It is time for the Ethereum price prediction with Bitcoin and Litecoin. This is a weekly feature I try to do every single week. I also do one for the S&P 500 e-mini futures on a weekly basis and sometimes even a mid-week review.

There is usually at least a monthly review for the Dow Jones futures, Nasdaq futures, and the Oil futures. Sometimes I also do those on a weekly basis. But if there is any trading unit you want me to review then I will be glad to do so. Check-in at https://evancarthey.com or subscribe to my newsletter because every new post is sent out in an email as well.

I went over to https://coindesk.com to see if there was any relevant news for the Crypto world but there wasn’t anything groundbreaking with predictions about where the price is headed. The closest article was “Bitcoin Price May Break Longest Weekly Losing run Since November.”

Coindesk is a site I view to see the trends and news for the crypto world and is actually really good.

Charts for Ethereum Price Prediction with Bitcoin and Litecoin for the Week of 9-8-2019

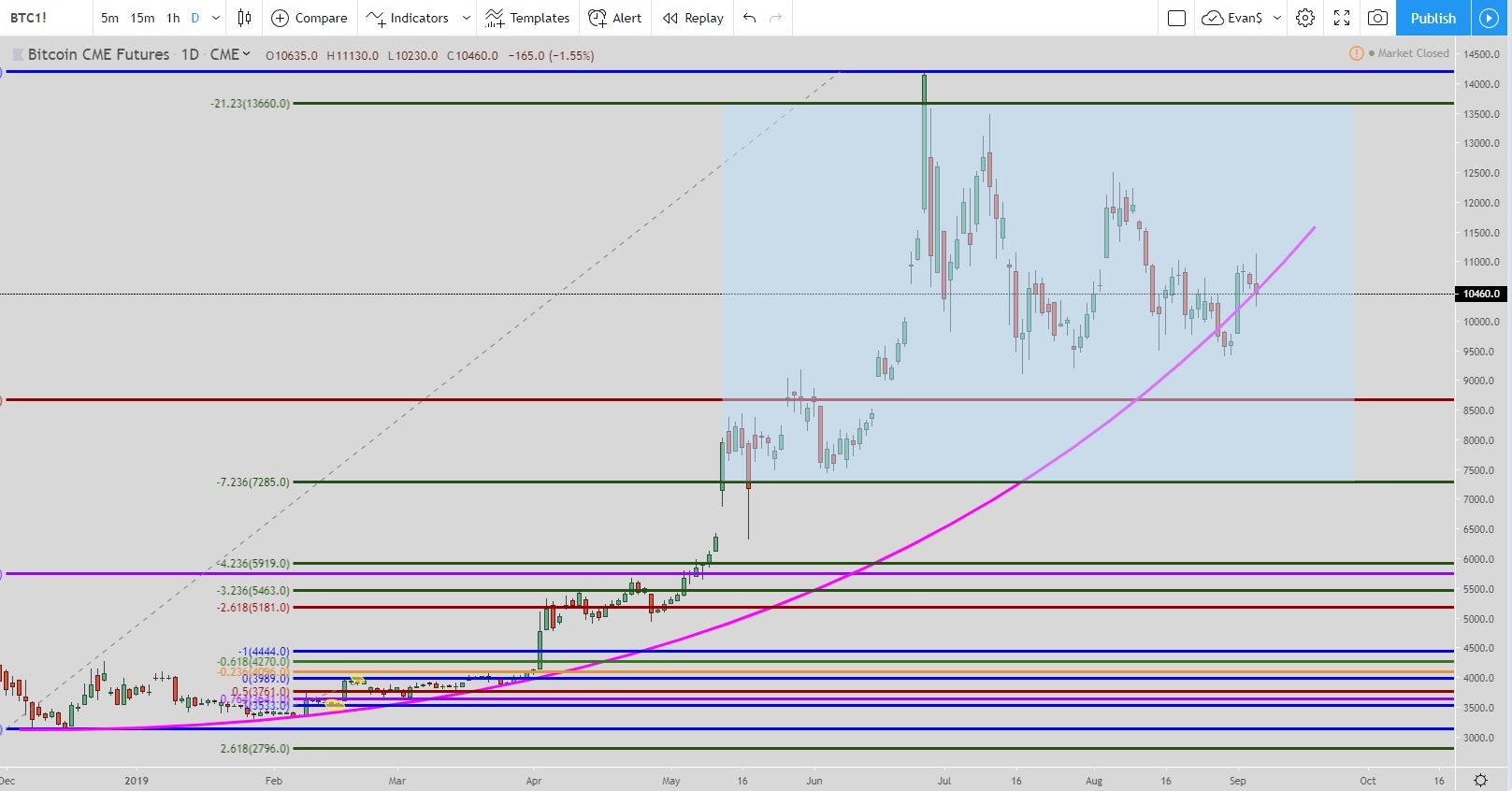

Here are the charts I went over in the video. If you want to enlarge them in order to see them then you should be able to do so.

The chart above is Bitcoin using the daily chart. There are two short setups going on. The first is the parabolic curve has been broken so the exit we are looking for is the 50% Fibonacci retracement level at 8,668. I had two trend lines on the chart but I took them off. You can see them in the video below.

The second trade is the 8.236% short setup. The exit we are looking for is the green line at 7,285. This is a trade I am thinking about entering but haven’t just yet because I am in several other trades.

With Ethereum we are waiting for the price to hit the 76.4% Fibonacci retracement line. That is the purple line. Once the price does this then the exit is the 50% Fibonacci line which is the red line in the chart above.

But if the price goes down and hits the blue line before hitting the red line then the exit moves to the purple line.

This is a trade I am waiting to get in with and am monitoring this chart very closely.

For the Litecoin chart, this is a trade I am currently long in for the trade. The exit is just below the purple line at around $92.00. But if the price continues to go down and hit the green line at $59.07 then I will also add to my position there. Then the exit will move to just below the blue line of the 100% Fibonacci level at around $88.00.

That will be the last time the exit moves for the trade.

So if there is a continued weakness in Litecoin then I will continue to add to my position.

Video for Ethereum, Bitcoin, and Litecoin

If the video does not load then click on the sentence to view it.

Conclusion for Ethereum Price Prediction with Bitcoin and Litecoin for the Week of 9-8-2019

Overall the crypto market is providing some really nice setups.

I am currently long in a Litecoin trade. For Ethereum I am waiting on the price to pull back a little bit more before I pull the trigger.

But with Bitcoin, I am looking for further weakness before I think about buying some more. So if you have some nice profits from trading Bitcoin then I would be careful. What I post here shouldn’t be taken as financial advice. These are only my opinions.

How I created my own trading style and trading system was through meditation. I truly believe it is the game-changer for anyone who puts in the time and effort. If you follow the hyperlink from the word “meditation” then it will take you to a post I did about the step-by-step process I use to create my own trading system.

No longer do I rely on “gurus” (who are losing traders themselves) to con me out of giving them money to learn their losing systems (a bunch of rip-off artists).

I trust myself and tap into my subconscious to find out how I need to trade so that I am a profitable trader.

You can be a profitable trader, you just have to trust yourself. The only way to do that is to create your own trading style and I 100% believe to do so it needs to go through meditation in order to tap into your subconscious mind.

Also, if you are looking for a broker to trade stocks that don’t charge trading fees then check out Robinhood: http://invite.robinhood.com/evanc203.

If you register using the link then both of us will receive a free stock.