There are many people who make a living who go around touting the best penny stocks to trade. The sell their alerts for when you should buy and sell the penny stocks and since you can buy a large number of shares for not a lot of money then their reasoning is it only takes one big move to make you rich.

What they do not tell you is they have already purchased the penny stock and is pumping up the stock to their subscriber base. Since most penny stocks have a smaller number of shares traded) per day then big moves can happen very quickly with smaller share purchases taking place. This doesn’t happen in the blue blood stocks with high average daily volumes of shares traded such as Exxon, Google, Facebook, Microsoft, Amazon, etc.

After the person pumping up the stock tells their subscribers to buy the stock then it soon takes off. Little do they know that as soon as they rush in to buy and make the price take off that the person who told them to buy the stock is already selling it with a very nice profit.

Soon the price of the stock has taken off and everyone is trying to get in. That is when the selling takes place and anyone who wasn’t one of the first to purchase the stock before it took off is soon stuck with it because they can’t find anyone to buy their shares.

They complain but no one listens because they are drowned out by the original person pumping up the stock and a few others who were lucky enough to get in first.

Rinse and repeat.

Here is an in-depth article at how it works and why you should never get in on one of these schemes: https://www.tradingschools.org/reviews/tim-sykes/

From the movie “The Wolf of Wall Street” (affiliate link) this is what Jordan Belfort peddled as he started his career in swindling people:

Click here to the link to video if it doesn’t load below.

Luckily, the stocks I am going over are real companies and not the traditional penny stocks that have no market value.

I am giving you the precise entries and exits to look for if you are thinking about trading any of these stocks. Most articles just give “buy or sell” recommendations. I give the exact entries and exits to look for.

The Investopedia Penny Stock Article

Investopedia came out with an article recently about the best penny stocks to trade in 2019. Here it is: https://www.investopedia.com/updates/top-penny-stocks/

These are the stocks from the article we are going to review using the technical analysis I use to trade the markets. The stocks are not pink-sheet stocks. They are all traded on the major exchanges and are real companies.

Here are the 6 stocks:

This one is troubled and hyper-risky – advanced investors only please. One of the most profitable times to buy anything is when sellers are capitulating. The mobs are dumping shares with reckless abandon, shareholders can’t get far enough away from the stock, and babies are being thrown out with the bath water.

Along with almost every other stock based in Argentina, Grupo Supervielle S.A. (SUPV) cut about in half on Aug. 11. In fact, the entire overall market declined alarmingly, in what was nearly the largest single-day market decline ever, anywhere.

Having dipped just below $5 per share in the last few weeks, TAT Technologies Ltd. (TATT) is technically only recently considered to be an official penny stock. Shares in this company were as high as $12.50 a few years back, and since then, there has only been decline.

Endologic, Inc. (ELGX) develops and manufactures minimally invasive treatments for aortic disorders (stents and other specialty devices). All things medical are much more likely to hold up well during any kind of economic tremors or recessions, since people typically prioritize health over finances.

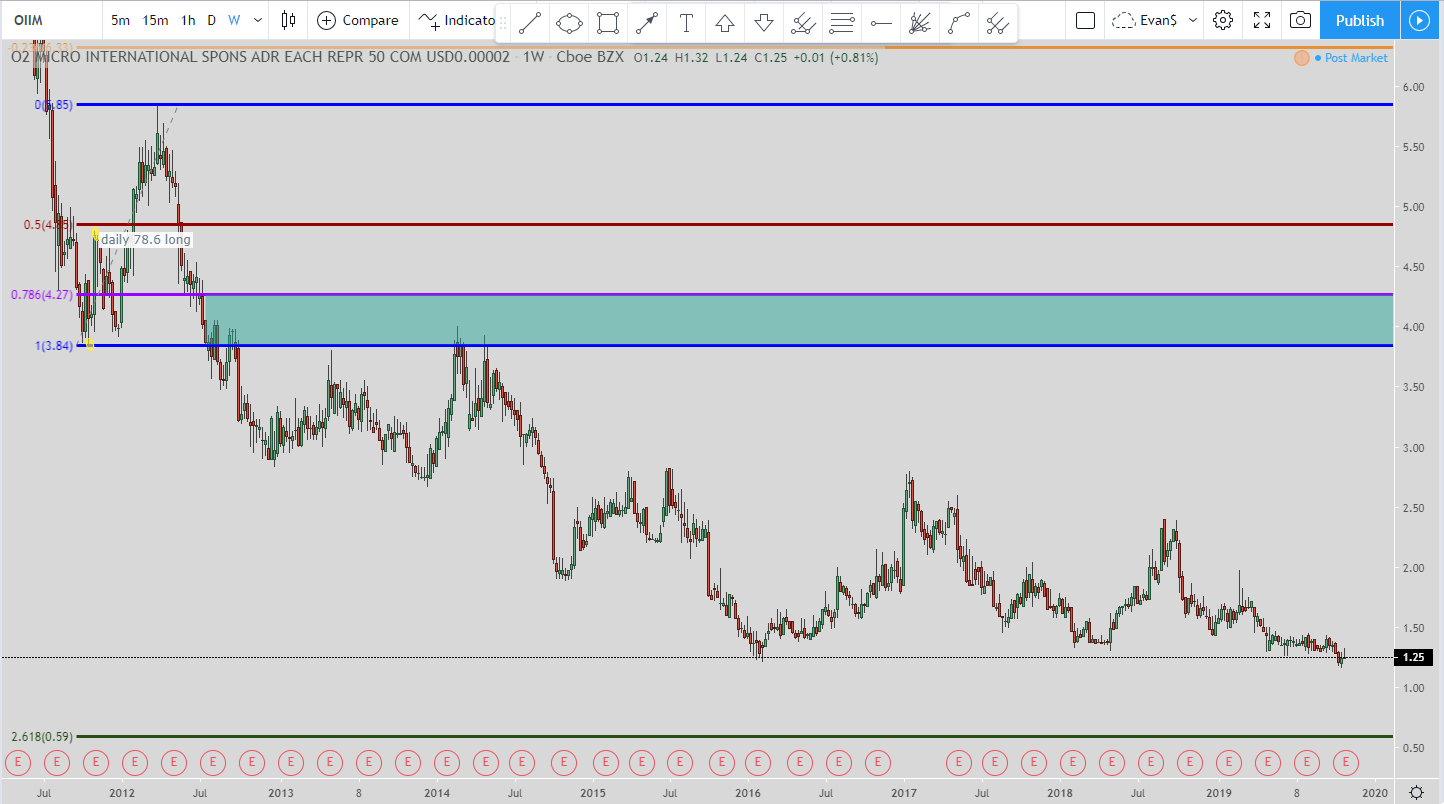

O2Micro International Limited (OIIM)

O2Micro International Limited (OIIM) has made a name for itself in high-performance integrated circuits and solutions. Granted, many of the company’s products are parts used in computers, automobiles, and consumer electronics, all of which may get hit by the recession.

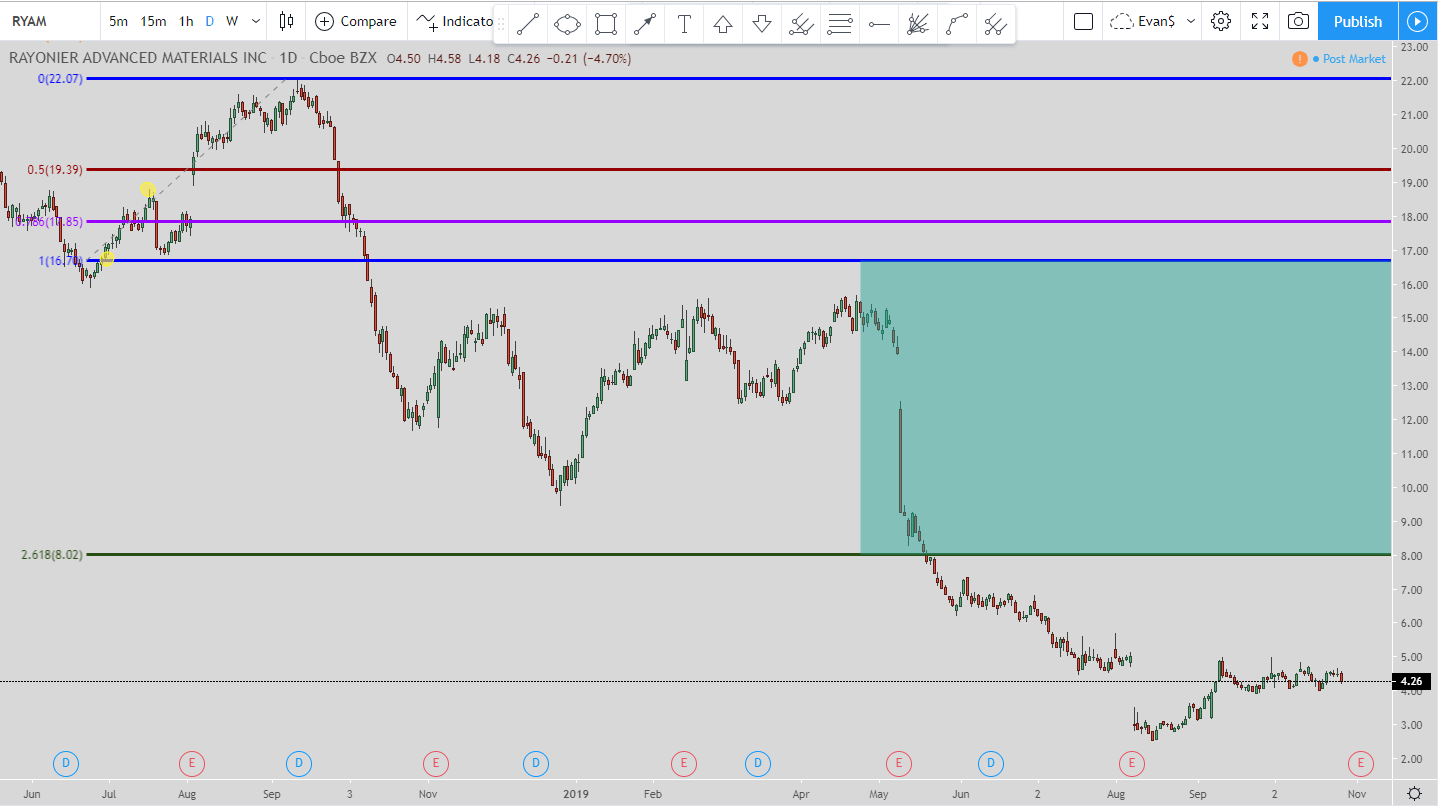

Rayonier Advanced Materials Inc. (RYAM)

Rayonier Advanced Materials Inc. (RYAM) engages in the production and sale of cellulose specialties. Its products include high-purity cellulose, lumber, paper and pulp, and paperboard.

The Best Penny Stocks in 2019 Technical Analysis

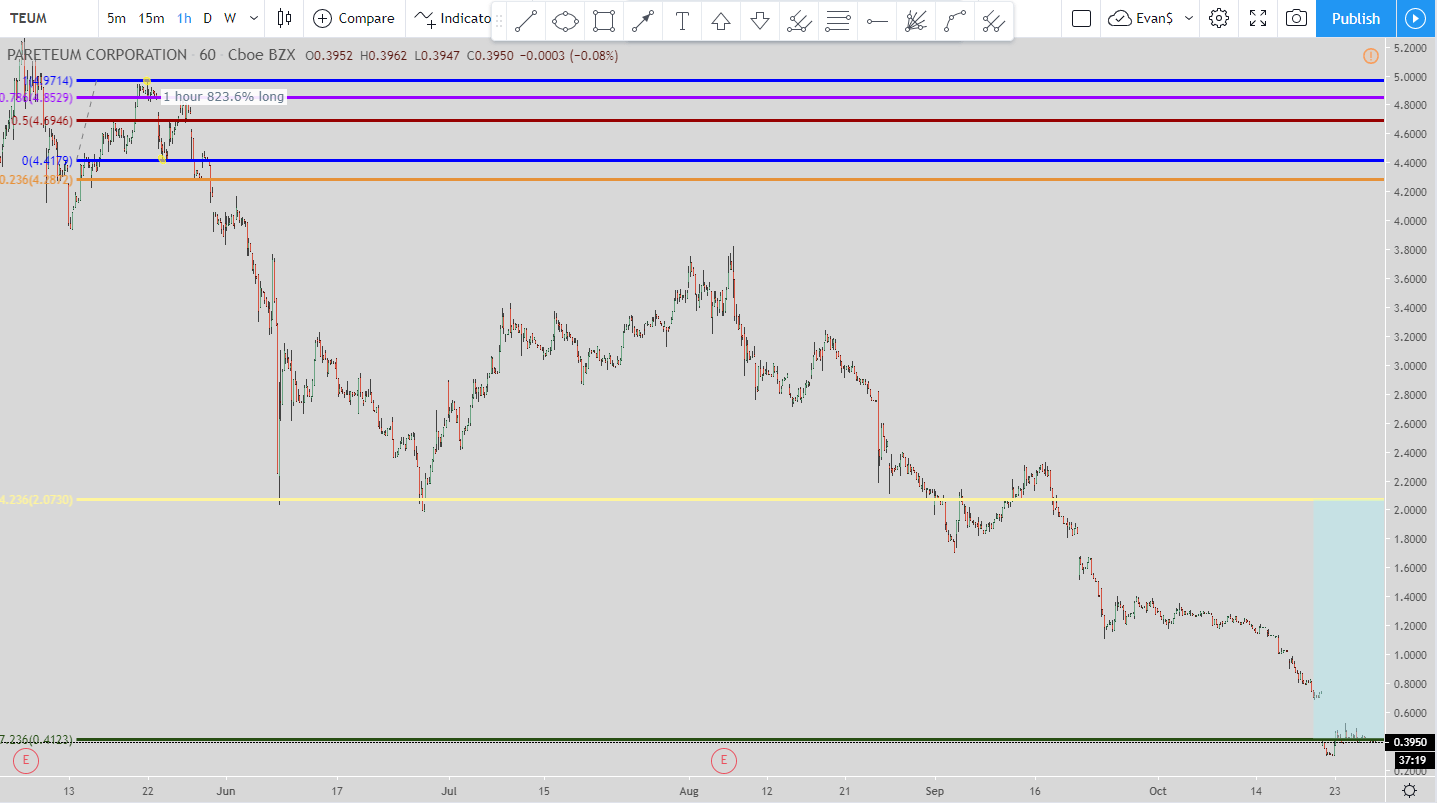

Pareteum Corporation (TEUM)

For the Parateum Corporation the setup we are looking at is a buy setup using the 823.6% setup.

The setup just initiated when price hit the 823.6% level (the green line) at $0.4123. This makes the exit at the 523.6% level (the yellow line) at around $2.073 cents.

The exit will not move from here because the next entry level is far far far down in the negative numbers.

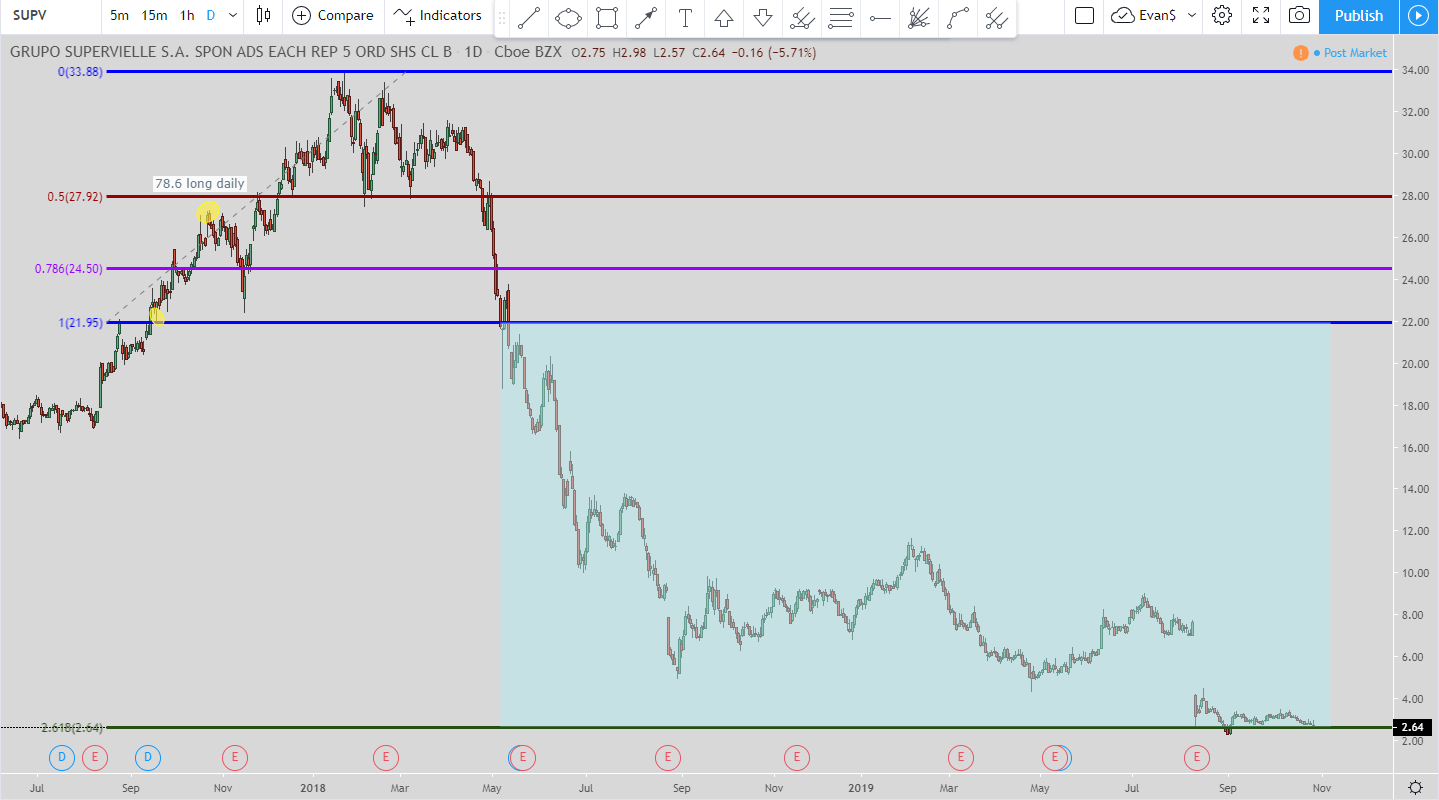

Grupo Supervielle S.A. (SUPV)

For the SUPV stock we are looking at the 78.6% long setup using the daily time-frame chart. The setup was initiated when price hit the 78.6% Fibonacci line (purple) at $24.50. But then price blew through there and hit the 100%.

But the price wasn’t done going lower and has gone all the way down to the 261.8% Fibonacci extension level (the green line) at $2.64. So when the price hit that level then it moved the price to the 100% level (the blue line) at $21.95.

The big issue with this stock is Argentina. Their country’s economy has been down and out for awhile now and they are holding elections today (as I type this) so there is uncertainty regarding who will become the next President.

If you think that all of the negative press for the country of Argentina has been priced into this stock then this could be a home run if Argentina recovers economically.

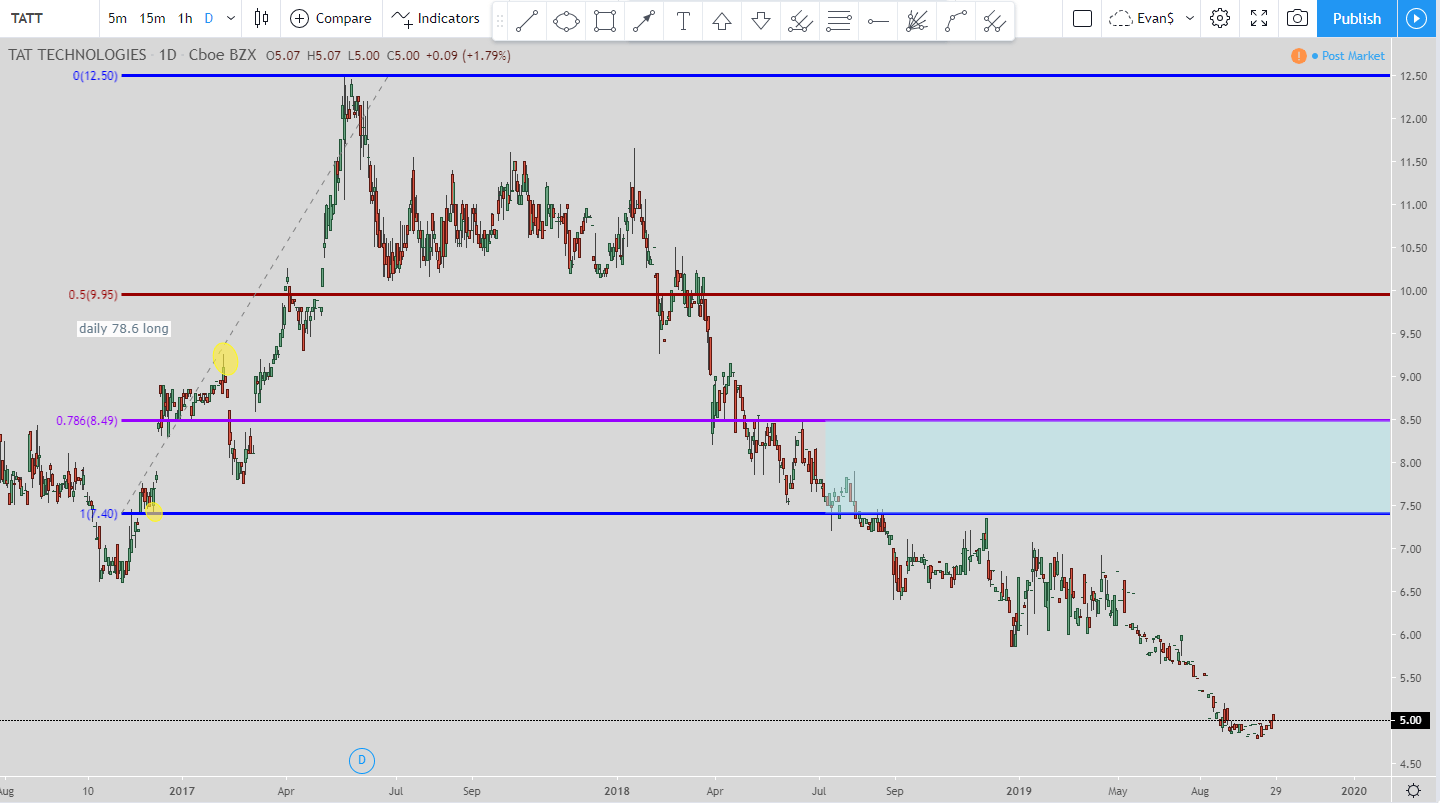

TAT Technologies Ltd. (TATT)

For TAT Technologies we are using the 78.6% long setup using the daily chart for the time-frame. This trade was started when the price hit the 78.6% line (the purple line). But the price kept going lower and then hit the 100% line which moved the exit from the 50% line (red line) to the 78.6% line (purple line) at $8.49.

So that is where the current exit is located, at $8.49.

The exit won’t move again due to the fact that the next entry level is in the negative dollar level which is why the exit won’t move again even if the price continues to move closer to $0.

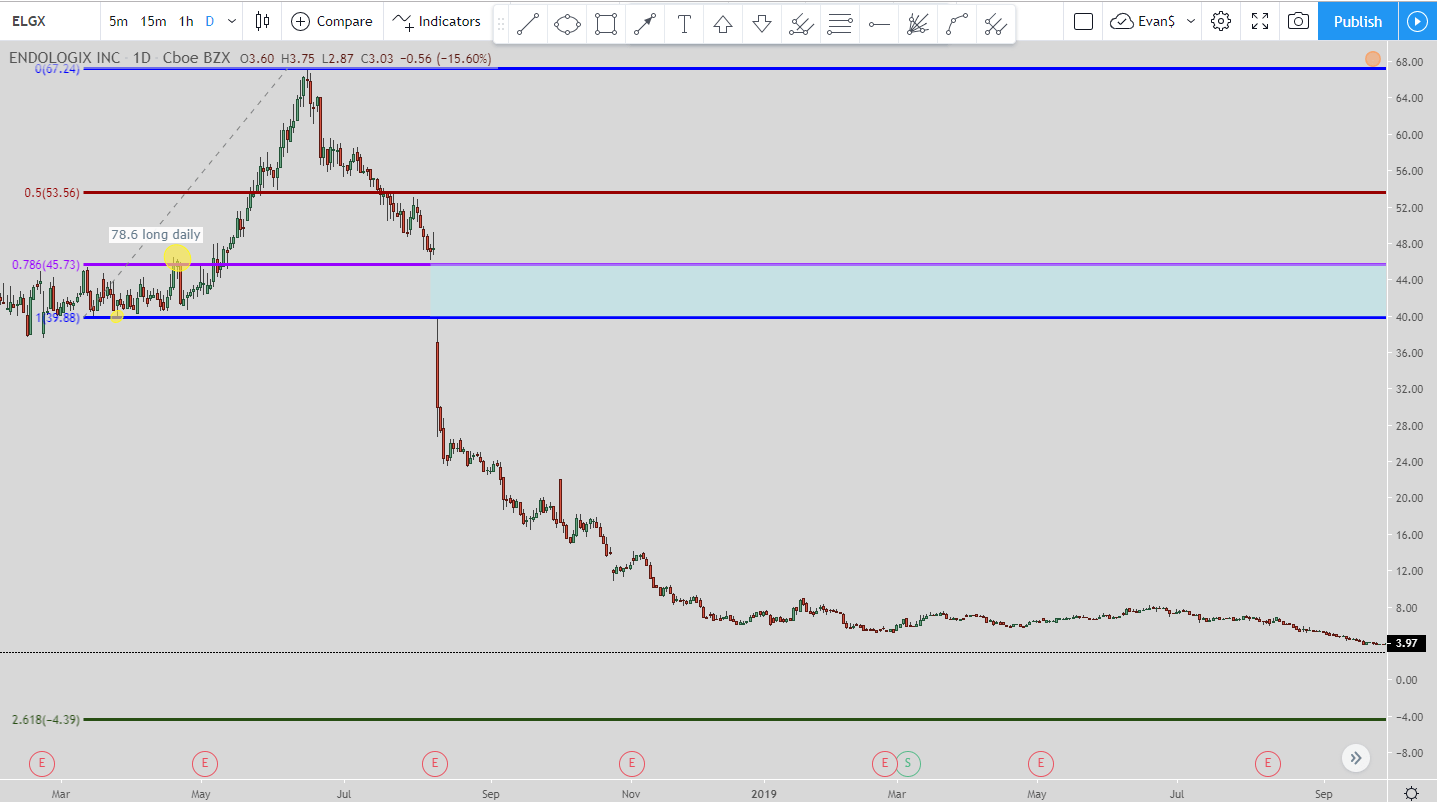

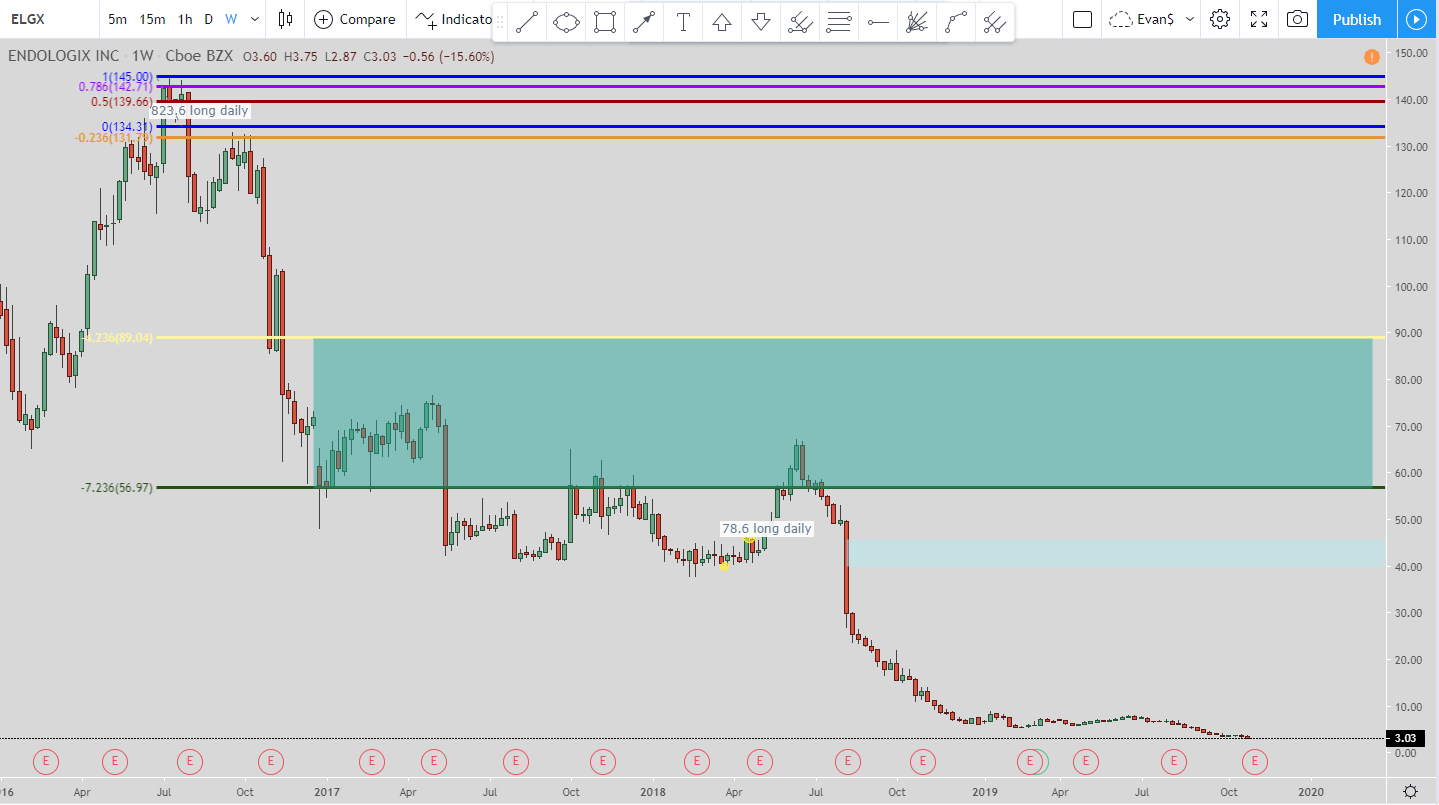

Endologic, Inc. (ELGX)

I’ll be honest. The technical analysis for this stock looks like absolute dog crap. This is one I wouldn’t be touching at all. But like I said I will give precise entries and exits for each stock listed and for this one there are two that I spotted.

Anytime you see a stock take a nose-dive down and then flat-line close to zero is usually a sign of things to come. And the things to come means bankruptcy.

The first setup is the 78.6% long using the daily chart. The entry initiated when the price hit the 78.6% line. But on the same day the stock tank and blew through the 100% Fibonacci level as well and that moved the exit from the initial 50% exit to the 78.6% purple line.

That is where the current exit is located, around $45.73. The exit will not move form here.

The reason why is because the 261.8% Fibonacci extension level is in negative territory so it cannot be hit and therefore have the exit move to the 100% level.

The second setup is using the daily chart again. In the picture I am using the weekly chart because I needed to zoom out in order for the bars to not be super small.

This is using the 823.6% setup and is a long (buy). The buy initiated when the price hit the 823.6% level (the green line) at $56.97. That makes the exit the top of the green box at the 523.6% level at around $89.04.

The exit won’t move from here because the next level at 2,223.6% is in negative territory so it will never be hit and therefore the exit level will not move again.

If you want to gamble then this is the stock for you. So if you have some money that you don’t mind losing at all then this is the stock to gamble with because if it does make a rebound then the exit levels would produce tremendous gains.

O2Micro International Limited (OIIM)

For O2Micro International Limited we are in a 78.6% long setup. The setup initiated when the price hit the 78.6% level but soon went through that and hit the 100% level (the blue line).

This made the exit move to the 78.6% from the 50% level so the current exit is at $4.27 which I also labeled at the top of the green box.

But the exit could move one more time. If the price continues to move lower without hitting the current exit of $4.27 and goes down and hits the 261.8% Fibonacci extension level at $0.59 then we would move the exit to the 100% level (the blue line) at $3.84.

So if you think that O2Micro can turn things around then this would be a good area to start scaling into the stock because right now the exit is at $4.27 and at worst the exit would only move down to $3.84.

Rayonier Advanced Materials Inc. (RYAM)

Rayonier Advanced Materials Inc is in a 78.6% long setup. When price hit the 261.8% level (the green line) then that moved the exit to the 100% level (the blue line) at $16.70.

I won’t go over the previous entry and exit levels because they are not valid anymore so it would be a waste of time.

What is important is the current exit level and it is at $16.70. Even if the price of RYAM goes lower the exit will not move again.

This is another stock where if you believe it can mount a turnaround then the rewards could be great.

Video for the Best Penny Stocks in 2019

Video coming tonight!

My View on Penny Stocks

Penny stocks and basically most stocks under $3 are a big risk. In my opinion they are there for a reason. Usually the reason is because their company has been doing horrible and it is going to take a major turn-around for the company to survive.

Plus, when stocks get under $1 then they can be delisted from the stock exchange they are on and that takes out a lot of volume because then banks and institutions won’t touch them. It ranges from one exchange to the other but that is the general idea.

Here is an article that goes into detail on how a stock becomes delisted:

The criteria to remain listed on an exchange differs from one exchange to another. On the New York Stock Exchange (NYSE), for instance, if a security’s price closed below $1.00 for 30 consecutive trading days, then the exchange would initiate the delisting process. Also, exchanges charge annual listing fees that companies must pay to stay listed. Beyond that, there are also significant legal and compliance costs associated with a company’s listing.

In addition to the price and fee criteria, the major exchanges also monitor market capitalization, shareholders’ equity, and revenue, but the price criteria are most common.

From the TradingSchools.org article I linked above, their sentiment on most penny stocks is how I feel as well:

Penny stocks investments is an oxymoron. There is no such thing as penny stocks investments. There is only “I lost all my money investing in penny stocks” and “my family is flat broke because I invested in penny stocks.”

If you trade stocks that are penny-stocks, meaning they are unlisted or have a super small daily trading average. Then be prepared to treat these as a gamble. They are definitely not an investment and cannot be considered a trade either.

So if you have that gamblers itch then set aside some money that you would have no problem losing because that is more likely to happen than you striking it big when trading unlisted penny stocks.

Conclusion

Hopefully this article showed the strategies I use when traded stocks that are even considered penny stocks. These normally aren’t stocks I look to trade but I know a bunch of people do trade them so I wanted to cover some of them.

Just please be aware that the money you put into penny stocks is really a gamble so you have to be prepared to lose with that money.

Do not ever trade penny stocks with money you need. That is a sure-fire way to ruin your life.

Most of the people touting penny stocks are selling you a service and even if they do trade penny stocks then they have it rigged so they are the first in and the first out while you get stuck with the crap stock that you cannot unload.

I do not own any of these stocks and have no plans to in the next 48 hours.

Penny stocks are volatile and can generate catastrophic losses. Price levels in this article are hypothetical and do not represent buy recommendations or investment advice. Keep in mind that it’s your responsibility to make trading decisions through your own skilled analysis and risk management.