In the first part that you can read here: https://evancarthey.com/my-bread-and-butter-trade-part1/ I went over the basics of my bread and butter Fibonacci Extension Trade. In part 2 I will talk about the entry levels I use.

Entry Level Primer

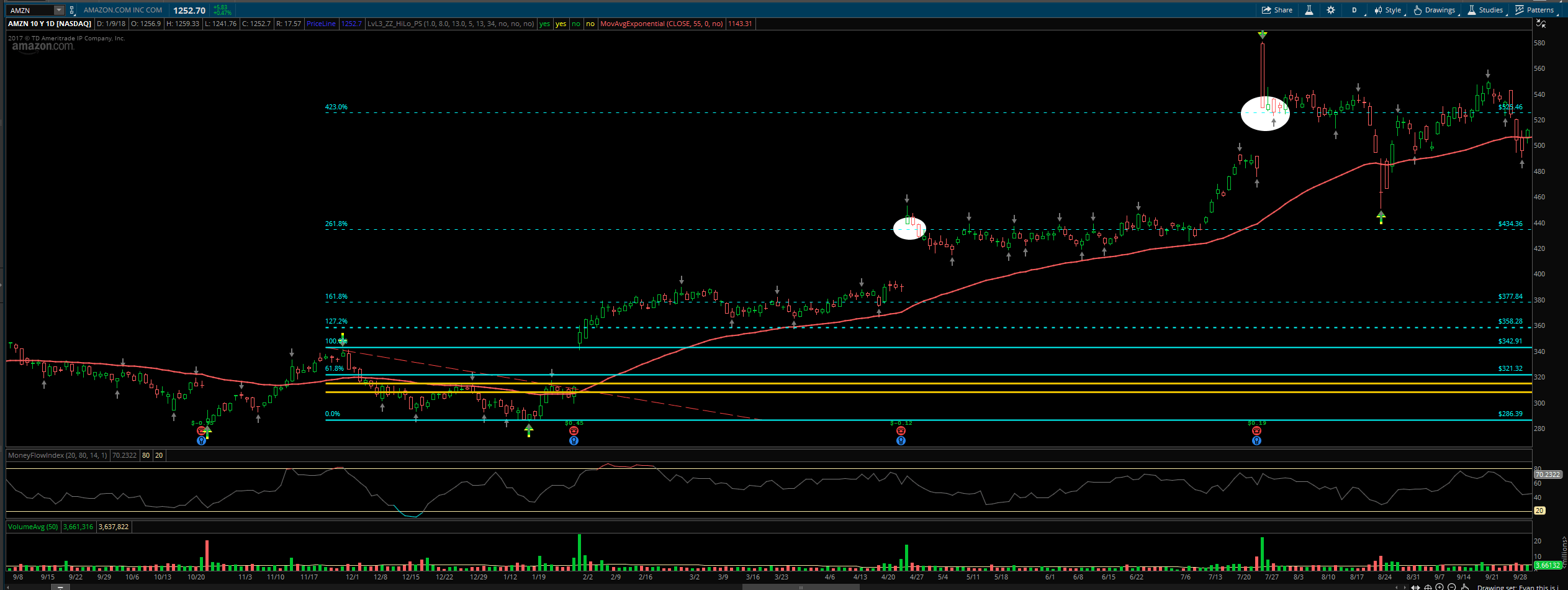

I used to get in at the 127%, 143%, 161%, 200%, halfway 261%, 261% and on and on and on. Since then I have refined it to where most of the time the earliest I get in is at the 261% fib extension. Then the 423%, half way to the 685%, 685%, and then the halfway to the next fib and then the next fib level on up and up. If you have your pivot points correct then you are good. Here is a chart showing this and I highlighted the entry levels I would have been in at for a short on Amazon:

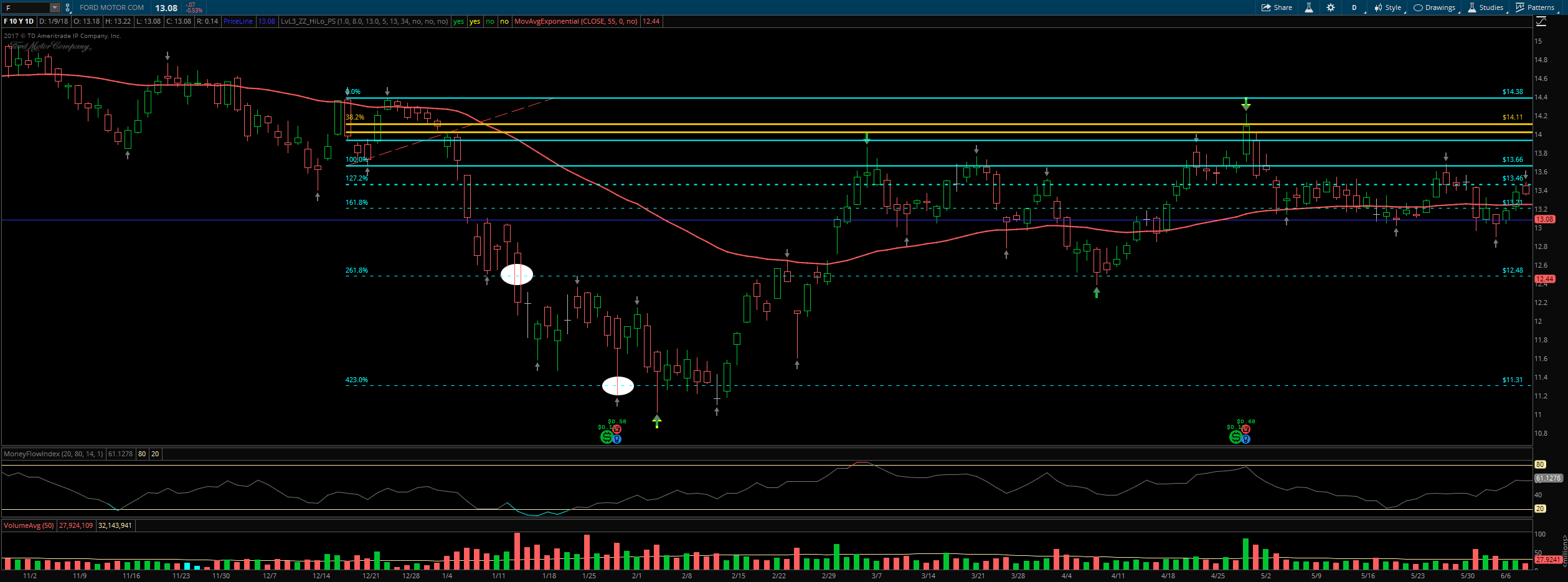

Here are some long entries for Ford (F):

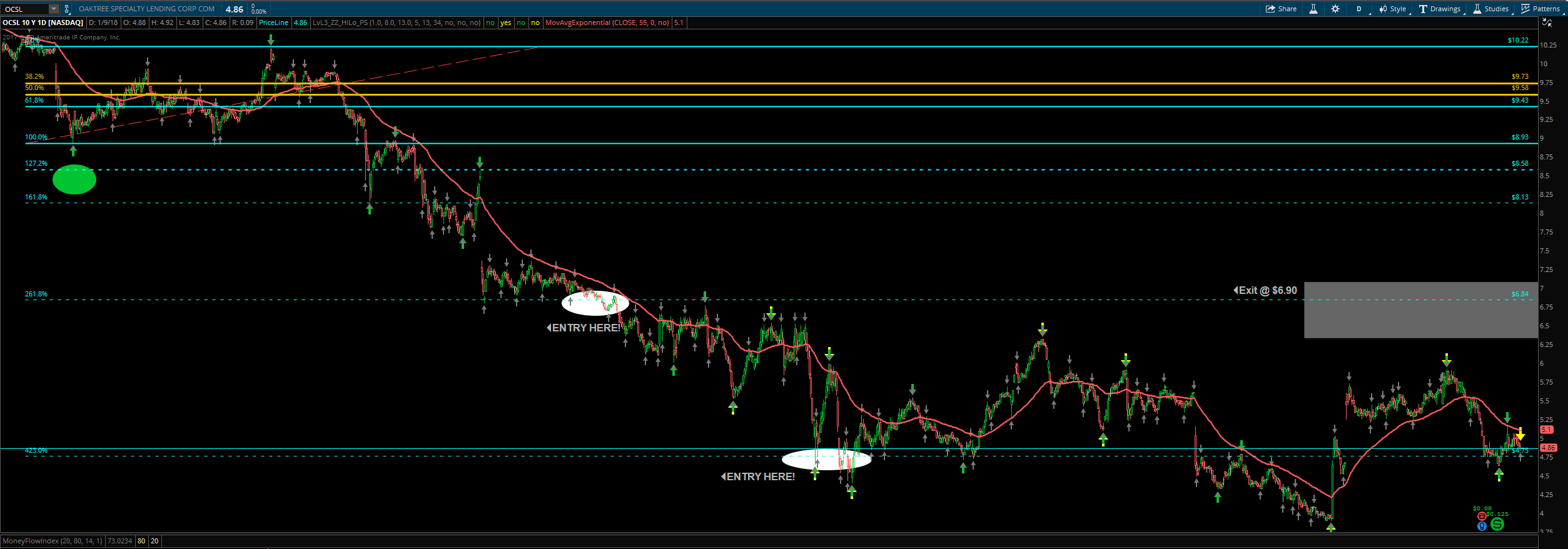

Here is OCSL that I am currently long in:

Fibonacci Extension Points I Use

Currently I use these Fibonacci Extension Levels and once price hits past the 423% then I also use the halfway point between the fib extension levels as entry points:

261% – 423% – Halfway 685% – 685% – Halfway 1109% – 1109% – Halway 1794% – 1794%, Halfway 2903% – 2903%

Other fib levels even further are the 4697.8% and the 7601.0% but from what I have seen from trial and error is that most of the time price shouldn’t go past the 1109% as the extreme with the 423% being the extreme the majority of the time. In Part 3 I will talk about the exit Fibonacci retracement levels I use for my Bread and Butter Trade Setup which is EXTREMELY important, probably the most important part because I have screwed up big time before I figured them out.

Conclusion

If you have your pivot points correct then your extensions will work out very nicely. I will talk about some key points to consider in getting the pivot points because there is one key aspect to remember to when not to use pivot points because price has violated the area.