Through the course of my trading journey, I have always said that my trading style is constantly evolving. In December 2019 I realized I needed to create a trading strategy that was better than I currently was using. From focusing on meditating I discovered new trading setups from re-inventing my trading strategy.

Since then it has been a slow grind back up as I had taken a loss from my previous winnings that I will explain about below. I knew it was time to evolve and create new trading setups because I was tired of my old style. The swings were too much and I needed a strategy where I didn’t have to wait for weeks for them to complete, especially since I had started trading the futures market.

How the New Trading Setups Were Created

From when I first created my first profitable trading strategy years ago, the one common theme the setups had is they did not use stop losses. The two markets I traded at that time were Forex and stocks. Since then I now trade futures and cryptos.

For the most part with Forex and stocks, it isn’t an issue because there isn’t a time decay and especially with Forex you get a lot of leverage which can be good or bad depending on how you trade.

But when I started trading futures, most contracts are on a 3 month cycle so I always had to factor that in because the trade setups could take days if not weeks to complete.

But the main reason why I was looking for a change was that I was tired of the draw-down while waiting.

A couple of months ago when I went live with futures trading I built my initial $2,500 account up to around $3,600 in 2 months. But the swings while waiting for the setups to complete were big and I grew tired of it.

Plus, I had noticed a flaw in the 78.6% setup where it didn’t always come back. So instead of waiting around I just took my losses over several trades and got out of all of them. I swallowed my pride and took the hit because I knew I needed to change my trading strategy.

So from the highs of around $3,600 I took the losses and went back to around $2,500 after all was said and done.

Why I Needed to Create a New Style

After I took those losses I did what I knew I needed to do in order to create a new winning strategy that incorporated stop losses. I was tired of going against the trend when I was obviously on the wrong side of the trade.

So, just like I did years ago when I created my first profitable setup (the Bread and Butter Trade) I started meditating nightly in front of my computer screen just like I wrote about in an earlier blog post that should be linked through one of the keywords in this post.

After a couple of days, I started having ideas come into my head to test out. I’m not a big fan of demo because it doesn’t give you the same emotions as trading live does so I started testing these out live.

Most of the ideas didn’t work but I kept on refining them. My account went from around $2,500 to around $2,100. I was going to put $500 more into the account if I hit $2,000 in order to make sure I didn’t have any margin calls.

But then I found two setups that I am using now. I know that one of them is simply an expanding pattern trading setup. But what works for me is how I enter the setup.

Now, both of these setups do not work 100% of the time which is perfectly fine.. If I am wrong in the evaluation of the setup then I take my loss and review where I went wrong. Sometimes I did nothing wrong but that the setup simply did not work.

The Two Setups

In the video below in the next section, I’ll show the setups but I want to post them here as well in text format.

During the course of creating a new trading style, I had a bunch of ideas come into my head. Some of them kept going back to Fibonacci retracement/extensions and also drawing tools such as the Schiff Pitchfork. I’ll talk about them further below.

A third setup is a symmetrical triangle but I am not confident enough in it yet to declare it a setup I am looking to trade. More testing on my part to adjust it to what I am looking for needs to be done but it is on my radar.

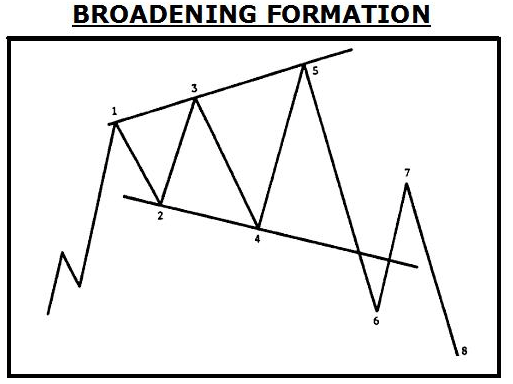

The Broadening Triangle

This is an old setup and not one I created as I mentioned before. It became famous as a pattern from the Elliot Wave theology. I tried learning the Elliot Wave strategy but it was too confusing to me.

But I discovered recently that I can spot the Broadening Triangle pattern. The way I trade it and spot it is not the same as the “official rules” from the Elliot Wave cult but it works for me and that is all that matters.

Study the market and how to trade, then manipulate the trading styles so they work for you. Simple. When you try to follow someone else’s trading strategy you will lose in the long term because you didn’t create it.

I had to learn that the hard way many times.

Here is a website that does a decent job explaining the broadening triangle:

https://www.investopedia.com/terms/b/broadeningformation.asp

A broadening formation is a price chart pattern identified by technical analysts. It is characterized by increasing price volatility and diagrammed as two diverging trend lines, one rising and one falling. It usually occurs after a significant rise, or fall, in the action of security prices. It is identified on a chart by a series of higher pivot highs and lower pivot lows.

What I like about the broadening triangle is that it is easy to spot for me. All I have to do is look for swings. In the swings of level 4 and 5 is when the big moves happen.

This is what I like. The interesting part is figuring out how to enter the trade. Below are a couple of pictures showing how I enter.

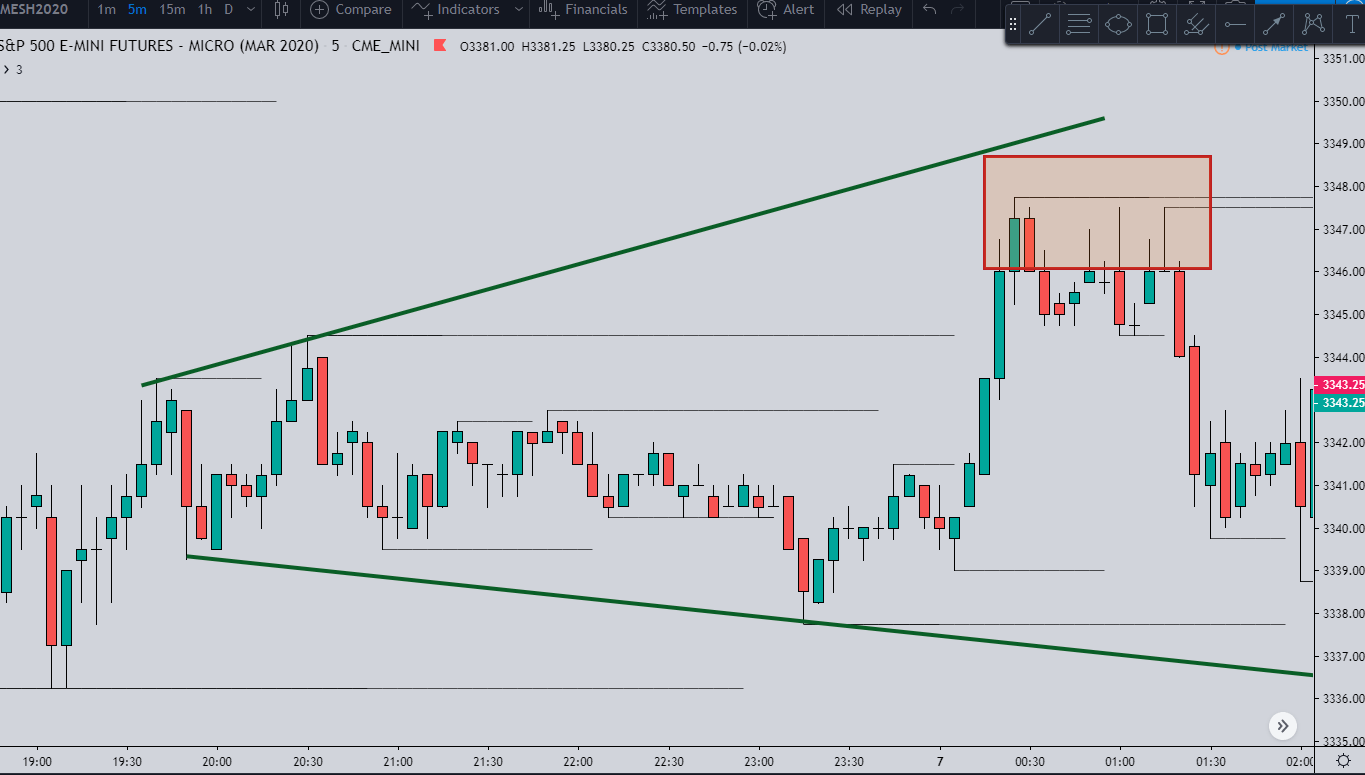

In the picture above the connecting points on the green lines are 1-2-3-4 starting at the top left, going to the bottom right, then top right and finally back down to the very most bottom right point where the candles hit the green line.

The red box above is the entry point. The bottom level is the 123.6% entry point. The top level of the box that was not hit is the 161.8% Fibonacci extension level.

Those are the two entry-level areas I look to get in. The stop loss is somewhere north of the 161.8% level, it just depends on what is going on for each trade.

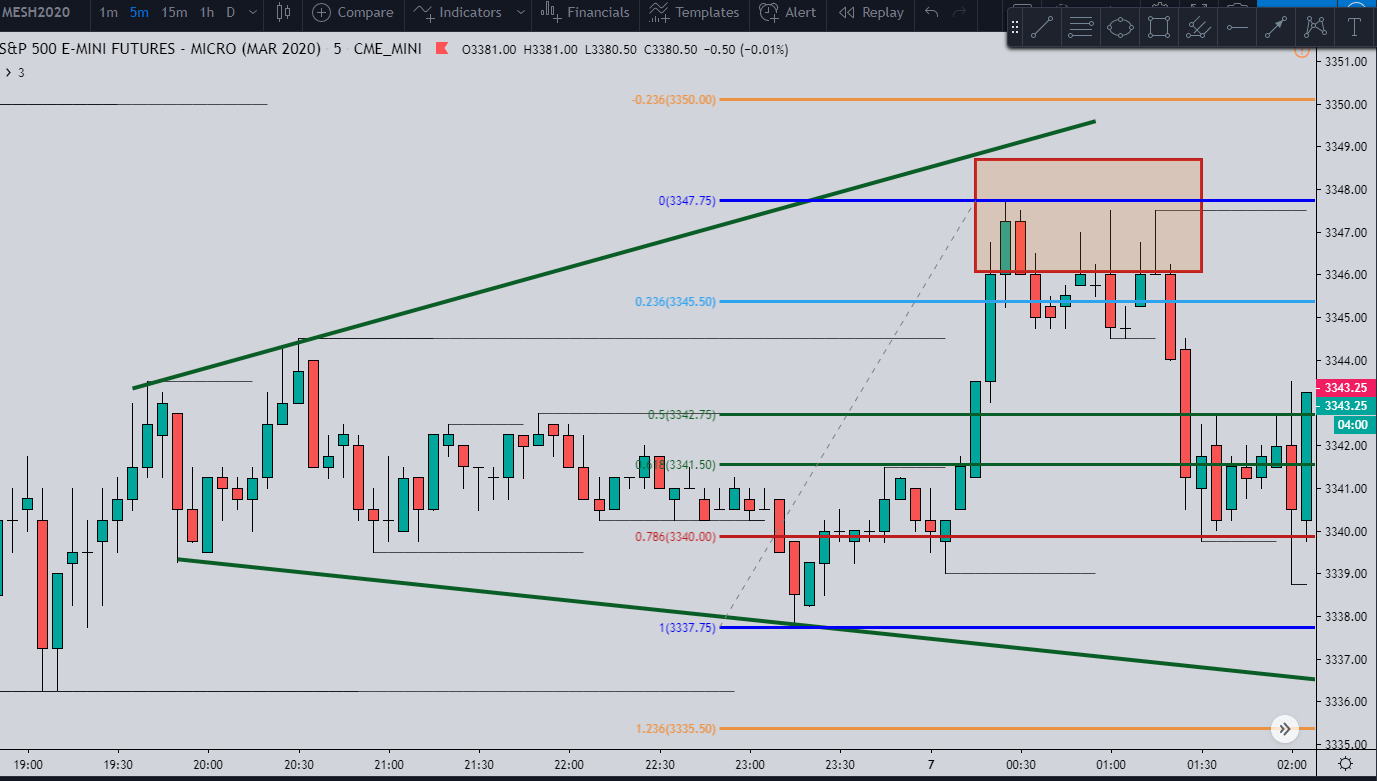

The exit is around the 78.6% level that I’ll put in the picture below.

The red line in the picture above is the 78.6% Fibonacci retracement level which is where the exit would be. I’ve looked at other exit levels because there are definitely times the move goes much further than that so it is something I am looking at with my new trade setups.

Maximizing the exit level is something I am always looking for so I will need to do more research in that area, especially for this trade setup.

Now this trade doesn’t work 100% of the time but I always have the profit margin around 1.5 to 1 so even if this only works around 50% of the time I will be in profit long term. A lot of the time this is a 2 to 1 profit margin trade so the win percentage of anything around 50% is a huge long term win.

Like I said above, my counts are how I do it. I am sure it violates the Elliot Wave rules in some way or fashion but it works for me and is actually something I can spot.

The Renewed 78.6% Setup

The one Fibonacci retracement level I have been coming back to is the 78.6% level through my setups. For some reason, I enjoy that level so even though the 78.6% trade I had been using in the past was scrapped, this was still a level I wanted to use.

So after doing some more meditation, I discovered this new setup.

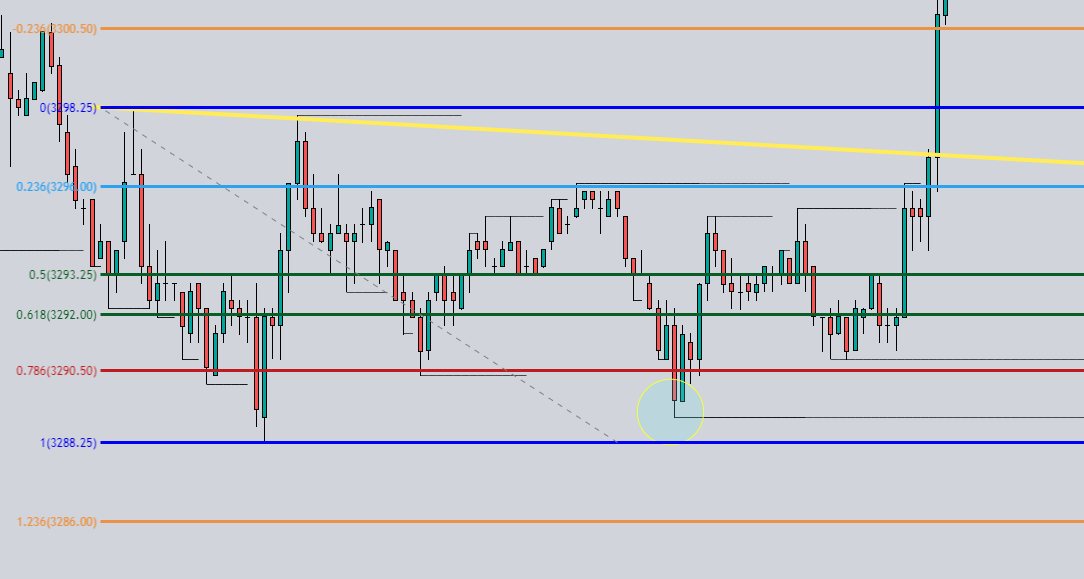

The first step is looking for a retracement back to the 78.6% level:

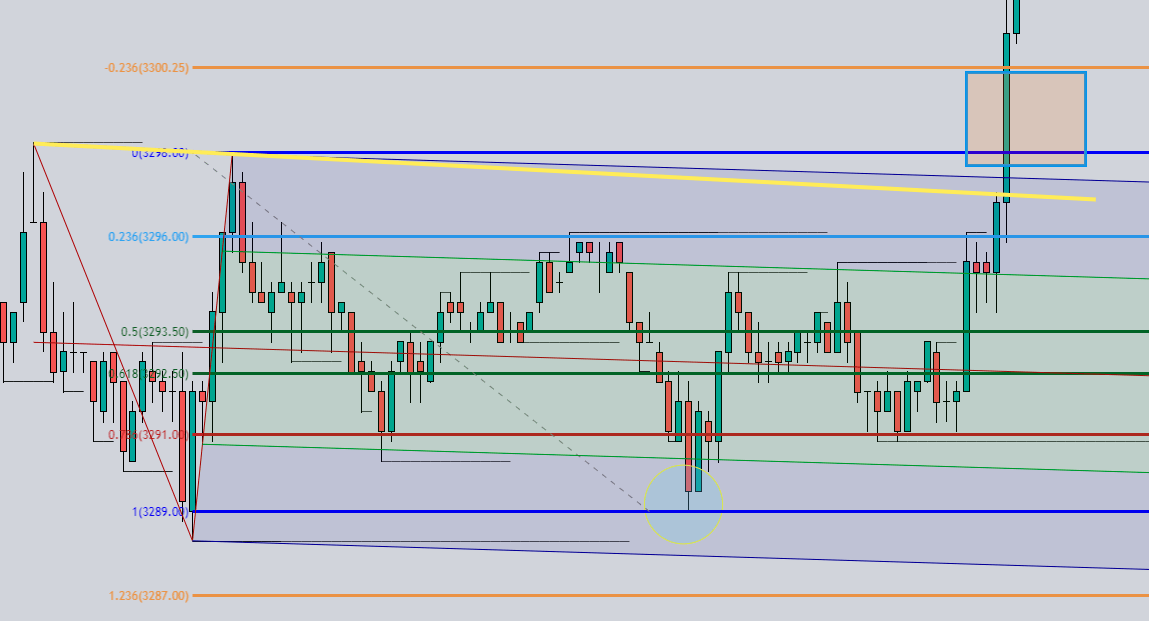

As you can see in the image above the blue circle is where the 78.6% level was hit. That is what I look for first.

The next thing to note is that the previous swing low level which is at 3288.25 on the picture above cannot be broken for this trade setup to remain valid. If that is broken to the downside then this setup is invalid.

I then draw the Schiff Pitchfork for the 1st three swings. Then when price closes above the top of it is when I enter. I’ll go over it into more detail in the videos but this is the general gist of it.

The entry would be the bottom of the orange box and the top of the orange box would be the exit.

The exit is the 123.6% Fibonacci extension level from the previous swing move that you can see from the picture.

The setup looks like a “W” so I’m sure it is called something else but this is what I use and how I use it. Maybe this is like a head and shoulders trade setup, I don’t know.

I’m not reinventing the wheel here, I’m just trying to find out what works for me and how I interpret it so I can trade it in real-time and be a profitable trader.

I know there is a lot going on in the picture but in the videos, I post it will clear it up.

Video and Daily Review

Video reviews/previews are something I enjoy doing so look for them regularly. Since I am now trading 5 different futures every single day, I will go over them and show the trades I took, the trades I missed, and how I am viewing the market.

I’ll also look at stocks and just about anything else I am trading that day.

The videos will, of course, feature the trading setups I use and the trades that I take from the video would have been live trades. Some of them I may still be in as I am doing the video review.

If the video does not load below then CLICK HERE TO BE TAKEN TO IT.

What is Next?

There are several factors that I needed to change as I mentioned above. One of them that I haven’t mentioned has been what and how I posted it to my site.

When I first started posting a couple of years ago it was basically my thoughts and experiences in my trading journey. That is what I am going back to. I had gotten caught up in SEO and ranking which is fun because it is like a competition but it took a lot of extra time that I just don’t have.

So what I am doing is going back to posting my thoughts and opinions on the markets I trade because this website was started as a way to keep track of my trading journey. If my journey can help you in your trading career then awesome.

But it was not created to be one of those annoying people who post Facebook and Instagram ads lying about how trading changed their life and now they are so profitable they are selling their system for $2,995. All you have to do is sign up for a free webinar!

I see those charlatans popping up every single day. It is sickening.

Also, doing YouTube videos for the chart reviews and previews is enjoyable so check out my channel because there will be several videos per week where I go over the trades I took, the trades I missed and the ones that were winners or losers.

Anyways, take care. Hopefully, the mistakes I share will help you avoid them in your trading journey.