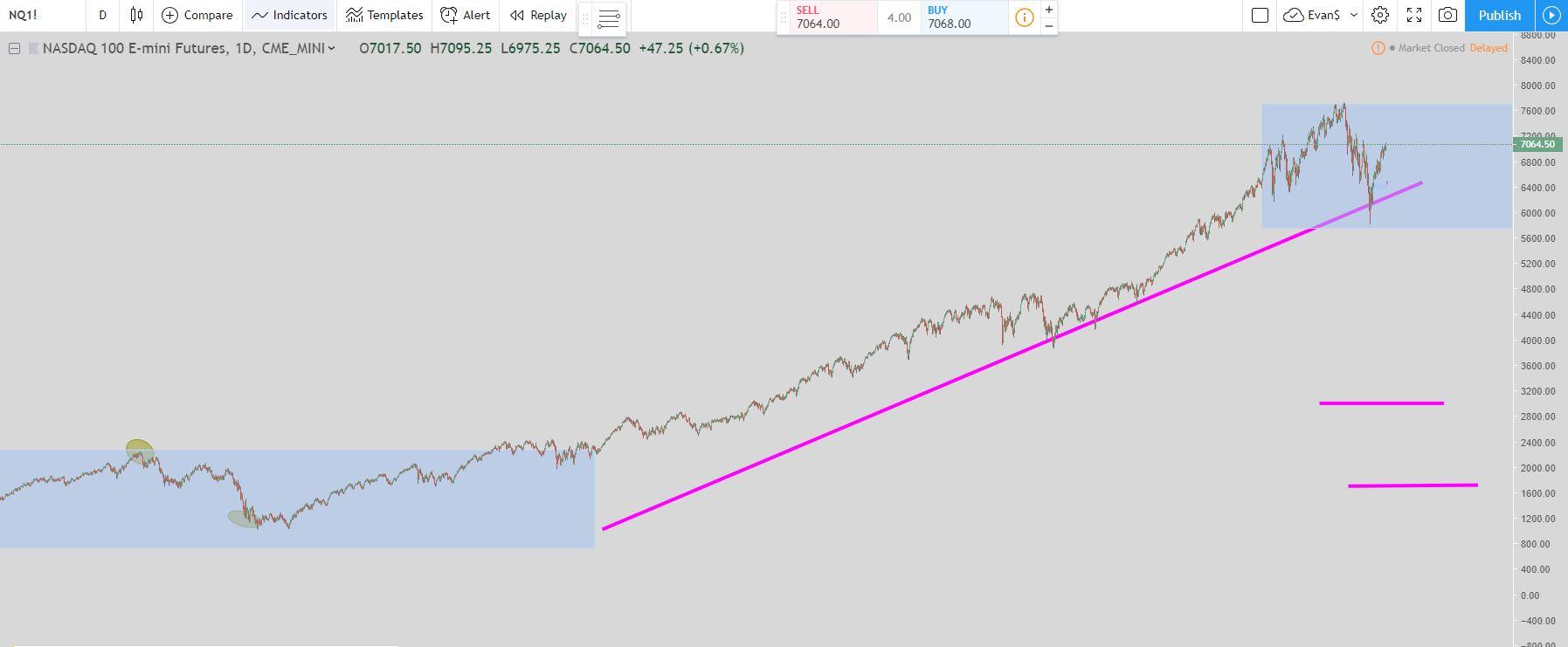

In the daily chart, the blue boxes are the consolidation phases. As you can see I believe we are in the 3rd phase of a move which is the top of the consolidation phase. The 1st blue box is the bottom of the consolidation before the move up. The long pink line is the move up which is the second phase.

Now with the 3rd blue box at the top, I think it is the 3rd phase, the top consolidation phase. The 4th phase is the decline or retracement. The two areas I am looking for it to hit are the two pink lines near the bottom.

I don’t want to see a big retracement down but unfortunately, it will eventually happen. In the video below, I show a couple of long setups that took over a decade to fill but they eventually did. The move down usually happens a lot faster than the move up.

Nasdaq Video Technical Analysis

Recap

Eventually the Nasdaq (NQ) will take a huge dive. I am still working on a trade setup feature to help with the timing. Right now I do not know.

But based on what I spoke about in the video I do believe we are seeing the 3rd stage of a move which is the consolidation phase before the drop. The 1st stage is the base consolidation. The 2nd stage is the move up. The 3rd stage is the consolidation at the top, and the 4th stage is the move down.

Based upon how the Nasdaq is acting to Fibonacci extension levels I think we are in the 3rd stage. One of the lightning trades that have yet to be filled for a short trade on the daily chart has price bouncing around between the levels. The other is so far overbought without a retracement that one is going to happen sooner than later.

I don’t want to see the market drop a ton but it will eventually happen. So be prepared and position yourself accordingly. Do not be too over-leveraged and have stocks you would love to buy at a cheaper price ready because cheaper prices are coming.

If this post benefits you and if you haven’t used Robinhood for trading stocks but are thinking to then please consider using my referral link when you do sign up: http://share.robinhood.com/evanc203.

This way each of us will receive a free share of a random stock if you sign up through my referral link.

My Robinhood Review: https://evancarthey.com/review-robinhood-trading-service-with-no-fees-part-1/