If you have ever ridden on a commercial airline then the chances are good you have ridden in a plane built by Boeing.

They are an American company that is best known for producing commercial planes.

The Boeing Company (/ˈboʊɪŋ/) is an American multinational corporation that designs, manufactures, and sells airplanes, rotorcraft, rockets, satellites, telecommunications equipment, and missiles worldwide. The company also provides leasing and product support services. Boeing is among the largest global aerospace manufacturers; it is the second-largest defense contractor in the world based on 2018 revenue,[6] and is the largest exporter in the United States by dollar value.[7] Boeing stock is included in the Dow Jones Industrial Average https://en.wikipedia.org/wiki/Boeing

For the majority of this post, I am going to focus on the technical side of their stock chart but I will also dive into a little news and fundamentals because those play a huge role in what has happened to their stock recently.

What to Look for with Boeing’s Stock?

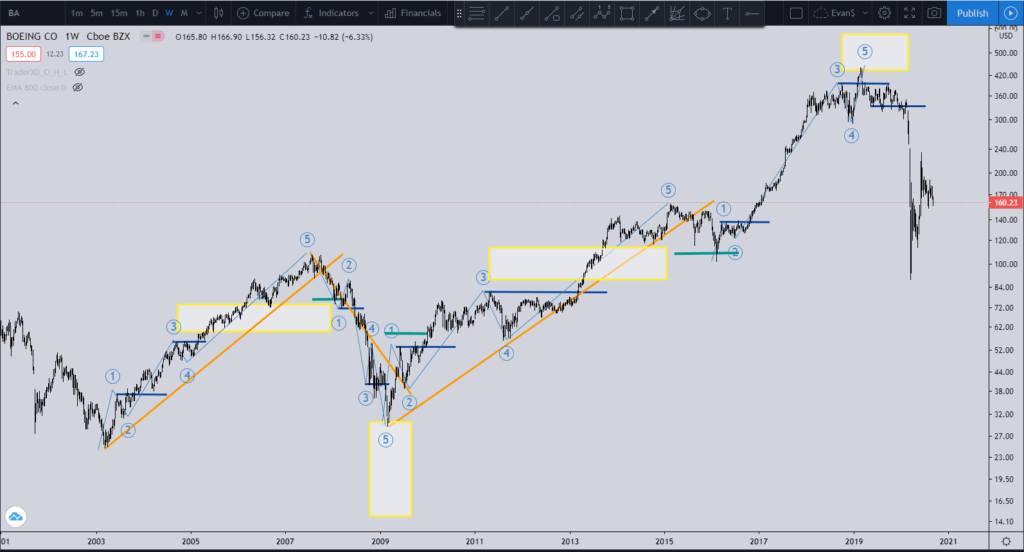

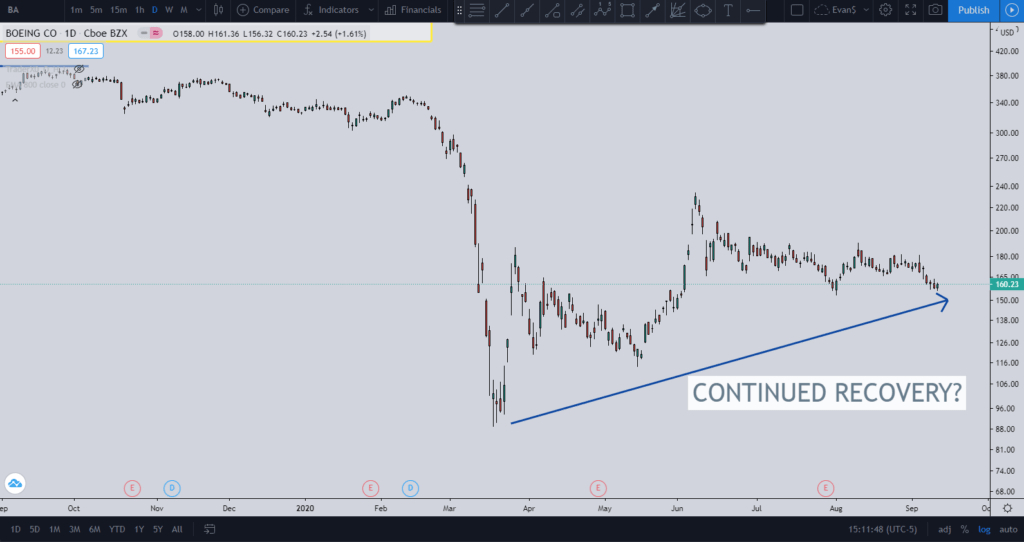

The chart above covers the past 20 or so years for Boeing’s stock. In the video that is later in this post, I’ll go into detail regarding the long-range move of Boeing and how it got to where it is today.

You can see how there were 5-wave Elliot Wave moves started way back in the early 2000s that have led us to the stock’s current point in time.

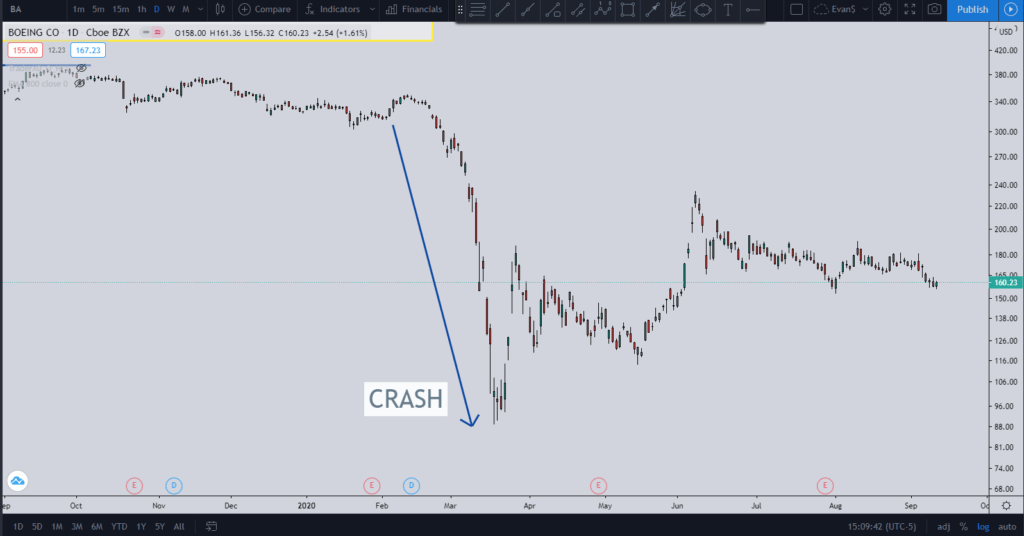

But now with the Coronavirus pandemic and several other factors, it has severely hurt the price of Boeing’s stock as you can see from the chart above.

So the main question I am looking for in this chart is, “Are we in another 5-leg Elliot Wave move to the downside?”

What Has Contributed to the Drop-in Boeing’s Stock?

The biggest factor is the Coronavirus pandemic. With global travel being halted and not recovering very fast it has crippled the demand for air travel.

However, even if air travel demand returns to near 2019 levels over the next couple of years, that doesn’t mean Boeing’s business will go back to normal. That’s because growth — rather than replacement demand — typically drives the vast majority of aircraft purchases.

Between 2015 and 2018, nearly 70% of commercial jet deliveries went to support airlines’ growth, with the rest used to replace older jets. If airlines buy only enough jets to replace those they retire over the next few years (which would be consistent with returning to 2019 traffic levels by 2022 or 2023), it would imply demand 60% to 70% below recent levels. https://www.fool.com/investing/2020/06/13/should-you-buy-boeing-stock-while-its-on-sale.aspx

But also a big issue they face is their 737 MAX airplane. It has been put on hold due to two fatal crashes. This has caused over 350 of their 737 MAX’s orders to be canceled.

Boeing Co customers canceled orders for 355 of its 737 MAX jets in the first half of 2020, the U.S. planemaker said on Tuesday, as the damage done by the jet’s grounding and the coronavirus crisis to the airline industry continued to mount.

The planemaker, which has now been striving to get its once best-selling MAX planes back in the air for more than a year after two fatal crashes led to its grounding, said airlines and leasing companies canceled another 60 orders for the jet last month.

Deliveries in the first half of the year also sank by 71% to just 70 planes as customers canceled or deferred shipments due to the collapse in air travel from coronavirus-led travel restrictions.

Deliveries are financially important to planemakers because airlines pay most of the purchase price when they actually receive the aircraft. https://www.reuters.com/article/us-boeing-deliveries/boeing-737-max-cancellations-top-350-planes-in-first-half-of-2020-idUSKCN24F20H

Should you Buy Boeing’s Stock in 2020?

So with the bad news coming in spades do we think the charts are showing a continued recovery for Boeing’s stock price?

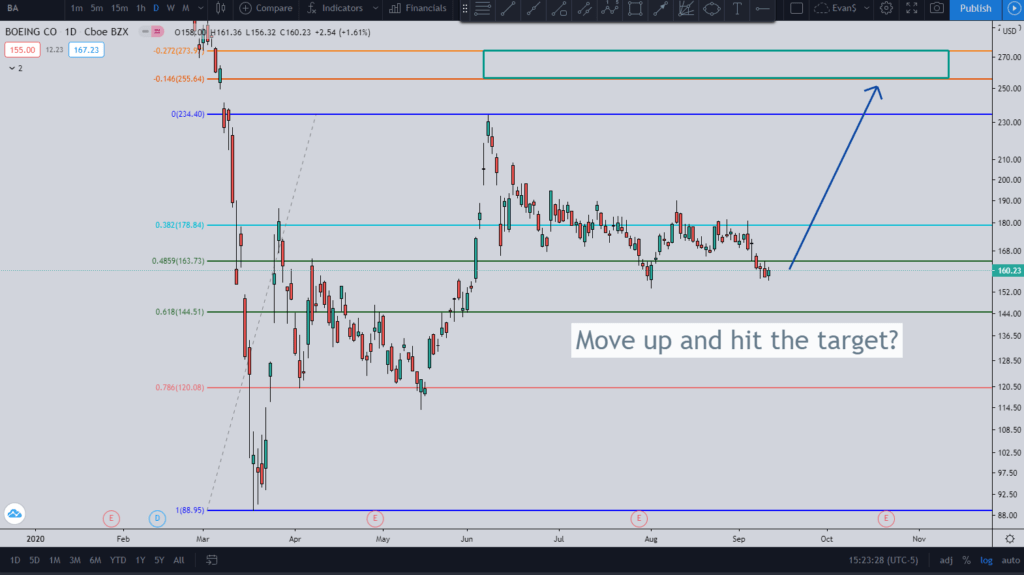

As you can see from the chart above that the stock recovered from the lows of around $89.00 to where it currently sits at $160.23. It did hit a high of $234.20 but has trended lower ever since that point in time.

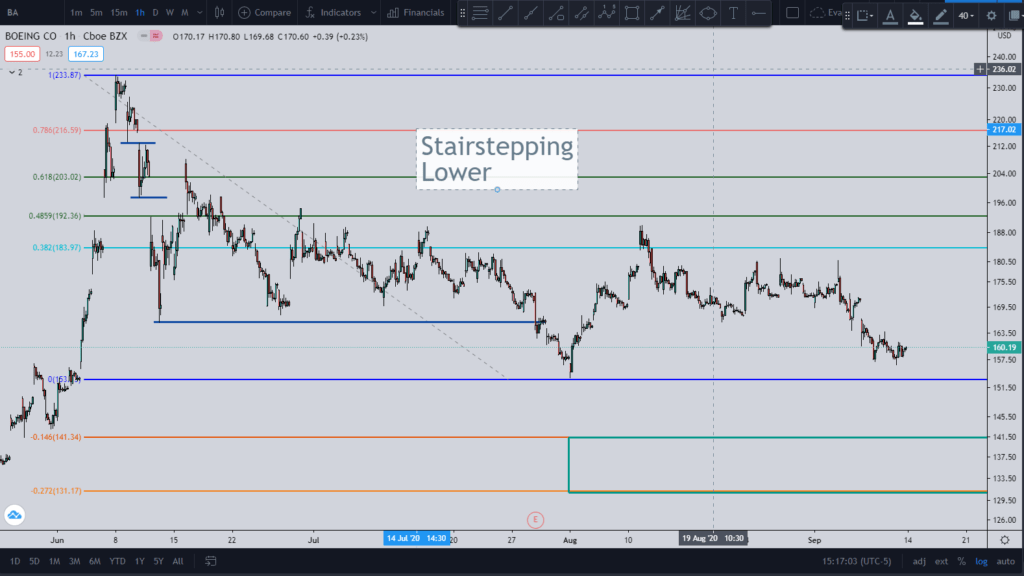

In the chart above we are looking at the 1-hour chart. The blue lines on the chart are the pivot point lows where the price reversed up from and hit at least the 38% Fibonacci retracement level before going back down and hitting its profit target which is the 1.46% Fibonacci extension level.

That has taken us to the current point in time where the next price target we are looking for to the downside is $141.34. If the price continues its move lower then this is the next price level we are looking to hit.

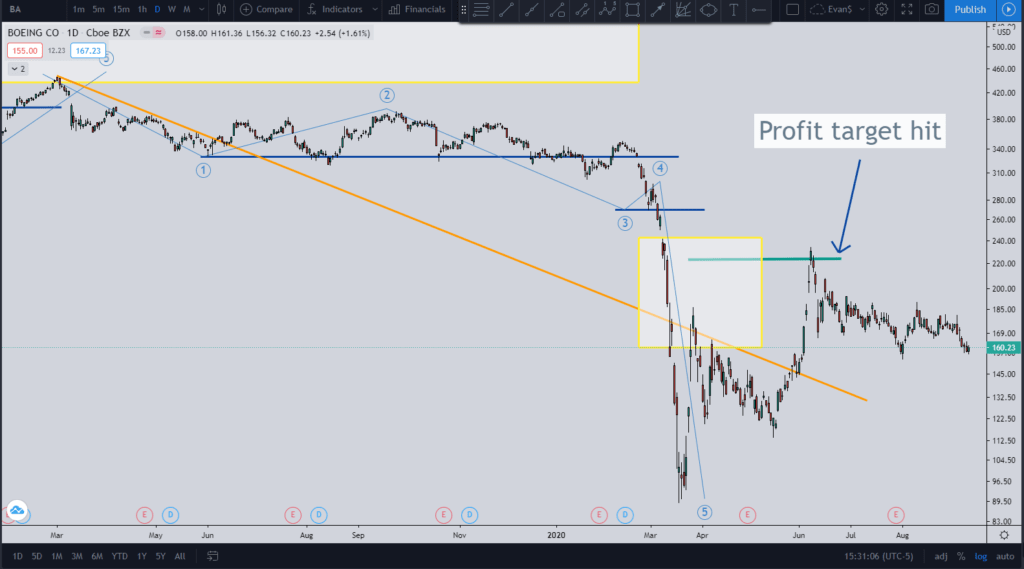

If you are looking at going long then we are in the middle of a long setup from the picture above.

The price retraced to at least to the 38% Fibonacci retracement area which signaled this long setup. The price is currently around the 50% Fibonacci retracement area.

The target area we are looking for is around $255 which is signaled by the green box in the picture above. So if this setup works out then that is the price target to look for.

It is also interesting to note that there is a gap just before the price target would be hit which can help lead to be another positive factor for this setup working because gaps love to get filled.

In the chart above it is a very messy 5-wave move. I’ll go into more detail about it in the video but the main point is that the price target has been hit which is the green line.

As you can see that after the price target reversal was reached the price has been trailing down ever since.

Video Review

If the video does not load below then CLICK HERE.

Conclusion for Boeing’s Stock in 2020

If I was going to buy Boeing’s stock then I would wait for the price to move down to around $140. This would complete the short setup I mentioned above and still be a valid long setup where the price target would be $255.

The main trade I look for is a 5-wave move but as you can see there are not any of them currently being presented in Boeing’s stock chart.

If you are a long term believer in Boeing then they do offer a 2.4% yield with their quarterly dividend of $2.055 (https://www.streetinsider.com/dividend_history.php?q=BA).

This is a nice bonus because you would at least collect their quarterly dividend as you wait for the stock price to recover from the Coronavirus pandemic and the setbacks from their 737 MAX airplanes.