Today I am looking at 3M (MMM) for a long term stock play. I will be using my technical analysis based upon my trade setups. Also, I will be using the 7 parameters I look for to see if a stock can be considered a growth stock. This analysis will more than likely be applicable for multiple years since the daily chart will be used for the time frame.

How to Trade 3M (MMM) for Maximum Profits in the Stock Market

There are 7 fundamental markers I look for in a stock. I try to only purchase growth stocks so these are the parameters I look for to see if a stock meets the majority of the markers. I prefer to have all seven fulfilled. You can it more in depth here: https://evancarthey.com/how-to-scan-for-winning-stocks-an-insiders-view-to-my-process/

- Market Cap: > $300 million

- EPS growth past 5 years: >0%

- P/E: Over 10

- EPS growth next 5 years: >0%

- Sales growth past 5 years: Over 20%

- Debt/Equity: <0.1

- Sales growth qtr over qtr: Over 5%

Does 3M meet these 7 markers?

- Market Cap: 125.09B (YES)

- EPS growth past 5 years: 6.40% (YES)

- P/E: 23.43 YES

- EPS growth next 5 years: 6.87% (YES)

- Sales growth past 5 years: 1.20% (NO)

- Debt/Equity: 1.49 (NO)

- Sales growth qtr over qtr: -0.60% (NO)

I used Finviz.com for the fundamental analysis screener. With 3M only hitting 4 out of the 7 markers I cannot pass this off as a growth stock. That doesn’t necessarily mean the fundamentals are bad. It just shows me 3M should not be considered a potential candidate for being labeled as a growth stock.

Technical Analysis of 3M

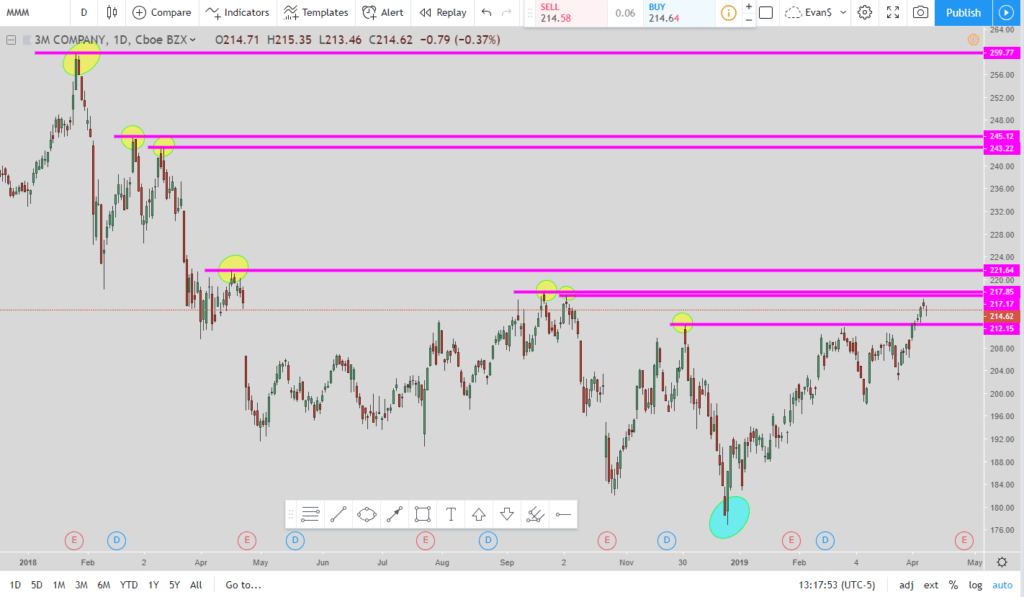

The yellow circles are the pivot point highs. When price breaks one of those levels then that will initiate a Reverse Lightning Trade setup. I drew the levels with the pink line. So as you can see there are quit a few potential bullish setups in 3M’s future. The teal circle is the pivot point low I would use when utilizing the lightning trade. If you are unfamiliar with the parameters of the lightning trade then I have a link at the bottom where I show you what the lightning trade is.

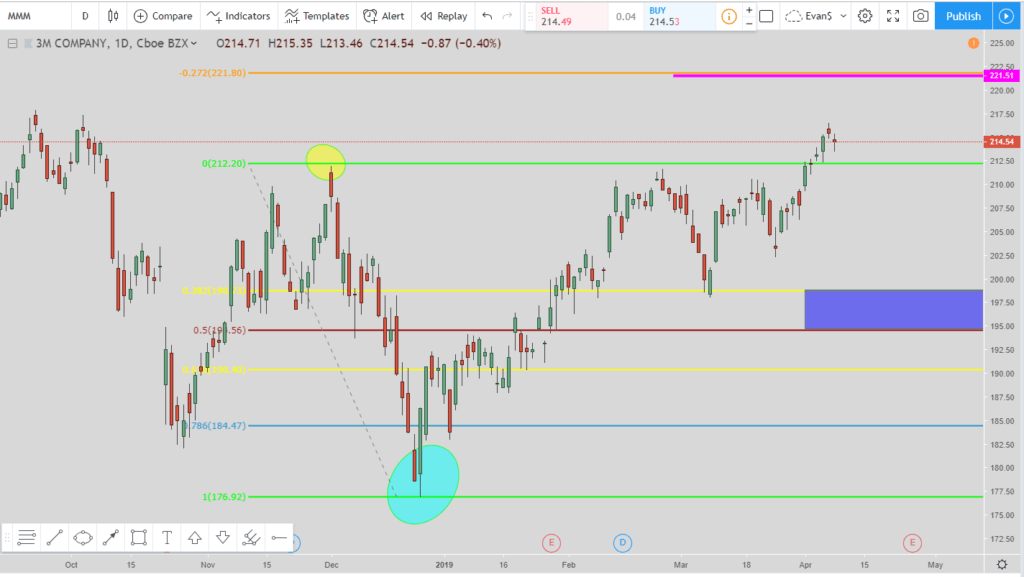

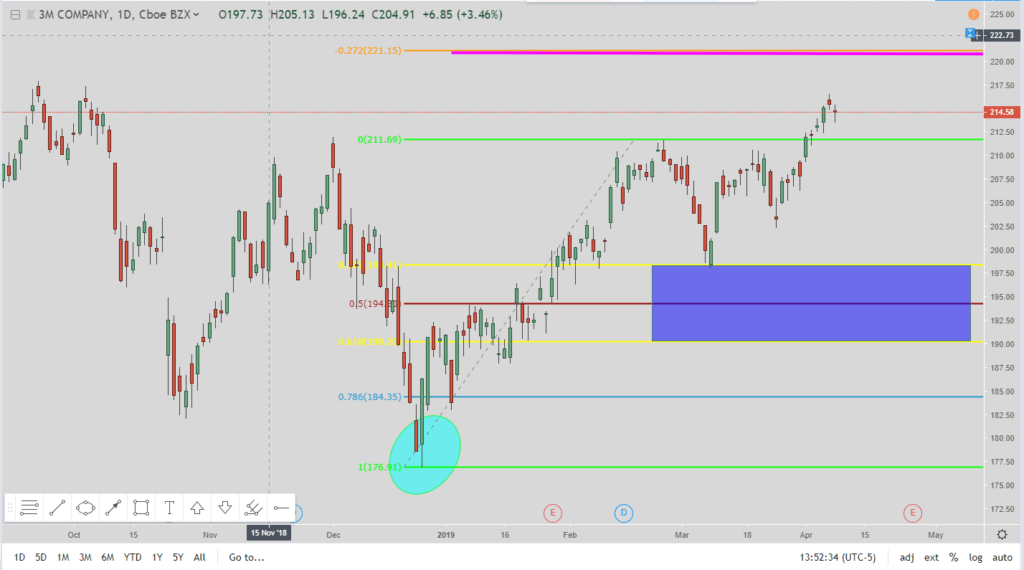

3M is currently in a Long Lightning Trade setup. The current exit is $221.50. But the exit could change if 3M does not go up and hit that target. But if it does, or hit any of these other targets that get initiated then the move is over and time to look for the next setup.

- 1st exit: $221.51

- 2nd eixt: If price retraces to $198.75 before hitting $221.51 then all exits move to $211.00

- 3rd exit: If price retraces to $76.92 before hitting $211.00 then all exits move to $194.10

- That will be the last movement of the exit, even if price continues to move lower

There is also a 38-127 trade buy setup 3M is currently in. The exit is $220.90. So as you can see 3M is in two bullish setups, at least for the near term.

Conclusion of 3M

3M cannot be considered a growth stock so if that is what you are looking for then you should not purchase 3M. However the technical analysis side is very promising. With multiple reverse lightning trade setups on its horizon and a 38-127 trade setup it is currently in, the technical analysis side looks promising if you are bullish on the stock.

All analysis is my own opinion and should not be taken as financial advice. I do not currently own 3M’s stock and have no plans to buy or sell their stock in the next 48 hours from the time this article was published.

Popular Links

Here are a couple of links if you are looking at how I view the market and some trade setups. You can create your own trading style and setups. Quit paying losing traders to teach you. The only thing they teach is how to lose money.

My Robinhood Shameless Plug

If this post benefits you and if you haven’t used Robinhood for trading stocks but are thinking to then please consider using my referral link when you do sign up: http://share.robinhood.com/evanc203.

This way each of us will receive a free share of a random stock if you sign up through my referral link.

My Robinhood Review: https://evancarthey.com/review-robinhood-trading-service-with-no-fees-part-1/