Almost all trading rooms are not worth paying for because the person or persons leading it do not make money trading. This review will go over the SP500GURU.com trading room to see if it is worth your money.

In the comments section I was asked if there were any trading rooms I recommended. To be honest I haven’t kept up with the trading room scene for a couple of years. In my estimation over 95% of all trading rooms are not profitable.

The only long term profit being made is the owner of the trading room receiving the monthly payments from the people who have signed up for the monthly or yearly billing option.

If these trading “gurus” were actually profitable and making massive amounts of money like many of them claim, then why would you bring on clients?

Clients are a pain but are 100% necessary if your main source of income is sales which is why most trading rooms are created.

***I get paid nothing if you sign up to use SP500GURU‘s trading room. I am not an affiliate for SP500GURU so I don’t care if you sign or don’t sign up to use his trading room services.***

Who Runs the SP500GURU trading room?

The SP500GURU trading room is run by a dude everyone calls “G” which is short for Gordon. From what I have read and my friend told me is he has been trading futures for over 15 years.

I have no idea if he has a full time job outside of his trading room and if he even trades himself. He seems like a pretty cool dude and if you go to their website you will quickly see he hardly uses any type of lead magnet or hard sales landing page to get you to sign up for a “free” ebook in order to get your contact information. It is a pretty bare bones layout that gets right to the point.

This is a positive in my book. The reason why is because I am in sales and I also am extremely familiar with sales funnels and lead magnets. I can usually tell right away if the “guru” who is trying to get you to buy their course or subscription to their trading room is legit or not by how polished their sales page and website is when you visit.

A good rule of thumb is if their page looks like a Click-Funnel landing page then get the heck out of there. There is around a 99% chance they are not a profitable trader but know people will buy their crap if they try to position themselves as a profitable trader even though they won’t provide any proof.

Here is the homepage for the SP500Guru below:

As you can tell this was created by someone who isn’t trying to get you to into their sales funnel as fast as possible. So the more unpolished the site is then the more I lean towards it being created by a trader who actually trades and not someone trying to trick you with their fancy presentation. (Does that make any sense?)

How Much Does it Cost?

If you want to give G’s trading room a test drive then you are free to do so. You can do it around the 1st or 15th of each month. After that the subscription service starts. The pricing is as follows:

- Trade the E-mini: $220/month

- To trade the ES weekly options: $350/month

- Trade the ES and gold: $350/month

- Pay per day: $15/day

If you are looking at trading the E-minis which is what I would be looking to do (if I ever join) then it would cost me $220/month which comes down to $10/day.

Also, if you know you can only trade 14 days or less per month then it is more cost effective to do the daily plan at $15/day.

$10-$15/day isn’t bad if his trading room works for you. I’ve seen much worse pricing from shady trading rooms that I know are scams.

What is the Room Like? Trading Signals? Entries and Exits?

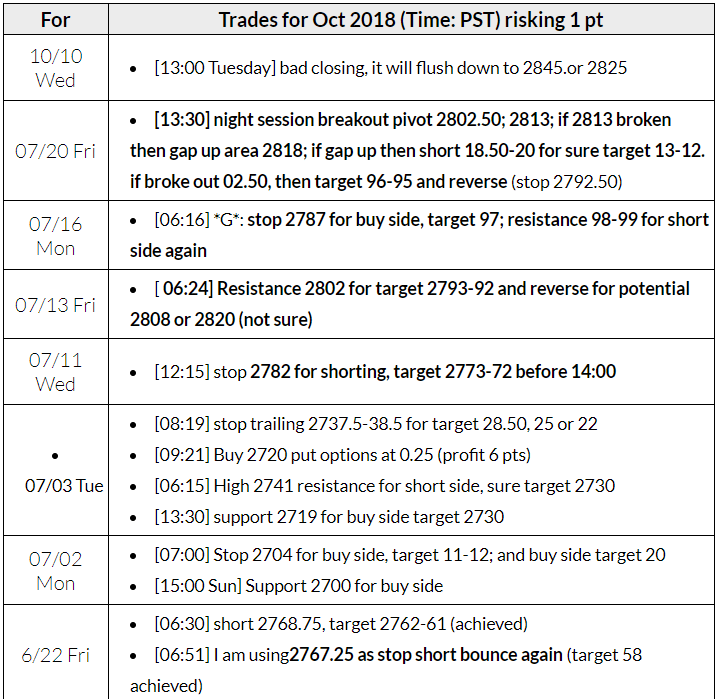

G’s calls can be confusing to some and may take some time to get used to. I’ll post a photo below of what they look like.

From what I understand he is looking for the areas where the big players are looking to enter. He’s obviously not right on 100% of his calls but he seems to be pretty accurate.

The room has other people who you can chat with and from what my friend told me he met some cool people in the room who he chatted with outside of the trading room.

As you can see from the trade calls they can be a bit confusing until you get the hang of them. The stop loss he recommends is 1 point for the e-mini.

Final Verdict

The highest praise my friend said about G is:

“I am no longer in the room but not for the reasons you may suspect. Gordon was a huge influence to me- He changed my trading style a lot primarily allowed me to double my profits. I learned more from reverse engineering his calls than I would have imagined. I think the world of him. His calls are confusing to some but if you dig down you begin to understand he is identifying the areas where the big players are looking to enter. “

That is the whole basis for my recommendation to the SP500GURU’s trading room. If my friend thinks the world of him then I believe him. Like any trading room you should not set out to use it the rest of your life. You should look to learn what you can and how it compliments your trading style.

Unfortunately my friend (who I mention often) passed away a couple of years ago. You can read more about him in this post: https://evancarthey.com/how-to-become-a-profitable-trader-using-meditation/

He is the one who got me into meditation that made me a profitable trader.

At the end of the day you have to create your own trading style if you truly want to be profitable. We all will take different paths to get to that place. SP500GURU’s helped my friend double his profits so obviously it was worth it to him.

It might or might not work for you. I don’t know. It ‘s for you to test it to see. This is one of the rare trading rooms that I would consider paying for their services when I go back to trading the e-mini.

Hope this helped you on your trading journey!

P.S. – If this post benefits you and if you haven’t used Robinhood for trading stocks but are thinking to then please consider using my referral link when you do sign up: http://share.robinhood.com/evanc203.

This way each of us will receive a free share of a random stock if you sign up through my referral link.

My Robinhood Review: https://evancarthey.com/review-robinhood-trading-service-with-no-fees-part-1/

11 comments

Trader

9.3.2021… nothing much has changed in G’s room from the comments above… calls out areas AFTER the fact…. ho-hum

wwaves

Hi Evan,

would you please email me?

Gordon

Hi guys, I am Gordon.

Found out this wonderful site just now. Thank you for your good words. As to bad words, thank you as well, we are adjusting.

9/24/2019 Tuesday night

I shorted 2974and 2978, target 2960~55, I covered 2061.25

(Night high 2979, low 2956.75)

9/25/2019 Wednesday opening

Stop 2974.50, I shorted 2972~74, covered 2955 and reversed to buy side with stop 2950.

(opening high 2974, low 2953.50)

Right now I am holding long….

Evan Carthey

Thanks Gordon, hope your trading is going well!

al

” as a trader for a longtime and WITH a lot of experiences and busted accounts” I meant this above

AL

I did not renew SP500guru.com room. Had him for one month. Zones and areas are not good unless you combine them with fibs and fractals.

As a trader for a long time and without a lot of experiences from hard work and losses and busted accounts, a person trading ES futures from 1999 would know if something is a hod ( high for the day ) or lod ( low for the day). G does not know this. Many traders do. He uses pivots which is a lagging indicator of price. Candle theory, fibs, fractals and number ratio are much more important.

Example, ES after open went up to 2746.00 area. I knew if was not going past 2748.25 and this was the hod of the day. G said we going to 2750-2760 and maybe 2770. He changed his mind after an hour when it was already 25 points down from 2746.00 and now says it may be going down to 2660 area. The lod was in 2698/2700 area.

The point is nobody needs hand holding. We just would like to confirm trades and high price with another trader. G does not trade futures. And to me this is not the same person as 2007, because G never did pivots. He would tell you in advance either short with 1 pt stop, a target with a time frame.

In his room this time, he’s the only one sending messages on this chat. You can’t be doing that if your trading, He does options now, along with GC.

The only thing I will still give him is his good globex suppor and resistance levels, but people in NOrth america are sleeping the the time to trade is after the 10:00. est. The setup usually occurs then for the day or till 2-3 hours. Then consol and either continue in same direction or reverse.

So, for anyone starting to trade, don’t waste your time in G rooms. At the end of the day, if you cannot see the person’s dome or trading statement for way he put the trades…don’t bother.

The best trader I saw and had his calls was in 2006. This guy made 2,500% return in 9 months starting with $10,000 and trade 1 lots on ES. He charged $64.00 a week and started in January 2006. Left in September 2006. I had his calls for one month. I have his whole track record at home. He would give you a call 15 minutes in advance short or long with a 2.5 pt stop. He let the trade run for the whole day. Rarely, did he exit until close of day.

This man was a true source and the only one I’ve come across. His site was tradergod.com. He left in September 2006 to get married, said he be back in December 2006. He told us in Decemeber he is leaving to work for a small hedge fund.

The guy was the god of daytrading the ES. One trade HOD to Lod.

If you start out daytrading, start with YM. I trade primarily RTY as I did this with ER2 back in the day. ES is very tricky.

Sp500 …G and his cronies are the only fans. With this volatility, his support and resistance levels were way of the current price and not worth the risk reward.

If someone could really make $1,000 a day trading, they would not need anyone.

Oh yes, I did ask Tradergod to teach me and I’d be willing to pay him. He advice, was to look at the charts, keep looking and try all sorts of things. It will finally come to you. You get the ephiphany.

He was right. 20,000 on one market and you know how it works everyday. Still a few more hours to go.

He did not teach or have a course. He figured what the market makers do everyday and it has nothing to do with pivots or G pivots as they were lagging.

Will be back later. I’ve realized I’m a good trader and don’t need to confuse my self with rooms with a guy who does not trade.

Al

MDM,

I’m sorry to hear about our friend.

I took the 1 day trial and i decided to sign up for his room about 3 weeks ago.

His Globex levels or support and resistance are the best I’ve seen when the markets are not volatile, as they have been last 3 weeks. Even, then his globex levels are good.

His daily levels can some times contradict each other and confuse the trader. Let me say with this Volatility he trades mostly options and he seems to know his stuff as he buys the options low and sell them high. Ex Nov 2 ES trading at 2705 area buy the 2730 call. Then he sells it. This all intraday.

I’m not on the option thing, but its a good way to double up profits or in this volatility use options.

With this Volatility his risk reward to trades are sometimes less than one to one unless you trade his extreme calls. For example, Nov 1, he was lookng for the market to get to 2750 and stated this was possible and so was 2790 if asian and European mkts open and no pull back. Well the high was 2741.25 Nov 1. Globex went to 2666.25. Instead of tellng his subscribers This area is a short opportunity as its strong resistance, he was still looking for 2770 2790 if 2740 Held. No short trade from 2666/2662 are to 2740!!! or below.

Mkt opened up at 2751.25 and when it was 2746 area he gave a trade resistance 2758 ( meaning you enter short at 2757 ) 1 pt stop risk and target 2740/2738 2735. Well 13 pts have gone from the area and the price never came back. So in this volatility his trade calls are not the best as he goes from pivot to pivot. Meaning if 2740/2738 held 2770 is valid. It may not get there and if it does he take credit. The market was in a downtrend. A great caller will give you 2-3 trades and knows which pivots won’t hold.

Problem is there are no great callers.

His timing for trade, meaning taking trades at certain times to take trades is good and his pivots for support and resistance overall are good, but you cannot listen to his predictions for the day as they change from morning to afternoon to late afternoon.

Ideally todays trade should have been Short 2755-2760 area ( after open) and cover at 2705-2700 area by 12-2 pm eastern. Second trade should be a long form 2707-2704 area to 2720/2722 pivot ( his pivots ) and that’s it. 2 trades. Or even that one trade short from morning would have made a killing with a one lot or more.

So, if you trading ES, the best way to use SP500 guru is options and take his levels are good areas but don’t necessarily take his calls in between. 1 pt stop getting blown out with this volatility. Usual market ( ES 20-30 pt range not 50-60-70 ranges ) you can take this calls with 2.5 pt stop. I don’t use 1 pt, though it does work sometimes, but I’ve been in his room with volatility days for the last 3 weeks and he mostly trades options and he does say when so much volatility thats the best. Once the market settles I trade his 1 pt stop call but use 2.5 pt stop. I use another person to verify trades and I’m looking for 1 more as well.

I don’t know if he trades futures but its rare. He posts constantly and there are hardly anyone else posting or asking questions. A trader his not posting constantly. He got his 2-3-4-5 fan followers who say G is the best thanks G and he takes credit on stuff when he should not.

I’m trying to get a caller who can trade the 1-2 trades a day…basically Hi to low or low to high. Sideways days is a range. G is not this caller. If it breaks out of a pivot he says it going to the moon and then if it comes down and breaks down from this and another pivot below he says it going way below.

He loves to use the term valid, but you cannot make money on something being valid. It has to hit.

So, I think he has merit as a caller, but there are many. His merit is in his option calling play. He’s not a great day trade in futures imho, because if he was he would not need any of us. If his options play daily were making a killing he would not need any of us.

I’ll be in his room till the end of the year an decide. So, far for daytrading purposes trading futures I rate him a C at best so far. I give him the due as Volatility has been huge. But this goes away in next 1-2 weeks we return to normal, I’ll rate him then again.

Again, a great caller would know today that 2666/2667 area is extreme resistance and the call should have been short 2655-2658 area to trade down to major support of 2705-2700. That’s it. But once it went lower and he took credit for his resistance 2658 target 38/35. Well the price was at 2746 and the low was at 2699.50.

Hope this helps.

Chris

If you’re trading only ES and want good areas try eminiplyer.net.

He is offering also a good trading plan for the RTH ahead.

MillionDollarMan

Thanks for that updated review! It is similar to what my friend told me. You cannot rely on G to call out specific entries and exits, that’s not what he does. He calls out areas. My friend had his style of trading and G helped him get in good areas and avoid bad ones which is why he said G’s room was well worth the money while he was in it. G’s room would only help someone who has their own trading style and is looking for an additional edge. There isn’t any hand holding. If you are looking for someone to call out all of your entries and exits then join Traders International so they can bleed you dry with their losing system (here is my review on their piece of sh!t company: https://evancarthey.com/should-you-join-the-traders-international-trading-room/). Your review confirms how I viewed his trading room. Thanks again.

You are on point about every single trading room in existence. IF the person calling out the trade was so good then why have a trading room? Why not trade for yourself and make $10,000, $20,000, $50,000 or $100,000+ per day?

Al

What is your friends name who reverse engineered his calls that allowed to double his profits?? Why is your friend not in the room??

I took a subscription from SP500guru.com in 2007 and found him to be arrogant and if you ask questions he gets mad. He only had the monthly plan back then at I believe it was U.S. $250 a month. There was no option or gold plan or daily plan. I found out about him in the futures magazine( don’t waste your time reading these magazines or stocks and commodities…they are useless).

Back then his ad was 1 point stop. Enter and Exit Target and time frame ( 45 minutes or 90 minutes). When I was in his room for a month he never gave a time frame. I asked a lot of questions and he and others would get upset and then I quit. Back then he posted his daily results. He changed that to post sporadic random results about 5 or 6 years ago.

His been around a long time and I don’t think its because of his trading. You only need one market to daytrade and I started doing this in 2005 on the ER2 ( Russell 2000) which was $10.00 a tick and $100 a point. It was wild and you could make $500 in 5 minutes. Now the its back ( from 2017 July on CME, RTY and $5.00 a tick $50.00 a point) and Its much better.

He did give daily globex support and resistance numbers. His 1 pt stop is ridiculous and he would argue with you saying he never got stopped out. He changed it and you did not hear him. It’s impossible to daytrade the ES with a 1 pt stop consistently. Impossible. And October 8 to Oct 12 2018 with so much volatility you be getting stopped out left right and center.

If anyone was in his trading room during the last week they should give their experiences.

I’ll see If I can get a one day free trial for the 15th of this month ( October ) and then fill you in with my experience.

I daytraded ER2 from Ocober 2005- ( got into ES in early 2006 and YM off and on 2007/2008. Then in 2009 just concentrated on ER2.)- and saw it all. Been to all the chat rooms on Paltalk ( it was THE thing back then with the trade rooms)..Kingfish was a big name back then in these rooms, Naturus, ER2 trading room on and on. I went to webinars, different subscriptions and these people make money from selling their subscriptions. While some may trade….they income comes from the monthly subscriptions and they make some money trading. Most don’t.

Daytrading secrets: If you start daytrading. Trade one market. Avoid CL ( its wild ) avoid GC ( it wild ). ES is ver tricky and most times it chops and chops and chops and then its Pressure time and you did not see it coming. YM is good but it moves fast at $5 a tick. Never daytraded NQ. Don’t scalp. Look to take 2-3 days a day. Trade from Hi to low and look for 5 waves.

I would suggest start with RTY. Its not wild like 2005-2010 ( I stopped in 2010 after blowing 6 accounts each with mid 5 figures). RTY is easy to figure out ( watch ES ). I’ve seen ES move 1 tick up and down countless times in my daytrading journedy from 2005 and seen ER2 and RTY move 6-10 points. Go see the RTY charts last 3 weeks and compare to ES.

Never double down on a losing trade. Start with 1 contract. and 5 pt stop on RTY. If you got the high area correct then at most you will be in a 1.5 range from your entry. I do 2 contracts and sometimes add 1 more. I try to be in the 1 pt range from the high or low but mostly been 2 to 2.5. ES and RTY market makers will do this. They will miss their target by 2 ticks or 4 ticks ( ES and RTY) and then go up 4-5 points only to come back down with the hour to hit their target.

Biggest secret. The big boys trade by time not price. You see sometimes its coming to 12:00 est or 2 pm EST or 3 pm EST and you will see the ES market makers…zoon the price up or down. Every day they know where they are going and the price they need to be at and at what time. And they know the market map.

I Came back in latter part 2017 on demo for a whole year off and on ( avoid Pagetrader…used them in 2006.. and again early 2018. Scam. They trading room is the worst with Jerry F. I can smell a scam now).

All I’m missing is a market map. Tom Hougaard use to do this in 2009 for Er2, YM and ES and his maps were good, but did invert. I know the low or high areas everyday but like any trader trying to achieve Nirvana, you always want to confirm the area.

So I’ll be going live soon and will keep you posted. Will be dayrading RTY primarily and day swing ES with 1 contract from low to high with 5 pt stop

( Oct 7-12) you cannot use 5 point stop with 70- 80 point ranges. So swing at the high area in the 10 pt range and you know its going to drop 40 pts from there..which is the median…not the low and get out. Yes you may have a paper loss of $500 on 1 contract but its 10:45 am and you are at the 50%-61.8 % are and the market closes at 4:15 est. Oh yes they will fake you out likek silly…ES loves to do that.

Hope the above helps.

Will stay in touch

MillionDollarMan

Best wishes Al, thank you for the feedback.

My friend unfortunately has passed away who recommended the SP500Guru trading room. He left the trading room because he got all he could out of it and had his own style of trading that worked very well for him.

Comments are closed.