Since 12/19/17 it has been a really rough year for the General Electric stock. Not only did their stock price go down from $32.38 to $17.25 they also reduced their quarterly dividend from $0.24 to $0.12. This used to be one of the stocks “they” said you could put your money in and collect the dividend while having safe growth.

They’ve had moves similar to this before. I’m a bargain shopper so GE has peaked my interest. I like to look for stocks that have been beaten up who still offer a dividend and start building up a position in them.

But is that a good move here? One main lesson i have learned from trading stocks is that the fundamentals are just as important if not more important than the technical analysis. Stocks make their big moves based upon what traders expect to happen.

That is why you sometimes see a stock report great earnings but their stock price tanks. The reason why is during the quarterly earnings report they gave bad guidance moving forward. So with stocks it isn’t about what have you done for me today?

The question is, what will you do for me tomorrow?

Better Times Ahead for the General Electric Stock?

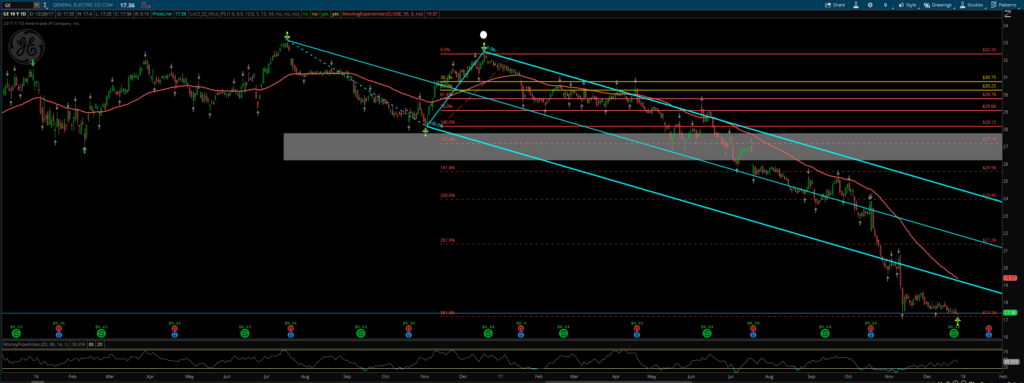

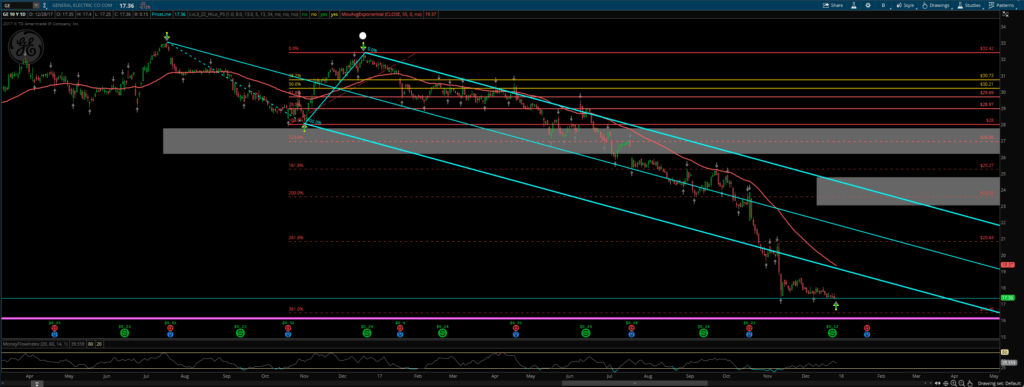

Here you can see that price is below the lower end of Andrew’s Pitchfork so the bottom has fallen out. Price has found some support along the 361% fib extension and price has been below 25 in the Money Flow Index which can signal a low is in but I only glance at it to see what it says, I don’t use it as a signal for trading, just some confirmation from time to time.

In fact, I don’t use any indicator to take trades. I do think they can assist in determining the trend and timing but that is far as they go. The main reason why is they signal after the fact so you are usually too late in the trade.

Another factor to consider that the bottom may be in……

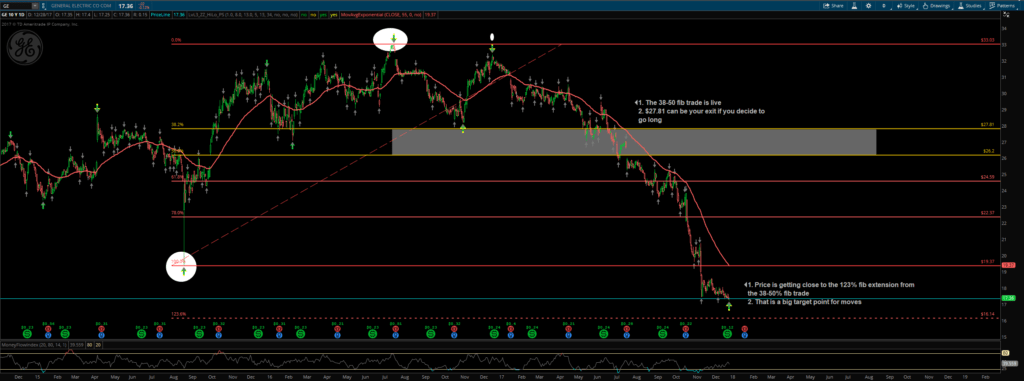

From my post about the 38-50% fib trade that you can read about here: https://evancarthey.com/38-50-fibonacci-retracement-trade/ it has come into play for this current move.

You can see the big white circles where I am using them as my pivot points. Price ran through the 50% fib retracement and never went back and hit the 38%. So you can use the 38% level as an exit point since I believe that price will eventually run back up and hit it.

Price is also getting close to the %123 fib extension from the pivot points in the chart and that can be a big area where retracements occur from big moves. You have that in the same area as the %361 fib extension so there is a fib support area.

What’s next?

The 50% retracement from the current move down is at $24.74 so you have two exit points you could use ($24.74 or $27.73).

If price continues to go lower then the $24.75 exit will move lower as well but the $27.73 will remain firm. With price getting close to the %361 fib extension from the move down and near the %123 fib extension from the %38-50 fib trade I am looking to start a position here soon.

I will start off small, maybe 20% of what I am going to trade this position with to get in initially. Then if price continues to go lower to the other fib extension levels then I will grab more shares there. Other entry fib extension price levels are $13.72, $11.00, $6.00 and $2.13.

The one main key to consider is will this stock go bankrupt? There is never a guarantee that a stock won’t go bankrupt. With the way the General Electric stock has performed it would be safer to say that bankruptcy will happen before a resurgence.

But if you enjoy looking for the stocks that have the potential to be two and three baggers then this may be one for you.

If you would like to see more analysis and reviews then check back frequently to https://evancarthey.com. I do reviews and previews 4-5 times per week based upon the technical analysis I use that I created through meditation.

If there is a stock, Forex, future, or cryptocurrency you would like for me to review then let me know and I will be glad to do so.