For the S&P Futures Live Technical Analysis for the Week of 9-22-2019, we are now firmly in a channel. I’ll go over where I think the market is headed in this post.

Some day (who knows when) the market will correct and the uptrend will be over. But until that happens then keep on riding this wave up.

The late news on Friday that caused the sell-off was trade fears with China. But as I have said before, pretty much all news is just a smokescreen so the big banks and institutions can position themselves accordingly. It looked like Friday’s selloff was them getting out of their positions for the weekend. We’ll have to wait for Monday to see if there will be any continuation of it.

But I am looking at the market to go down. In the long term, I am bullish but in the short term I am bearish. In the charts and in the video below you will see the setups that have shown themselves. They are all short setups.

So that is why we need a pullback so we can complete all of the short setups and start generating some long setups.

What the News is Saying About the Upcoming Week

The news is very interesting because the lead story is, of course, the trade war with China. That is what is going to move the market one way or the other in the near term so that isn’t a surprise.

But look at the two articles I circled. One is some dude who is predicting a recession in the next 12 months and the other is Goldman Sachs talking about a wild October.

The article about the recession is nothing but click-bait. The reason why is they are mostly wrong and when they are the articles are buried and you never hear from them again.

But the one time they are right they tell everyone about how they predicted the “insert major market move here” and how they are so smart. So really it is smart on their part because no one remembers the 100 times they were wrong but they will remember the one time they were right.

Despite the Federal Reserve’s latest efforts to boost the economy, long-time market bear David Rosenberg warns a recession is coming.

The Gluskin Sheff chief economist and strategist predicts economic growth in the U.S. will turn negative sooner than most investors anticipate — setting the stage for a painful market pullback.

“There’s a recession coming in the next 12 months,” he said last Thursday on CNBC’s “Futures Now.

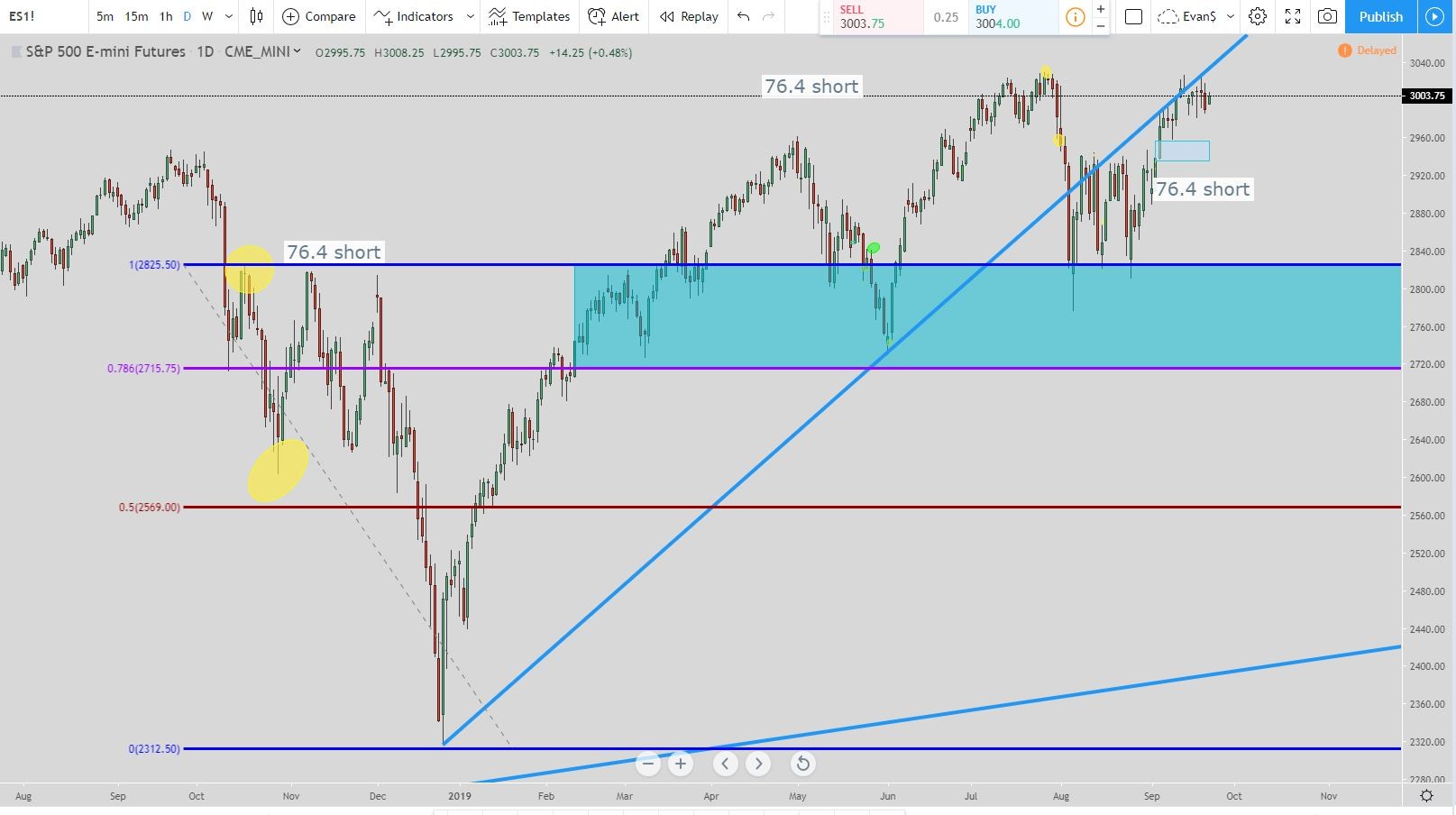

S&P Futures Live Technical Analysis for the Week of 9-22-2019

Here is the weekly chart for the S&P emini futures. You can see the major trend line that it is currently on. As long as the price of the S&P 500 stays on top of the trend line then I would look for any big pullbacks as entries to get into the market at a discounted price.

But when the price of the emini futures for the S&P 500 do break that trend then I would be extremely cautious. Until then all is good.

This is the daily chart and is a short setup. The current exit is the bottom of the teal box at around 2715.75. So with the current price at around 3003.50, there is a way to go.

Also, look at how the price has broken the trend line and now is on the other side. This is what I look for so this is another reason now that the trend line is being used for resistance.

In the 1 hour chart, this is another 78.6% short setup. The exit is currently at the bottom of the green box around 2902. But if the price goes up first and hits 3029.25 then the exit moves to 2975.

In this 15-minute chart, the price has gone above the 4.236% Fibonacci extension level which is a huge move for the 78.6% short setup. This is yet another short setup that needs to come back and be completed. The exit is the bottom of the blue box at 2935.

The last week or so has created a support and resistance area between 3025 and 2985 so the price will eventually break out of this area one way or the other. My leaning is towards the downside so we can complete all of the short setups I have listed.

Video for the S&P Futures Live Technical Analysis for the Week of 9-22-2019

If the video does not load below then click on this sentence to be taken to it.

Conclusion

In the long-term, we are still within a very strong trend so I really do not think the huge market crash is coming anytime soon. But when the S&P 500 emini futures break that trend-line then things will start to get interesting.

Until that happens I have to say we are still in a bull market. Even though I am currently bearish it is for the short to intermediate time frame. I am waiting for the short setups that have dominated my trading screen to fulfill and then we will start seeing the bullish setups to return. But we have to flush these out in order to move higher.

The market seems to be topping out right now which is normal for it to take a break since it has a historic run-up. There definitely seems to be big money that doesn’t want the S&P 500 futures to break to a new high.

So be careful out there with the market because I really think we are in for some selling in the near future.