Is a recession incoming or should you be buying the pullback? For this post about the S&P Futures Live Technical Analysis: Recession Incoming or Buy the Dip, at the end of last week the S&P 500 sold off in a big way. The US and China are in a trade war which is the reasoning behind the sell-off. I firmly believe that news stories are only used to manipulate the market. That means the big moves use “the news” to make up any excuse as the reason for the move. All of the banks and institutions they were waiting for this dip.

You’ll notice how the market recovered slightly at the end of the day. But the big question going into next week, the week of August 25th, 2019 is, will the sell-off continue or is this just a pull-back where we should be buyers.

I went over the positioning and what I was looking for last week in my mid-week review and the weekly preview.

For this post, we will see which setups were completed last week and how the pullback has created new setups along the way. As always, I provide precise entries and exits for any setup or trade I post. The setups are ones I personally use that I discovered through meditation by tapping into my subconscious.

CNBC is already prepping the market for a bigger move down. Look at their top headlines:

Do you see how they are trying to make everyone think the big sell-off on Friday isn’t over? This isn’t random and just CNBC “doing their job.” This is coordinated until the big institutions and banks are able to unload the rest of their short positions.

As you can tell I am very cynical to “news” reporting because there isn’t a major network who is interested in reporting the truth anymore. There is always an agenda behind their stories. But let me stay on track and see how we can make some money trading the S&P 500 this upcoming week.

Video for S&P Futures Live Technical Analysis: Recession Incoming or Buy the Dip?

If the video does not load below then click this sentence to be taken to it.

The Charts

Here are the charts from the video. In case you want to see them and enlarge them I have provided them below with a little description or highlight for each.

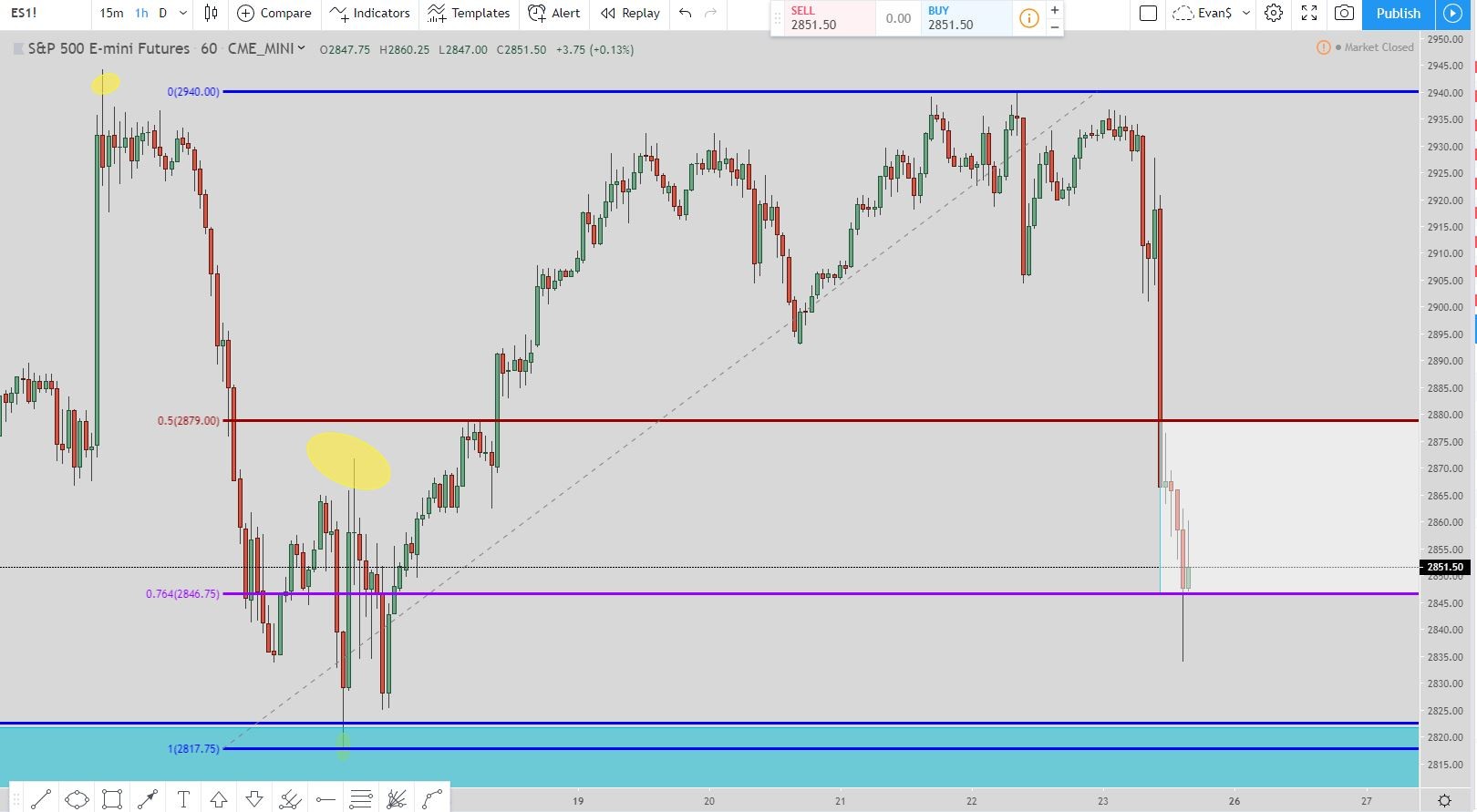

Here is the chart from the continuous e-mini contract chart. This is a long setup with the exit being at 2,970.75. The black lines are the support and resistance areas that have developed in this long trade as well.

This is a long setup that developed at the end of last Friday. The exit is currently at 2,879.

This is the daily chart where we are looking for a big short move to eventually be completed. The level we are looking for the move to complete will be at 2703.50.

My prediction is it isn’t going to happen in the next week or two. I think we have a couple of long setups to complete before we get down there. But even if we do it isn’t the end of the world.

Just look at last December how the price went down to 2,320. Even if we go down to the 2700 level it will be just fine.

The conclusion to S&P Futures Live Technical Analysis: Recession Incoming or Buy the Dip??

From the video and what I posted above, I am firmly in the camp of “buying the dip.” I mentioned in the video that on Friday I made a couple of small purchases in some stocks I own. If the market continues to go lower then I will keep adding to my positions.

The market will eventually correct but no one knows when that will happen. The trade war between US and China will soon be forgotten by some other “major” headline that will move the markets one way or the other the next couple of weeks.

Since we have the support level that has been created from a long setup then that signals to me that it is even more of a reason to be bullish in the short term. The sell-off on Friday gave us even better entries to purchase stocks.

Until that long setup gets completed, I remain bullish on the S&P 500 and consider any pullback a great buying opportunity.

Also, if you are looking for a broker to trade stocks that don’t charge trading fees then check out Robinhood: http://invite.robinhood.com/evanc203.

If you register using the link then both of us will receive a free stock.

2 comments

Bill

Awesome analysis.

Evan Carthey

Thanks Bill!

Comments are closed.