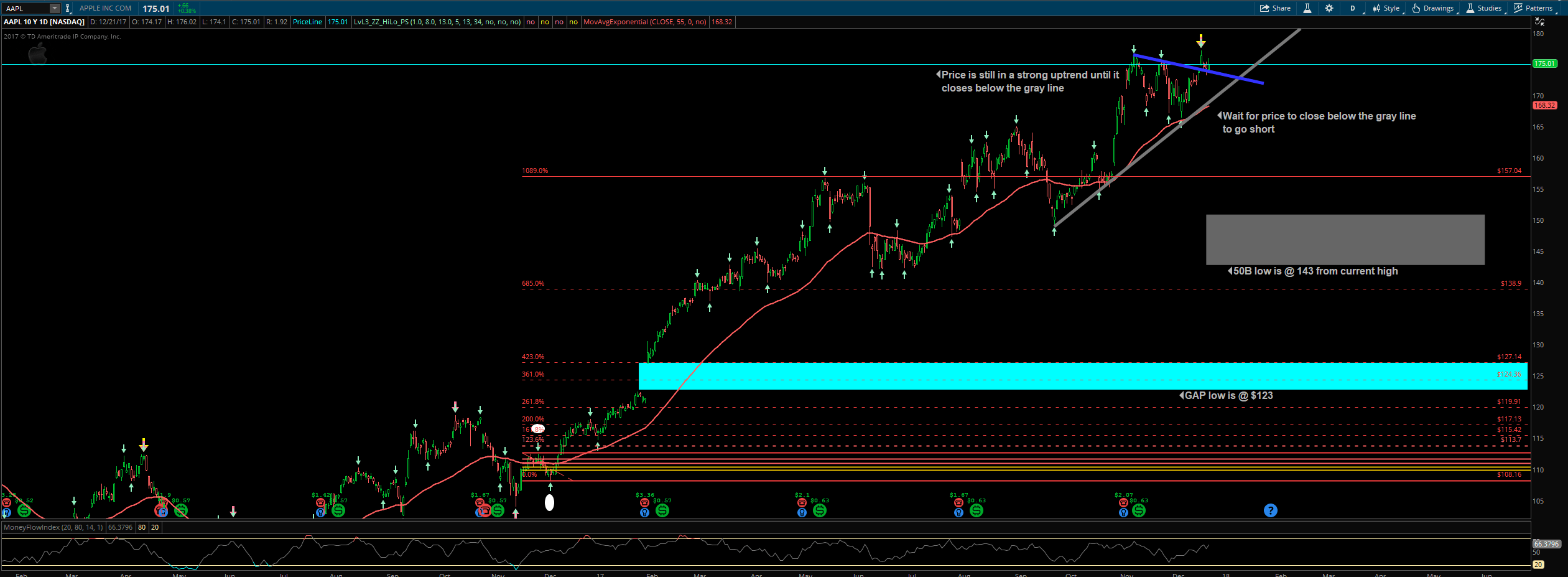

Apple (AAPL) has had a very nice run since May 2012 where it was around $90 and now on 12/22/17 it is at $175.01.

It is still in a very strong trend up but it is showing signs that the retracement is nearerr rather than farther.

Apple’s next fib extension target is $188. If I had to take a long or short position today then I would be long, that is until price closes below the gray line and then I would be short.

From the current highs the 50B retracement is at $143 but if you are looking for another target then look at the gap low at $123. That will eventually be filled.

Price did recently close in a bullish move above the blue line so in the short term the move is to the upside. So for the short term I remain bullish on Apple until price closes below the gray line and then I am bearish. But even if I do short AAPL when price closes below the gray line it would only be for about 25% of what I would be willing to invest in the move to the downside. Price has broken previous trend lines before but then found support and went higher so I wouldn’t go all in on the first purchase. I would hold back and scale into it with shorts if price continued the move up. Eventually the $123 gap will be filled as well as the 50B so for those who are able to hold onto their shorts then they will make some really nice money.

Remember:

1. Don’t go short until price closes below the gray line

2. Scale into the shorts in case price continues to rise after closing past the gray line – Next entry would be around $210 and then $240.

3. I am bullish on Apple until it closes below the gray line

4. First exit would be at $143 from the current high

5. Second exit is the gap low at $123 which you could use as the first exit because price will eventually fill this spot