For my Fibonacci Extension Bread and Butter Trade this part is probably the most important – the Exits. I have been too greedy before and it has cost me dearly. Here is the post I recently did about the “A-HA” moment I had and I adjusted my short exits to the 38% Fibonnacci retracements. The long exits remained the same at the 50% fibonacci retracement level. https://evancarthey.com/moving-the-short-exit-to-the-38-fibonacci-level-from-the-50-for-my-fib-extension-trade/

[mc4wp_form id=”1229″]

Exit Right On the Level?

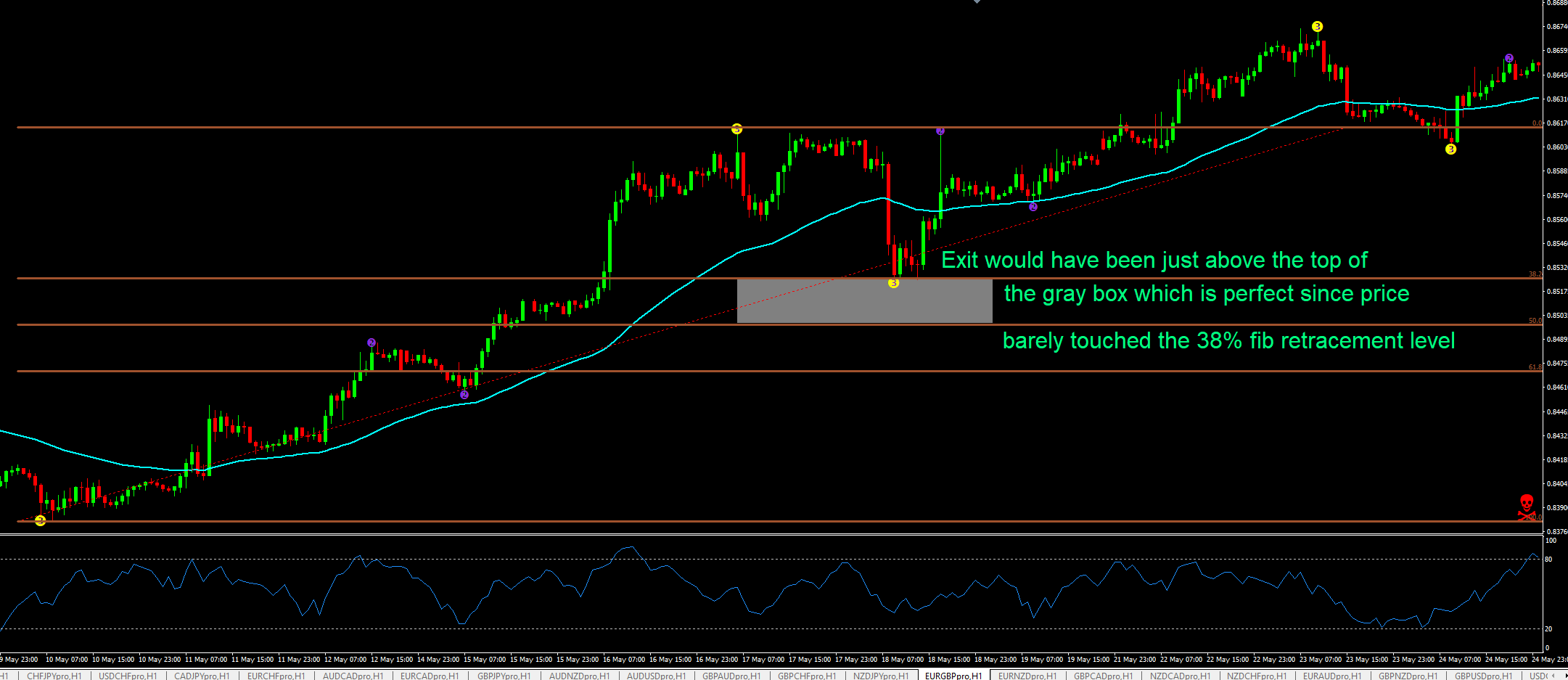

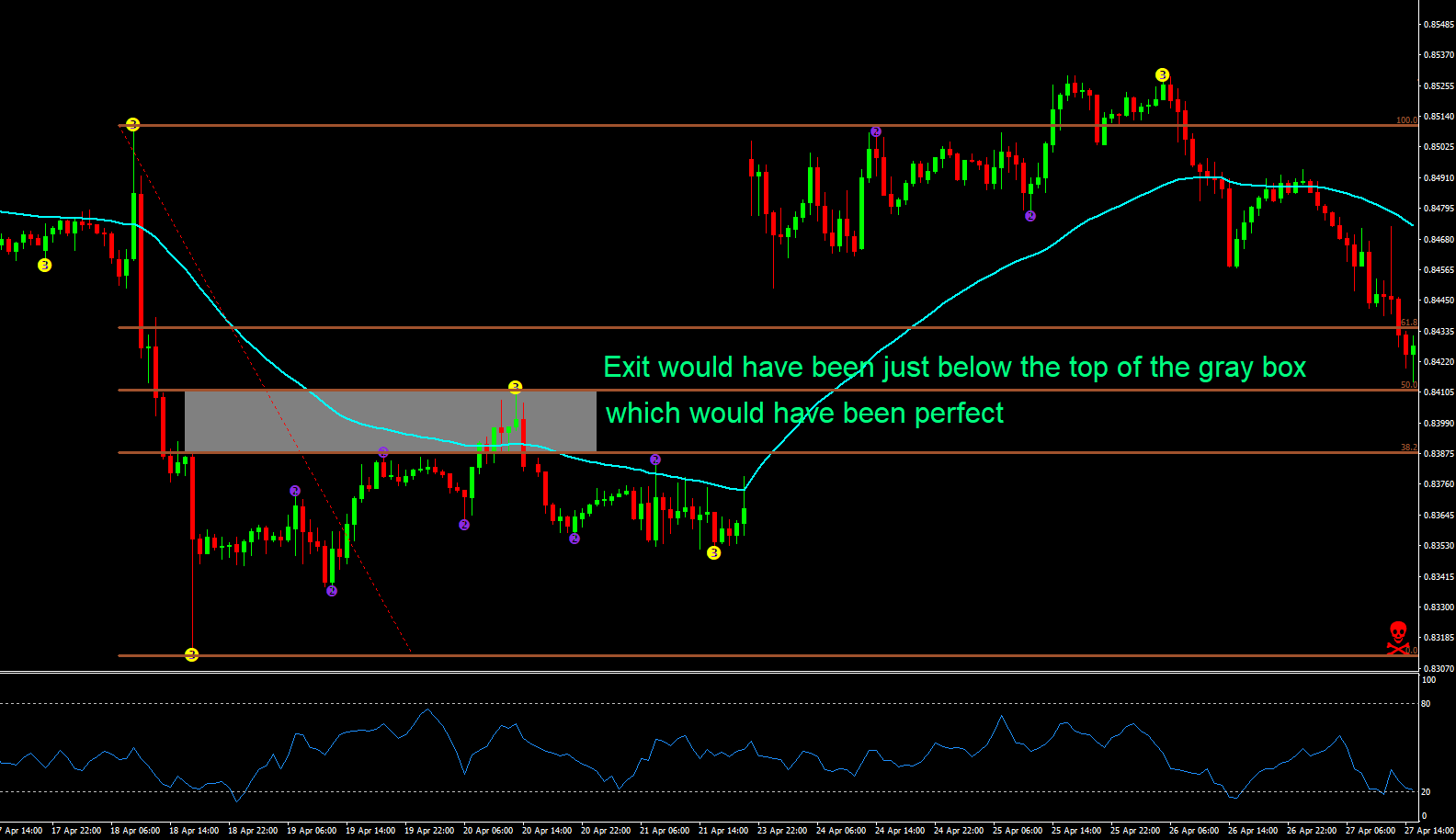

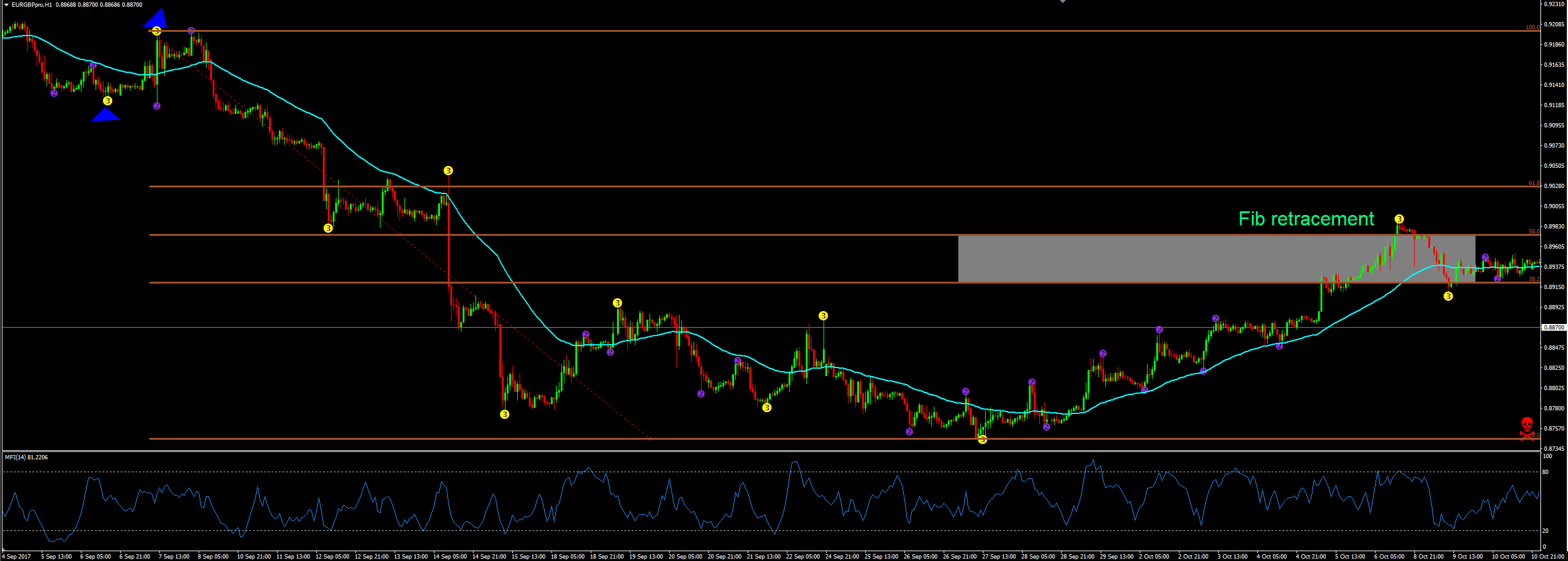

Most of the time I don’t have my exits right on the 38% fib retracement for shorts and the 50% fib retracement for longs. I usually move it just above/below (depending on what side I am on. Here are some charts to show you what I am talking about

A lot of the time price will go through the levels and you get out just fine but there are plenty of times when price barely comes down and touches the 38% fib retracements and comes 1-2 pips, fractional points, cents (depending on the market you are trading) to the 50% fib retracement level before moving back the opposite way. That is why especially for my long exit for the 50% level I move my exit up a little bit from it. Sometimes I’ll even go halfway between the 38-50% retracement level depending on how big of a profit I have. My rule of thumb is to have my exits slightly off the level to ensure my exits get filled. THAT PART IS EXTREMELY IMPORTANT! I keep my exits off of the 38% and 50% Fibonacci retracement level. I have seen price barely graze or come-o-so-close to hitting the 38% or 50% and then take off the other way. DO NOT LET THAT BE YOU (if you use these types of exits). Don’t be greedy, give just a tad up in order to guarantee your exit and locked in profits!

When Is a Move Complete?

When price comes back and hits the 38% for shorts and 50% for longs then I consider that move over and I am now looking at other pivot points for the next move. Price can definitely go further then the 38% or 50% level but those are the areas I use as my exit points for all of the trades I am in.

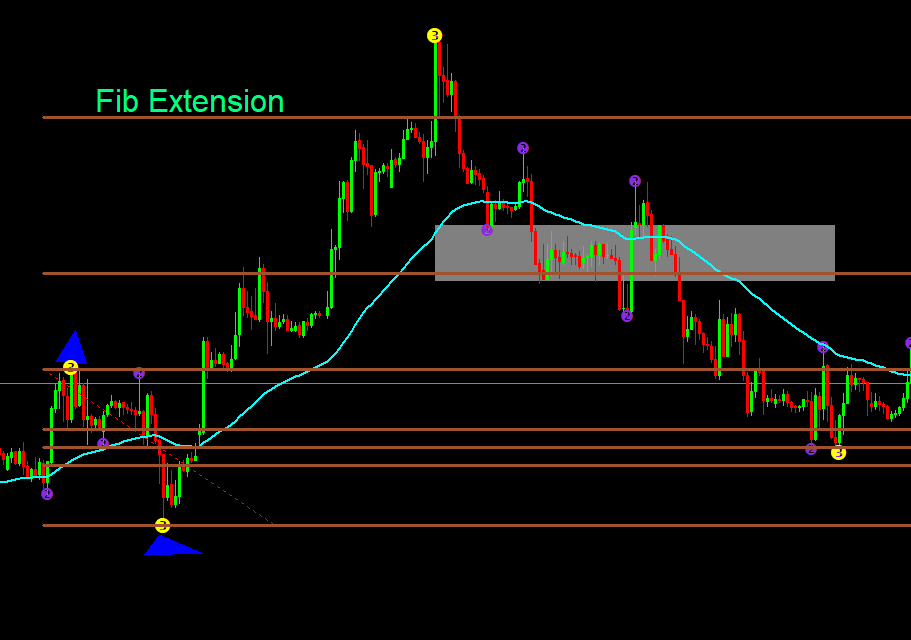

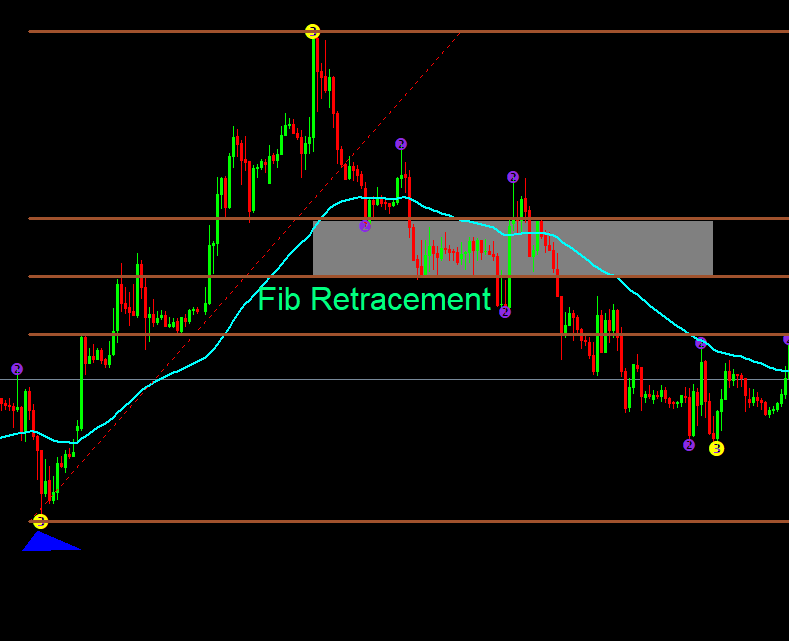

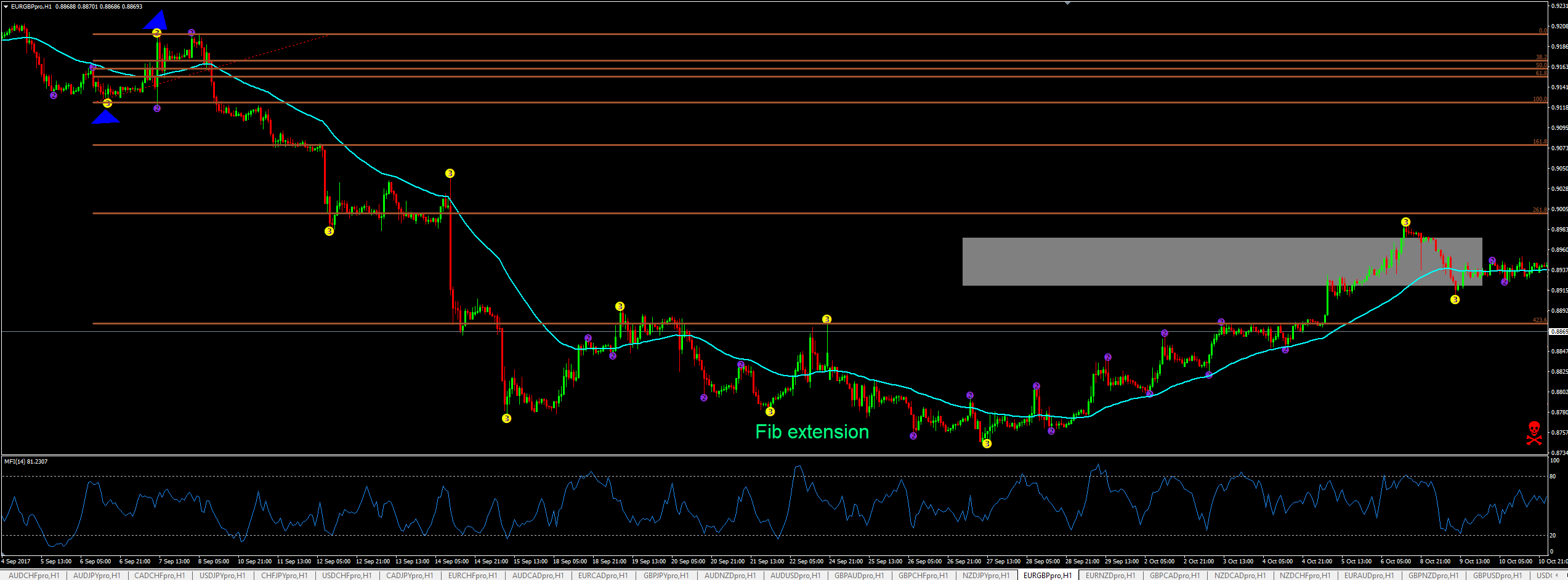

- The blue triangles are the pivot points I am using to draw the Fib Extension

- The gray box is the 38% and 50% Fib retracement levels

- For a short trade the 38% is on the top and for a long trade the 50% is on the top for the gray box

Short Trade

Long Trade

This is why I use my entry points off of Fibonacci extensions and my exits off of the retracements. There are plenty of times when the price extension doesn’t go far enough for me to enter before price retraces back and takes out the retracement level. No big deal, I just look for the next setup.

The key is to be patient because I now have a plan that works for me and has all of my entries and exits setup before I am even in the trade. You can look through these charts and see plenty of times that price didn’t make it to my Fibonacci extension levels before taking out the retracement level. In fact it happens more time than not.

To Recap:

- My exit for a long position is just short of the 50% Fibonacci retracement level.

- My exit for a short position is just short of the 38% Fibonacci retracement level.

- If price comes back and takes out the retracement level before I am able to get in then no big deal, I mark that move as complete and look for the next setup. This happens more often than not.

Parts 1 & 2

For the first two parts of the series you can find them below: