In 2 days on November 30th OPEC is set to meet to discuss the possibility of a production cut. They have dangled this carrot in front of the market for months now only to artificially inflate the price of oil. Then when nothing would come of the talks price came back down. But this time could it be different?

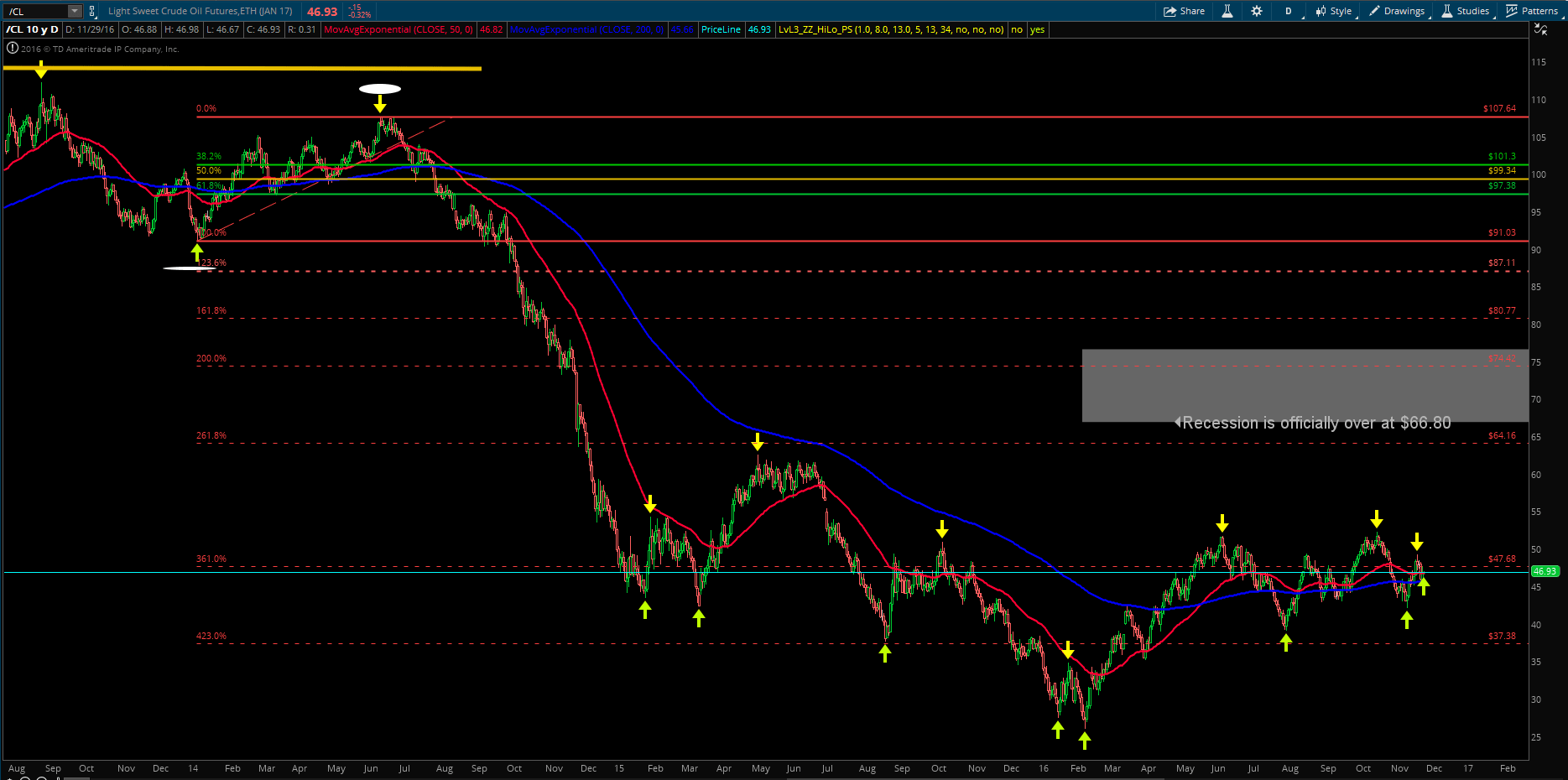

I have slightly adjusted how I mark my fib extension levels but from last time they are still very close: https://evancarthey.com/updated-long-term-cl-oil-analysis/

Here you can see that price dipped below the 423 extension but soon came back up and used it for support. Since then it his waffled around with around $52 being the high point. I still believe that price will hit around $66.80 and then in my opinion the huge move down that started in June 2014 will be over. After that we will have to look at the next closest move to predict where price might head. The 423% fib extension for the daily chart is usually the maximum a move will make. In exotic markets such as the USD/MXN it has blown past it but for non-exotic markets you can usually count on the 423% fib extension to be around the lowest price will go on a daily chart. But the question is when will price finally start making that move higher to hit the $66 level?

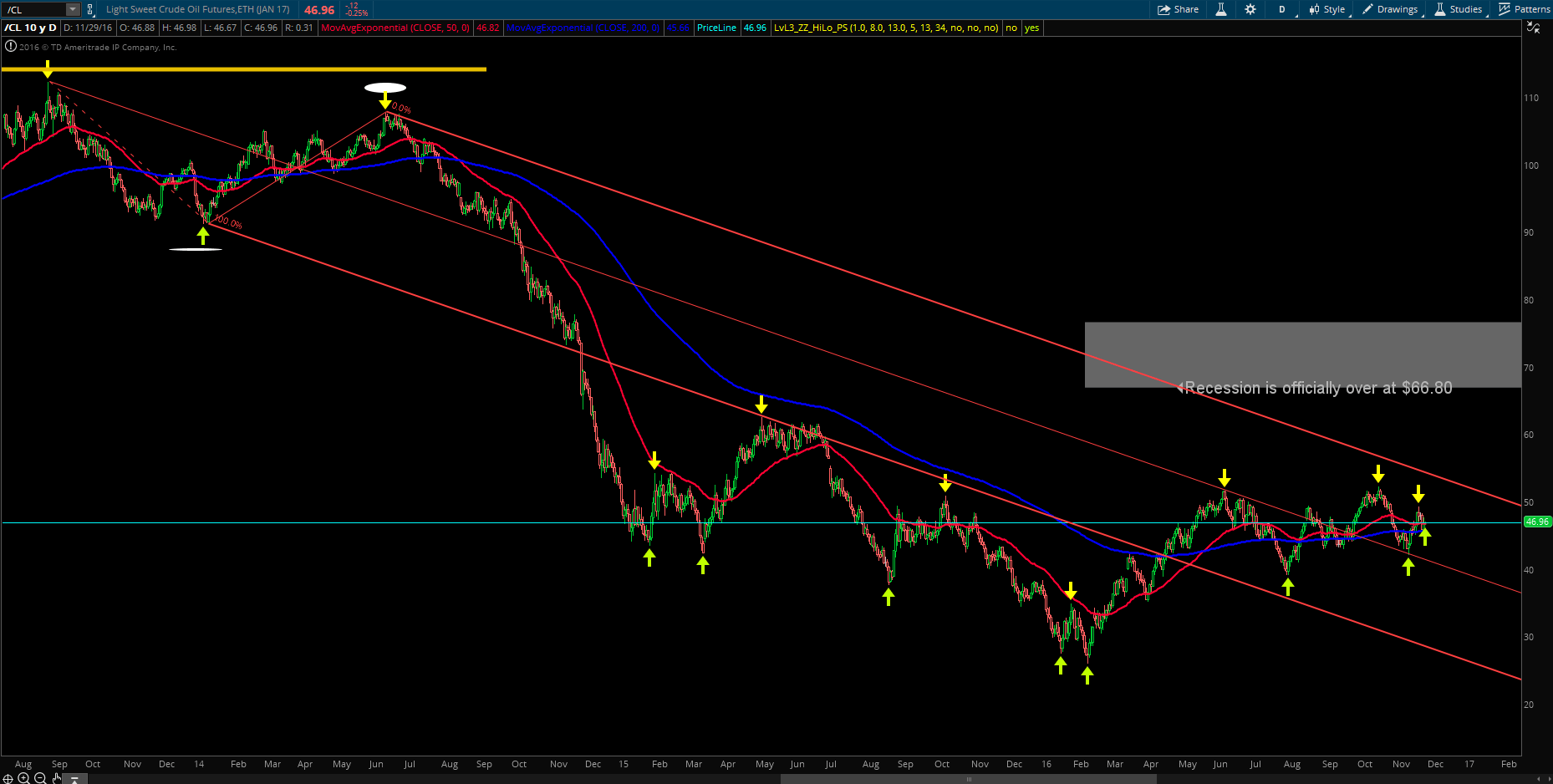

One tool I have started using as a guide is Andrew’s Pitchfork. I don’t know how to trade off of it but it does provide a good reference point for me to see where price is in a move.

Here you can see how price shot way below AP (Andrew’s Pitchfork) but recently went up and hit the mid line before retracing back down in June – August. From August – November price shot back up past the mid line and has retraced to consolidate north of the mid line. Price still has to rally north of the top line but this next picture shows why I think now is the time and why OPEC will agree on November 30th to a production cut.

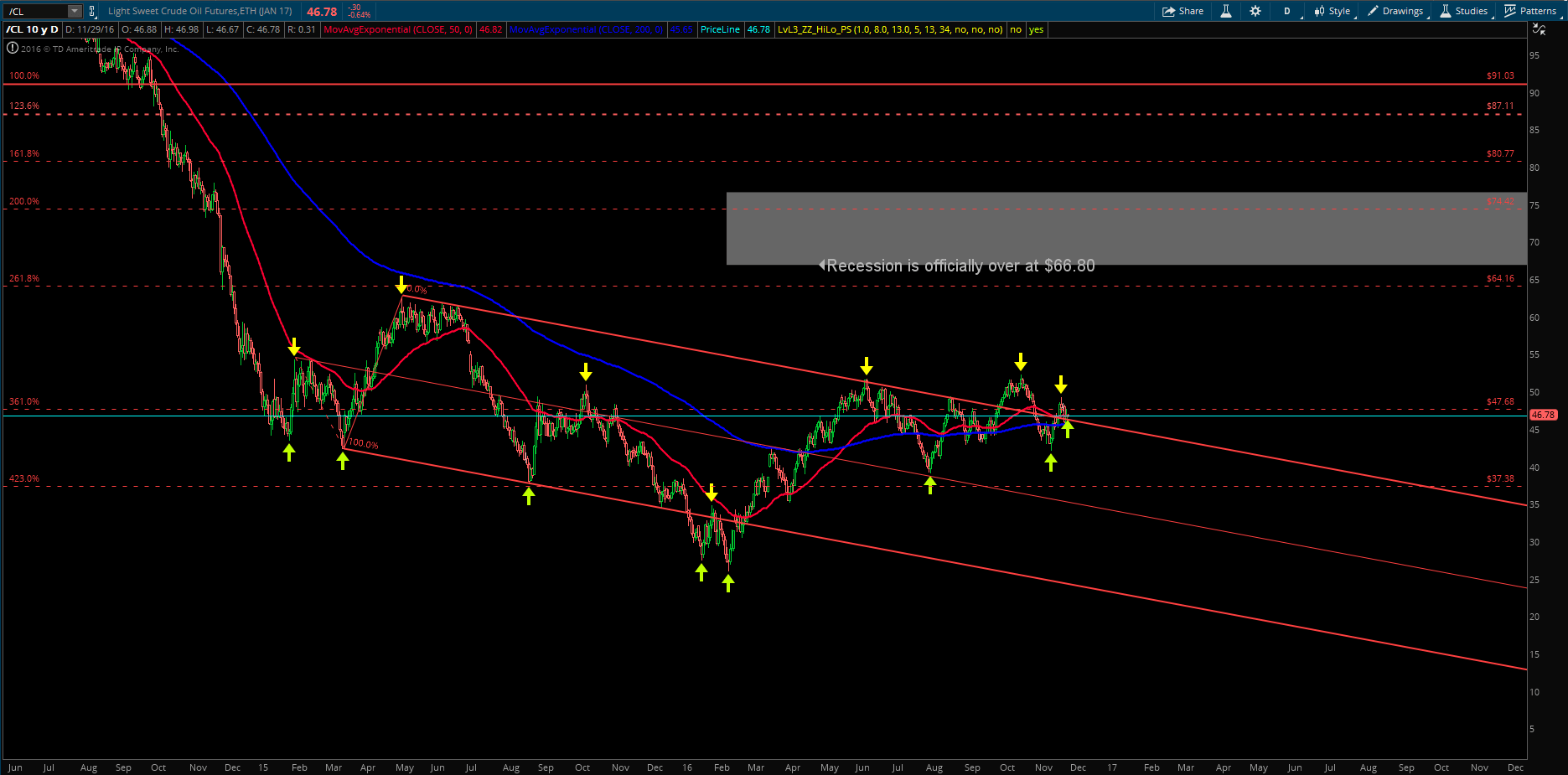

Here you can see that price how broken out of this AP and is using the top line for support. Price is using it to catapult off of when OPEC announces their production cuts on November 30th. I already said 2 months ago that the bottom had been in for oil and the next move will be to $66. I believe now is the time and on November 30th OPEC will announce plans to make a production cut and $66 will be the next stop. Price can of course go higher than $66 but for me when price reaches that number then I will declare the two years of hell in the oil and gas industry to be officially over.