In this article Doug Casey lays out why he thinks gold could go “hyperbolic” in the not too distant future: https://www.zerohedge.com/news/2018-02-18/doug-casey-why-gold-could-go-hyperbolic. It is a very interesting article and one that I don’t disagree with. Let’s look at the charts as to why I think there is some resistance ahead if price continues to go up and then what price must do to go hyperbolic:

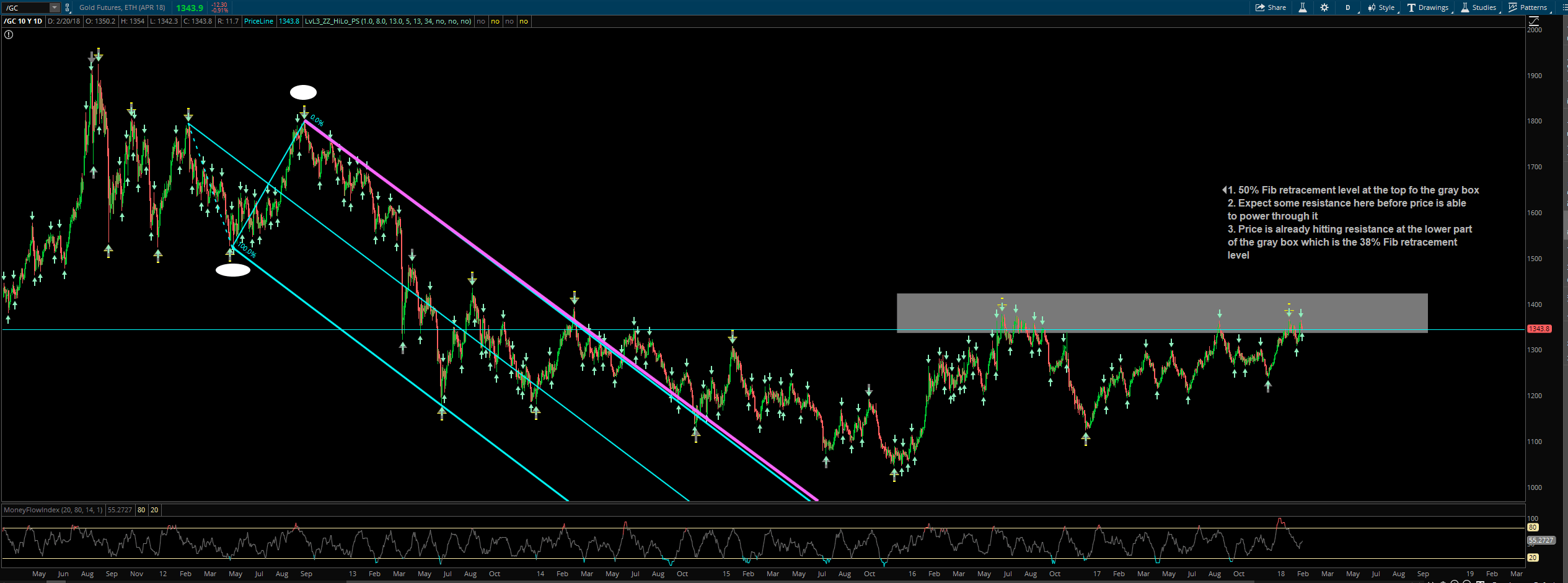

Current State of Gold

The 50% Fib retracement level is at the top of the gray box. Expect some resistance here before price is able to power through it.

Price is already hitting resistance at the lower part of the gray box which is the 38% Fib retracement level and is stalling out there. It is only a matter of time before price goes through it but does that mean that a move straight up will happen?

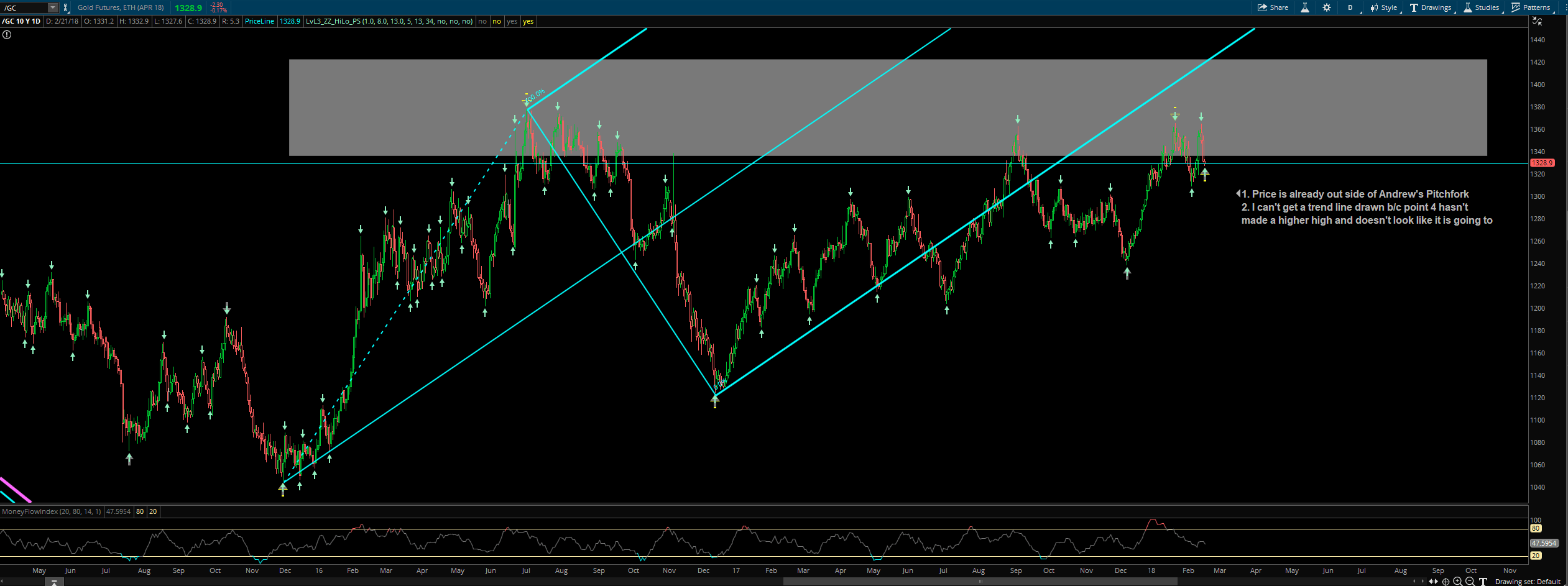

A Hyperbolic Move Imminent?

Price is already out side of Andrew Pitchfork’s line which is a sign that this isn’t the move that is going to go hyperbolic. It could make a huge move from there but when price is already outside of AP before the move begins then this move isn’t the move for it to go nuts. I can’t draw a trend line b/c point 4 hasn’t made a higher high and doesn’t look like it will so we can throw that out the window. From this current state a hyperbolic move isn’t going to happen.

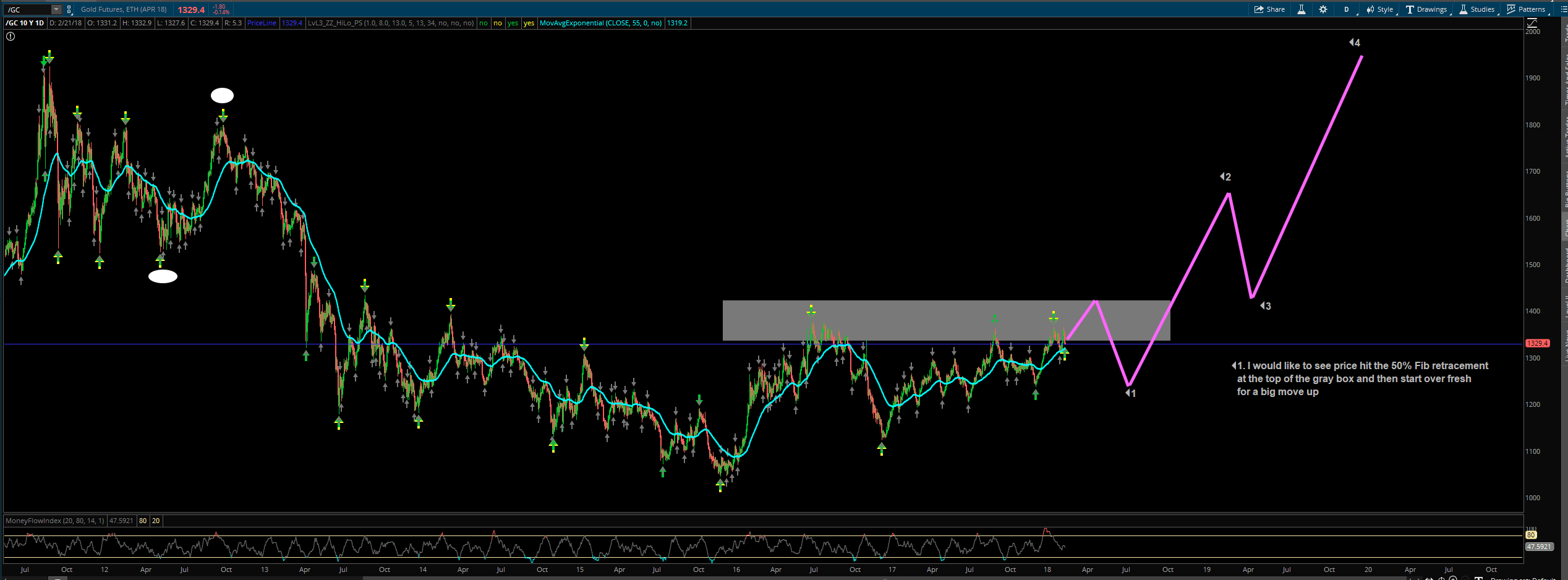

What Would the Next Move Look Like?

In my perfect world price would rise up to hit the 50% Fib retracement level at 1421 and that would signal it’s own retracement (how low I don’t know). Then after that retracement price begins its big move up that I have labeled with 4 points in the chart.

tl;dr

I would like to see price hit around 1421 to take out the 50% Fib retracement level and then retrace to signal the beginning of a big move up. I do think it can happen and if it does that is what I think the move will look like. There is still room to go long if you want until price hits around 1421 then I would get out of the long.