Back in May 2018, I started trading Forex again. This post will be my 2018 Forex results so how did I do for the year? This time I am using a US-based broker since I am in the US. I have a hard time trusting the offshore brokers that are not regulated. Even though they offer much better leverage than US brokers thanks to our government putting the restrictions on Forex traders. We are only allowed 1:50 leverage. I would prefer at least 1:200.

Hopefully this time I have learned from my past mistakes that you can read about here: https://evancarthey.com/back-in-the-forex-game/

2018 Results

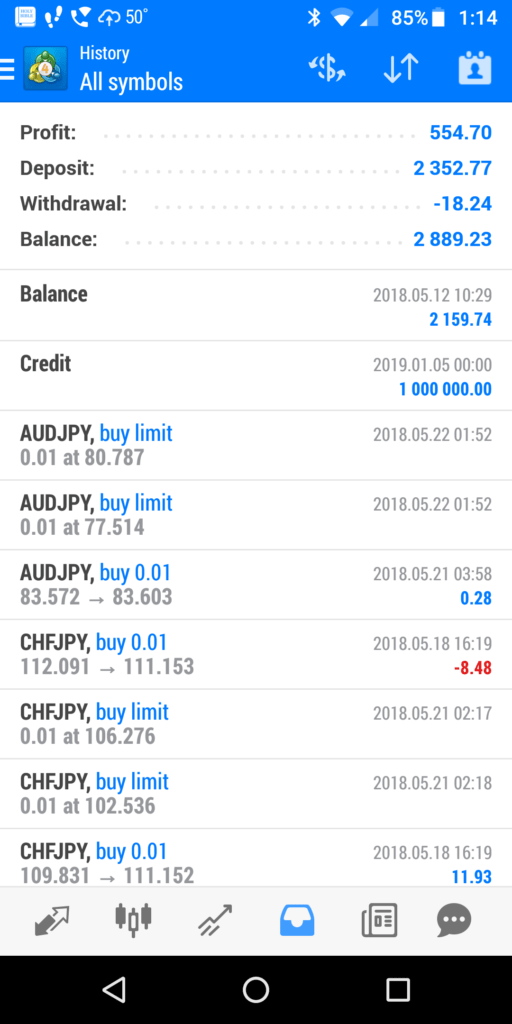

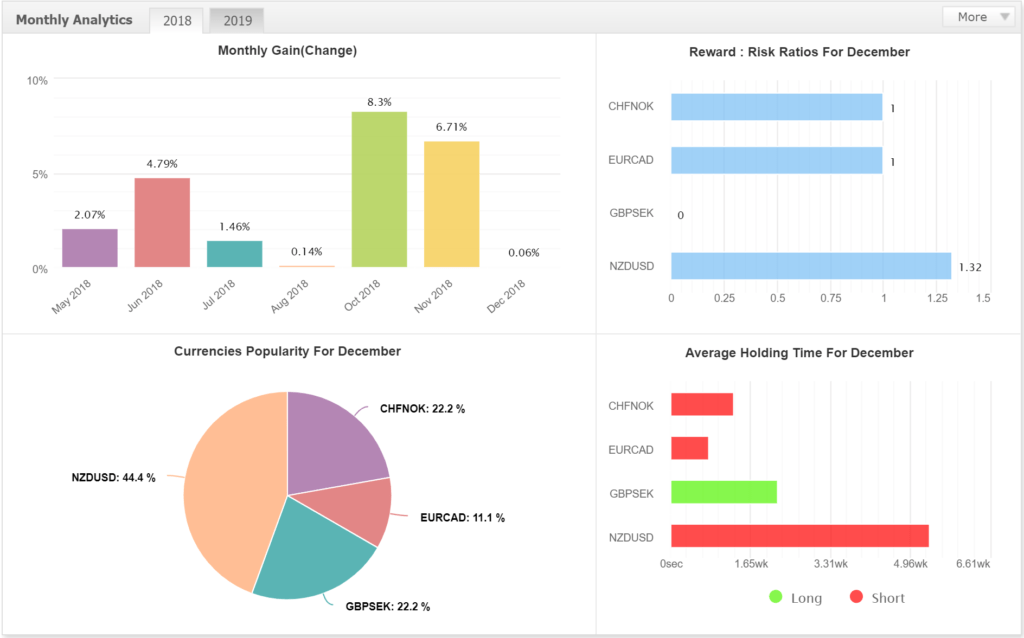

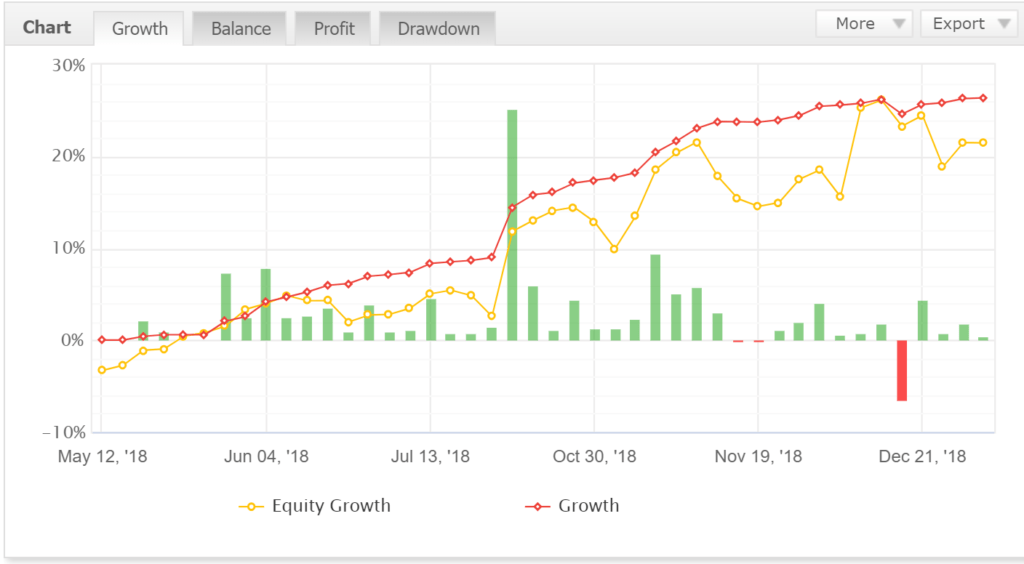

For my 2018 forex results, I came in at just under a 25% growth rate. I originally deposited $2,000 and my total at the end of 12/31/2018 was $2,889.23 for a profit of $889.23.

I am happy with it. With only being able to use 1:50 leverage it definitely slows down the growth because I can’t get in as many trades from when I had 1:400 leverage. There are definitely some things I could clean up to get the growth rate to be over 30% for 2019.

My goal for 2019 is to have over a 30% growth rate but I won’t force it. I will look for the best setups that have a positive swap rate and are a “free trade.” A “free trade” is when the setup has presented an opportunity that when I first enter that first entry will be a winner no matter how much more price goes against me.

This happens when price becomes overextended so the key for me is to be patient and wait for the setup.

Best Trade

USD/TRY was my best trade. When Turkey had their financial issues earlier in the year the price went sky high and presented an amazing opportunity to short the pair. The setup used was the 127-143-161 trade. This was a great example of waiting for the price to become extended before getting in so I can maximize my profit. Trading parabolic moves the opposite direction when they present themselves are a staple of my trading style.

Worst Trade

The GBP/JPY is a trade I am still in. The reason why I consider it to be a bad trade is that I got in when it was not a free trade. I was trying to go for a momentum push to the up-side and got too early. It was still a legit entry based upon my Lightning Trade setup. Of course, right when I entered price went against me and I had to enter at my other defined areas. It is a classic example of me being too greedy. The good news is it has a positive rollover rate but I should have waited for the “free trade” to confirm before getting in.

This would have freed more units to trade since it has a leverage of 250% that ties up a good chunk of capital.

What Is My Plan for 2019?

My plan for 2019 is to really watch for the over-extended trade setups. Where I have gotten in trouble in the past is getting in too early. Even though it fit my trade setup it is much more profitable to wait until the moves go to extreme levels before getting in.

At a minimum, I will wait for a “free trade” to appear before getting in. The two trade setups I will use for this is the 127-143-161 and the Lightning Trade. For the 127-143-161 I will try to wait to get in until price has passed the 161 level. For the Lightning Trade I will wait until the price has passed the 50% Fibonacci Retracement level. This will ensure that even if the price goes against me that I will not have to worry about getting in at other times to make sure the end result will be a positive outcome.

This will mean I will miss out on plenty of short term moves. But the goal is for all of my trades to be “free trades” when I enter for the first time. There are plenty of opportunities to get in.

I am also looking at the 15 minutes, 1 hour, 4 hour, and daily time-frames. The 1 hour is my preferred time period. But opening up and looking at the other time frames mean I have many more setups and opportunities to wait for.

I will continue to mainly trade when there is a positive rollover rate. It really helps to have a positive rollover rate. So that when I have to wait for weeks or even months for a trade to complete that I am receiving a little bit of interest for being in the trade each week.

P.S. – If this post benefits you and if you haven’t used Robinhood for trading stocks but are thinking to then please consider using my referral link when you do sign up: http://share.robinhood.com/evanc203.

This way each of us will receive a free share of a random stock if you sign up through my referral link.

My Robinhood Review: https://evancarthey.com/review-robinhood-trading-service-with-no-fees-part-1/