The S&P 500 for December 2019 is underway and this post will be a daily running update for the market. All opinions are my own and are based upon the setups I personally use to trade.

I trade Forex, futures, the stock market, and crypto-currencies. All of my setups were created through meditating and trusting myself. It wasn’t until I gave up trying to use trading-gurus systems and starting trusting myself that I began having sustained success in my trading career.

I created an article with videos (all free!) about the exact steps I took to look within myself to create the trading setups that work for me that you can read/watch here: https://evancarthey.com/how-to-become-a-profitable-trader-using-meditation/

If you are looking for more insight into the setups I use and items that have helped me in my trading journey then see these links below:

- Best Meditation Books for Traders:

- How to Improve Your Meditation with the Brain Evolution System:

- Forex Trading for Beginners: How I Doubled My Account and So Can You:

- Day Trading Setups for Maximum Profits: The 78.6% Trade:

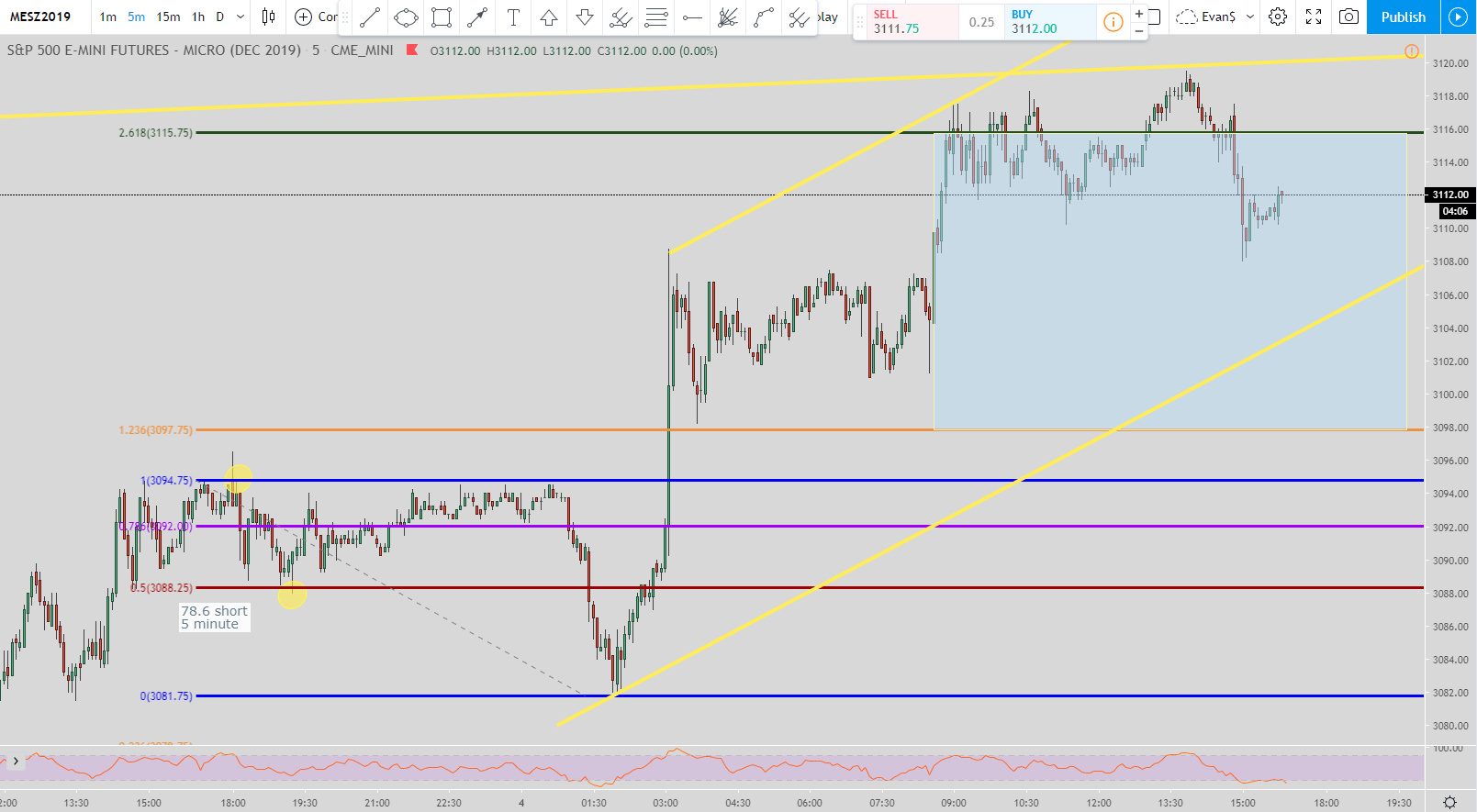

S&P 500 for Wednesday the 4th

In the above picture you can see how the price of the S&P 500 went back up to the bottom of the trend line and used it as resistance. This is a possibility I mentioned that could happen yesterday. I’m still very bearish for the short term for the market.

A new setup was created today using the 5 minute time frame. The setup is the 78.6% short. The exit is the orange line at 3097.75. You can also see how a potential trend channel has been created as well but I’m not too confident in that yet. I just wanted to show what it could look like.

The main factor to focus on is how the price bounced off of the 261.8% Fibonacci extension level that moved the exit for this short move to the 123.6% level at 3097.75.

This is another setup that is showing how the short setups need to come back and get filled before another big move up can and should take place. I’m still short in the Russell 2000 and and looking for more weakness (eventually) since it pretty much mirrors the S&P 500.

So for tomorrow, my “no hedging” analysis is to look for weakness and a move down in the S&P 500 to 3097.75.

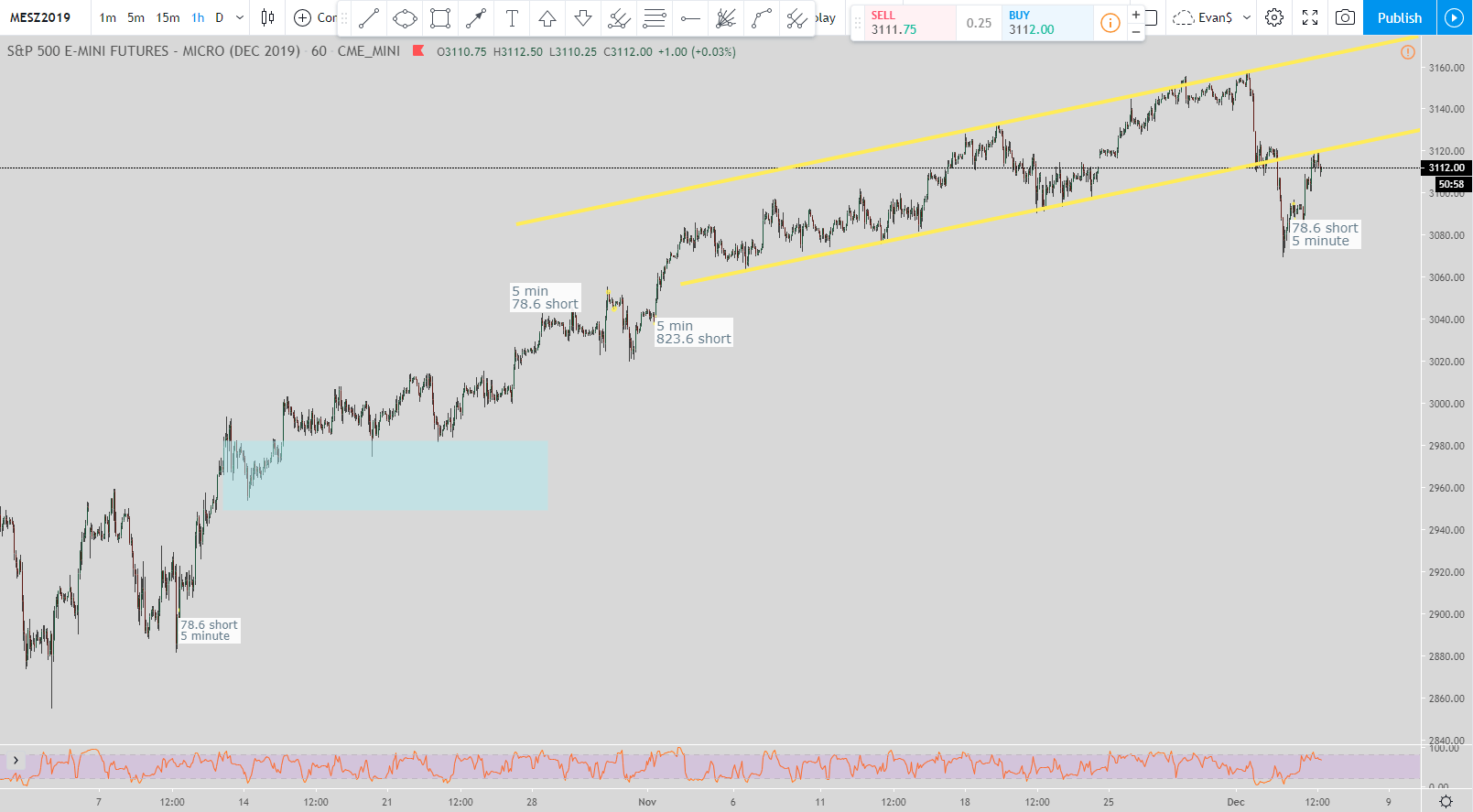

The S&P 500 for December 2019: Tuesday the 3rd

Quick Analysis: The market is looking for more of a move down. If the market moves back up then it is pulling in weak money to flush out.

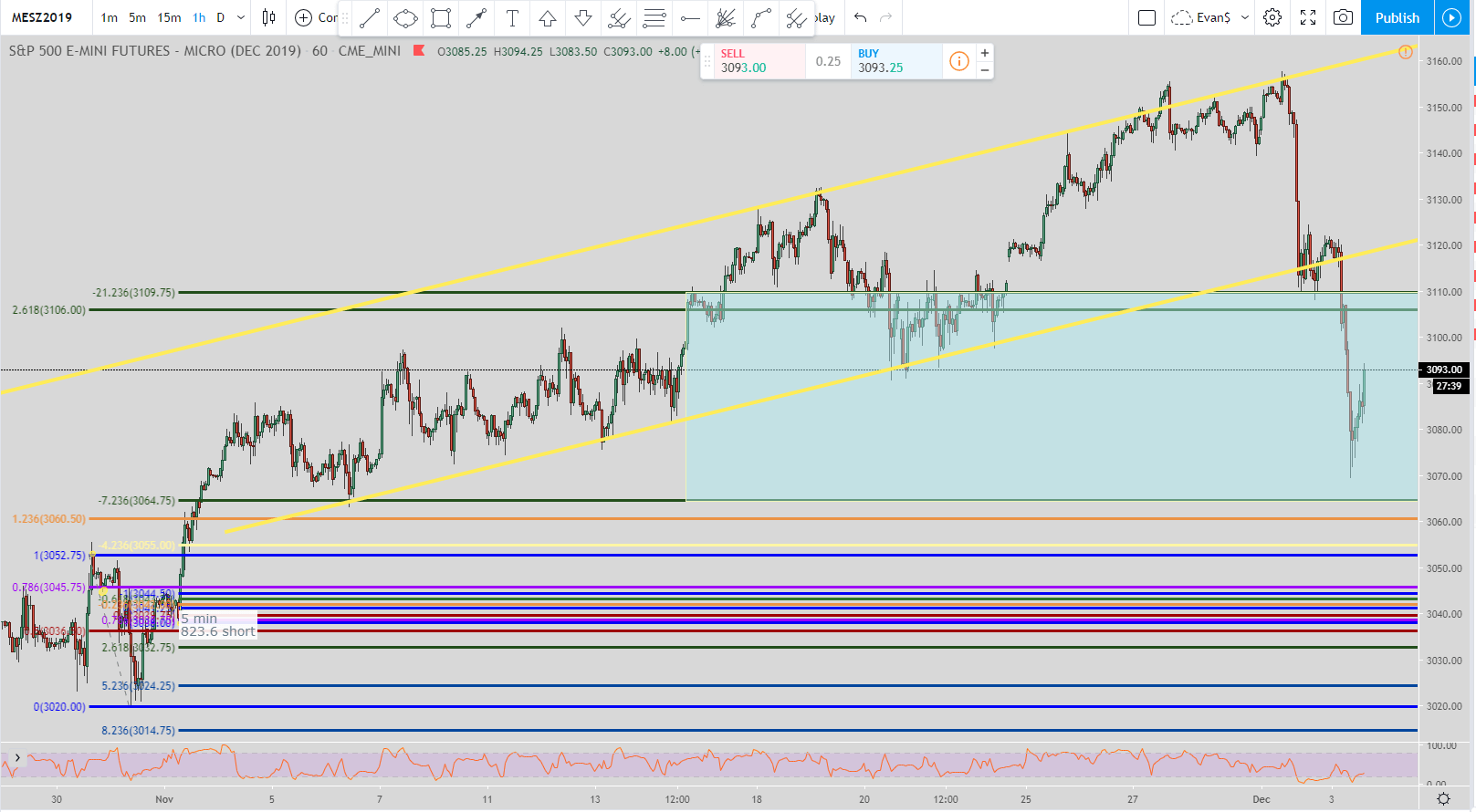

The market took another dive today but it is not unexpected. The S&P 500 for December has been overdue for a pull-back. I thought it would happen in mid-November but obviously the market makers were waiting until after Thanksgiving break before starting the sell-off.

I think we’ll see some more downside until these short setups are completed.

The two setups are the 823.6% short and the exit for it is the bottom of the light-blue box at 3064.75. You can see how the price came down and got close to it but it wasn’t completed so more downside is coming.

The other setup is a 78.6% short setup which is the orange line that is just below the blue box at 3060.50. So with those two setups still yet to be completed I think we get there this week. After that I will look and see if some long setups have been created from the move down.

You can also see how the uptrend (the yellow line) was dramatically broken. Now, there is a chance that the price comes up and hits off of the bottom of the yellow line before moving back down again. If it does go back up that high before hitting the exits I mentioned earlier then do not get sucked into going long there.

I will be looking for shorts if price continues to move up from these levels. Currently, I am short the Russell 2000 with a target exit of 1523. The hard exit is 1517.9 but I always get out a little early to ensure I get filled.