If you are thinking about getting into the world of day trading then this post is for you. It is A Beginner’s Guide to Day Trading. It is a top-down approach to what I wish someone had told me before I started day trading. It covers the topics I feel that most other people don’t cover but should because they can save you thousands of dollars. My first experience was with Traders International. Here is the link to my review about their horrible trading room. The one positive it taught me was your emotions play the biggest part in trading and also that almost all trading rooms are a ripoff (so really it taught me two lessons).

What this Beginner’s Guide to Day Trading won’t cover is:

- Make sure you have a fast internet connection

- Make sure you have a computer

- Which trading room is the best?

With all trading, there is risk involved and with day trading it is magnified even further. This article assumes you are looking at making trades that open and close within the same day (the same day’s trading hours).

Should You Day Trade Futures, Forex, Stocks, Binary Options, Cryptocurrencies ? (Or all of them?)

To be honest it doesn’t really matter what you trade. It is easy to lose your money trading any instrument on any time frame. Anyone who tells you otherwise is trying to sell you something. If you currently trade stocks and can’t make money on longer time frames then you will for sure lose money day trading at an even faster rate. Day trading magnifies every decision because the time you are in a trade is reduced drastically than “normal” trades that last for days, weeks, months, or years.

Some instruments are designed for day traders so the setup is easier. The e-minis (ES) are the most traded futures contract in the market so it is easy to get setup day trading for them. Stocks can be used for day trading but you need a lot more capital, to begin with. So although you can day trade stocks you need far more money to start with.

Forex can be day traded as well as binary options. So as you can see it is whichever market you want to trade. What you should do is pick the market that appeals to you the most, the one you are most interested in. And of course the market you have the bankroll for.

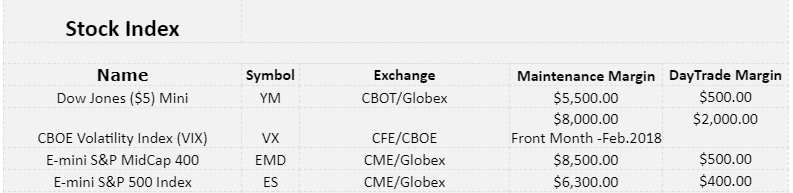

If you are looking at trading the e-minis then here is a picture from AMP futures for your margin and day trading balance required to carry a trade:

From the image above you will need to have at least $6,300 in your account if you hold a position overnight. If you are day trading then you need $400 minimum per contract to trade.

Obviously, you would be crazy to only open an account with a $400 margin. How much you have in your account is up to you. For me, I always have somewhere between 5-10X the day trade margin minimum per contract. For example, if I was trading the ES then I would at MINIMUM have $2,000 in my account, and that is the bare minimum.

What I prefer to do is have 1.5X above than the maintenance margin per contract in my account. That way I am covered if I do have to hold a position overnight.

You should never open an account with the minimum advertised amount. You might as well go gambling with that money because at least you can get a free drink or two out of it while sitting at the tables.

For binary options the ONLY broker I recommend is Nadex. They are at least regulated by the CFTC. I don’t trade them anymore. Maybe someday I will get back into them but not today.

In trading through Nadex their withdrawal option was extremely easy and I never had any issues with them which is why I recommend them. During that time I was also trading binary options through an offshore binary broker named Cherry Trade and they closed up shop and took the money I had in it.

So that is why I recommend only trading binary options through Nadex since they are based in the US and are regulated by the CFTC. That doesn’t guarantee your money is safe but it is at least a step in the right direction.

I’ve traded the e-mines, Russell 2000, oil, Nasdaq, 30+ Forex pairs. Binary options, Bitcoin, Etherium, and numerous stocks. For day trading, the ones I like the best are the e-minis and oil (CL). They are the ones I felt provided the easiest access to get in and out of the market. I’ve traded Forex and stocks longer but my Forex trades are more geared to swing trading and my stock trading is more geared to medium to long term trades.

Although during the night of Brexit the Forex market trading on the 4-hour time frame felt like trading the 5-minute chart during FOMC announcement. It was insane and my most profitable day/night of trading.

What Trading Platform Should You Choose for A Beginner’s Guide to Day Trading?

There are so many available I can’t possibly go over all of the different instruments. Just look at how many are available through AMP Futures:

That is 9 right there and I cut the picture short in order to fit on the screen. They offer almost 60 trading platforms!

What you have to do is find the one that works for you. In this beginner’s guide to day trading, I will go over the ones I have used because those are some of the more popular ones a lot of people use. As a side note, I’ve heard good things about Sierra Charts. I have downloaded their software but never really used it in depth so I can’t give an accurate review.

The 6 I have used extensively over the years for trading are:

- NinjaTrader

- eSignal

- Think or Sim

- TradingView

- MetaTrader 4

- MetaTrader 5

NinjaTrader is only available through them. You used to be able to use them if you were using someone like AMP for your broker but they stopped that a couple of years ago. So you have to go through them unless you had their lifetime option already grandfathered in. I’ve used them to day trade before and they have a great program. Depositing and withdrawals were never an issue.

They offer futures and a couple of Forex pairs. I have never used them for Forex. You can try them out free of charge in demo to see if you like their platform. Once you figure out the hotkeys and bind them how you want them it makes trading very easy. I preferred to trade off of the charts rather than the DOM but you can do either. If you do go live you will either have to pay a fee. You can “lease” NinjaTrader or you can buy it for $1,099. There are tons of indicators people have developed as well if you like to test out indicators.

Overall it is an extremely strong day trading platform and I give it a very high review. If you know you will be day trading and only using one computer then definitely check out NinjaTrader.

eSignal was my 1st entrance into day trading. It was okay for the time. I haven’t used it in 10 years so I can’t give an up to date review on it. The one thing that was a huge ripoff was the amount they charged per month. If I remember correctly it was around $100. Of course, this was through Traders International so I’m sure that crappy trading room got a cut of it for a referral. I just looked at their pricing and there are so many more options available today that I’m not sure why anyone would pay $168/month for it. It’s not worth it.

Think or Swim is TD Ameritrade’s trading platform. If you have an account open with them then it is free to use. I used to use it a lot before I discovered TradingView. Now I hardly use it. It is clunky and slow. Plus, I had a really hard time finding someone who could convert an indicator for me with it. I finally found someone but 2 people had to back out because they couldn’t code it correctly. Also, they had an issue where if you loaded too much data in the time frame it wouldn’t have indicators show up. They would flash on the screen and then disappear. I researched what was going on and apparently it was some glitch that they never fixed in the 2 years I used their platform.

If you have an account with TD Ameritrade and need a free platform for swing, medium, or long term trades then it is fine. Some people enjoy the charting properties it contains so the goal is to find out which one you prefer. Also, since it is through TD Ameritrade you can only trade live through an account with them.

TradingView to me is the new kid on the block. They aren’t really that new but to me they are. I started using them a ton a couple of months ago. The reason why I like them is that they are free to use (with restrictions) for testing and they use HTML5 so you don’t have to lug your computer around to have your trading platform. There isn’t a program for their charting software you have to download. You can trade from a tablet or any computer with internet access. You are not restricted to one computer like you would be with NinjaTrader.

Now you don’t have to purchase a decent computer in order to operate a trading program. I am currently testing them out with an AMP futures account in order to get familiar with their entries and exits protocols. To be honest, NinjaTrader, in my opinion, is a little better as far as ease of use and execution but I think I can make it work with them.

AMP waives their monthly fee if you trade live through them so that boosts the benefits for me over NinaTrader. Plus I can access their trading platform from any computer. That is the biggest advantage of TradingView over NinjaTrader.

The one negative I have is they use Pine Script for the coding of their indicators. It makes Think or Swim’s coding look like the best coding ever. I’ve tried to hire 2 different programmers to convert code for an indicator I use for pivot points and no one can do it. I’ve found another indicator that can be used in place of it but I like my other one better. Other than that, it has been a great platform.

You can connect many different data feeds and brokers through them. They have a social aspect to it where you can post your own ideas and people can comment on them.

Overall I give TradingView extremely high marks. Being HTML5 based is a much bigger deal than I thought it would be since I am not tied to one computer to trade from. Their charts are pretty easy to use and are easy to navigate.

MetaTrader 4 is old, clunky, and ugly but I still love her anyways! MT4 is also free so that is the biggest bonus. This is the platform I use to trade Forex through and have for years. I’ve used several brokers through it and have never had any issues.

I also have their app installed on my phone so I can open or close orders if need be and I am not at my home computer.

MT4 is not the best but for some reason, I have stuck with it over the years. If you are looking at trading Forex then you will probably be offered MT4 to trade from. It suits my needs at the moment just fine.

But again, it is not the best and I would not use it for day trading. My Forex trades usually last a couple of days to even weeks or months so I don’t use MT4 to hop in and out of trades in minutes or even seconds. If I had to then there is no way I would use MT4.

MetaTrader 5 is the newer version of MetaTrader 4 but I can’t bring myself to upgrade and use it exclusively. I traded futures through it for about 6 months but I didn’t really enjoy it. They were swing types of trades where you hold them for a couple of days on average.

In my opinion, MT5 is clunkier and even more awkward to use than MT4. A big reason people use MT5 is you can use trading robots. A trading robot is basically an automated trading system you allow to trade for you. You can also use MT5 to copy other people’s trades. What you do is pay someone and whenever they place a trade then it is automatically placed for you as well. It is a service I will never use.

I don’t like MetaTrader 5. It is free to use so you should check it out for yourself to see if you feel the same way. This is one platform I have phased out of using and don’t plan on going back to it unless something drastically changes.

The one positive for MT5 is they have a robust community and it is very easy to hire programmers if you need a custom indicator.

Should You Use Simulation Trading for Practicing Day Trading?

My answer is “no” and “yes.” Let me explain…….

This can be a hotly debated topic and this beginner’s guide to day trading will not shy away for how I feel about simulation.

You should get your account setup and test the trading platform you are using in simulation. You want to be able to enter, exit, and modify orders on the fly. The guesswork or any questions or hesitations need to be taken out of your trading execution before you go live.

What I would recommend would be to practice entering, exiting, and modifying trades in simulation. Do not worry about your simulation profit and losses. Right now what you are doing is getting yourself so familiar with the order entry and exit parameters that you could execute them without having to think how to do so.

Your execution can mean the difference between a profitable trade and one that costs you money, especially if you know you have to get out and need to do so ASAP. So for simulation trading, I do recommend it for you to get yourself extremely familiar with the trading platform you have decided to use.

But as far as what happens when trade live then simulation trading should not be used. Do not treat simulation trading like you would live trading. I can guarantee you the first time you go live in a day trade your emotions are going to wreak havoc on you. Fear and greed will hit you like never before and at the same time.

All the time in simulation cannot prepare you for the psychological aspect that live trading brings. The reason why is because you know deep down you are not trading with live money so there isn’t any risk. As soon as you put on your live trade you know you put your money at risk in the shortest time frame you have ever traded so your decisions are magnified.

I remember the 1st time I went live trading through esignal. I got flooded with emotions now that real money was on the line. For two weeks previously I simulated trading and got myself familiar with the platform. The execution in using esignal wasn’t the issue. Now the issue was how to manage my emotions now that I was in a trade.

Years later when I went live with NinjaTrader the same thing happened. I still had not have done the psychological work I needed to do so it all makes sense now. But then it didn’t.

So I would recommend you use simulation to get familiar with how the trading platform works and to test it out. But be warned that when you do go live, no amount of practice in the simulation will prepare you for the emotions you will receive when your real money is on the line.

Should You Join a Day Trading Room?

A beginner’s guide to day trading would not be complete without talking about day trading rooms. They are a dime a dozen and most of them are worthless.

I thought the key to controlling your emotions would be to be taught by someone who knew how to trade and was profitable. That is 100% incorrect. The three ways I have found to work with your emotions is through meditation, live trading, and a psychological coach.

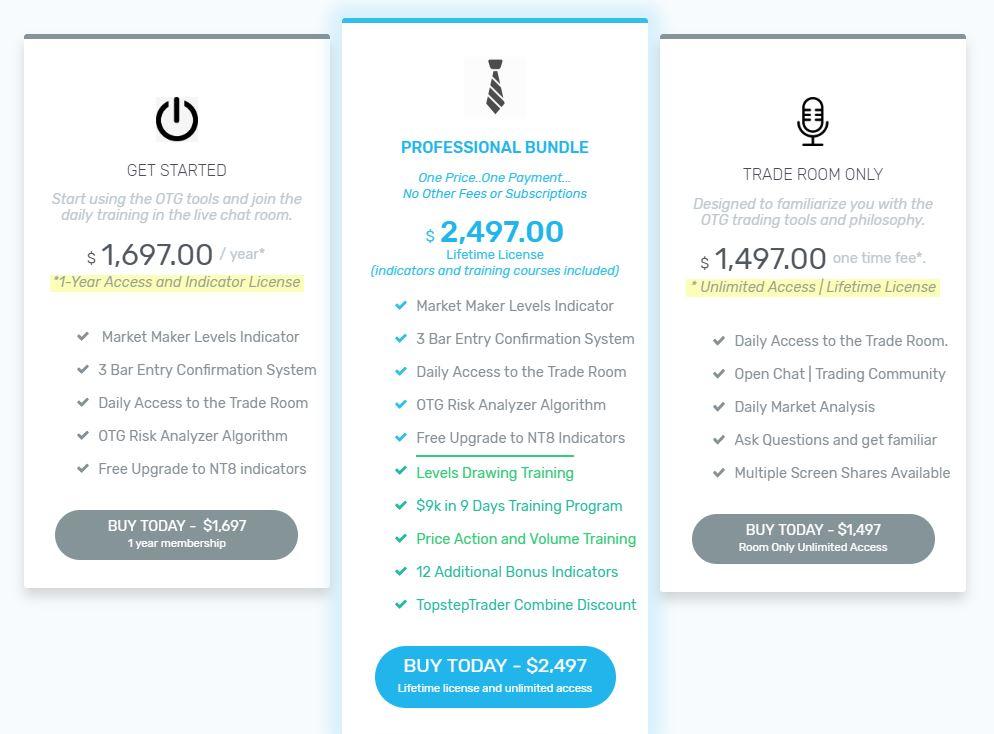

Trading rooms are mostly run by people who are not profitable at trading the markets. The only money they make is from selling their subscriptions and having people pay their monthly or yearly fees. Sometimes even a lifetime membership. The one point most of the people who have in common who sell trading room services is they are great marketers. They prey on your hopes for a better life.

Look at this crap offer above. For only $2,497 you too can be taught by an instructor who goes way out of his way to never provide verified proof of trading statements that he is a profitable trader!

That offer from above is from a trading room that is still around today. They’ve removed the pricing from their website since then because they want you to contact them. I wrote about them here: https://evancarthey.com/proof-of-profitability/

Sadly that is what most are trading rooms are about. Trying to con you of thousands of dollars while never providing proof the person selling the product actually is a profitable trader.

If you are convinced the trading room you want to join is legit then fine. But 6 months from now there is a much greater chance you will find out the hard way that you wasted thousands of dollars on someone who isn’t a profitable trader. If a trading room was profitable then why don’t they have people showing their verified trading statements that they are making money hand over first? Why won’t the lead instructor show proof of his profitability? You know why they don’t and won’t.

If you take only one piece of advice from this then it is this: DO NOT PAY HUNDREDS OR EVENTHOUSANDS OF DOLLARS TO ANY TRADING ROOM! If you are planning on spending $2,000 or more on a trading room, trading service, or trading program then do this instead:

- Take that money and trade live with it

I am dead serious. You will learn WAY more trying it out on your own than you would trying to copy a losing trader. All you will do is throw away that money to that loser and then if you do go live following their losing system you’ll lose that money as well. You won’t learn what works and what doesn’t work. Trading is all about trial and error. You have to learn for yourself what works and what doesn’t work.

So get your trading system down. Test it out in demo to make sure you know how to enter and exit using it in your sleep. Then go live with it. You’ll discover real fast if it works or not. Trust me. I know because that is exactly what I did once I swore off trading rooms and trading services.

I relied on myself to create the trading setups that work for me. I quit paying the charlatans and scam artists who operate most of the trading rooms out there.

If you want a shortcut on how to create your own trading style that works for you then read this post: How to become a profitable trader using meditation

The conclusion to A Beginner’s Guide to Day Trading

I sincerely hope this beginner’s guide to day trading has assisted you in at least one aspect. This is information I wish someone would have shared with me before I started the journey.

This obviously doesn’t cover everything and answer every question for day trading but I hope it provided a new perspective for you on a couple of topics I feel are not really addressed.

If you ever have any questions don’t hesitate to reach out to me. We are all on this journey together and I hope you become a profitable trader if you are not already.

Popular Links

Here are a couple of links if you are looking at how I view the market and with my trade setups as well as products I like and use.

- How to become a profitable trader using meditation

- How to scan for winning stocks

- The Ultimate Guide for the Best Day Trading Books in 2019

- How to Improve Your Meditation with the Brain Evolution System

- Review: Stikky Stock Charts – An Excellent Trading Book That is Interactive

Robinhood Trading Broker Review

If this post benefits you and if you haven’t used Robinhood for trading stocks but are thinking to then please consider using my referral link when you do sign up: http://share.robinhood.com/evanc203.

This way each of us will receive a free share of a random stock if you sign up through my referral link.

My Robinhood Review: https://evancarthey.com/review-robinhood-trading-service-with-no-fees-part-1/