In this article an analyst from Golman Sach’s predicts the GBP will fall another 25% by the end of the year: http://www.zerohedge.com/news/2016-10-13/goldman-warns-much-more-downside-come-pound-sterling.

Goldman Sachs Predicts the GBP to drop another 25%…………true or false?

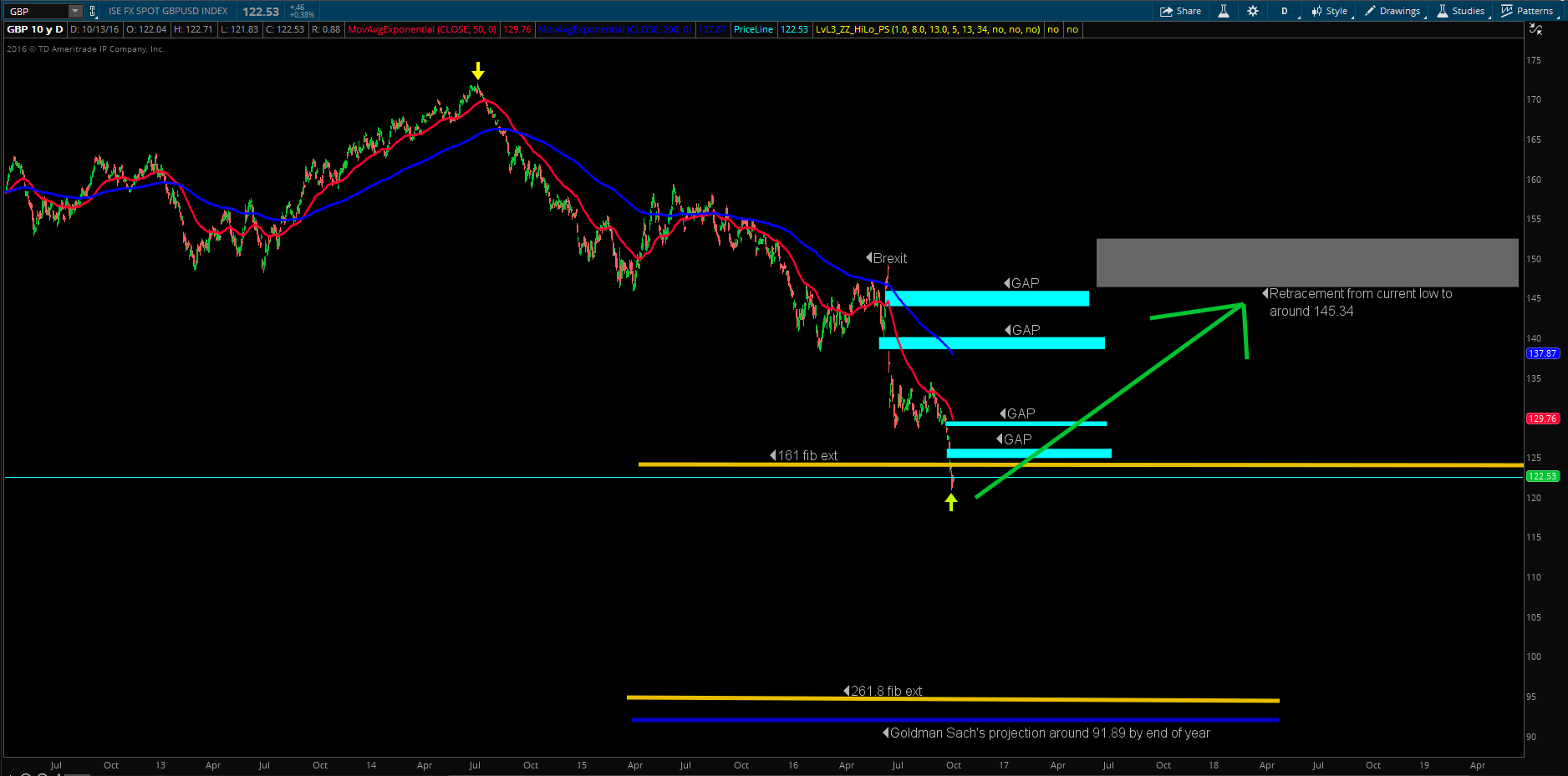

With the current price of 122.53 a 25% further fall would end up at 91.89. Let’s see what that looks like on my chart:

As you can see the blue line at the bottom is Goldman’s projection which puts it just past the 261.8% fib extension level. That projection is not out of the realm of possibility so it could happen but I want to talk about one chart pattern that may give us an additional clue to help make a definitive statement on Goldman’s projection and if we agree with it.

Do Gaps Always Get Filled?

I currently do not use chart patterns or candlestick formations for my analysis except for one (if you can call it a pattern). The mantra that “gaps always get filled.” When you see a gap there is over a 90% probability that price will come back and fill it. Don’t believe me, read this article: http://bioequity.org/2013/11/13/statistics-do-stock-price-gaps-always-get-filled/.

In the chart I posted above it is a daily chart and you can see 4 large distinct gaps that I marked in whatever blue that color is. (Edit: now the article has updated and the author says it doesn’t apply to downward gaps)

Since there is over a 90% probability that one gap will be filled then it makes it even more likely that 4 gaps in the same area stand a good chance of being filled. If the price stays at the current swing low then the 50% retracement would take it just up to the top of the uppermost gap.

The factors we have regarding an imminent retracement to around 145.34 are that the GBP is already overextended at the 161% fib level, there are 4 large gaps above it that need to get filled, and the 50% retracement lines up perfectly with the top of the uppermost gap.

Also, in this article, I also noted that the bottom was just about in for the GBP for the near future due to where the GBP/JPY price is located: https://evancarthey.com/update-gbp-bottom-98/. Due to these factors, I am making the prediction that the GBP will go up to around 145.34 which would put it around pre-Brexit levels. If the price does drop by another 25% from the current low then it will only do so after it goes to at least 145.34.

What could be the factors that influence the rise in the GBP? My guess would have to be that they announce soon a super soft-Brexit or there becomes a lot of smoke that Brexit won’t go through at all. Who knows, but one thing I do know is that the charts predict the news.

Popular Links

Here are a couple of links if you are looking at how I view the market and some trade setups. You can create your own trading style and setups. Quit paying losing traders to teach you. The only thing they teach is how to lose money.

My Robinhood Shameless Plug

If this post benefits you and if you haven’t used Robinhood for trading stocks but are thinking to then please consider using my referral link when you do sign up: http://share.robinhood.com/evanc203.

This way each of us will receive a free share of a random stock if you sign up through my referral link.

My Robinhood Review: https://evancarthey.com/review-robinhood-trading-service-with-no-fees-part-1/