The S&P Futures live trades for July 2019 with precise entries and exits will be continually updated throughout the month of July. I plan on doing these every single month and keep them updated with the trades I am looking at doing. I trade both long and short so it doesn’t matter to me if the market is going up or down.

It will be a running collection of trades specifically for the ES which is the futures contract for the S&P 500. Last week I started trading the ES again using TradingView as my platform and AMP Futures as my broker. I’ll do another post on how to get set up on TradingView using AMP Futures. It is pretty straightforward and easy. The specific contact I am trading are the ES micros, not the ES minis. The micros are a new set of futures to trade where the margin is extremely less than the minis.

Some of the trades will be after the fact but I will do my best to put them here in this post as they are live or getting ready to be a valid live trade. Sometimes they will be late because there might not be any way for me to add to this post and monitor the trade at the same time. But for the most part, I will do my best. I will try to have at least a couple per week added to this post.

I’m also going to do one for the Nasdaq (NQ) futures next. After that, I may do one for the Russell 2000 futures. I will for sure do one for oil futures because oil trading is something I plan on doing when I have the bankroll. The moves in that market are awesome!

So the setups I put up are ones I am thinking about taking, am currently in, or have taken. These trades are not based on theory and what “I think” the market can do. I’ve seen so many gurus on Twitter post their crappy charts thinking about what the market can do but they never provide entries or exits. They also never provide their proof of profitability. I always provide entries and exits and my monthly verified results. If I am wrong then I am wrong but entries and exits will always be provided for the setups I put for the S&P Futures Live Trades for July 2019.

ES Trading

In the section above I mentioned the new micro contracts. The margin required is about 10X less than the mini contracts. Here is a picture showing the margin required:

As you can see for someone like myself who is not a whale of a trader yet, the reduced margins are extremely nice. The way I trade there are plenty of times where I hold trades overnight and I utilize more than 1 contract at a time. At a minimum, I always make sure to have 2-3X the amount in my account to cover any and all futures contracts I trade.

S&P Futures Live Trades for July 2019

Here are a couple of items to recognize the way I trade:

- I don’t use stop losses

- In most trades I scale into the trade

- I don’t always wait for the profit target to be hit

- If I feel I have enough of a profit locked in then I will take it

- I am still learning and make mistakes so I am not perfect

- I use Fibonacci retracements and extensions for all of my trades, they are the basis for my entries and exits

I still struggle with fear and greed. So even though I may have the profit target listed I don’t always wait for it to be completed. Fear and greed are the two biggest factors in trading and they still come up in most trades. Sometimes they have no impact on my trading and other times I feel their pull greatly. The biggest times I feel their pull is when I have a decent sized profit and I would rather lock it and get out early rather than see the gains evaporate. I can always get back in again if the setup is still valid.

I attribute all of my success to meditation. There are ways to improve your meditation once you get started but the most important thing is to just do it. Consistency wins. You will experience amazing benefits in all areas of your life if you can take 30 minutes out of your day to close your eyes and wait for your thoughts to quiet.

So without further ado here are the trade setups S&P Futures Live Trades for July 2019:

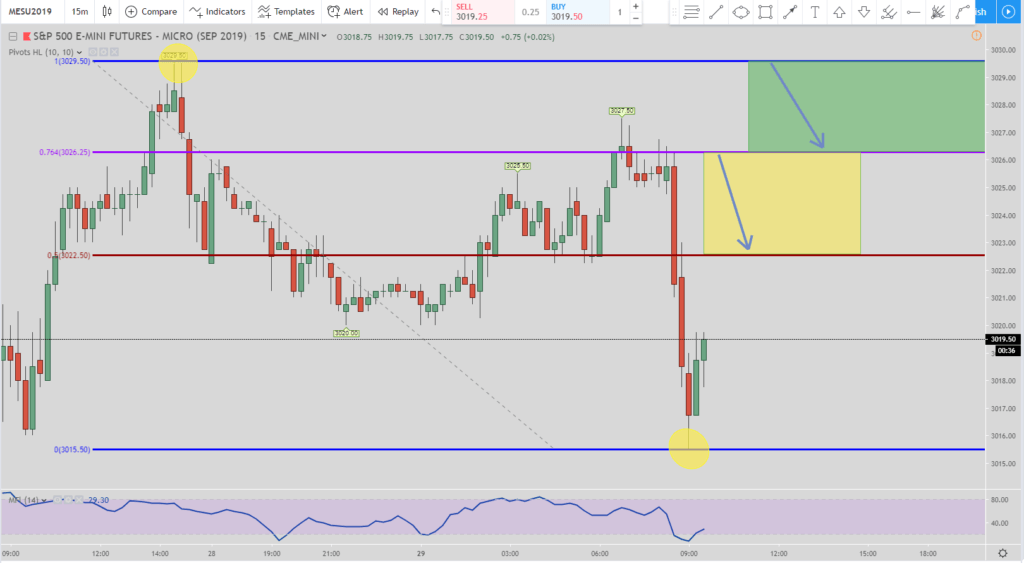

Monday July 29

This setup is the 76.4% short setup. If the pivot low holds of 3015.50 then this trade setup remains valid. When price hits the top of the yellow box at 3026.25 then that is your 1st short. The exit is the bottom of the yellow box at around 3022.50. But if the price doesn’t hit that exit and continues to go up and hits the top of the green box at 3029.50 then the exits move to the bottom of the green box at around 3026.25. Once one of those exits are hit then the move is over.

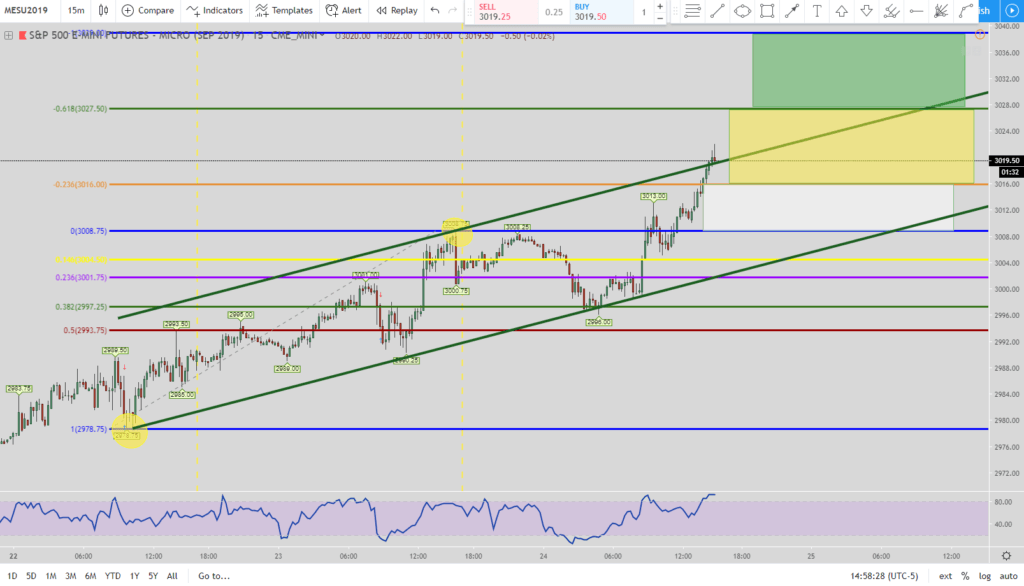

Wednesday July 24th

There is a short setup in play. Currently the exit is the bottom of the white box around 3009.25. If price first moves up to hit the top of the yellow box first around 3027.50 then the exits move to the bottom of the yellow box around 3016.50. Then if the price keeps moving up without hitting the exit and hits the top of the green box at 3039 then the exits move to the bottom of the green box around 3028.

After that the exits do not move anymore even if the price keeps moving higher. If an exit is hit then the move is over even if one of the entries has not yet been filled.

Also notice how the price has broken over the top of the upper trend line. When this happens in an uptrend then you can usually expect a retracement below the bottom trend line sooner than later.

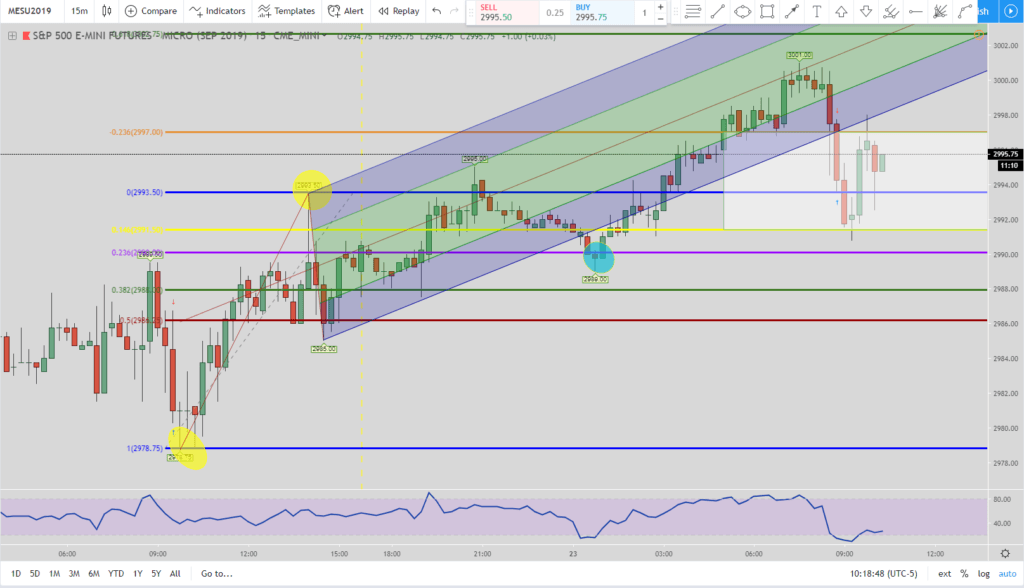

Tuesday July 23rd

Here is a super quick scalp for the S&P 500 futures. The setup is the 123-161 short. You can see how once price broke below the Schiff Pitchfork median line it never went back above it.

The yellow circles are the pivot point. The blue circle is the 1st point where I could have gone short that was legit. Price had closed below the Schiff Pitchfork median line and had touched the 23.6% Fibonacci retracement area. Obviously the price of the e-minis went the opposite direction when that entry was signaled. Once the price hit the 123.6% Fibonacci extension level then this is a “free trade” if you do not have any positions yet. Fortunately I did not have any positions at that time so it was a free trade for me.

You can see the arrows on the bars I got in and out of. The bottom of the white box was the exit level. I got out a little early to lock in the gains in case the price hit the 0% level and retraced back up again. If the S&P 500 did that then I would have gotten back in. The final exit was the yellow line (bottom of the white box) which is the 14.6% Fibonacci retracement level.

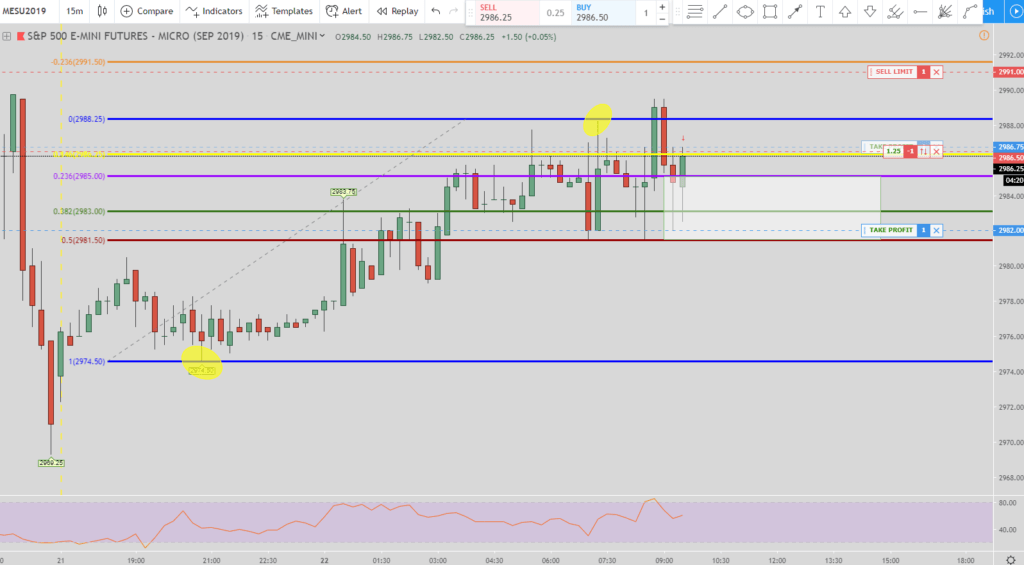

Monday July 22nd

This is a live trade!

The entries and exits are listed above. This is a trade I just took and was able to get it posted on here. I am not sure how long it will last because the market is moving pretty good today.

The setup used is the Springboard Reversal. The move is based upon not hitting the 123.6% Fibonacci extension and therefore reversing with a trend line break using the Schiff Pitchfork.

Monday, July 22

This setup will be live when the market opens again after the weekend. We had a selloff during the last two hours of trading on Friday so that has opened it up for a very nice long setup.

The setup I am using for this trade is the 123-161. This is a trade I will look to get into when the market opens. I can’t guarantee I will but I will try.

Currently, since the price did not hit the 1.618 Fibonacci extension line yet (the green line) then the exit is still the top of the orange box at around 2981.25. But if the price continues to move down and hits the 1.618 extension first, then the exit level moves to the top of the white box around 2,976. If the price continues to move lower and doesn’t hit the exit but goes down and hits the 200% Fibonacci extension level at 2,960 (the blue line) then the exit moves to the top of the green box around 2,968.00. That is the last time the exit will move. Even if the price of the S&P 500 continues to move lower there isn’t another exit move. You can continue to get in at better prices if the /ES continues to move lower.

But my guess that even if the downward move does continue that we will be able to get a quick retracement up to complete the setup. Once one of the exit levels is hit the move is over. Even if one or two of the Fibonacci extension levels still has an unfulfilled entry it doesn’t matter. As soon as an exit is hit the move is over and time to look for another setup.