Bitcoin Price Prediction for 2023: What Experts Say About the Future Value

Want to know what experts are saying about Bitcoin‘s price prediction for 2023? Look no further because this article will give a no-hedge prediction.

Predictions range from bullish to bearish, but all agree that Bitcoin’s future is uncertain. Some insiders believe that BTC could test new highs in 2023, while others predict a continued decline.

I am on the bullish side.

Bitcoin’s price has been volatile in recent years, with highs and lows that have left investors wondering what the future holds. Some experts predict that Bitcoin’s price will continue to rise, while others believe that it will fall. The truth is that no one knows for sure what will happen in 2023, but there are some factors that could influence Bitcoin’s price.

Factors such as macroeconomic conditions, government regulations, and the adoption of Bitcoin by institutions could all play a role in determining Bitcoin’s price in 2023.

Whether you’re a seasoned investor or just getting started, it’s important to stay up-to-date on the latest news and predictions surrounding Bitcoin’s price.

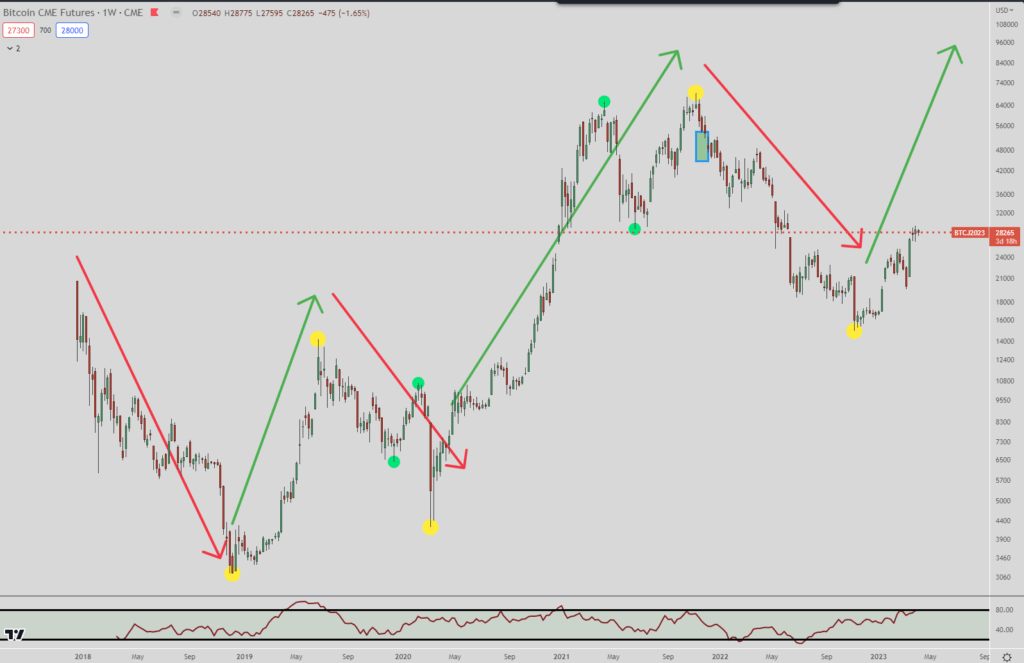

In the image above you can see how since the futures contract was created for Bitcoin that the price has gone down, then up, then down, then up, then down, and now it looks like it is headed up again to new highs.

This has setup Bitcoin for a 5-wave Elliot Wave move that I will discuss below.

Current Bitcoin Price

As of 2023-04-03, Bitcoin’s price is $27,755.93, increasing by 0.35% in the past 24 hours.

The recent price action in Bitcoin left the tokens market capitalization at $536,416,254,084.86. According to CoinCodex, the value of Bitcoin is predicted to rise by 0.25% and reach $28,486 by April 7, 2023.

Bitcoin recorded 15/30 (50%) green days with 11.42% price volatility over the last 30 days.

It rose roughly 21% in March, despite a turbulent last two weeks in which markets teetered at times but always seemed to snap back above the $28,000 threshold.

Professor of Finance at Sussex University, Carol Alexander has called for a $30,000 Bitcoin price increase in the first half of 2023, eventually hitting $50,000 by the end of the year. https://www.techspot.com/news/97629-bitcoin-hits-highest-price-since-august-despite-regulator.html

Given her background, Alexander’s predictions are taken seriously by many in the financial community.

Factors Affecting Bitcoin Price Prediction for 2023

Several factors can affect the price of Bitcoin prediction for 2023. Understanding these factors can help you make informed decisions about investing in Bitcoin.

One of the most significant factors affecting Bitcoin’s price is supply and demand. Bitcoin’s supply is limited, and as more people want to buy it, the price can increase. Conversely, if there are more sellers than buyers, the price can decrease.

Another factor that can affect Bitcoin’s price is investor sentiment. If investors are optimistic about Bitcoin’s future, they may be more willing to buy, which can drive up the price. On the other hand, if investors are pessimistic, they may be more likely to sell, which can decrease the price.

The sentiment comes down to fear and greed. When investors are fearful then they sell. When they are greedy then they buy.

These two emotions are the dominant emotions that control all traders’ actions to some degree. If you would like to read further about how to control your emotions in trading then check out these articles:

Regulation can also affect Bitcoin’s price.

Governments and financial institutions around the world are still figuring out how to regulate Bitcoin and other cryptocurrencies. They want to control it because they want to know what and how we are spending our money.

If regulations are favorable, it could help increase demand and drive up the price. However, if regulations are unfavorable, it could decrease demand and drive down the price. I’m on the bearish side of this one. I don’t see how the government could help Bitcoin at all.

Finally, the overall state of the economy can also affect Bitcoin’s price.

If the economy is doing well, investors may be more willing to take risks and invest in Bitcoin. However, if the economy is struggling, inflation is rising, and the market is going down, then investors may be more cautious and less likely to invest in Bitcoin due to the fact they’ll have less disposable income to invest.

| Factors Affecting Bitcoin Price | Impact on Price |

|---|---|

| Supply and demand | The less Bitcoin available the more the price increases |

| Investor sentiment | Fear will make the price decrease and greed will make the price increase |

| Regulation | If governments adopt their own digital currency then this could cripple free-market cryptocurrency |

| Economy | A hot market with more money means more speculation |

Expert Predictions

Insiders predict that Bitcoin could hit a new all-time high in 2023 and possibly reach $100,000.

According to the latest Finder’s forecast, Bitcoin is predicted to peak at $29,000 in 2023: Bitcoin Finders Forecast 2023

Investor and long-time crypto supporter, Tim Draper, has revised his $250,000 prediction for the price of Bitcoin to hit in 2023. Bitcoin Will Soar to $250,000 in 2023, says Billionaire Tim Draper.

Experts gathered by Finder predict that Bitcoin will hit $29,000 in 2023 but forecast a low of $13,000.

Bitcoin’s value is predicted to rise by 0.25% and reach $28,486 by April 7, 2023.

According to experts, Bitcoin is in for a wild ride in 2023 which seems to be pretty much the same fo every year.

While some experts are optimistic about Bitcoin’s future, others are more cautious. I’m going to share my Bitcoin Price Prediction for 2023 now.

My Bitcoin Price Prediction for 2023

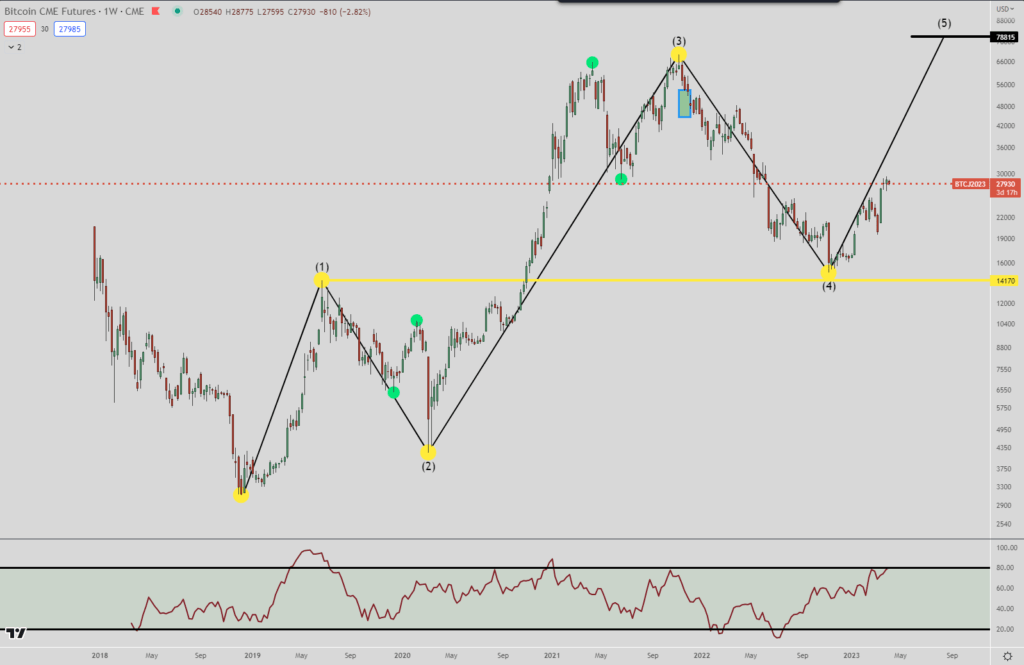

In the video above, my no-hedge Bitcoin price prediction for 2023 is that Bitcoin’s next move will rise to over $78,000.

Here is the chart below with my final Bitcoin price prediction for 2023 which shows the black line around $79,000. That is where I think Bitcoin is headed next.

This would result in almost a 2.5X move from where it currently resides.

This prediction would be invalidated if the price of Bitcoin goes under the yellow line which is at $14,170.

One of the main rules of the 5-wave Elliot Wave is that wave 4 can not cross into wave 1. So far it has not and is the main item to watch. If wave 4 does go under $14,170 then my prediction is wrong of Bitcoin hitting $79,000.

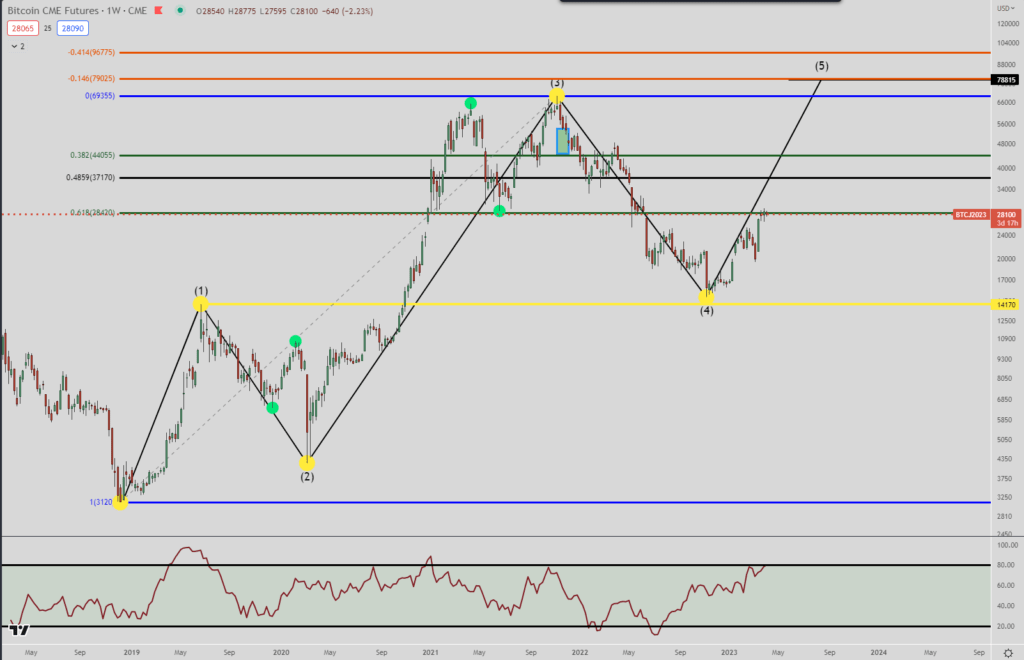

The reason why I have the target of $79,000 is that that is the 1.146 Fibonacci extension level from using points 0 and 3 from the chart below.

The 1.146 Fibonacci extension level is one of the main targets I look for in my trading, whether it is day trading, swing trading, or holding a position for a long time.

The price of Bitcoin can of course go higher than $79,000 but that is the level I look for in order for this 5-wave Elliot Wave move to be complete.

Potential Risks and Rewards

Investing in Bitcoin can offer both potential risks and rewards.

On the risk side, Bitcoin is a highly volatile asset. Its price can fluctuate dramatically in a short period of time. We will go over the charts for Bitcoin and you’ll see it goes from having a big rally to a big decline and then rally again.

This volatility can lead to significant losses for those who invest in Bitcoin without fully understanding the risks involved. Especially if you get shaken out easily.

Another potential risk of investing in Bitcoin is the lack of regulation.

Bitcoin is not backed by any government or financial institution, which means that there is no protection for investors if something goes wrong. This lack of regulation can also make it easier for scammers and fraudsters to take advantage of unsuspecting investors which have happened numerous times before.

On the reward side, Bitcoin has the potential to offer significant returns and potentially be more stable than many government currencies.

Many investors see Bitcoin as a hedge against inflation and a safe haven asset. As such, it can be a valuable addition to a diversified investment portfolio.

Bitcoin’s limited supply also adds to its potential value. There will only ever be 21 million Bitcoins in existence, which means that as demand increases, so does the price. This scarcity can make Bitcoin a valuable asset for long-term investors.

It is important to note that investing in Bitcoin is not without risks. Investors should carefully consider the potential risks and rewards before investing in this highly volatile asset.

Here is what the Federal Trade Commission says about Bitcoin scams and how to spot and avoid them: https://consumer.ftc.gov/articles/what-know-about-cryptocurrency-and-scams

Tips for Investing in Bitcoin

Investing in Bitcoin can be a lucrative opportunity, but it’s important to approach it with caution. Here are some tips to keep in mind:

- Do your research before investing. Look into the history of Bitcoin and its market trends.

- Bitcoin’s history is to have a big rally and then a big decline.

- Don’t invest more than you can afford to lose. The cryptocurrency market is volatile and unpredictable.

- Consider investing in Bitcoin through a reputable exchange or broker.

- Keep your Bitcoin in a secure wallet and use two-factor authentication for added security.

- Stay up-to-date on news and developments in the cryptocurrency industry.

It’s important to remember that investing in Bitcoin is not a guaranteed way to make money. While some experts’ Bitcoin price prediction for 2023 say that it will continue to rise in value, others caution that the market is highly speculative and subject to sudden fluctuations.

Ultimately, the decision to invest in Bitcoin should be based on your own financial goals, risk tolerance, and research. By approaching Bitcoin investment with care and an informed perspective, you can make the most of this exciting opportunity.

Conclusion

Based on the analysis of various sources, the outlook for Bitcoin’s price prediction for 2023 is positive. Insiders predict that BTC could test new highs in 2023, despite the challenges it faced in 2022.

Machine learning algorithms also predict a positive trend for their Bitcoin price prediction for 2023. However, it is important to note that these predictions are not always accurate and should be taken with a grain of salt.

In my Bitcoin price prediction for 2023, I believe that Bitcoin will rise to over $78,000. Using a 5-wave Elliot wave move is how I came up with that prediction. As of 4/3/2023, this formation is still valid so my prediction is still true.

Overall, it is clear that Bitcoin’s price is influenced by a variety of factors, including market sentiment, regulatory changes, and technological advancements. It is important for investors to stay informed and make informed decisions based on their own risk tolerance and investment goals.

You want to get in on the rally and watch out for the inevitable decline. The easiest way to do this is to buy when Bitcoin is declining and be prepared to hold it for a year or more.

If you are looking to speculate then you can do so with Bitcoin but it may take longer than anticipated.