Simon Property Group (SPG) is a company whose stock has taken a severe beating the past couple of years. They are in the real estate business, specifically commercial real estate such as malls. During the Coronavirus, they obviously have been getting worked over in their stock price due to the closure of virtually every mall.

Here is how they describe themselves from their website https://investors.simon.com/:

Simon is a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations and an S&P 100 company (Simon Property Group, NYSE: SPG). Our properties across North America, Europe and Asia provide community gathering places for millions of people every day and generate billions in annual sales.

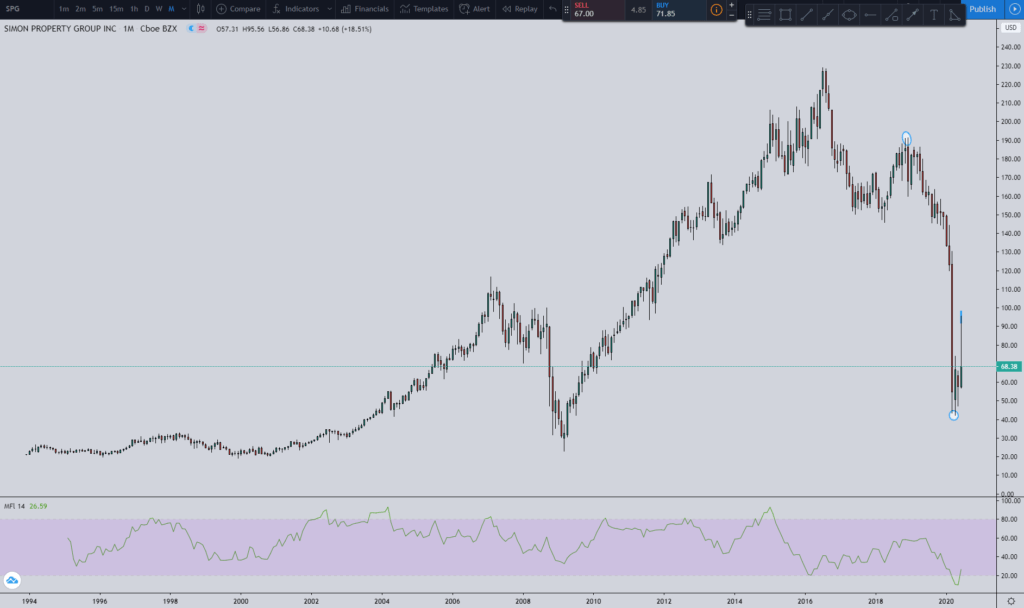

Below is their chart for the life cycle of their stock. As you can see it had a very nice run up from March 2009 to July 2016. Since then it has been a really rocky ride for Simon Property Group’s stock price.

Notice how the Money Flow Index (MFI) is coming out of being oversold. That is a key component I will touch on in the conclusion section of this article because it does impact how I view the stock.

In this blog post, I will look at their stock using the technical analysis I use to trade. At the time of this writing, I do not currently own SPG and do not plan to do so in the next 48 hours.

Simon Property Group Technical Analysis

The Simon Property Group stock has a couple of technical setups that it is currently in and I will list them below.

After I list the setups then in the conclusion part of this article I will give my opinion on if I think this stock would be worth considering. What I mean by that is if I would purchase the stock so please don’t take this as professional financial advice because it is only my opinion on how I trade.

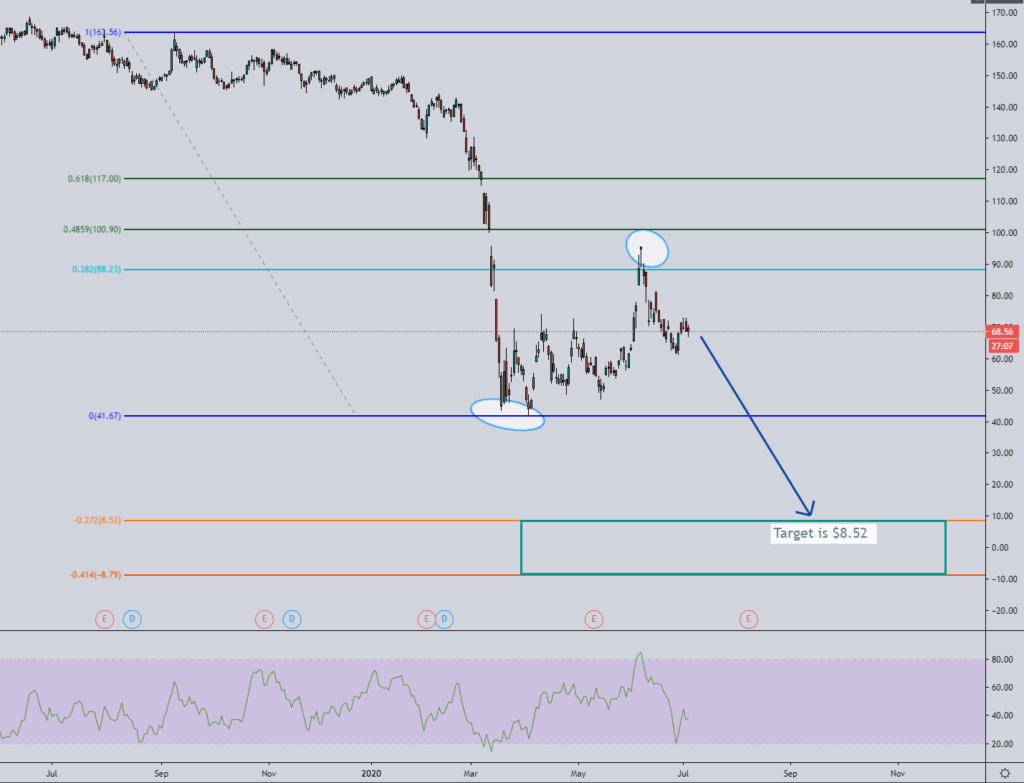

In the picture below we are looking at a short setup using the daily time frame. You can see how the price came back up and retraced to the 38.2% Fibonacci retracement line. When the price does this then this locks in a potential short setup.

Since then the price has moved back down and is currently sitting at $68.93. If the price does go down and hit the price target of $8.52 then the Simon Property Group has a lot bigger issues going on.

So this is a valid short setup on the daily time frame that the SPG stock is currently located.

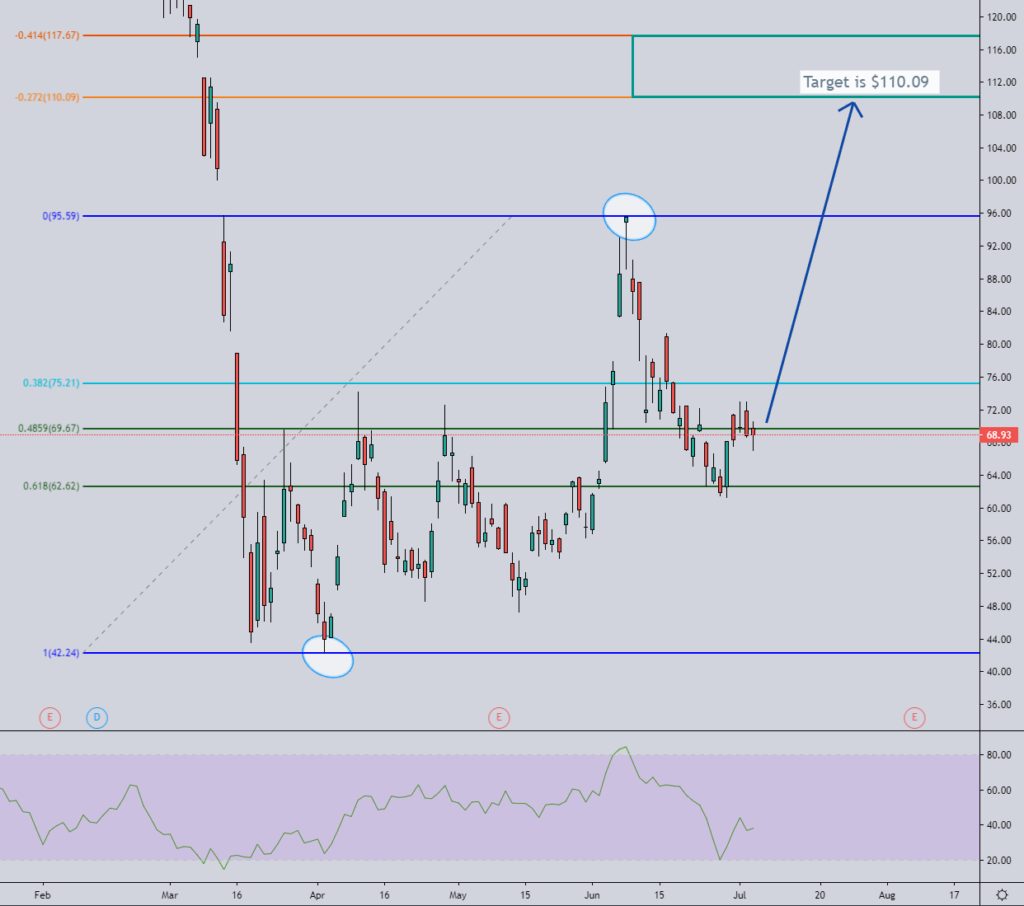

In the picture below we are looking at a long setup for the Simon Property Group. It was triggered when the price hit the 38% Fibonacci retracement level and found support at the 61.8% level.

The current target for this setup is $110.09. This setup would become null if the price continues to move down to around $52.00 because then the 61.8% Fibonacci level would be too beat up to consider that a level that held. The shorts will have taken over.

But if the price can hold without going too far under $60 then this long setup remains valid.

Also, note that the Money Flow Index (MFI) is coming out of the oversold area. This is a good barometer to see if the price could be at a turning point which it may be. It doesn’t guarantee it but is one of the factors I look for in a trade.

There is also a gap from $95.81 to $99.66 and another from $112.72 to $114.87. Gaps love to be filled so keep that in mind there are a couple to be filled to the upside so that could be a magnet to help move the price upwards.

SPG Stock Price – Video Review

In the video below I go over the setups for the Simon Property Group’s stock from the section above because it is sometimes easier to see what I am trying to explain through a quick video.

Simon Property Group in the News

One of the big reasons people own SPG is for their dividend but with the recent news, there could be up to a 50% cut. This is to assist their recovery efforts due to the mall shutdowns of the Coronavirus:

https://www.fool.com/investing/2020/06/09/simon-property-group-telegraphs-a-50-dividend-cut.aspx

Parsing this a little bit, the first takeaway is that the CEO is telling investors to expect a dividend cut to be announced in June. It seems like, at the time of the first-quarter earnings conference call, he believed the cut would be 50% or less.

Even if the stock begins to recover due to the Coronavirus finally ending and opening everything back up this article shows why it could take a while for the turnaround. The stock currently has around a 13% dividend yield but from the article above that could soon get slashed which makes this stock even less attractive. https://www.fool.com/investing/2020/04/13/is-simon-property-group-stock-a-buy-reit.aspx

So, is Simon Property a buy here down 57% year to date with a 13% dividend yield? With all the financial commitments the company has to deal with, it is hard to recommend it. Simon may well muddle through without having to cut the dividend, but a lot of things will have to go right for that to happen. Simon had stagnant growth to begin with, was operating in a sector with issues already, and is hemorrhaging cash right now. Once the crisis is over, it will take a while for things to get back to normal. Absorbing Taubman will carry all sorts of execution risk. It makes sense to watch and wait until the storm has passed and we have clarity on the dividend situation.

There was one positive piece of news for the Simon Property Group’s stock in June with an 18.5% gain https://www.fool.com/investing/2020/07/02/why-simon-property-group-macerich-tanger-factory.aspx:

Although the stocks of Simon, Tanger, and Macerich each had a good June, the ups and downs through the month show just how quickly things can still change. And all it takes is a bit of news to shift investor moods — often in dramatic fashion.

Moreover, these REITs are hardly interchangeable, with Simon likely the best positioned, financially speaking, to muddle through this period. It’s also worth noting that all three of these REITs have now reduced or suspended their dividends at this point. Put simply, despite what looks like a nice monthly gain, this is clearly not a sector for investors with weak constitutions.

Conclusion – Is the Simon Property Group Stock a Buy in 2020?

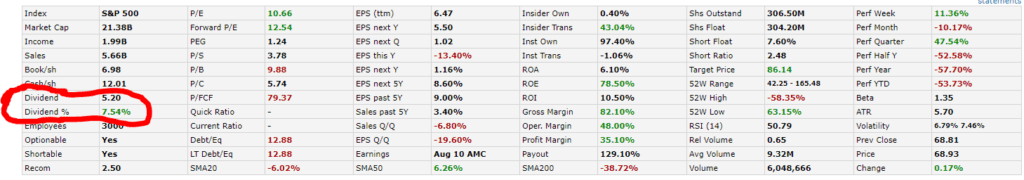

One aspect I will add in here is that the Simon Property Group currently has a 7.54% dividend yield. (https://finviz.com/quote.ashx?t=SPG)

When there is a dividend this large then this is a long term play a lot of people will be looking at, especially if the stock price continues to move lower. But as I mentioned above there looks to be a big dividend cut in the future so that is a big reason I would be hesitant to purchase this stock until the dividend is decided either way.

Right now with the Coronavirus going on and the shut down of malls, there might be room for the stock to move lower or at best to hang around the area where it is currently at for its price.

Until the global economy opens up for good and puts the Coronavirus behind us then there is definitely room for the stock to move lower.

For the worst-case scenario, the stock continues to crater and hits the short setup of $8.52 that it is currently in.

The current best-case scenario is the stock rises higher while keeping its dividend intact and hits the $110 price target from the long setup.

The Money Flow Index coming out of the oversold area for the Simon Property Group stock on the monthly chart does make it intriguing because it can signal a run-up could be imminent but it is hard to say due to the Coronavirus.

At this current time, I would hold off on purchasing SPG. The Simon Property Group needs to decide and let everyone know what the future holds for its dividend.

Without it then this becomes a risky play where there are better stocks positioned in this current environment that could offer better returns (Hint: Look to the tech industry).