The crude oil price forecast will provide precise entries and exits for the setups I use when I trade. This doesn’t mean I am taking these trades but they are valid setups for the way I trade. I currently do not trade crude oil futures.

Since the high of over $63, the price of oil has gone pretty much straight down to where it is currently sitting at around the mid $52 level.

So what is in store next for it? Will the downturn continue or will oil eventually find some support?

A couple of weeks ago I wrote about the crude oil price that you can view here: https://evancarthey.com/crude-oil-price-futures-how-to-trade-the-oil-market-for-late-sept-2019/. The big gap was filled which was created from the attacks by Iran on the Saudi oil fields. In that post, I mentioned how the disruption was only temporary to the global supply so the big move up would be short-lived and in my opinion, you should be selling rather than buying.

But it is not all gloom and doom for oil. Yes, the downtrend could continue but we have entered into a long setup I will go over in this post. The lower the crude oil price goes then the better value we can receive when it eventually does go back up and hit the exits.

But I love big moves down. The reason why is because it means they have created buy setups that will be very profitable when they complete.

As long as you stay patient and stick to one of my main trading rules which are………….

Trade ONLY AFTER the Big Move

During one of my meditation sessions I had a thought or concept come to me. It was that the way I trade is I look for the entry AFTER the big move has occurred.

I had tried numerous times before to be a break-out trader and all that did was cost me money. But it wasn’t until after a recent meditation session did I see that all of my setups work best after a big move has occurred.

If you trade that way then awesome. If not then no big deal. I am just showing you how I trade in hopes that it will help define your trading to assist you in making you a profitable or even more profitable trader.

Patience is the key. It is something I still battle with but have gotten a little better over time. There are so many times when I see a valid setup that I want to jump in. I know I should have been patient and waiting but I got greedy.

Fear and greed are always there. It is my job to manage them. They each pull on my “patience” and tell me to cut “patience” out of my life.

Greed wants me to get in trades to early while fear wants me to get out of trades too soon. It is a delicate balance in managing them.

But one item that has helped is to look for the big move either way. Once I spot it then it becomes easier to look for an even better entry into the trade.

The way I trade is pretty much a counter-trend trading style. It really isn’t a trend-trading style. But it works for me and that is what matters.

That is why I always pound the table for everyone to use meditation to discover their own trading style and system. It wasn’t until I started meditating for trading setups that I then started becoming a profitable trader.

You can do it too.

The Charts for Crude Oil

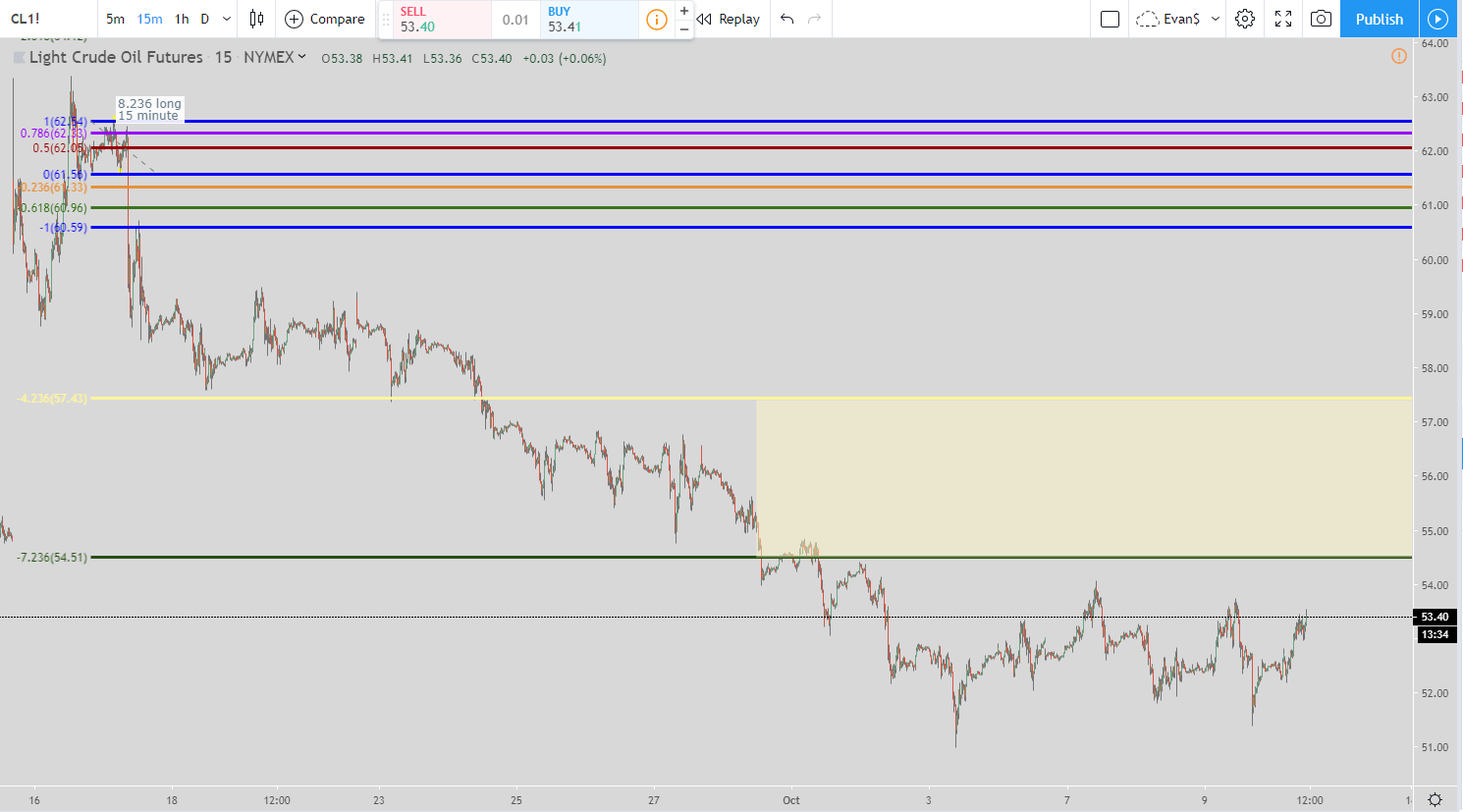

In the 15-minute chart for crude oil, we are currently in an 823.6% long setup. The initial entry was at the 823.6% Fibonacci extension level at around $54.51. The exit is the top of the yellow box which is the 523.6% Fibonacci extension level at around $57.40.

But if the price of oil keeps going down to the 2223.6% Fibonacci extension level at around $40.86 then the exit would move to just below the 823.6% Fibonacci extension level at around $54.50. That is the last time the exit would move.

Personally I don’ think the price will go down that low before the 1st exit of $57.40 gets hit. With price currently at $53.66 that isn’t too big of a prediction on my part that I am well aware of.

But if you are looking to get long on oil then this does have some upside in the future but there is a short setup that is in play.

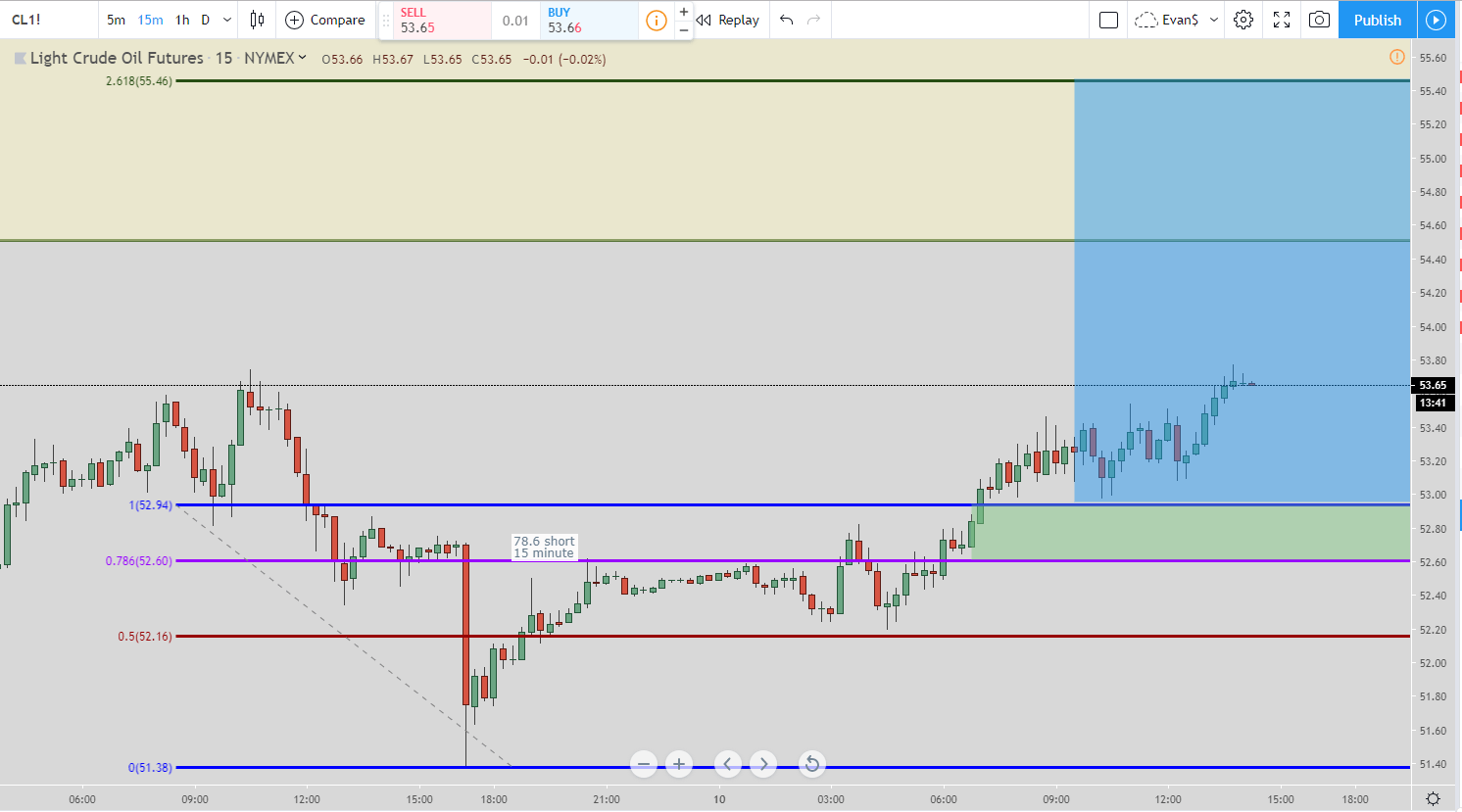

Here in this 15-minute chart, we are looking at a 78.6% short setup. The trade started when the price hit the 78.6% level at around $52.60. But when the price continued to rise and hit the 100% line at $52.94 then the exit moved to the 78.6% line at around $52.60. So that is where the current exit is located.

But if the price continues to move up and hit the 261.8% Fibonacci extension level which is the top of the blue box at $55.46 then the exit moves to the bottom of the blue box around $52.94.

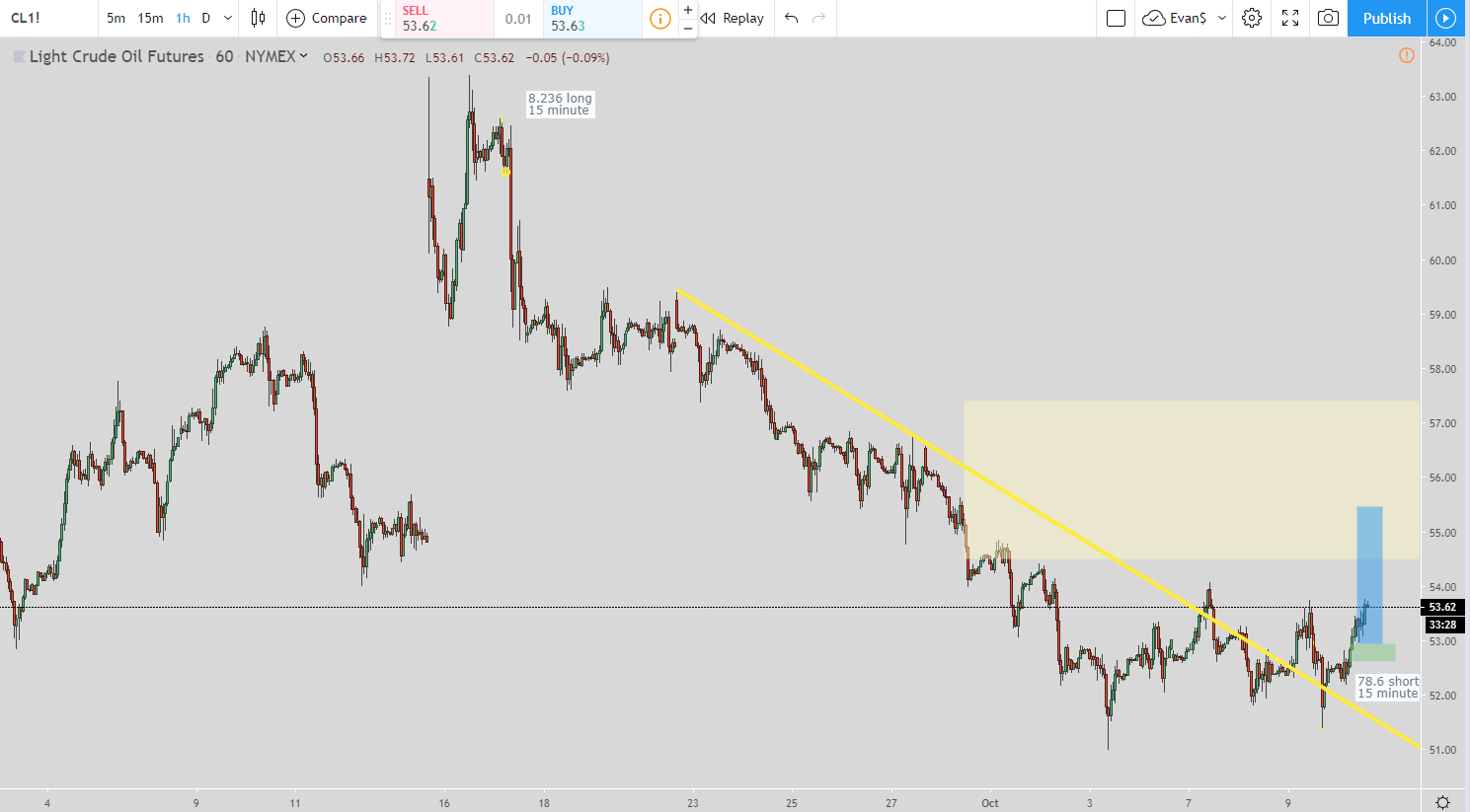

Finally, in the 1-hour chart you can see how for the past month the price of WTI has been in a downtrend. But recently a major trend-line (the yellow line) has been broken and then the price used the former resistance as support to bounce off it.

Could this be the signal for the move higher? Maybe but the price has been in a range from around $54.00 all the way down to the mid $51 level this past month. Now, the price is getting close to the top again.

The difference this time is the trend line has been broken and the resistance has been used as support which can mean that a reversal higher is taking place.

The Video for the Price of Crude Oil Technical Analysis

If the video does not load below then click on this sentence to be taken to it.

Oil Price News

You will hear more and more about “clean energy” and how we must embrace it. Some politicians have gone as far as to say we will all be dead in 12 years. Just about all of it is nonsense and is being pontificated by people who are pushing a nefarious agenda.

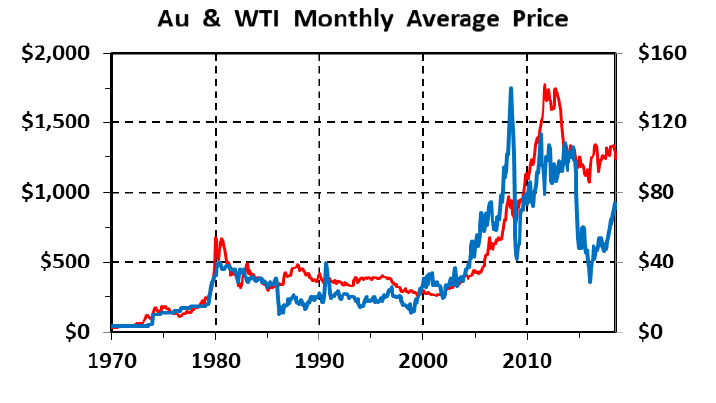

Yes, it is good to diversify our energy sources but oil and gas are going to be the main driver for the next 100 years and more. The renewable energy sources will grow the fastest but all of them combined will not come remotely close to matching the energy output and consumption of oil and gas.

For instance, you may think it is strange how oil and gas focused companies are spouting off about how important renewable energy is to everyone. Here is the link to a video where the CEO of BP discusses the challenges being faced by the oil industry and the push toward renewables: https://www.cnbc.com/video/2019/10/09/we-cannot-carpet-the-world-with-renewables-fast-enough-bp-ceo-says.html

The reason why you hear this from major oil companies is for optics. They want the public to view them as champions for “clean energy.” That is one of the reasons why Statoil changed their name to Equinor.

With the challenges of the image the media has created about the oil and gas industry, they are facing challenges of hiring top talent to come and work in oil and gas. Many programmers and engineers are going into tech and finance. This is where the oil and gas industry is falling short. So to assist in attracting top talent they have started the campaign to re-brand themselves and “embrace” clean energy in order to compete for top level talent in the marketplace.

But do not be fooled, these are still oil and gas companies at heart which is where their profits come from.

Remember the last article I listed about the BP CEO saying how the oil industry must push toward renewables? Where here is a recent article going against Michael Bloomberg and his $500 million dollar plan to stop the US from going to a 100% clean energy economy.

https://www.cnbc.com/2019/10/09/bp-ceo-bob-dudley-bloombergs-500-million-plan-irresponsible.html

In June, Michael Bloomberg, the former mayor of New York City, said that he would donate $500 million to a co-ordinated campaign called “Beyond Carbon.”

The campaign, according to its website, is designed to get the U.S. “on the path to a 100% clean energy economy.” In doing so, it plans to prevent the growth of natural gas and close every coal-fired power plant in the U.S.

In a separate speech to those in attendance at the Oil & Money conference, Dudley said that while Bloomberg’s efforts “may be well intentioned,” they were also “misguided.”

“They rest on a false equivalence between gas and coal. And an assumption that an all-electric economy will emerge just as soon as we close the alternatives,” Dudley said.

When asked by CNBC why he referenced Bloomberg in his speech, Dudley replied: “Because I think it is irresponsible.”

Obviously Michael Bloomberg lives in some other dimension because the propaganda that is listed on their website is extremely deceptive:

The good news is that solutions to climate change and alternatives to fossil fuels are available now. Renewable energy sources, including wind and solar, are emissions-free and cheaper than coal power – and they create more jobs and enhance local economic development. Electric vehicles, cheaper advanced batteries, electric heating and cooling units and other technologies mean we already have methods to readily replace most of the fossil fuels in our lives – and they will give us cheaper energy and cleaner air.

The paragraph above is very unfortunate because the false propaganda the renewable resources crowd disseminates does much more harm than good. Instead of looking to work with fossil fuels and coal they seek to demonize them and make it an “all or nothing” situation. There is great room for growth for renewable energy sources but claiming they are cheap and can replace oil, gas, and coal is a straight up lie.

And we cannot forget about OPEC: https://www.cnbc.com/2019/10/10/oil-prices-opec-downgrades-2019-oil-demand-growth-forecast.html

OPEC trimmed its forecast for oil demand growth for the third month in a row on Thursday, citing weaker-than-expected data in the Asia Pacific region as well as advanced economies in the Americas.

The move is likely to add to growing pressure on the Middle East-dominated group to impose a deeper round of production cuts at its December meeting.

In a closely-watched monthly report, OPEC cut its forecast for global oil demand growth for the remainder of this year to 0.98 million barrels per day (b/d). That’s down 40,000 b/d from its September estimate.

The group, which consists of some of the world’s most powerful oil-producing nations, kept its forecast for 2020 in line with last month’s projections. It expects world oil demand to grow by 1.08 million b/d next year.

The world was forever changed with the shale revolution. OPEC increased its output a couple of years ago to try and destroy the US fracking industry which was one of the factors that led to the collapse in the price of oil.

But what it did was strengthen the fracking industry in the US because the companies that made it out are now more efficient in their operations and can survive on $30-$40 barrel of oil pricing.

OPEC will still be a major player for years to come but their stranglehold on the oil industry is over. This was a major turn in the history of the world that I feel most people don’t recognize. The US set themselves up to be

Conclusion to the Crude Oil Price Forecast for October 2019

Oil is in an interesting spot at the moment. After the Saudi oil fields were attacked by Iran last month I was pounding my fists on the table to be sellers from the huge spike up.

Now that the gap has been filled and the past month has been pretty much straight down, the price of oil finds itself in an interesting scenario.

We are currently in a long setup and also a short setup.

For the oil bulls, they have the fact that the downward trend-line was broken and that the former resistance is now being used as support that the price has bounced off of.

For the bears, we are in a short setup. Also, in the long setup there is much more room to go down before the next entry gets hit (if that happens).

So with all of that hedging I am doing, I am simply waiting on the side and seeing which way the next big move crude oil takes off to.

If it makes a big move higher then I will be calling for the short trade that is currently live.

If oil makes a big move lower then I will be calling for the long trade that is currently live.

So right now I am waiting for the oil market to move either direction and then I’ll make my call if I would recommend being buyers or sellers.

You could get in either way right now but in my opinion, I would wait for the move to take place and then get in the opposite way.

That is how I trade.