Netflix (NFLX) on 11/27/2018 has presented a great buy opportunity to make some pretty good money. The time frame I am using is the 15 minute so this should be a fairly quick trade. It could take weeks or months, I have no way of knowing but it seems with the lower time frame then the quicker the trade. Netflix (NFLX) has sold off in a matter of 2-3 weeks and has not retraced enough to complete a move up. This has given us a great opportunity for my Lightning Trade setup.

[mc4wp_form id=”1229″]

Netflix (NFLX) and the Setup

Netflix 1

As mentioned above the setup I am using is my Lightning Trade setup which is my favorite out of the 4 I use. The reason why is the profits seem to be the greatest and it works the fastest compared to my other setups. It is what I mainly use for my Forex trading.

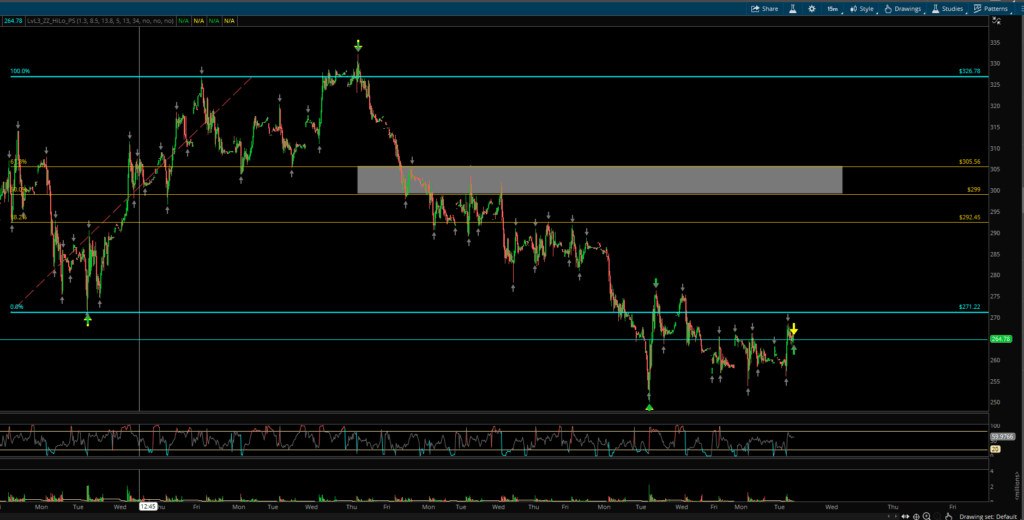

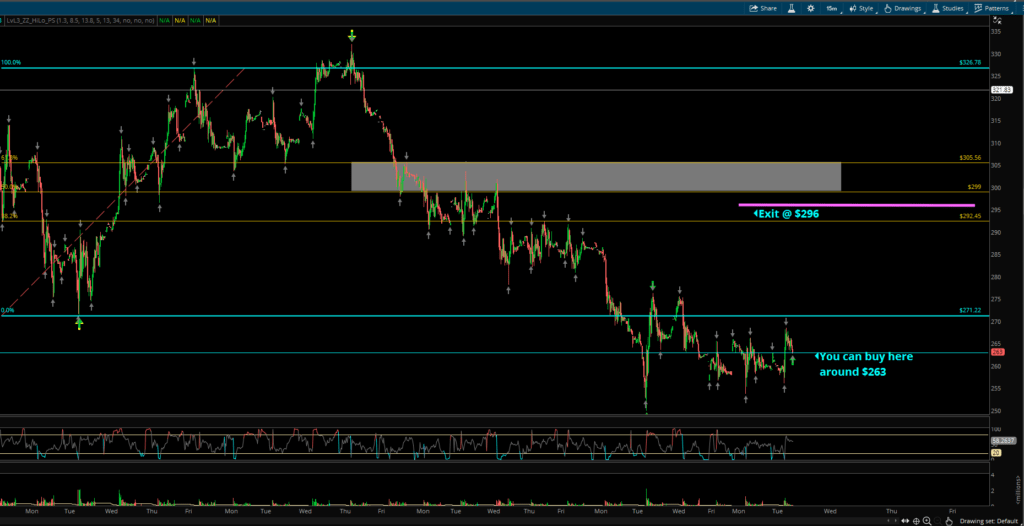

From the chart above price broke out to the upside and made a high around $322.05 before selling off to where it is currently at the time of this writing of around $263.25.

Price has not retraced back up to the key levels I look for in the Lightning Trade. Because of this it has given us what I call a “Free Trade.” What I mean by a free trade is the exit does not move. So if you enter at around $262 then your exit will be at $296 and will not move even if price continues to go down.

Netflix has found support around $256. If price breaks lower then the next couple levels of support would be $247, $237, and $216. If you do get in and price hasn’t gone up and hit $296 then I would look to add at those levels as well.

Once price goes up and hits $296 then the trade is over so get out of the trade and take any limit buy orders you may have on. It will be time to look for another trade.

Entry and Exit

From the chart above the magenta line at $296 is your exit. You do not move this exit, even if price goes against you. If price does go lower then I listed the next support areas where I would look to add to the position.

Price is currently around $263.22. If you have your exit at $296 then that is almost a $33/share profit. And since this is a 15 minute chart it shouldn’t take as long for the move as a 1 hour or 1 day chart like I usually use. Of course I can’t guarantee that so please be aware it could take weeks or even months for the retracement upwards to $296 to happen.

The hard exit is $299 but I like to have my exits just short of the hard exit to ensure I get filled. I’ve seen price plenty of times go up and barely touch the hard exit. This completes the trade but it can also mean not enough contracts traded in order to get filled.

Just make it easy on yourself and come off the hard exit a little bit to ensure you get filled and out of the trade.

Conclusion

Netflix (NFLX) has given a great opportunity to buy and go long. I am not currently in the trade and do not have plans to buy in the next 48 hours. If I did then this would be a perfect setup for me. I do not want to be too over invested in this market which I am already am. That is why I have to sit out on this trade for the time being.

But if you are looking for a trade that has a great potential ROI then this is an excellent trade to consider.

P.S. – If this post benefits you and if you haven’t used Robinhood for trading stocks but are thinking to then please consider using my referral link when you do sign up: http://share.robinhood.com/evanc203.

This way each of us will receive a free share of a random stock if you sign up through my referral link.

My Robinhood Review: https://evancarthey.com/review-robinhood-trading-service-with-no-fees-part-1/