If I’m going to give my opinions on where I think stocks are headed then I have to show if I make a profit or not. This post will be my 2018 results from trading the stock market. Did I reach the goal of doubling what I made last year? Did I lose a ton of money trading? Let’s find out…….

2018 Results

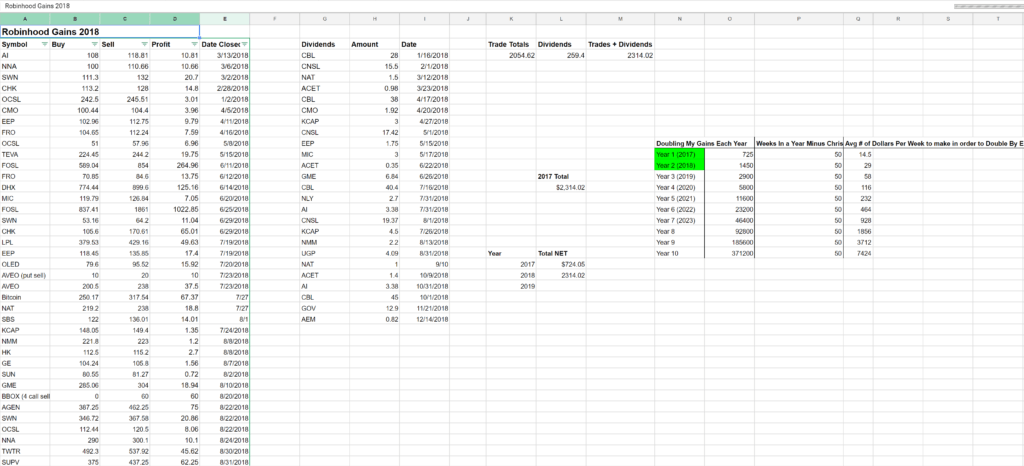

I track all of my trades for stocks since the Robinhood app doesn’t do a very good job. Here is a picture of the excel spreadsheet.

2018 Robinhood screenshot

In 2017 it was my first year ever to be profitable trading where I ended positive at $725.00. So for2018 my goal was to double the profit I made in 2017. That put my target at $1,450 which would be averaging $120.33/month.

After 2018 was said in done I ended up making $2,314.02. I’m not going to double that target for 2019. I’m going to leave it from the 2017 ten year projection of doubling that original profit each year. That puts the 2019 target at $2,900.00.

I include crypto trading in my results since that can be done through Robinhood as well. Basically, this is everything I trade through Robinhood which right now are stocks and cryptos.

These results aren’t huge amounts, I am well aware of that. But it is now 2 years in a row where I have been profitable. Yes, it has been a bull market but in the past, during bull markets, I still lost money.

My Best Trade

Fossil (FOSL) was by far my best trade of the year. The setup I used was my bread-and-butter trade. The stock had been getting decimated over the past couple of years with declining sales. Also, the digital watches were taking market share from them and they didn’t look to be able to adapt. Well, they did turn it around for a bit, or they at least posted shocking numbers to show they had a little growth in them and weren’t going bankrupt.

My first sale was on 6/11/2018 for a $264.96 profit. Then I took the rest as a huge profit (in my eyes) of $1,022.85 for the second trade. It wasn’t close to hitting my targeted exit of around $70.00 but it had made a ton for me compared to my account size.

FOSL has a big gap around $9 so if it gets close to $10 I will look to get in again. For right now I am letting it be but I still see it moving up for big gains in the future. Here is the chart:

My Worst Trade

BBOX. That stock is terrible. The main difference between stocks, futures, and forex is that stocks rely more on fundamentals when trading. I’ve learned that the hard way. Stocks can go bankrupt where you really do not have that issue in futures or forex.

So that is one thing I am keeping in mind for 2019. I thought I didn’t need to worry about financials but it turns out I do. I need to at least look over the info and see what is going on with the stock before I make a purchase in a depressed stock.

BBOX turned out to have that issue. The end goal was for management to sell the company where the stock would have gone up over $2/share. Of course, it didn’t happen that way and the stock was sold for $1.08. People are livid. I heard there is a lawsuit against the sell because the CEO screwed everyone.

I went ahead and sold my shares at $1.08 for a $436.27 loss. What softened the blow was I had sold some covered calls and puts before. Here is the chart:

What is my plan for 2019?

The biggest adjustment is focusing on Lightning Trade Setups and 127-143-161 setups. The Lightning Trade is my go-to setup right now. Another aspect is I am now looking for growth stocks that fit the setup. I use Finviz to screen for the fundamentals: https://finviz.com/screener.ashx (no affiliate link). They have a paid version but the free version works fine for me.

Another adjustment is I am looking at 1-hour time frames to trade rather than daily time frames. I started doing this near the end of 2018. Although the returns may not be as high the time invested is much faster for the moves.

I will still use the daily time frames but I have now incorporated the 1-hour charts.

I am using more covered calls and selling puts to get into my trades. As you can see from my profits I don’t have a big account yet. This does restrict the use of covered calls and selling puts since each unit is 100 shares. For those trades, I am looking at stocks under $10 which limits my options but it is what it is.

The goal for selling puts is to sell a put when the price is close to a strike level and collect the premium that fits my trade setup. Then if I get assigned the stock I am fine with it.

The goal for selling covered calls is to buy 100 shares a little below the nearest strike price at a level I want to get in based on my setup. For example, if a stock is at $4.85 then I buy 100 shares. Next, I sell a covered call at $5.00. If the call gets exercised then I’ll gain a little profit and collect the premium. This way I can start to build up more consistent profits over the course of the year. Of course I could miss out on bigger moves but usually, the stock goes against me when I first purchase it. So I might as well try to collect a little premium.

This won’t be done for every entry but is something I am looking to do more of. Oh, and the strike price I am looking at is no more than 30 days away.

P.S. – If this post benefits you and if you haven’t used Robinhood for trading stocks but are thinking to then please consider using my referral link when you do sign up: http://share.robinhood.com/evanc203.

This way each of us will receive a free share of a random stock if you sign up through my referral link.

My Robinhood Review: https://evancarthey.com/review-robinhood-trading-service-with-no-fees-part-1/