12/27/2017

The 38-50% fib trade is one I noticed awhile ago and have used on occasion but there are definitely some considerations if you are going to take the trade. You can have this be a winning trade in 2 seconds, 2 days or 2+ years so it isn’t the holy grail of trade setups.

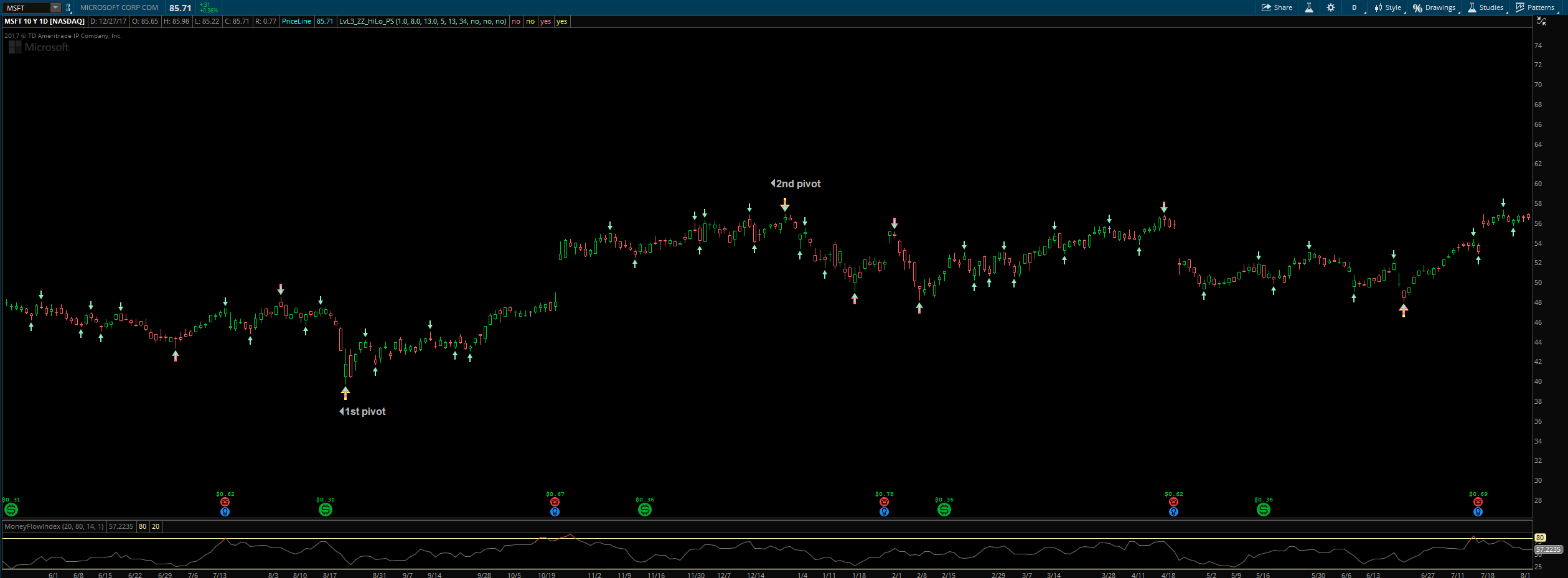

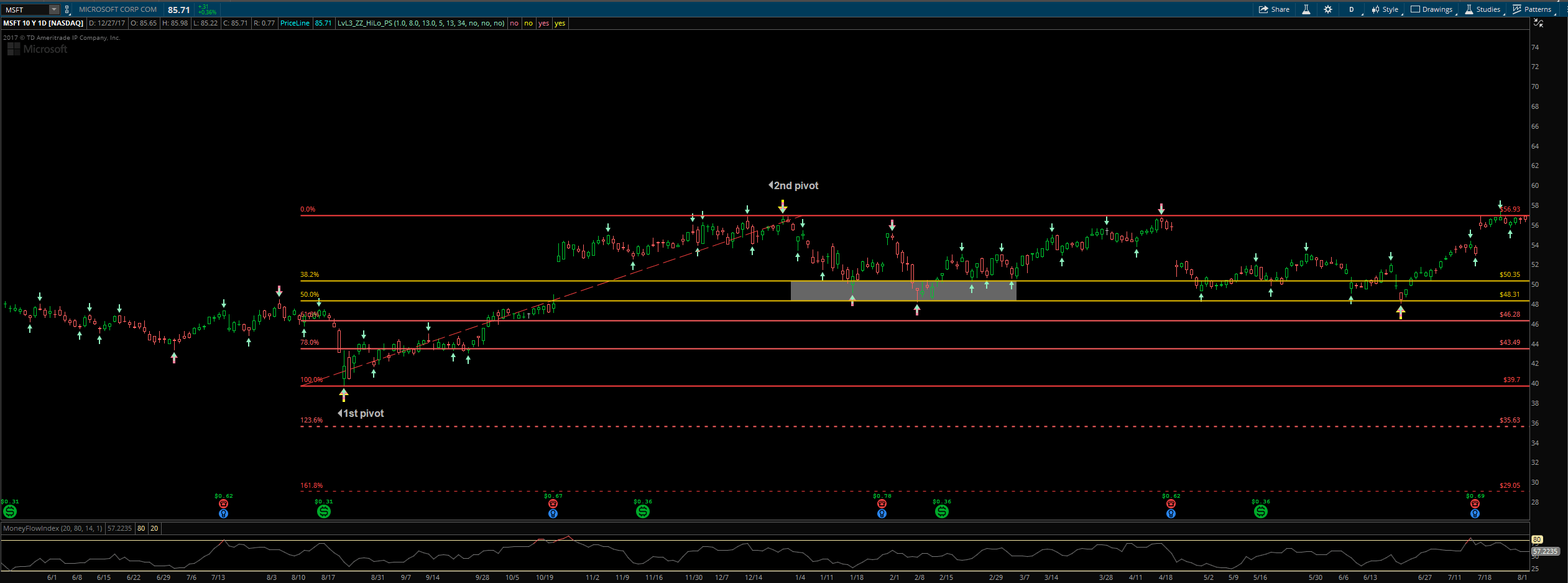

What you do is choose two pivot points from low to high:

Next you draw your fib retracements and I like to highlight the 38-50% fib retracement level with a gray box:

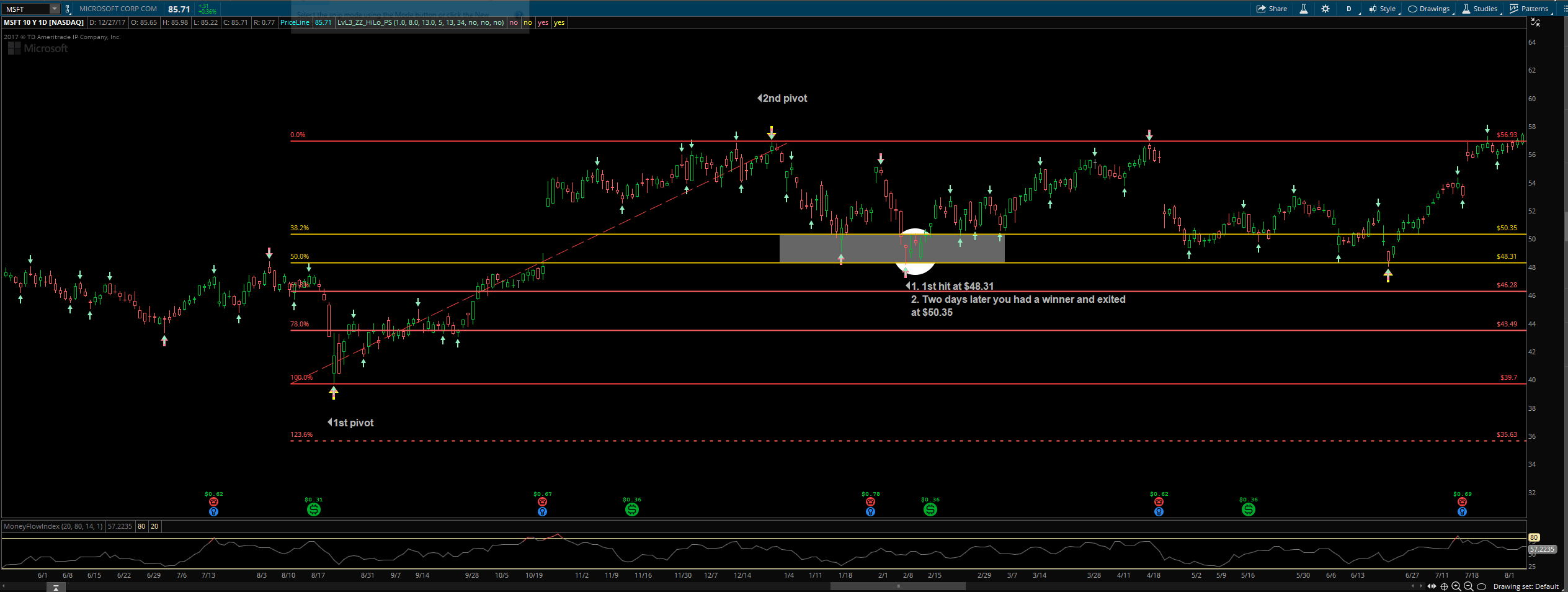

Now look at what happened when price hit the 50% fib level, it was hit then reversed and two days later you had a winner where you exited at the 38% fib level:

So basically all you do is enter at the 50% fib level and exit at the 38% fib level. It is not the perfect scalping method though, it does have some drawbacks.

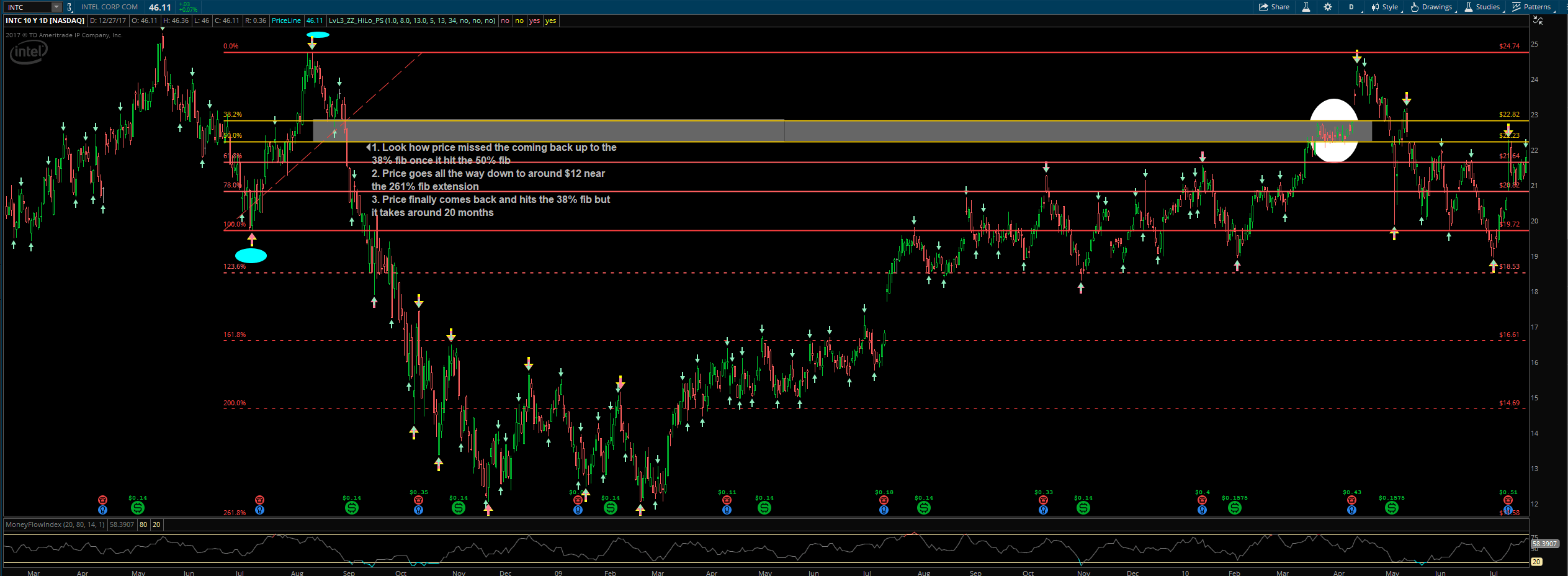

Here is an example from Intel (INTC) where price blew past the 50% fib and it took around 20 months for price to come back to the 38% fib:

From that chart if you were prepared to be in it for the long haul then you could have bought more at the 123% fib extension and around the 200% or near the 261% in order to make some excellent returns when price eventually came back. The problem is that most people don’t want to have their money tied up for that long of a time. So that is why this trade can be a winner in 2 seconds, 2 days or 2+ years.

Key Points to Consider

-

- 1. I would only go long with it, I’ve seen shorts run and run and run away from it and not come back and hit the 38% fib until a very very very long time

-

- 2. I would NEVER use it on margin or leveraged products

-

- 3. I would only use it in the stock market and on stocks with dividends in case you have to wait 2 years for it to come back

-

- 4. I would only invest 20% or so of my initial money for the trade at the 50% fib, I would NEVER go all in with 100% of the money I was planning on using for the trade in case price goes against you a ton

- 5. If price does go against you then I would look at getting in at either other retracement levels or fib extensions such as the 123% and the 200% or 261%. It just depends how much you want to risk.

-

- [mc4wp_form id=”1229″]