For the Roku stock forecast for 2019, we are going to look and see if Roku has become another victim to the evolution of technology in regards to their stock price.

As you are well aware, in technology, the product or service you offer is constantly evolving or it is dying. There is not really a middle ground.

Roku is a media player that many people use for streaming services such as Netflix, Hulu, and Amazon Prime.

Here is their Wikipedia description:

Roku players, branded simply as Roku (/ˈroʊkuː/ ROH-koo), are a series of online media players manufactured by the American company Roku, Inc. Roku partners provide over-the-top media services in the form of channels. The name comes from the Japanese word 六 (roku) meaning “six” and was named so because it was the sixth company that Anthony Wood (founder and CEO since 2002) started.[1][2] A Roku streaming device receives data (the video stream) via a wired or Wi-Fi connection from an Internet router. The data is output via an audio cable, video cable, or an HDMI connector directly on some of the device models.

Programming and content for the devices are available from a wide variety of global providers.

I own and have owned several Roku devices over the years. Some have been pre-installed in the TV and others have been the little box or USB stick you plug into your TV.

Overall they have provided a nice little service as ditching cable for cord-cutting has become increasingly popular over the past five years. I always thought they would eventually sell out to a media provider or create their own media service.

The recent sudden drop in its stock price reflects the fears some people are just starting to have with the stock. The reason why is because Comcast announced it will offer a free streaming box to its internet customers.

This is the first time (as far as I am aware) that one of the major cable companies is actually embracing cord-cutting. Now Comcast is helping their customers stay subscribed to their cable services, although now it will be streaming. At least they keep the customer and now the customer doesn’t have to deal with all of the additional cable fees.

Seems pretty simple and makes you wonder why the cable providers haven’t helped their customers stay with them and get rid of all of their cable boxes. Actually I know exactly why.

If you have ever had Comcast or DirecTV/AT&T (I’ve had both) you will notice on your bill all of the added charges for extra equipment. It is a super-easy way for them to inflate your bill from $100/month to over $120/month with a built-in excuse. That is one of the major reasons why cable cutting has become so popular over the years. It is simply about cost and competition.

This is one of the main reasons why Roku has profited so much over the past couple of years. The main device people used when cutting cable and going to a streaming service was through a Roku. They are inexpensive and work well.

Now that Comcast has entered into the arena it does create a big issue for them if DirecTV/AT&T follow along.

News about Roku

There is an article on CNBC about how the author believes Roku has another 30% to drop before finding a bottom. At the time of this writing, the price of Roku is $108.77.

Roku shares plummeted nearly 30% last week, its worst weekly performance stretching to its 2017 IPO.

The streaming platform stock was pummeled Friday after Pivotal Research slapped a sell rating and $60 price target on it, fearing a rush of competition in the space. It was crushed days earlier after CNBC owner Comcast announced it would offer a free streaming box to its internet customers.It could get even worse, according to Craig Johnson, chief market technician at Piper Jaffray.

Roku has “violated the uptrend support line off those April lows of this year. You’ve got some support that comes in at $113. But purely based upon the charts, your best support comes in all the way back down at the 200-day moving average. So you can see the stock trade back down to $81, maybe even $75,” Johnson said Friday on CNBC’s “Trading Nation.”

With a 30% more drop then the stock price would be around $76.00. I think they are being too conservative.

Based upon my technical analysis I have a setup that is currently live where I am showing the price of Roku’s stock to go down even lower than that. I’ll go over it in this post.

The Charts

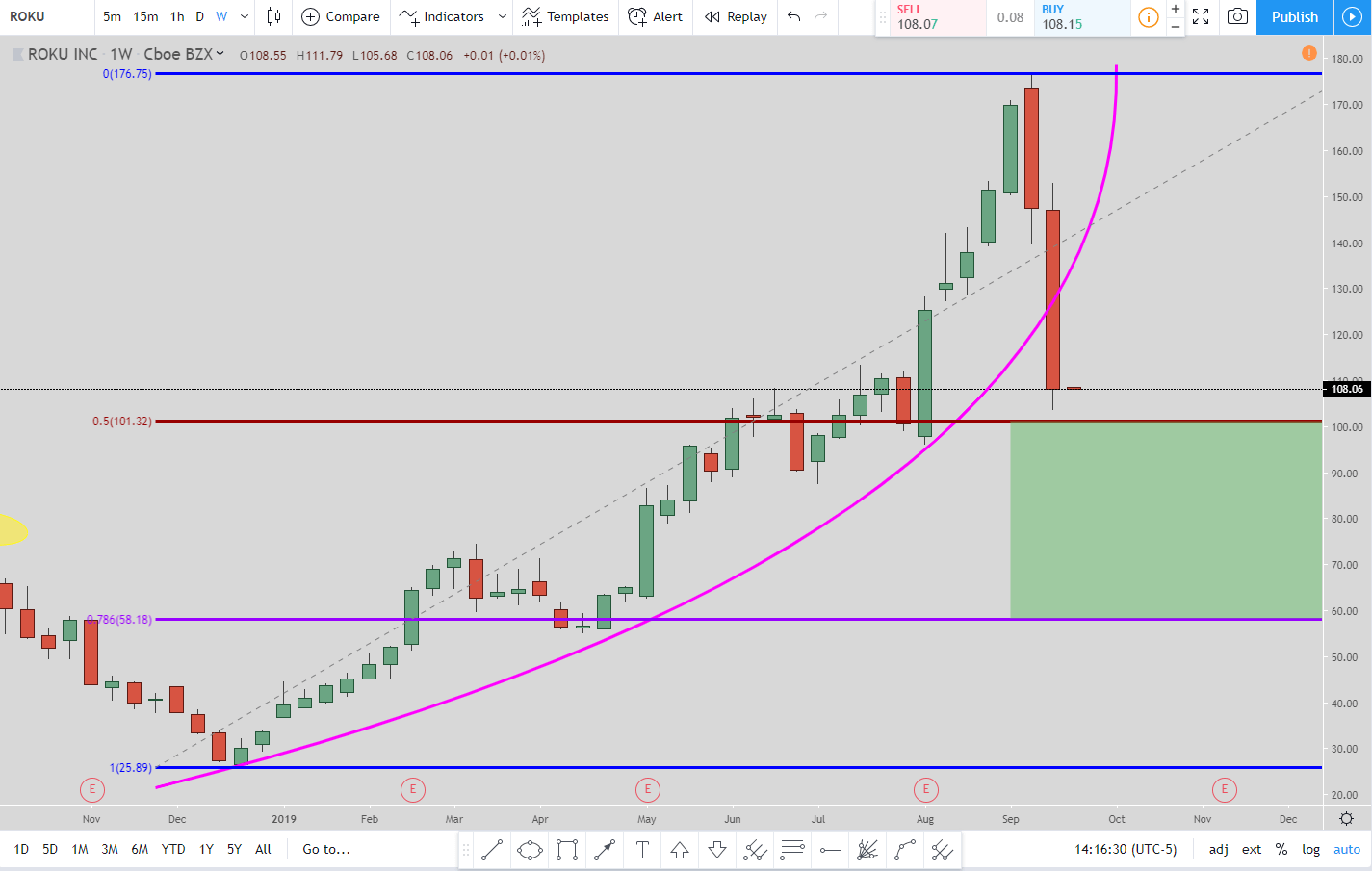

This is the move I referenced in the story about the CNBC target price. If Roku continues to go down then I am looking for the 78.6% retracement line of $52.19 to be the initial entry.

Again, this is a trade setup that is not yet live.

If $52.19 is hit then the exit is the 50% line at $97.43 will be the exit.

But if the price continues to move lower then the next entry would be the 100% Fibonacci retracement level at $18.34. This would move the exit to the 78.6% line at $52.19.

So this is a setup I am waiting on. Hopefully, the move is going to go much lower because I will definitely be looking to get in at that level.

The price has taken such a dramatic dive down that a trend-line has not yet been established for the move lower. The price will eventually go back up some which will set the first point for the trend-line down.

You can also see from the chart above that the big gap up the stock previously had was filled. There is also one other easy to see gap in the daily chart from $34.11 to $36.52. So I would not be surprised if the price someday comes back and fills that gap as well.

Here is the potential parabolic curve I found for Roku. These can be very subjective so I am not guaranteeing this is the correct curvature. But it was the one I found that had the most touches to it.

The good news if you are long Roku is that since the parabolic curve has been broken then the price is extremely close to the 50% Fibonacci retracement level. This is the main target once the parabolic curve is broken.

Price can also go down to the 78.6% line (the purple line and the bottom of the green box) but it isn’t guaranteed. So that is why the 50% is the target.

If this parabolic curve drawing is correct then the price is very close to fulfilling its parabolic curve break.

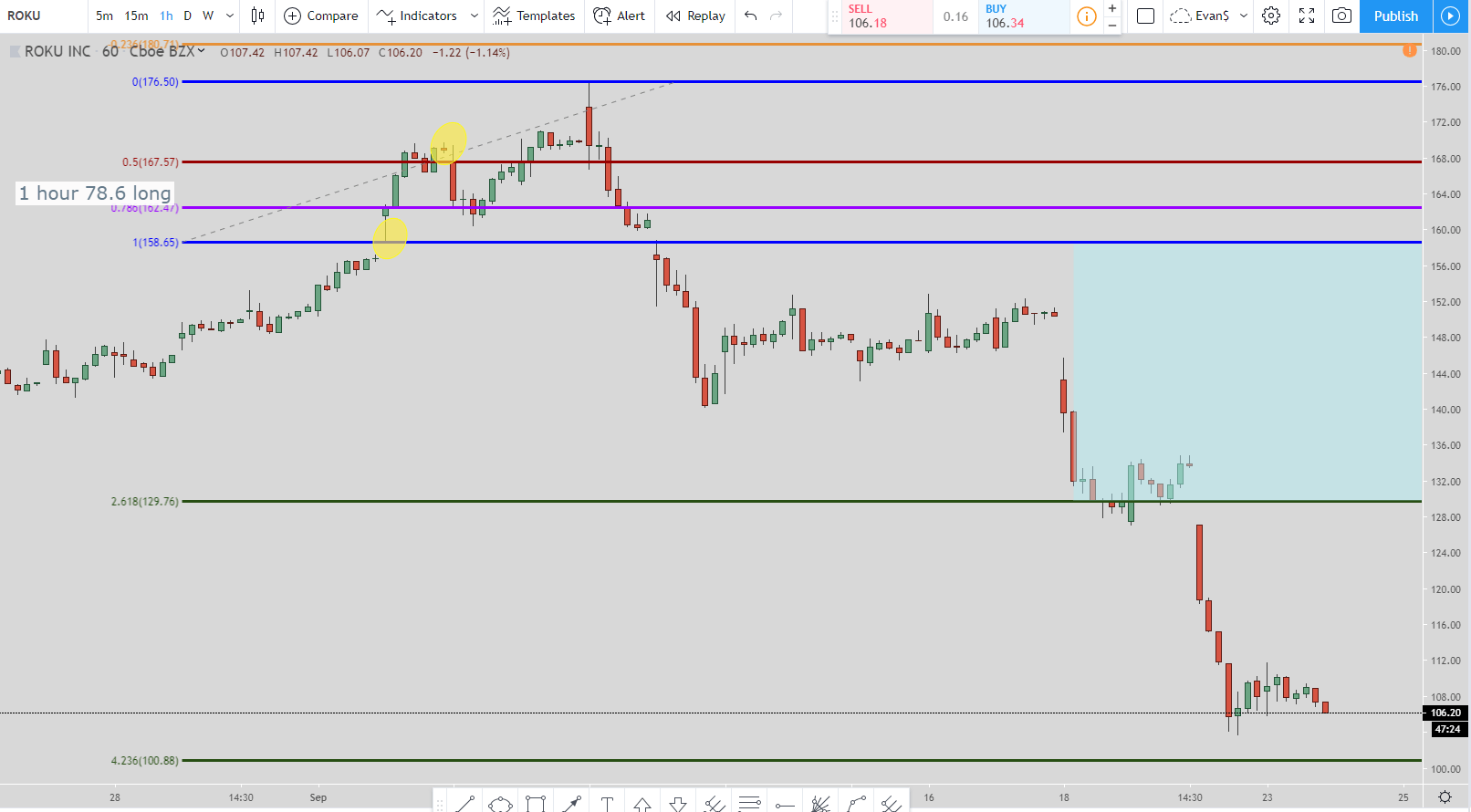

It is not all gloom and doom for Roku. It is currently in a 78.6% long setup in the 1-hour chart.

For full disclosure, I just purchased some of Roku’s stock at around $107. As I was looking at this setup I saw that it was too good to pass up. So I am really glad I chose to review Roku’s stock today!

The exit is just below the 100% Fibonacci retracement line which is also the top of the blue box. I have my exit set at $156 just to make sure when the price goes up there that I get filled before the hard exit of $158.65.

The exit will not move from here even if the price continues to move lower. If the price does continue to move lower then I will continue to scale into the stock. A rule I have is that my first purchase is always on the smaller side. I never trade 100% of my trading account in the first entry.

Add in the fact the price just filled a big gap and we do have the potential for this being the bottom from this move. I’m not guaranteeing it but it could be. But I am ready to purchase more if the price continues to move lower. In fact, I kind of hope it does go under $100 because I would like to keep purchasing the further down it goes.

Video for Roku Stock Forecast for 2019

If the video does not load then click on this link to be taken to it.

Conclusion Roku Stock Forecast for 2019

The evolution of technology for the consumer is excellent because it creates more competition which gives us a better product/service that is usually less expensive.

Roku has been great for its time but has its time passed it by? Will it adapt, sell-out, or try to continue what it is doing? Only time will tell.

I think the sell-off Roku is currently having is overdue but is now overextending its move. With Roku’s extreme rise up over the past couple of years it was due for a pullback.

Combine that with the bad news that recently came in and you have a lot of people taking profits. But when you see a decline this much in a stock that has been so positive it does open the prospect of getting in at a great price.

Hopefully with the technical analysis I have presented for Roku, it has shown that there is still some great upside available for the stock. It can be very hard to purchase a stock that looks to be in free-fall mode but I did just that. That is how I trade and Roku fits my 78.6% setup perfectly so for me it was a great time to make a purchase in the stock.

Could Roku’s stock price continue to move lower? Of course, it could. But as I mentioned above, I just purchased a little bit today and am willing to scale into the position more if the stock price continues to move lower.